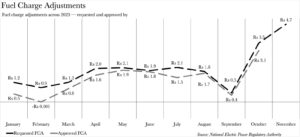

In a development poised to jolt consumers, all power distribution companies (DISCOs) — with the exception of K-Electric — have requested a significant increase of Rs 4.6617 per kilowatt hour (kWh) in the electricity tariff, citing fuel charges adjustment (FCA) for November 2023. The requested FCA is the highest for the year 2023 and marks the highest point since June 2022.

The Central Power Purchasing Agency (CPPA), acting on behalf of the DISCOs, has submitted an application to the National Electric Power Regulatory Authority (NEPRA) to adjust the electricity tariff under the FCA for November 2023. NEPRA has scheduled a public hearing on the 27th of December 2023 to consider this FCA proposal. Once a verdict is reached, the FCA will be levied on units of electricity consumed in November, against the meter readings recorded throughout December, and will eventually be billed to customers in January. Consequently, the inflationary impact of the decision will be recorded in February 2024.

The CPPA’s application reveals that the total electricity generated from various fuels in November was 7,547 GWh, at a cost of Rs 7.1704 per unit, resulting in a total energy cost of Rs 54,113 million. The data also indicates that the net electricity delivered to DISCOs in November 2023 was 7,288 GWh, at a rate of Rs 9.4448 per unit, with the total cost amounting to Rs 68,834 million.

| Generation (GWh) | Percentage of Total Generation | Price per Unit (Rs) | |

| Hydel | 2,755 | 36.5% | 0.0 |

| Coal | 1,473 | 13.1% | 15.3 |

| Gas | 695 | 9.2% | 14.6 |

| RLNG | 798 | 10.6% | 23.7 |

| Bagasse | 27 | 0.4% | 6.0 |

| Wind | 148 | 2.0% | – |

| Solar | 50 | 0.7% | – |

| Nuclear | 1,572 | 20.8% | 1.2 |

| Iran | 30 | 0.4% | 27.7 |

We have already covered in extensive detail as to what an FCA is, and how it is calculated.

Read more: What in the world is a fuel charge adjustment and why is it swelling your bill?

To regurgitate, the FCA represents the disparity between the reference and actual costs. The actual cost can deviate from the reference cost due to fluctuations in the fuel mix and cost. So, what has precipitated the FCA to clock in at its current level? Rao Aamir Ali, Vice President Research at Arif Habib, attributes it to the 33% year-on-year decline in nuclear-based generation, the 6% year-on-year decline in wind-based generation, and, finally, the 37% year-on-year decline in solar-based power generation.

How much of the FCA requested by the DISCOs will be passed on to the customers? That is anyone’s guess. NEPRA has not matched the requested FCA in any of the months across 2023 till date with the regulator even giving a negative FCA — a rebate to customers — in February.

So, what does all this signify for consumers? “It will undeniably exert an upward pressure on inflation,” declares Afia Malik, Senior Research Economist at PIDE. “For domestic consumers, the demand is already low in winters, so the impact will be minimal. However, it will have a negative impact on industrial customers particularly given how gas prices have escalated irrespective of its unavailability,” Malik elaborates.

This means consumers will get a lot of fuel adjustment prices in their bills. 🙁