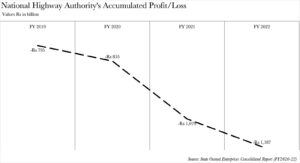

The Federal Footprint, State-Owned Enterprises (SOE) consolidated report for fiscal year 2020-2022, unveiled on Sunday, paints a rather grim picture. It lays bare the startling revelation that Pakistan’s 31 SOEs have collectively incurred a colossal loss of Rs 730 billion in the fiscal year 2022 alone. The primary offender in this financial debacle is the National Highway Authority (NHA). The NHA not only registered losses worth Rs 169 billion in fiscal year 2022, but also saw its total accumulated losses soar to Rs 1.2 trillion. Is this a cause for concern? Maybe.

The NHA’s losses are largely a byproduct of accounting practices, owing to the nature of its operations. Its losses are predominantly depreciation, and do not impact the national exchequer — at least in the short to medium term. So, what’s going on?

First and foremost, the NHA’s profitability. The NHA has consistently posted a gross profit each year from fiscal year 2019 through to fiscal year 2022. Moreover, it has reported an operating profit each year, with the sole exception of fiscal year 2019, over the same period. The catch, however, is that these gross and net profits have failed to crystallise into net — or final — profits. The NHA has endured a net loss each year over this span, culminating in a total cumulative loss of Rs 691 billion over the aforementioned four-year period. This has led to the total accumulated loss reaching a staggering Rs 1.2 trillion in fiscal year 2022.

The reason for this lies in the operational nature of the NHA.

“The government transfers funds to the NHA as a cash development loan through the Public Sector Development Programme (PSDP). This loan then appears on the NHA’s balance sheet, against which the NHA creates an asset,” explains Ammar Habib Khan, an independent economic analyst.

“In its quintessence, the entirety of the nation’s motorways find their place on the NHA’s balance sheet. Possessing such an abundance of assets necessitates their annual depreciation, in accordance with accounting protocols. Depreciation is treated as an expense in accounting and can quickly escalate to billions when even a modest 1% or 2% is applied, given that the motorways are appraised in the trillions,” Khan elaborates.

Why do we need to depreciate the NHA’s roads? The answer lies in accounting practices. Financial statements are normally prepared for a period of twelve months; however, not all investments can yield returns within this span of time. “From an accounting perspective, any expense whose period or utility exceeds a year is prorated,” explicates Aamir Younas, a Partner at EY Ford Rhodes.

Depreciation, therefore, empowers businesses to distribute the cost of tangible assets — such as a sophisticated piece of machinery or a fleet of sleek cars — over several years for accounting and tax purposes. There exists a myriad of depreciation methods, including the straightforward straight-line and various forms of accelerated depreciation.

The NHA, in particular, cannot always operate within the confines of a twelve-month period — if at all. Let’s hypothesise that a road constructed by the NHA carries a price tag of Rs 1 billion. The NHA’s primary source of revenue for this would be toll collection. It is highly improbable that the NHA will manage to amass more than Rs 1 billion in toll fees to generate a profit within a single year, for a multitude of reasons. The NHA acknowledges this reality and instead projects the financial viability of the road over a more extended time horizon.

If the road boasts an operational life of ten years, then the NHA will allocate a depreciation expense against the toll revenue it collects over a decade. What will this depreciation expense amount to? It’s the cost of the road divided by the operational life of that road, based on the matching concept — ten in our example. In essence, it is the allocation of fixed expenditure cost over a period of time or over the lifespan of the asset.

Moreover, depreciation is a non-cash expense. Noncash expenses are those expenses that, while recorded in the income statement, do not involve an actual cash transaction.

“It’s not a cash expense. It’s not a cash loss. Even if that non-cash item is an expense, it does not impact the budget, and that doesn’t imply that the state-owned enterprise is inefficient,” Khan asserts.

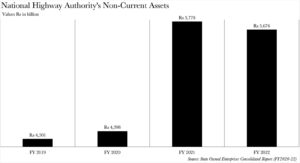

But why are the NHA’s depreciation expenses so astronomical to begin with? Revisiting Khan’s explanation of asset creation, the NHA’s non-current assets have soared from Rs 4.3 trillion in fiscal year 2019 to a staggering Rs 5.7 trillion in fiscal year 2022. All of this will have to be depreciated. Furthermore, the report indicates that the depreciation is based on the revaluation of NHA’s assets. What does that mean? Higher depreciation.

Imagine a road that spans one kilometre. A decade ago, it would have taken a mere Rs 10 lakh to construct it. Today, however, the same road would incur a staggering Rs 40-50 lakh in construction costs. As the NHA re-evaluates the value of this road, the depreciation expense inevitably rises in proportion. This is not an isolated case. The NHA has applied this revaluation method to all of its assets, as the report reveals. Consequently, the depreciation expense has soared.

Then there’s the dearth of information in the report, leaving many accounting issues unresolved. For instance, what depreciation method is being employed.

“The report does not indicate which accounting policy the NHA uses. It might not be employing straight-line depreciation. It might be utilising the reducing balance method. This suggests that the depreciation expense will be significantly high in the initial years. Consequently, revenue will be low in the initial years and higher in the later years,” Younas expounds.

The NHA currently has roadworks planned until 2030 as part of the ambitious China-Pakistan Economic Corridor (CPEC). Why is this timeline important?

“If you are to scrutinise the NHA from a privatisation angle, then the depreciation expense is crucial because if all of the expenses are in the initial years and you privatise it, then you are set to miss out on the revenue it will generate in the years to come. The NHA’s revenues are problematic if the long-term plan that it has itself states that the roadworks under construction are unprofitable,” Younas concludes.

How economically viable are the roads that the NHA is building? The answer is elusive. The fact remains that a large part of infrastructure constructed under the CPEC project is under utilised and the revenue generated falls short of the depreciation. This, however, does not insinuate that these roads will not witness an upsurge in capacity utilisation in the future. Accounting losses incurred due to depreciation necessitate a thorough examination to unearth the reasons behind the inadequate and incompatible revenue streams. It is imperative to assess the quantum of cash inflows from operations and ascertain whether the accounting loss alone suffices to draw a conclusion.

The silver lining lies in the fact that the conclusion can be deferred. The immediate concern is that the report on the surface leaves people baffled, and the perplexity surrounding the NHA’s losses is justified. The government bore the responsibility to explain the matter. By failing to do so, they have missed a golden opportunity to cease portraying themselves as hemorrhaging losses — particularly when they are not in actuality doing so.

Indeed spells work. I wanna express myself on how this psychic priest Ray saved my marriage from divorce. Myself and my husband were having some misunderstanding and it was tearing our marriage apart to the extent my husband was seeking for a divorce and during that time he left home and I was really devastated I cried day and night I was searching about love quotes online I saw people talking about him and his great work whose case was similar to mine they left his contact info I contacted him told him about my problems he told me that my husband will return back to me within 24hrs i did everything he asked me to do the next day to my greatest surprise my husband came back home and was begging for me to forgive and accept him back he can also help you if you have same marriage issues contact

psychicspellshrine@gmail. com

WhatsApp: +12133525735

I want to share with the world my sad experience with a fake cryptocurrency scammer after falling for his gimmicks. I was cat fished by a man on POF, he then introduced me to this fake crypto miner. Honestly, everything the scammer showed me looks legit worth giving it a shot as it’s a short-term investment with lots of profits. My investment later turned sour and It was the saddest moment of my life because I couldn’t believe what had happened. How I just lost $638,000.00 within a period of 3 months to this scammer. I reported to the authorities and they weren’t helping in any way to help me recover my lost fund. I had lost at a point and was falling into depression until I came across an article online about ethical hackers and their expertise in recovering BTC. I searched for one and that’s when I discovered a professional recovery hacker who could help me recover my funds, to my surprise they {RECOVERYCOINGROUP AT GMAIL DOT COM} were able to trace and recoup every penny I thought I had lost. I am sharing this to the world because they saved my life and my career and I strongly recommend it.

Nice post . Thank you for posting something like this