On January 5, 2024, the State Bank of Pakistan (SBP) injected Rs 1.25 trillion into the banking system for up to 28 days through open market operations (OMOs). Of the Rs 1.25 trillion, Rs 1.21 trillion was injected into the conventional banks and Rs 0.49 trillion was injected into the Sharia-compliant banks. This move aimed to mitigate liquidity shortages and cater to the financially strapped government’s financing needs. How would this impact the economy?

Demystifying OMOs

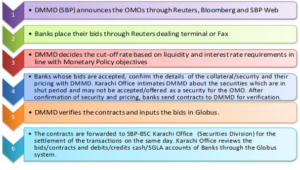

OMOs are a key tool of monetary policy that allows the central bank to control the liquidity in the banking system by either adding or removing funds through the purchase or sale of eligible securities, depending on the demand and supply of money. In simple terms, when the SBP injects money, it lends money to banks against some collateral. The banks then use this money to buy government securities. The SBP earns interest on the money it lends, while the banks make a profit by charging a higher interest rate to the government. For instance, if the SBP lends money to banks at 21%, the banks can lend this money to the government at 21.5% or 22%, earning a spread of 0.5% or 1%.

Why are injections needed?

The government has to borrow money from banks to finance its fiscal deficit, which is the gap between its revenues and expenditures. The gap exists as the government’s expenditures exceed revenues mainly due to colossal interest payments and salary and pension expenses of its employees and retired personnel.

As per the economic update and outlook report of December 2023, total expenditures grew by 35% to stand at Rs 3.7 trillion during July-October in fiscal year 2024 against Rs.2.7 trillion last year. Within total expenditure, current spending grew by 44% mainly due to a significant rise in markup payments (interest payments) that increased by 63% during the first four months of the current fiscal year.

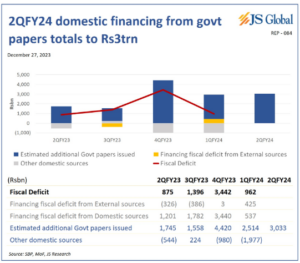

The government’s reliance on domestic commercial borrowing has remained high, even though the Federal Board of Revenue (FBR) collected higher revenues in the first four months of fiscal year 2024 as compared to the IMF’s targets.

Growing expenditures of the government have prompted it to borrow from banks. The government borrowing has crossed the Rs 60 trillion mark and two-thirds of it pertains to domestic lending. In the last few years, the government has doubled down on borrowing by offering short-term securities in the domestic market. This has negatively impacted the maturity profile and resulted in exposure to high debt servicing costs.

“When the banks do not have enough money to lend, the SBP injects money into the banks so that they can lend this money to the government,” explains Yousuf Farooq, director of research at Chase Securities. This thereby increases the money supply (more on that later).

Previously the government could directly borrow money from the central bank but that changed by the end of 2021 when the International Monetary Fund (IMF) imposed restrictions on the government, prohibiting it from directly borrowing from the SBP to fund its deficit. Later, the government agreed to make this a permanent ban through the SBP Act issued in September 2022.

However, the government found a way around this by borrowing from commercial banks, which in turn got financing from the SBP, creating a circular flow of money. “I believe a big chunk of OMO injections are circular as the SBP lends to the banks, banks to the government and the payback takes place in the reverse order. Therefore, it is important to look at it from an outstanding OMO perspective”, said Mustafa Pasha, chief investment officer at Lakson Investments.

Impact of OMOs on CinC:

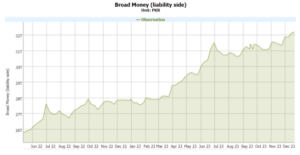

The perpetual cycle of OMOs has impacted the money supply. The broad money supply, also known as M2, refers to the total amount of money in circulation in an economy, including currency in circulation (CinC) which is the physical money held by the public, demand and time deposits held by individuals and businesses, and other liquid assets held by the non-bank financial sector.

Syed Salim Raza (former governor of SBP), Sultan Ali Allana (Chairman of the board of Habib Bank Limited) and Zafar Masud (President and CEO of Bank of Punjab) authored an article jointly titled “Transitioning away from cash economy”. It discussed the impact of OMO injections on the money supply.

“In the last two years, the single largest contributor to the money supply has been the SBP’s OMOs. The size of OMOs increased to a staggering Rs 9.4 trillion by the end of September 2023, roughly the same size as the CinC — and close to the size of outstanding private sector credit”, read the article.

As of December 2023, the money supply has exceeded Rs 32 trillion. SBP data indicates that the CinC at the end of December 2023 stood at Rs 8.7 trillion, which is equivalent to 27% of the total money supply. At the end of June 2023, CinC stood at Rs 9.2 trillion, equivalent to 30% of the total money supply, or around 11% of the national gross domestic product (GDP).

High money supply leading to higher inflation

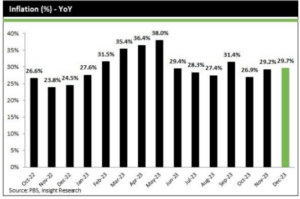

Injection of such large amounts of liquidity is one of the primary contributors to runaway inflation and has undermined SBP’s monetary policy efforts to control the price levels.

“An excess of money in circulation relative to the available goods inevitably drives up prices due to increased demand. In Pakistan’s context, heightened consumer purchasing power for additional goods leads to a surge in imports. This surge in imports, in turn, amplifies the current account deficit and contributes to the inflationary pressures within the economy. It also results in currency depreciation,” explained Farooq.

According to the monthly economic update and outlook report of December 2023 published by the finance ministry, in November 2023, the CPI inflation was recorded at 29.2% on a year-on-year basis, up from 23.8% in November 2022 which was more than the expectation of the analyst community.

To counter the high money supply, the SBP has maintained the policy rate at 22% since June 26, 2023. The sustained high policy rate has curbed the expansion in the money supply to some extent, as the broad money (M2) growth decelerated to 13.7% year on year as of November 24, 2023, from 14.2% as of end-June.

However, this came at the expense of the private sector, which has almost been cut off from the credit market. “This deceleration is attributed to net retirements in private sector credit and more than seasonal decline in commodity operations financing,” read the official statement of the monetary policy committee meeting held on the 12th of December.

Way forward

Farooq stressed that the only solution for the government to decrease the money supply and inflation is to control the fiscal deficit. To achieve this, expenditures need to be reduced and revenue needs to be increased. The December economic outlook report by the finance ministry paints a positive picture, total revenue receipts outpaced the growth in expenditures. The fiscal deficit has been curtailed to 0.8% of GDP, and the primary surplus improved to Rs.1.4 trillion during the first four months of fiscal year 2024.

The primary surplus improved owing to contained growth in non-markup spending recorded Rs.1.4 trillion (1.4% of GDP) during Jul-Oct in the fiscal year 2024 from Rs.136.2 billion (0.2% of GDP) last year. Net federal revenue receipts increased to Rs 2.8 trillion in the same period from Rs 1.3 trillion last year. The sharp rise in revenues was due to considerable improvement in non-tax revenues that grew by more than 300% during the period under review.

Further, going forward, interest rate cuts are expected in the next 12 months which will also reduce the fiscal burden.

it is this simple article that if understood by people would make them understand how, I flatiron is not their own fault and how saving money is equal to throwing it in garbage.

if I save 1000 rupees and state bank injects 9.4 trillion rupees, does my saving stand any chance ?