In what might prove to be the first major outcome of Pakistan’s startup revolution, the Turkish fintech giant Papara is all set to acquire Pakistan’s prominent fintech company SadaPay. While the finer details of the acquisition are yet to be announced, the all-stock deal is reportedly valued between $30 to $50 million.

What will be more encouraging for the country’s fintech landscape as well as its regulator, the State Bank of Pakistan (SBP), is that Papara has also committed an additional investment of $10 million into Sadapay to further solidify the company’s position as a banking challenger. In the middle of a global funding crunch, this will mark much needed investment not just in the startup ecosystem but specifically in Pakistan’s diverse fintech space.

Insiders have confirmed that the SBP was approached months ago to give its regulatory blessing to the acquisition, which sources close to the deal say could be coming any day now. While the finer details of the deal are still being worked out, insiders are confident that the execuation of the transaction will soon be announced.

The transaction may come as a surprise to sceptics, who have had doubts about EMIs being a profitable business due to limited avenues of earning. EMIs that had received approval from the State Bank to undertake this business have withdrawn one after the other, casting doubts on the workability of this model in the Pakistani market.

The Turkish company, which has made a similar model work in the home country, now plans to buy out 100% of SadaPay, according to internal deal documents available with Profit. The acquisition will not alter the corporate or operational fabric of SadaPay Pakistan Limited, and the entire SadaPay team including people in the management, and directors would be retained. Brandon Timinsky, the founder and the current CEO, will continue serving as the company’s chief executive. The company will maintain its strategic course under the new ultimate beneficial owner (UBO), the Turkish fintech company Papara.

Following the acquisition, Papara has planned an immediate $10 million injection into the Pakistani entity for expenditures on technological advancements and market expansion to solidify Sadapay’s position as the leading EMI. The acquisition and the investment is expected to provide an impetus to SadaPay’s plans of moving into the remittance business for expatriate Pakistanis in the UK and Saudi Arabia.

Why sell? Because it checks all the boxes

SadaPay has refrained from commenting on the deal altogether. However, based on what sources have conveyed to Profit, the size of the deal is expected to range between $30 million to $50 million, in an all stock deal in which shareholders of SadaPay will receive shares in Papara rather than cash in exchange for SadaPay’s share capital. SadaPay shares will also become more liquid this way because Papara has plans to go public in 2025.

SadaPay, which has raised over $20 million so far in funding between two rounds, is being valued at less than what the company was valued at in its last round. Sources have said that the fintech startup SadaPay was valued close to $100 million in its last round, marking a 50% or more value reduction in the new deal. But perhaps everyone now knows that startups all around the world were overvalued when risk capital was abundant. As sobering started, valuations started getting cut left, right and centre. In fact, SadaPay getting acquired at the numbers mentioned above is not bad at all, sources say. Even unexpected, as a source said.

A $30 million price tag would be a fair deal in the current market. A $50 million tag would be a great deal in these times. Getting any of these prices is good for the company before valuation drops to a point of zero returns on investment.

The questionable sustainability of EMIs in Pakistan

Then the EMI business model is perceived as shaky at home, with questions around sustainability of the business. How they would make money has been the big question. The EMI regulations essentially allows a company to create a payments business, which is not considered a lucrative line of business. EMIs that are focused mainly on e-commerce and point-of-sale transactions earn primarily from a transaction fee, which is typically 1%.

“You cannot earn [enough] purely on a transaction basis on an EMI licence. Based on my own calculations, an EMI cannot make money from that in the first five years at least,” Omer Salimullah, the COO of SadaPay had told Profit in an earlier interview. For these initial years, he said, EMIs would need strong investors to carry them.

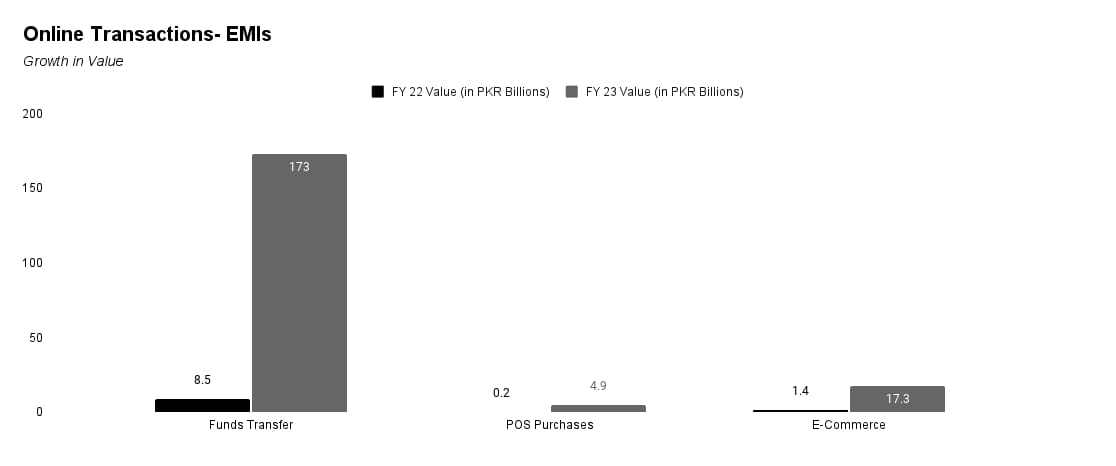

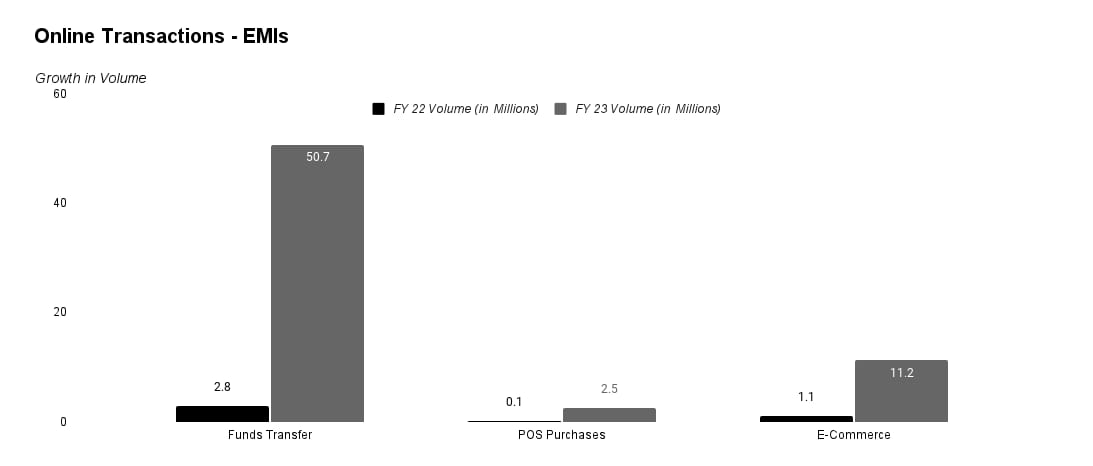

The recent State Bank circular decreasing interchange fee from 0.5% to 0.2% further caps revenue from POS transactions, which are still very small. The State Bank of Pakistan’s data on payments shows that POS transactions through EMIs were 2.5 million in volume and Rs4.9 billion in value. Overall transactions from EMIs are mostly funds transfers, which for 2023 were 50.7 million in volume and Rs 173 billion in value.

But EMIs for instance SadaPay offer these funds transfers free of cost, limiting it as a revenue source. In the transactions business, the EMIs are competing with banks because EMIs are also focused on the similar target market as banks and have not yet tapped into the unbanked segment. Encouragingly, however, Papara in Turkey also offers most of these transactions free of cost and has yet achieved profitability.

Unlike banks, EMIs are allowed to invest up to 75% of their deposits in government securities. This is again a segment that is heavily dominated by the commercial banks that can lend to the government without any cap. EMIs can further only lend to consumers through partnerships with banks or other financial institutions licenced to carry out lending and not directly.

Some of the EMIs have even tried buying or becoming banks for a better shot at sustainability. While becoming a full bank is a logical outcome for an EMI, fintech companies in Pakistan have tried to do that sooner rather than later.

TAG, a competitor to SadaPay whose licence had been revoked by the central bank, for instance tried buying Samba Bank when it wasn’t even commercially launched as an EMI. Finja, another one of the EMIs, partnered with HBL to get a digital bank licence and eventually sold its EMI licence to Chinese/Nigerian fintech company OPay.

Some others have withdrawn altogether. Paymax unexpectedly requested business closure and licence withdrawal in October 2023, while Careem withdrew the licence in August last year. Similarly, UAE-based YAP faces potential downfall as it reportedly let go of nearly its entire workforce in the country. The team, now insufficient to run a fintech, faces the risk of getting its licence revoked.

All of the above supports the scepticism in the market that EMIs can’t make money. They can if they can create more products specific for the Pakistani market. For instance, SadaPay has a product called SadaBiz that allows freelancers to bring money into Pakistan. But there still are regulatory bottlenecks that do not allow roll out of products such as investment into gold. A headway was recently made in the EMI space with the State Bank allowing EMIs to enter into the remittance business, which has increased some charm for this licence but broadly, the distrust remains strong.

On record, these companies can become profitable, however, that would take a while, as Salimullah also said. How does a company sustain itself until profitability is achieved? It has mostly been venture capital so far that companies like SadaPay and NayaPay have been relying on to fund operations but venture funding is running dry these days. So, on the one hand, the company needs funds to sustain and possibly try to achieve a bigger scale, while on the other, the funding required to do that tends to run out overnight. The reduction in funding availability creates an environment where sustaining innovation and growth for fintechs, like SadaPay, can be particularly challenging.

It isn’t illogical then that the CEO of SadaPay Brandon Timinsky considered it beneficial to sell his fintech company, that he grew to over 1 million customers, to a company like Papara that has excellent financial heft to keep the operations of SadaPay going, and actually grow it further, giving it a better shot at sustainability. The other alternative for SadaPay would have been an ugly one: raise relatively smaller amounts of money in a funding winter and at highly unattractive valuation and terms.

If you aren’t with Papara, you are against it

There would have been another big downside of choosing not to sell to Papara. The Turkish fintech company is planning an initial public offering (IPO) in 2025 and has been aggressively unlocking new markets. Papara, which has been valued at over a billion dollars and is the first fintech unicorn out of Turkey, recently acquired Rebellion Pay in Spain and is reportedly making another acquisition in Egypt. In October last year, Ahmed Karslı, the CEO of Papara, had said that the company was actively entering into mergers and acquisitions in the European market. Like other markets, an acquisition would be a faster entry into the Pakistani market as well and sources close to the deal have revealed to Profit that if it wasn’t SadaPay, Papara would have gone on to acquire any of the other EMIs in Pakistan like NayaPay. And that would have made things very difficult for SadaPay.

Established in 2016, Papara is a fintech subsidiary of PPR Holding A.Ş., Papara is also an EMI in Turkey that has made it work in the home country and that too with limited venture capital. The company has over 17 million users and an e-money licence, offering a suite of services, such as money transfers and payments. Crunchbase data shows Papara has only raised as much as $2 million in funding. The company processes an estimated 528 million transactions yearly, with a volume of $32 billion. At home it plans to become a financial superapp and offers investment services as well, allowing users to buy Turkish stocks, US stocks, commodities and bonds.

The financial health of Papara is enviable: deal documents show Papara exceeded $200 million in revenues for trailing 12 months until November 2023, and was projecting an EBITDA exceeding $100 million for financial year 2023. So, instead of having a formidable partner in Papara, SadaPay would have been competing with a formidable opponent instead, had SadaPay refused the offer.

Plans post acquisition

The acquisition is useful for Pakistan considering Papara has proven it can make EMIs work. It has done that by rolling out numeros products in the Turkish market and the key to making EMIs work here would also be to roll out various products distinct for the Pakistani market. SadaPay and Papara plan to do exactly that.

To reiterate, Papara plans to immediately bring $10 million as foreign direct investment into Pakistan to solidify SadaPay’s position in the market. Over a few years, this could go up to $50 million, which could set SadaPay up for securing a digital retail bank licence (DRB) licence in the future. In the immediate horizon, this investment has been earmarked for technological advancements, which would enable rolling out new products and market expansion.

Specifically, SadaPay plans to use the investment to expand its consumer footprint, including scaling SadaPay’s consumer base, enhancing marketing efforts and developing new customer acquisition channels. These funds would also be deployed towards enhancing the acceptance of QR codes via Raast at SMEs, and towards rolling out credit products through collaboration with partner banks.

One of the plans in the works for SadaPay has been introducing remittance services for overseas Pakistanis. Papara happens to have similar plans and the acquisition would accelerate the rollout of remittance service in key markets, with a significant Pakistani expatriate population, such as in the UK and Saudi Arabia.

On the tech integration and strategy front, the company aims to install a unified technological platform across all regions where Papara operates. Since there is a substantial overlap with the technology infrastructure at SadaPay and the one developed by Papara, Papara’s current technology stack will be integrated in SadaPay, wherever feasible, post acquisition.

Deal documents show that on the back of technological integrations, SadaPay would be able to accelerate the launch of advanced financial products and services that Papara has in other markets, such as diverse card options, including ghost virtual cards for one time use and voice cards for the blind. Customer loyalty programs, multi currency accounts, automated savings accounts, investment and wealth management services, insurance and other products are on the list of products and services to be rolled out.

Very informative article written and author get good information

This is the best way to receive my Client’s payment through Sadapay for my website and from Clients. Easy to use app but the charges and feel are a bit high

undervalued

Such a shallow approach, a startup with such a good potential in fintech and giving up so early! They’re leaving way too much for some cheap money.

For those not aware of startup economy. This is not an investment into company but a simple sale. A lot of startups do this abroad but there are always genuine founders who lead the industry.

Will people be able to make transfers in between these accounts? Or both companies will operate in their parent country?

Hello there, just became alert to your weblog thru Google,

and located that it’s truly informative.

I think I have been scammed by Bitmartsd.com. I was invited to trade at bitmartsd.com and I transferred funds (86,000 USD) there. They said I have to transfer another 5000 USD after seeing a supposed profit of 44,000 USD added to my initial capital or else they will block my funds which I did and I was asked to transfer another 10,000 USD then I started suspecting it to be a scam, the website also looks much simpler than the bitmart.com website. I did my research and came in contact with “Recoverycoingroup at gmail dot com” who recovered all my funds in less than 72 hours. Although it wasn’t free, it was worth it. I promised to let everyone know about the Recovery Coin Group (RCG). I strongly recommend RCG.

I think this is the right place where you can see all the information about the turkish country.

Thank you for sharing

Nice Post

Wow Really You Are Providing Very Good Information, Thank You For This Information if you are looking best video editor VN App

Thanks For Sharing

nice

best

Provident Botanico Whitefield in Bangalore is a premier residential enclave that epitomizes luxury living amidst the bustling cityscape. Nestled in the prestigious locality of Whitefield, this project by Provident Housing Limited offers a serene oasis with a perfect blend of modern architecture and lush greenery. The residences at Provident Botanico Whitefield are thoughtfully designed to provide spacious and comfortable living spaces. With contemporary designs, premium finishes, and ample natural light, every home exudes elegance and sophistication. Residents can choose from various meticulously crafted apartments catering to diverse lifestyle preferences.

Thanks For Sharing

Face Yoga for Jawline and Cheekbones

This acquisition between Papara and SadaPay represents a pivotal moment for Pakistan’s fintech sector. With a significant investment and strategic alignment, it’s a testament to the potential of startups in the region. Exciting times ahead for both companies!

An exciting development for Pakistan’s fintech scene! The acquisition of SadaPay by Papara, along with additional investment, reflects growing confidence in the country’s startup ecosystem. Looking forward to seeing the impact of this collaboration.

A notable advancement in Pakistan’s fintech industry! Papara’s acquisition of SadaPay, coupled with further investment, demonstrates increasing faith in the country’s startup environment. Eager to witness the outcomes of this collaboration.

Very Informative article.

Thanks for sharing this amazing blog…

Sadapay is an excellent platform for freelancers, offering valuable services. I would like to suggest the integration of a Rupee payment feature (create a link for getting payment from Pakistani clients) within the app. This addition would enhance convenience, particularly during occasions such as Eid and for freelancers (video editors) who are working locally.

La adquisición de SadaPay por parte de Papara, un gigante turco de fintech, no solo refuerza el ecosistema fintech de Pakistán, sino que también promete transformar significativamente la infraestructura financiera del país. Este acuerdo, valorado entre $30 y $50 millones más una inversión adicional de $10 millones, podría resultar en un avance considerable para SadaPay al expandir su capacidad de ofrecer servicios financieros innovadores. Este desarrollo es un indicativo fuerte de que los modelos de negocio como los de Papara pueden ser exitosos y sostenibles en mercados emergentes, lo cual podría animar a más inversiones extranjeras directas en la región.

That`s really nice blog.

On this site, you can check the latest numbers, updated daily at 3:50 PM and 4:30 PM except Sunday. Interestingly, you will get second-to-second updates as soon as the authorities announce them.

I read this full article, and this is full of inforative content. Thanks for sharing such a wonderful content.

Amazing information. Sadapay would make the life of freelancers easy. Hope they offer dollar accounts. That would be dope