Everyone knew that the finance ministry was going to be the toughest ministry in the upcoming term, when the government was naming its cabinet. With all the climbing debt and interest rates, an everlasting balance of payments crisis and shortage of dollars, the ministries toughest days were ahead of it. Any party who would have hence formed the government would have had to deal with tough circumstances. What has since unfolded is the unlikeliest of plans.

The PMLN has come up with a peculiar way of dealing with the country’s finances. On one hand they have the qualified, experienced and well-reputed banker, who gave up his overseas citizenship to be at the helm of the financial management team. While on the other hand they have the finance ministry veteran, Ishaq Dar.

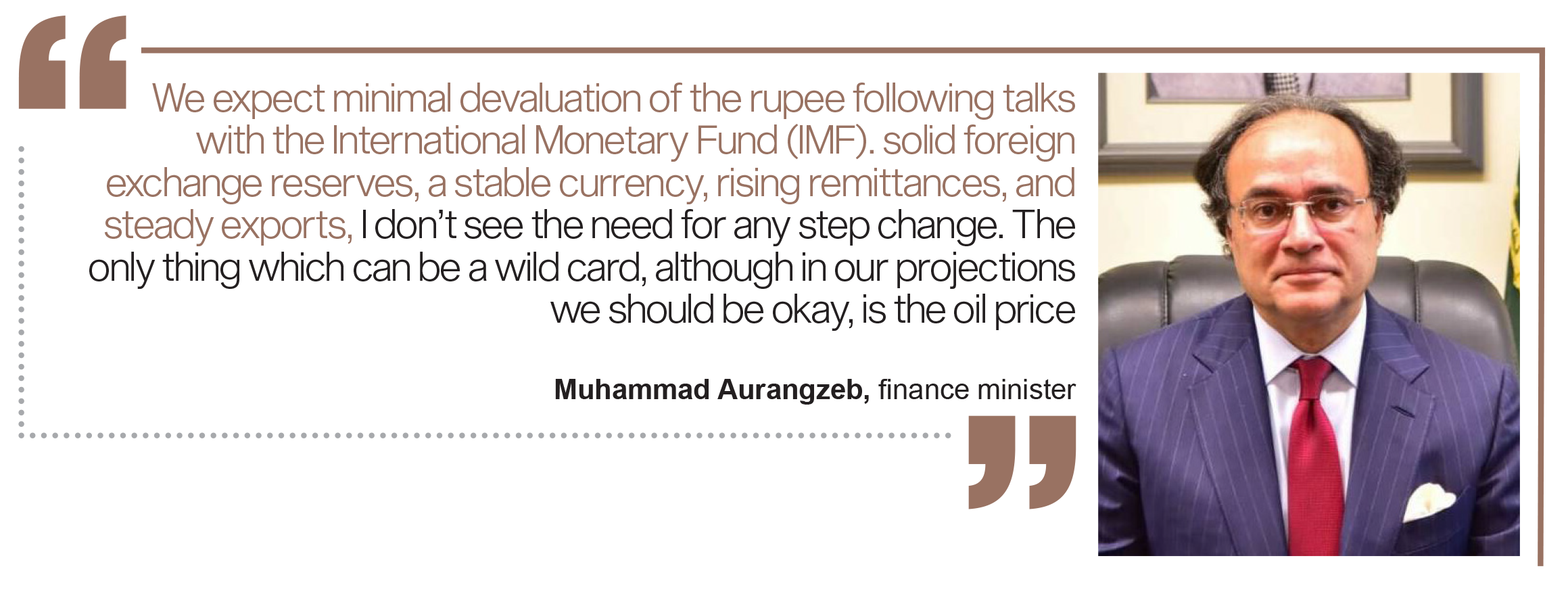

Taking up the Finance Minister office, Aurangzeb had high hopes, however, he saw himself immediately sidelined from all the major decision making committees of the internal finances of the country. The media was quick to question what his role was going to be as the finance minister, but that question remained unanswered, up until now. On his recent mission to the United States, the picture has become somewhat clearer.

Running a bank is not akin to running a country. The rules of public finance and corporate finance are like night and day. It is not that Pakistan has always had the precise experts running the ministry anyway but banking-for-profit is as far from public finance management as can be. Why then, would Shehbaz Sharif choose someone like Aurangzeb to be the finance minister.

The answer lies in his banking abilities. The banker may not be the ideal candidate for managing the rifts between province and centre, or designing poverty alleviation budgets.

But one thing that his recent visit to DC has shown is that he is no stranger to stakeholder management. And why would he be? With the wealth of experience that he has at his disposal, not only in Pakistani banks but also some of the biggest international banks, he is right at home dealing with important stakeholders. That is, apparently, what M Aurangzeb’s role has been reduced to as the finance minister.

The visit to Washington

It has been common knowledge that Pakistan wants to enter another IMF program, if it is to avoid another default scare. And that was exactly the task that Muhammad Aurangzeb diligently took on. The veteran banker landed in DC for a week full of meetings on Monday.

As of now, Muhammad Aurangzeb has already held a meeting with the WB chief, the IMF chief along with members of the IMF board. He has also met the chief of the Asian Development Bank and has also had the chance to meet the US state department’s infamous Assistant Secretary, Donald Lu.

In all of these meetings, Aurangzeb has been reported touting a “reform agenda”. In his meeting with the IMF Mr Aurangzeb “underscored aggressive reforms, including broadening the tax net, privatising loss-making SOEs, expanding social safety nets and facilitating the private sector,” his team said in a statement issued a day after the meeting.

None of these reforms are new and as apparent by the detailed coverage of these topics in the media, none of them have a high likelihood of being reformed or resolved in the ongoing finance ministry’s term.

What then is the Finance Minister talking about. In his meeting with the IMF, Aurangzeb also mentioned the implications of geo-economic fragmentation on Pakistan and expressed gratitude to the IMF, multilateral development banks, and “time-tested sincere bilateral partners” for their unwavering support during trying times.

While Pakistan has always had political affiliations with the global north when it comes to global disputes, the recent language coming out of the finance and foreign ministry both indicate that the current government is leaning towards International Financial Institutions (IFIs) such as the IMF and the World Bank, and in turn the US and its affiliates in Saudi Arabia to rescue it from the storm this time.

As the birthing ground and the largest contributor, the United States’ foreign policy is always believed to have some involvement in the decisions of the IFIs. It is also important to note here that in Pakistan’s most recent balance of payments crises, both Saudi Arabia and the UAE made their aid to Pakistan conditional upon an approval from the IMF.

To kill two birds with one stone, Aurangzeb’s visit to America and his meetings with the State Department and IFIs aim to ensure Pakistan’s chances at an IMF program. But Profit’s latest coverage indicates that only an IMF program still might not be enough, what is the finance ministry doing about that?

It seems as though the finance minister has been assigned one mission only. The mission is to secure the country’s external account. With vast resources in the private market up his sleeve and a wealth of experience dealing with multilateral institutions, he is more than equipped to do so.

So then who is left to deal with the economy at home? Who is responsible for bringing in newer investments? And is that person equipped to deal with a problem of this magnitude?

Backstage Daronomics

In the books of PMLN, there could be only one answer to who runs the domestic economy while Aurangzeb runs the show around the world? And that is “Ishaq Dar”. His love affair with a strong rupee has landed Ishaq Dar in quite a bit of trouble in the past. But just as in any love story, Ishaq Dar has found his own way to manage the rupee, even if it is not in the finance minister’s chair.

Just last week, news reports claimed promised gains in the rupee’s value in the coming months. Of course this could be achieved fundamentally over the course of PMLN’s term in office, provided Aurangzeb’s reforms agenda is put into practice on an immediate basis. However, if it was to be achieved in the coming months, the whole ordeal would reek of Ishaq Dar and his Daronomics.

Another interesting aspect of the current economic plan of the PMLN is that the shots are not just theirs to call. Under the new domestic finance regime, overlooked by the SIFC, responsibilities have to be shared.

Ishaq Dar, however, remains the focal person. Being the foreign minister of Pakistan, Ishaq Dar has already met the Saudi foreign minister and the Emirati Energy minister. The meetings may be diplomatic in nature, but Ishaq Dar, famously is not.

That is one of the reasons why the topic statements of not only Ishaq Dar’s meetings with the Arabs, but also the SIFC’s communication has been investment opportunities and its facilitation on Pakistan’s part.

It can hence be noted that while Aurangzeb holds down the fort at the offices of multilateral institutions, Ishaq Dar gears up to kickstart the domestic economic activity.

Of course a peculiar plan like this comes with a cost. The cost of these shenanigans, in this case, is Ishaq Dar’s primary job in the foreign ministry, but also policy continuity in the Q-block. Should the foreign minister be calling shots on key economic decisions? And more importantly, should the finance minister actually be shunned out of that decision making process?

Great information shared.

It was not an easy job. Thanks for sharing.