Circular debt.

It’s one of those terms everyone seems to use when talking about problems in Pakistan’s energy sector, and there aren’t a lot of solutions out there. The roots of the problem can be traced back to the way energy is provided in the country which has only compounded the problem further. The issue needs to be addressed with targeted reforms that need to be put into place. With a lack of initiative and political will, no such reforms are being implemented.

With the issue of circular debt so deep, there was an interesting idea pitched recently from within Pakistan State Oil (PSO), regarding how they could manage their rising circular debt problem. Of course, PSO managing its circular debt would just be one part of the puzzle, but it is worth looking at the proposition. The suggestion is for PSO to swap its debt for equity. Essentially, PSO wants to pass off its debt to another company and offer that company shares in return. Easy peasy, right?

Not quite. While it is an idea (we’ll give it that), it would be like rearranging the deck chairs on the Titanic while the country is careening towards the iceberg. Profit takes a look at what exactly is the proposed solution that is being promoted, and could it be effective?

The circular debt

The energy supply chain in the country is mostly controlled or operated in some capacity by the government. The government and its entities aVre the buyers of gas and electricity in the country. They are also the ones who are responsible for setting the prices for electricity and gas. The electricity prices in particular are charged on a cost-plus basis which means that the end price of the utility is charged once the cost has been accounted for. This means that the pricing mechanism is not grounded in economic reality or economic use. This is also prevalent in the gas provision and gas pricing as well. What ends up happening is that electricity and gas is sold at a fraction of the cost it should be selling it.

The price being charged for the two utilities ends up being much lower than the one that needs to be charged. The government rationalizes this behavior by providing a subsidy and debt which is able to fill some of the gap that exists between the cost of providing the services and the cost charged to the consumer.

In simple terms, the government keeps kicking the proverbial can and debt down the road and the circular debt keeps accumulating. The nominal impact of this debt is that entities end up owing each other and as the payments are not being settled, the debts keep increasing over time.

In normal circumstances, the debts would be paid off in time and the company would be able to generate the necessary cash flow in order to meet their operational needs. As the receivables are not paid off, the companies have to experience bloated receivables while they end up funding their own operations through bank loans and borrowings. The rotting impact of the circular debt then extends into the banking sector and private credit market of the country as well as these funds are being taken with little scope of these being returned in the near future. The private debt market gets crowded out as well as the private sector has lessened access to these funds.

The caretaker government wanted to decrease some of the impact of the circular debt by injecting funds from one end of the debt cycle which would pass through the whole system and would be funneled back to the government in some form. The basics of the measure would have been that Rs 710 billion would be given to the power production companies who would end up paying their debt to the gas distribution companies which would then make their way to exploration and production companies in the end.

Some of the leading exploration and production companies are Oil & Gas Development Company and Pakistan Petroleum which are listed on the stock exchange and who have a huge chunk of their shareholding held by the government. As these companies would get some of their receivables, they would announce dividends which would make their way back to the government’s coffers. The government would also earn revenues in the form of tax that would be charged on the dividend income.

Due to the complications in the deal, the International Monetary Fund (IMF) rejected this measure and stated that funds could not be utilized in this manner. In essence, this was a short term solution that was being put into place where a far reaching and impacting solution was required. These far reaching solutions are dime a dozen and need political will and ambition in order to be put into place. With a government looking to keep all stakeholders, there is little that can be expected in the near future.

So what else could be done?

The problem keeps compounding

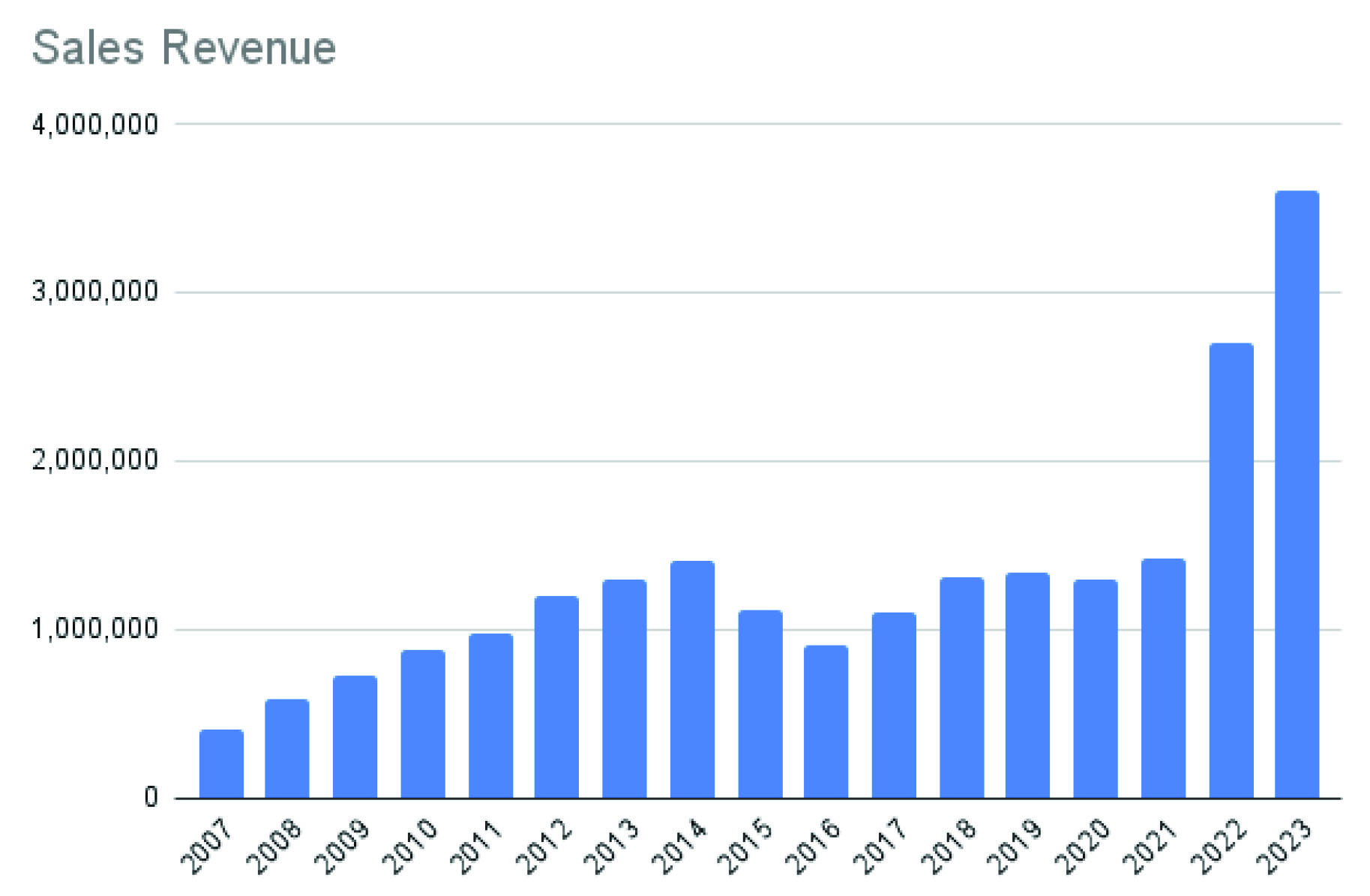

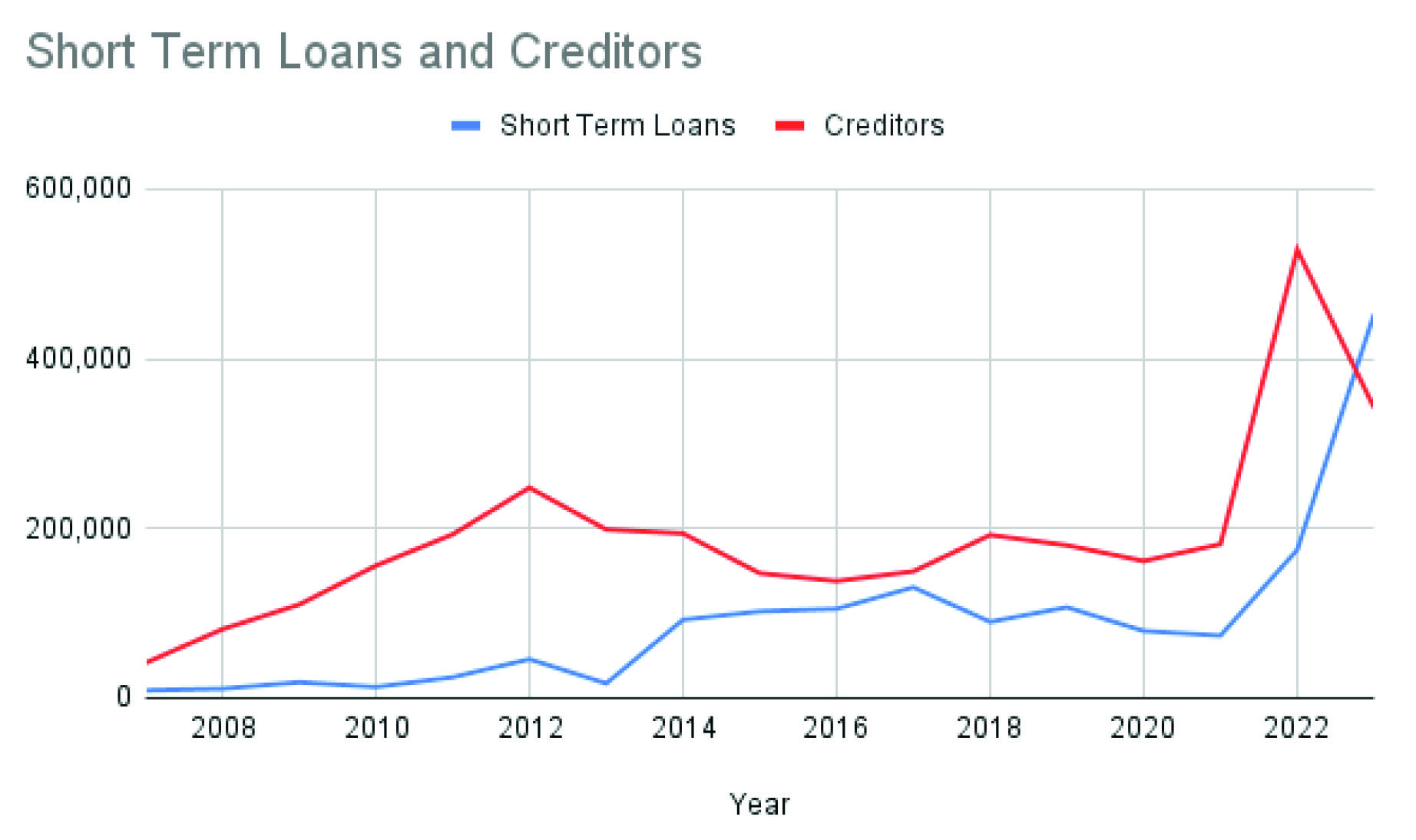

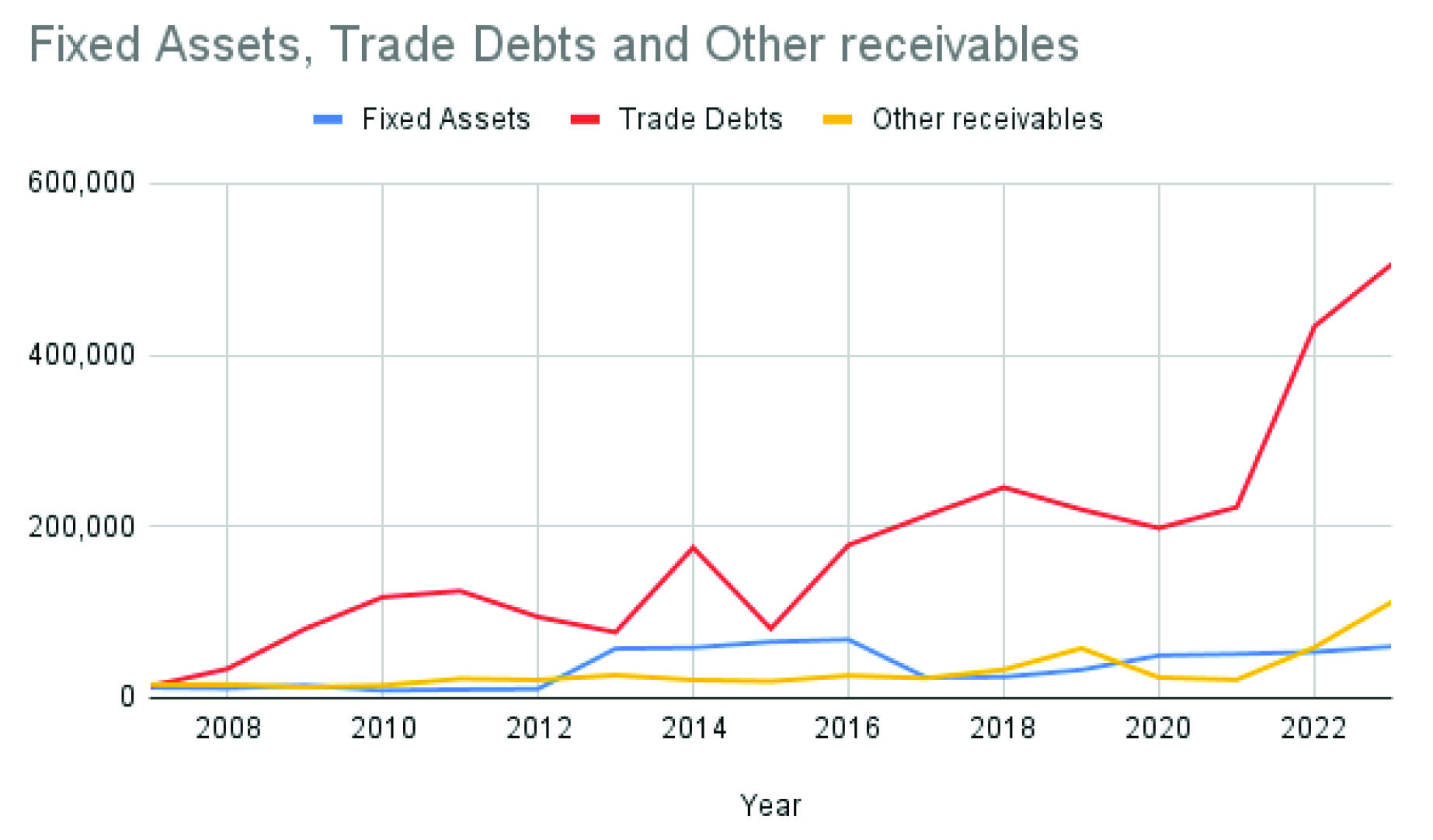

Pakistan State Oil (PSO) is one of the companies that is on the frontline and facing this crisis head on. In recent years, the company has faced growing receivables on its balance sheets which are not being paid off. From 2007 till now, PSO has seen its sales revenue grow from Rs 411 billion to Rs 3.6 trillion in 2023. As the sales increased by more than 9 folds, it is obvious to expect that the company would see its trade receivables to increase as well. The magnitude of the increase is the shocking part. The trade debts of the company went from Rs 13 billion in 2007 to Rs 505 billion in 2023. This shows an increase of more than 37 times. As sales are high and receivables are low, there is a gap that is created that needs to be financed by short term borrowings. Short term borrowings were only Rs 9 billion in 2007 which grew to Rs 452 billion in 2023. The company has been taking more and more debt in order to fund the gap that is created. The company is not able to receive the payments that are due and has to go to the bank in order to finance the gap. The company also uses its creditors in order to finance this gap. Creditors only were around Rs 41 billion for the company in 2007 which increased to Rs 342 by the end of 2023.

This means that PSO is not only suffering from the circular debt but also becomes an active participant in the problem. Companies which are buying from the company are not making the payments due on them to PSO. This causes PSO to not be able to pay its own creditors which only adds to the circular debt problem.

On the face of it, these might seem like just numbers but to give them some context, the company has fixed assets of only Rs 60 billion while its trade debts are around 10 times that. This means that all the infrastructure and fixed assets the company has, the receivables are 10 times more than its fixed assets.

The situation becomes even more alarming when the recent trend in its earnings and share price is seen. The market price of a share is the reaction of the market participants to the fundamental performance of a company. Market price gauges what the buyer is willing to pay for a company based on the performance of the company. One of the biggest indicators of a company’s performance is the price to earning multiple or ratio. Lets say a company is earning Rs 10 on an yearly basis. An investor might be willing to buy this share for Rs 100. The price to earnings multiple becomes 10 as the investor can expect to make back his investment in 10 years if the company keeps performing in the same manner.

Normally, the price to earnings multiple shows how a company is performing and gives a metric by which its performance can be measured against other companies trading and operating in the market. PSO usually trades at a multiple of 5 and in years of low profitability, this ratio increased to around an average of 8. The biggest blip took place in 2022 when the company had a price to earning multiple of 0.94. This meant that the company earned a profit of Rs 184 per share and the market was not even willing to pay Rs 184 for such a share. Imagine investing Rs 184 in a company which is expected to earn the same amount in that one year. The market was not even willing to do that.

How could that be possible?

The market price of a share is a reflection of the perception that the company carries and investors felt that even though the company was earning a healthy amount of profits and revenues, the trade debts were a huge concern. There were chances that the company might never see the recovery of its trade debts which meant investors were not willing to pay the price that was prevailing in the market.

So it is evident that the receivables are accumulating at an alarming rate and something needs to be done in order to address this issue.

The out-of-the-box solution proposed

In the face of the deepening crisis, a solution has been proposed by the Managing Director at PSO. Syed Muhammad Taha feels that the receivables of the company can be wiped out by turning the loans to equity. This is what is known as a debt-to-equity swap.

So how does it work?

Let’s say there is a person who needs a loan in order to start their business. The person is a friend of mine and in order to help him, I lend him Rs 100. The friend himself invests Rs 100 of his own. The business is set up and it starts to operate. It is expected that I will get the loaned money back in due time. But rather than being successful, the business starts to make a loss. The friend has no other choice but to invest more money. The friend starts to sell off his personal assets to finance the losses his company is making. In order to keep the business afloat, he invests another Rs 100 in the company bringing his share to Rs 200 in the capital. Seeing the state of affairs, I reach out to my friend and tell him not to worry. Rather than paying me back, he can turn my loan into equity and he can pay me a part of his profits once his company turns a corner.

This is essentially what a loan-to-equity swap is. A loan that was supposed to be returned is turned into part of the equity and the creditor becomes a shareholder in the company. The original investor or owner of the company is willing to give up a share of his company in order to facilitate this. Once my loan is turned into equity, I will become owner of 33% of the company and hence its profits and assets going forward.

Based on the ground reality, this might seem like a good option. In the words of Taha himself, the only viable option that needs to be considered is to settle the circular debt amounts as the government and its entities have little interest in addressing it. The solution was given in May by the MD and has been solidified in the recent corporate briefing of the company. The management of PSO feels that the government can give some of its assets in order to pay off the receivables.

At this juncture, the idea proposed can be seen as having two primary prongs. On one hand, the government can act in a manner where it sells some of its own assets to PSO. The idea is to sell off shares in companies like Oil & Gas Development or give a portion of projects like the Nandipur or Guddu power plants. As PSO gets ownership in the new government owned projects, they can write off some of the debt against the new assets that they end up acquiring.

Shankar Talreja, Director Research at Topline Securities states that “PSO management has been recommending a share swap with the ideology of getting shares of government owned companies against receivables, however, we have not seen development in this regard. Further, the government is planning to issue a minority stake in the oil and gas sector to GCC(Gulf Cooperation Council) based strategic investors. So, how practical this share swap agreement is, is yet to be seen.” Topline is the company which helped PSO conduct the corporate briefing session for the market recently.

Getting a share in the assets of the government does make sense. The government will be handing over ownership of some of their priced assets to PSO which will address the issue that the company is facing but the problem will still remain that the government will be taking over the debt onto its own books. Plus, the government wants to attract foreign investment into the country so selling some of its best assets to foreign interest will take precedence. The idea has no legs to stand on once the solution is scrutinized to an extent.

The problem

So what if one of the biggest debtors of the company looks to use their own shares to pay off this debt?

As of June 2023, the biggest debtor for PSO was Sui North Gas Pipeline Limited (SNGP). According to estimates, SNGP owes around Rs 500 billion to PSO that it needs to pay back. Even if the interest on its loan is taken away, the company still owes more than Rs 300 billion as part of its debt.

What happens in vanilla loan-to-equity swap is that when such a transaction is carried out, both companies have to carry these transactions through their balance sheets. In this case, PSO will end up getting shares which will be an investment that the company holds. As shares are issued, it will increase one of its assets while its receivables fall. The net result would be zero in terms of total assets. On the other hand, SNGP currently shows the debt as part of its liabilities. Once the debt is paid off, its liabilities will fall. In order to make sure the accounting equation still balances, the equity of the company would need to be increased.

Seeing how this will impact SNGP’s balance sheet, the share price of SNGP is Rs 65 right now. In order to pay off most of its principal, the company would need to give 5 billion shares in order to pay off the debt. The problem? SNGP has total outstanding shares of 634 million shares. Out of these, the government owns around 32% of the shares. When the new shares are issued, the government will see its shareholding go from 32% to 3%.

The solution that has been proposed by the MD might seem beneficial to PSO but it is obvious that it will fail to even get off the ground based on the consequences it can have on the shareholding of the government and other shareholders of SNGP. A loan-to-equity swap dictates that new shares need to be issued.

Another solution can be that the government sells all of its shareholding in SNGP to PSO and then the funds raised can be used to pay off the debt as well. In case the government looks to sell off its shares to PSO, it will be able to generate Rs 13 billion from the transaction which is peanuts compared to its total debt. It will only pay off less than 3% of the loan while the problem will still exist and now the government has lost all its shareholding in SNGP.

The circular debt problem is one that needs to be addressed sooner rather than later and any solution which can contribute in the addressing of the problem needs to be considered. However, rather than coming up with fancy and out-of-the-box solutions, there needs to be concrete steps that need to be taken to address the circular debt problem once and for all. These solutions being proposed might seem flashy and attractive but they will prove to be a band aid on a gaping, rotting wound.