The fiscal year 2023 witnessed a puzzling conundrum where electricity generation in the country plummeted by over 10%, capacity payments soared by a staggering 29%. This surprising divergence, where installed capacity grew amidst shrinking demand and soaring costs, highlights a critical turn for the country’s energy landscape.

A recent review of the year that was for the power sector paints a grim picture of the current state of the country’s power sector. In an event, attended by a mix of both local and international experts, the think tank provided an in-depth look at the electricity sector’s turbulent year, from July 2022 to June 2023.

Trends in Pakistan’s electricity and power sector

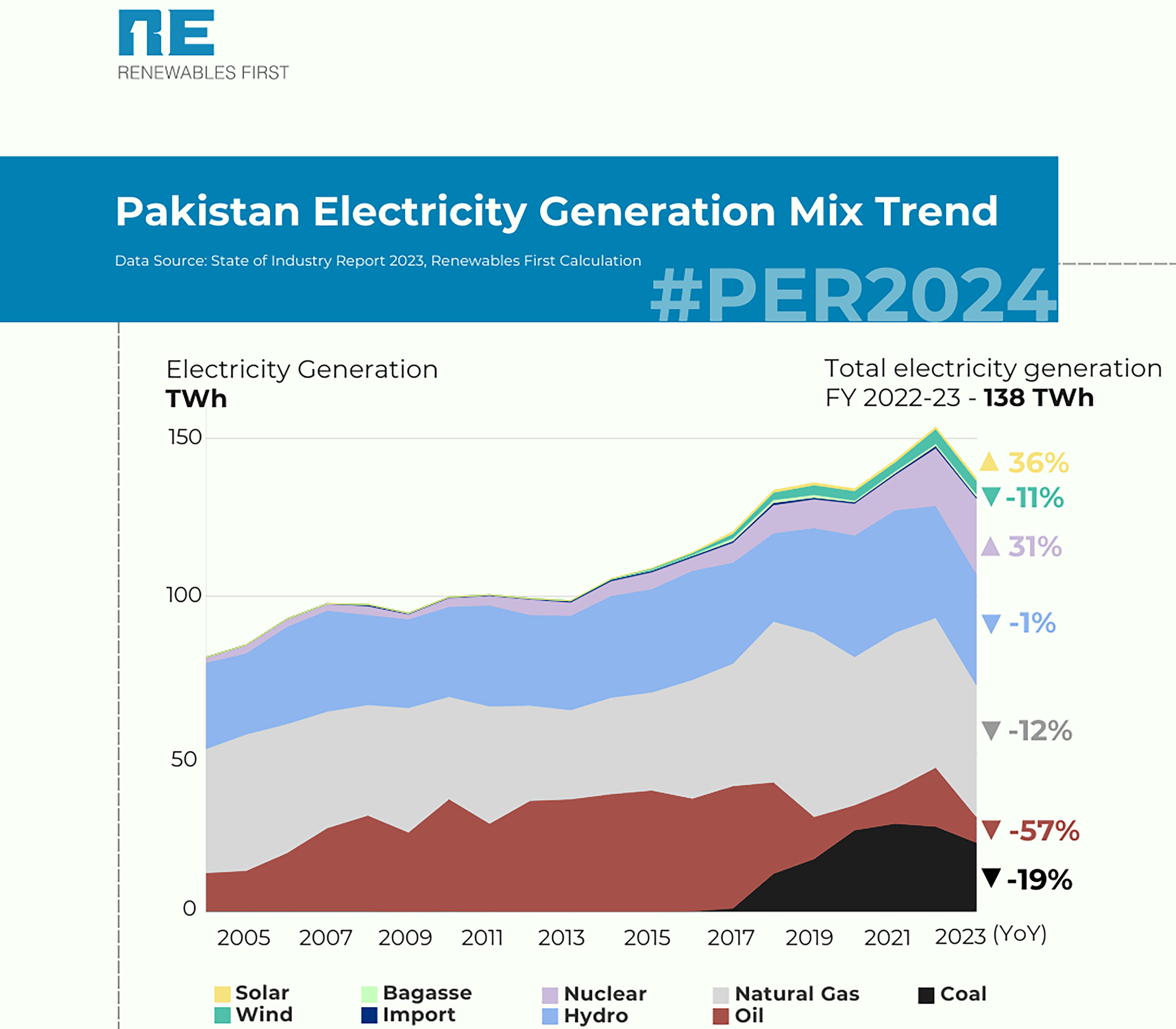

According to the electricity review presented by Rabia Babar from Renewables First, there was a significant decline of 10.4% in electricity generation, primarily due to a decrease in fossil fuel generation. Specifically, generation from oil saw a reduction of 57%. This decline in fossil fuel generation can be attributed to increased fuel prices following the Russia-Ukraine War, higher KIBOR and LIBOR rates, increased CPI rates, and PKR currency devaluation.

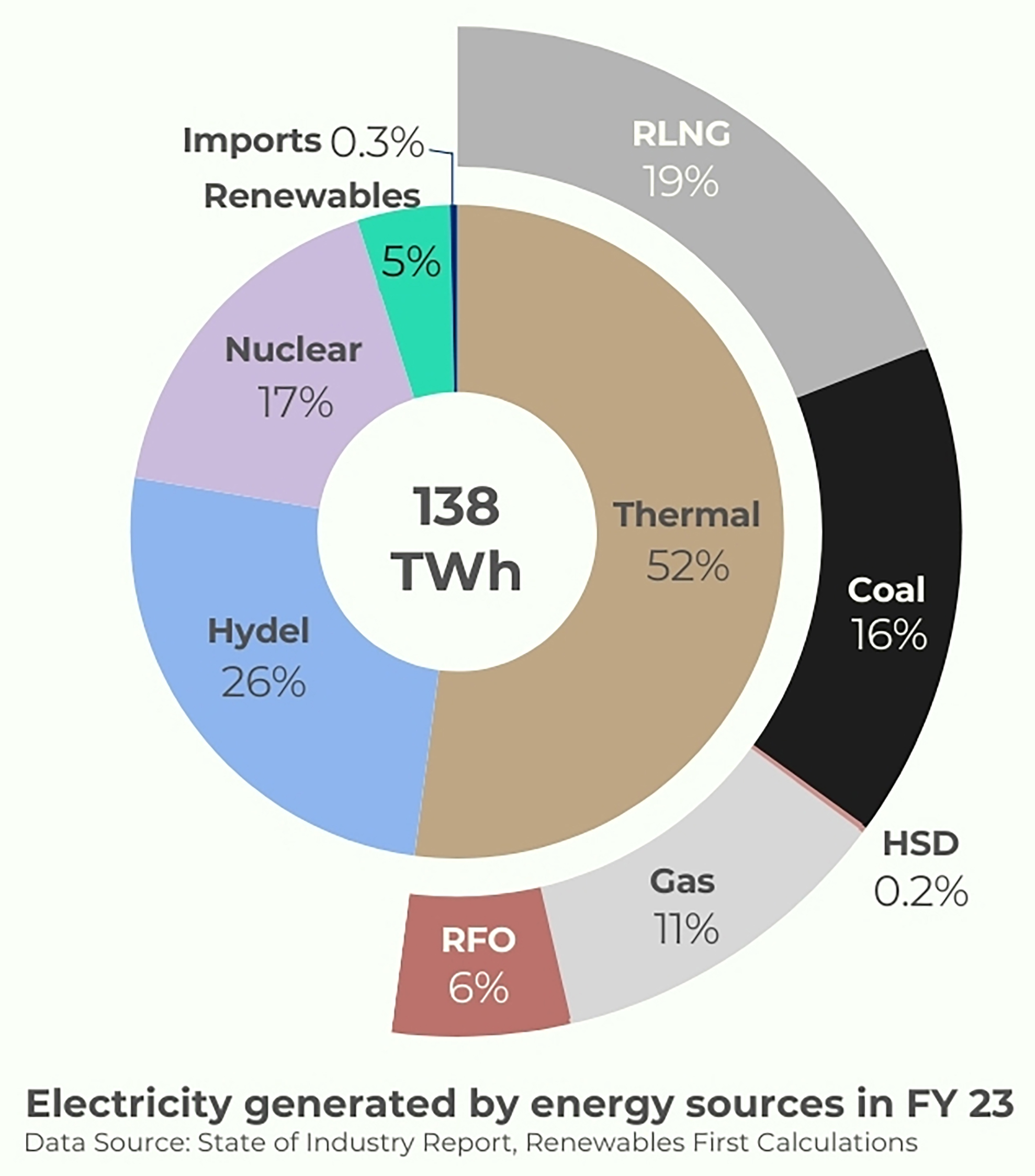

In terms of renewables, wind energy generation significantly declined from 4.5 terawatt hours to 4 terawatt hours, possibly due to wind curtailment in the power sector. Examining the generation mix for the recent fiscal year, thermal energy accounted for 52% of total electricity generation, with the highest contribution from regasified liquefied natural gas (RLNG) at 19%, followed by coal at 16%. Renewable energy held a 5% share, while nuclear energy increased to a 17% share in the generation mix.

It must be noted that there are seasonal variations in the use of different energy sources.

It must be noted that there are seasonal variations in the use of different energy sources.

Hydroelectric generation plays a crucial role during the summer months when river water flow is high, coinciding with Pakistan’s peak electricity demand. In contrast, during winter months, when hydro generation is low, thermal generation primarily meets the demand. Renewable energy sources such as solar and wind can serve as reliable substitutes for flexible loads during periods of low hydroelectric generation and a complement during high demand in the summer. Additionally, pumped storage can be explored as a solution to address intermittency issues associated with wind and solar power generation and to supplement peak demand.

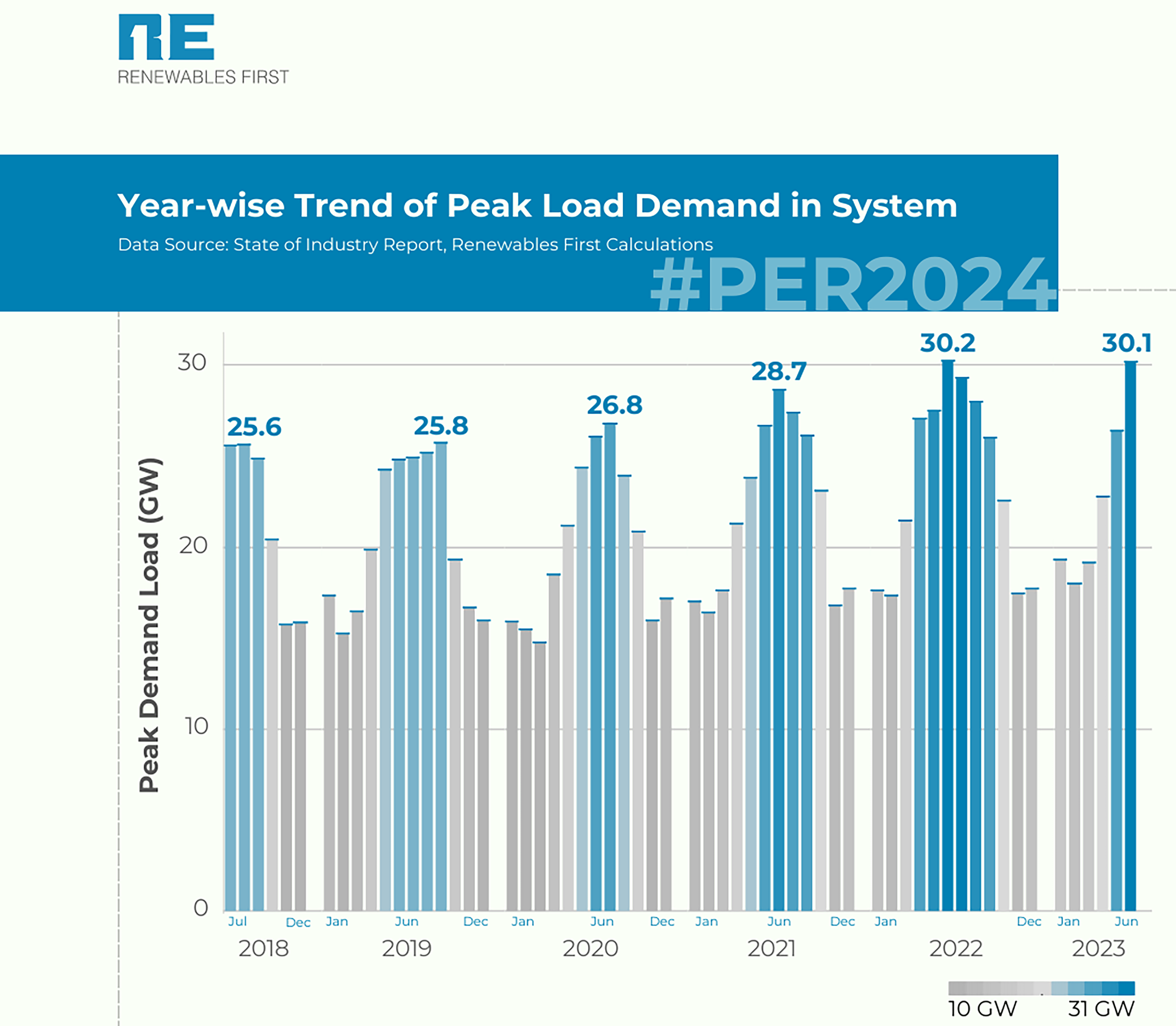

The trends of peak load demand are greatly impacted by the challenging economic conditions in Pakistan.

From 2018 to 2022, there was a gradual increase in peak load demand. In 2018, the peak demand load was 25.6 GW, which steadily increased to 30.3 GW by 2022. However, in the recent fiscal year, the peak demand load saw a slight decline of 0.3%. During summer months, peak demand is managed through fuel-based peaker plants, which remain idle outside peak periods. An interesting trend is the rise in solar and wind generation during summer, with wind generation ranging between 500-600 GWh. Exploring renewable energy hybrid solutions could help address peak demands and mitigate this issue.

Electricity sales growth also shows a decreasing trend.

Electricity sales growth also shows a decreasing trend.

In fiscal year 2023, electricity sales experienced a significant decline of 10% year-on-year, reflecting the earlier discussed trend of reduced electricity generation. Despite an increase in the number of electricity users, sales dropped sharply, primarily among domestic and industrial users. For domestic users, high electricity costs led to reduced usage and a shift towards distributed generation through rooftop solar installations to decrease dependency on the national grid. The decline in industrial consumption can be attributed to multiple factors, including a slowdown in GDP growth, which mirrors the decline in electricity consumption. Additionally, industries increasingly rely on captive power plants and solar power to meet their energy needs.

Addressing reliable energy needs and clean energy requirements is crucial for industries to cope with scope 2 emissions and comply with the Carbon Border Adjustment Mechanism (CBAM) to remain competitive in the international market. High electricity costs are a significant factor driving consumers away from the national grid.

The power purchase prices comprises two main components: the Energy Purchase Price (EPP) and the Capacity Purchase Price (CPP). The EP primarily covers fuel charges and variable operation and maintenance (O&M) costs of generation plants. In contrast, the CPP is the capacity payment for each generation plant in the fleet. In fiscal year 2023, the CPP experienced a significant growth of 29% year-on-year, emerging as a crucial factor driving up tariffs across the country. This increase in capacity payments has contributed significantly to higher electricity costs.

These trends are a direct result of high inflation and the government’s need to appease the International Monetary Fund’s (IMF) demands, in order to secure a substantial bail out, the costs of which are paid by the public. Given the rising electricity costs, policies to boost sales growth are essential. Efforts should focus on bringing consumers back to the national grid, as a shrinking consumer base would further strain the power sector’s revenue.

Capacity Payments Trend Over the Years

The increase in capacity payments over the years has not been solely due to thermal plants; nuclear and hydro capacity additions have also played significant roles. For instance, in fiscal year 2023, the thermal share in capacity payments increased by 38% year-on-year, largely due to the addition of three coal-based plants to the generation fleet. Additionally, the inclusion of K-2 and K-3 nuclear plants in recent years has increased the nuclear share in capacity purchase payments.

The electricity review provides insights into the power purchase price projection, as well as a forecast of electricity generation for the current and next year.

A comparison of power purchase projections for fiscal years 2024 and 2025 indicates a reduction in overall electricity generation from 139 terawatt hours in FY 2024 to 135 terawatt hours in FY 2025. When examining the percentage change in energy sources over these two fiscal years, the share of renewables is projected to decrease from 6% to 5%, while the share of RLNG is expected to increase by 12%. This shift will likely add to the country’s fuel import bill.

For fiscal year 2025, the national average power purchase price, after adjusting for losses, system charges, and the market operator fee, is projected to be PKR 27 per kilowatt hour. Examining energy source-wise pricing, the power purchase projection for solar has increased significantly, while the price for RLNG is projected to decrease by 35% compared to fiscal year 2024.

The fiscal year 2023 was marked by challenges in managing capacity payments, power purchase prices, and shifts in energy generation sources. With capacity payments rising significantly and a forecasted increase in power purchase prices, addressing these issues through strategic planning and policy interventions is crucial for ensuring the sector’s financial viability and sustainability.

Why is Pakistan in this crisis and what needs to be done?

It is clear that Pakistan’s recent power sector planning has faltered, leading to soaring tariffs, regulatory pressures, and utility crises. To address these issues, it’s crucial to overhaul the planning process with a strong foundation in data-driven strategies.

Sohaib Malik, an energy analyst at a European renewable energy company, commenting on the cycle of grid abandonment and rising costs during the current economic crisis, said, “Examining the current dynamics of the power grid, it’s clear that while reliability has improved, evidenced by reduced load shedding, the cost of electricity remains a significant concern.”

“As a consumer and energy analyst, I see that the trade-off for better reliability has been higher costs, impacting both consumers and industries. Although capacity has increased, the expected GDP growth and demand haven’t materialised, partly due to rising reliance on imported fuels. This discrepancy has led to decreased demand and heightened affordability issues, creating a cycle where high prices discourage consumption. Addressing these challenges is crucial to ensuring both affordability and effective grid utilisation,” Malik said.

Pakistan’s utility sector is trapped in, what Malik calls, the “utility death spiral,” where declining profitability accelerates its financial collapse, hindering its ability to meet revenue needs and remain operational.

One of the biggest reasons why we find ourselves in a utility death spiral is because when the IMF program began, the government chose to pass all power sector costs to consumers. This led to reduced production, demand, and GDP growth while exiting the crisis. Alternatively, continuing support for industry and incentivizing electricity use could have utilised idle capacity, potentially spurring economic development and GDP growth.

Speaking on the matter, Abubakar Ismail, a local energy and industry expert, said, “To advance under the IMF program, Pakistan must address tariff design and capacity payments. And discussions are underway to eliminate cross-subsidization by passing subsidies directly to consumers and improving the efficiency of tariffs and capacity utilisation.”

Ismail highlighted that the ideal policy would have been to establish an open market five years ago, allowing the purchase of energy for critical times and summer months while adding about 60% to 70% capacity. “Currently, with over 50% of capacity controlled by outdated government-owned plants, scrapping these inefficient units and reallocating their manpower could improve efficiency,” he said.

Continuing on possible solutions, he also shared that, “The current debate involves four RLNG plants: two owned by the federal government and two by Punjab. Tariffs have decreased from 16% to 12% dollar-based returns, but the government still requires dollar-based returns to attract foreign investment. To address this, the dollar rate could be fixed at 200 rupees, and returns adjusted accordingly. Reducing certain capacities and focusing investment on transmission and distribution infrastructure for the next two to three years could enhance regional tariff competitiveness, particularly in textiles, and improve overall consumption.”

Ismail stressed that there is a compelling case for considering the early retirement of certain energy projects, such as those using RFO, RLNG, or imported coal. Despite their relatively recent installations, their utilisation rates are low. Engaging in discussions about this, supported by international financing mechanisms, could drive down costs significantly and attract interest from global stakeholders.

When asked whether it’s possible to address this issue during the IPP renegotiation process that Pakistan is about to initiate, Malik responded, “To tackle Pakistan’s energy challenges, several strategic actions are crucial. Firstly, the government should examine successful international models, such as Indonesia’s Just Energy Transition Program and ongoing discussions with countries like Vietnam and South Africa, to draw valuable insights.”

“Engaging with key partners, both international and local, is essential to develop and execute effective solutions. Additionally, creating an integrated energy plan is vital, one that balances sustainability, affordability, and reliability by carefully assessing capacity needs and addressing seasonal consumption patterns. Emphasising long-term sustainability involves planning for a shift towards a more sustainable energy mix while managing the current reliance on base load power. Finally, it’s important to continually refine and update the energy strategy based on evolving demand profiles and technological advancements, ensuring the plan remains effective and responsive to changing conditions,” he concluded.

He highlighted that the government needs a more educated and informed strategy, while the private sector must recognise that if they don’t contribute to stabilising the sector, it risks collapsing, which will ultimately impact them as well.

Moreover, during the panel discussion, Dr. Fiaz Chaudhry from LUMS Energy Institute discussed the challenge of managing peak demand, which exceeds 30,000 MW primarily due to cooling needs. Despite a system capacity of 30,000 MW, the current supply only meets 25,000-27,000 MW. With utilisation remaining low at 23% outside peak months, concerns about cost recovery and tariff adjustments arise, likening the situation to charging fares for empty bus seats. For effective supply, both generation and comprehensive transmission infrastructure, from bulk to local distribution, must be fully aligned and operational.