Cleantech is having a moment in Pakistan’s startup scene. From energy initiatives to sustainable agriculture solutions, innovative ventures are sprouting up across the country at an unprecedented rate. But what’s driving this green revolution in the entrepreneurial landscape?

Recent months have seen a flurry of activity in the sector. The Climate Finance Accelerator (CFA) conducted an investment roadshow, while USAID’s Private Financing Advisory Network (PFAN) also showcased its cohort of cleantech SMEs to potential investors. Meanwhile, the likes of Accelerate Prosperity are ramping up support for eco-friendly startups, particularly in Pakistan’s underserved regions.

This surge isn’t limited to funding opportunities. Incubators and accelerators are increasingly focusing on climate-related innovations. The National Incubation Center (NIC) Faisalabad now brands itself as an agritech incubator, Innovate 47 has launched a dedicated climate accelerator, and New Energy Nexus recently announced its partnership to support clean energy ventures in Pakistan.

The urgency behind this trend is clear – Pakistan is grappling with the intense fallout of climate change, as evidenced by the recent devastating monsoon rains. But beyond the ‘why,’ this article aims to explore the burgeoning landscape of cleantech startups in Pakistan.

What unique challenges do these ventures face? And more importantly, how can they overcome these hurdles to create lasting impact?

So are these ventures investable?

But before answering this question, let’s get two things out of the way. First, while ‘climate tech’ is the globally preferred term for such initiatives, ‘cleantech’ remains more commonly used in Pakistan. For consistency, we’ll use ‘cleantech’ throughout this article.

And the segments included within this definition are carbon tech, industry, sustainable foods, low-carbon mobility, dispatchable energy sources, clean fuels, built environment, land use, intermittent renewable energy sources, grid infrastructure and agritech.

Now let’s take a look at what’s been happening in the global funding scene. It’s been a rough couple of years for investors in cleantech, to say the least. Geopolitical chaos, valuations taking a nosedive, inflation creeping up, and interest rates climbing. It comes as no surprise that private markets across the board have taken a hit.

Resultantly, total venture and private equity investment, as per PwC, dropped by a massive 50.2% compared to last year, bottoming out at $638 billion in 2023.

Now, cleantech startups didn’t get hit quite as hard, but they still took a pretty big knock – funding fell by 40.5%. To put that in perspective, the funding levels for the vertical are back to where they were five years ago.

But there’s a silver lining. The fact that cleantech didn’t fall as hard as the overall market is an indicator there’s still some fight left in this sector.

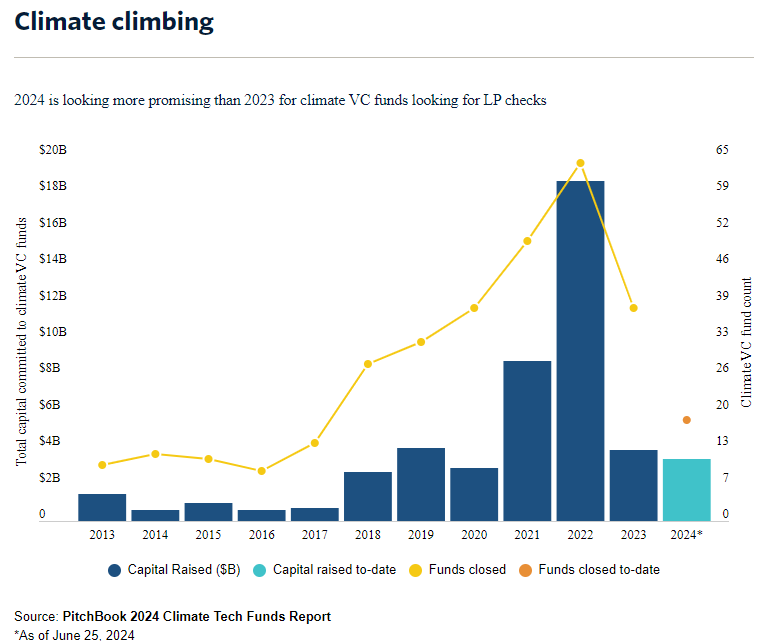

Additionally, investors have shown growing interest in this sector, with dedicated funds gaining momentum. In 2022, dedicated VC funds successfully raised a record $18.7 billion in capital. While the levels plummeted in 2023, there was a notable resurgence in 2024. Adding to this tally is Bill Gates-backed climate VC, Breakthrough Energy Ventures, that has secured $839 million to raise its third flagship fund.

But why should we care?

Pakistan is a key signatory of the Paris Agreement. Under its Nationally Determined Contributions (NDCs), the country aims to reduce emissions by 50% by 2030.

However, progress toward these goals is lagging, largely due to a massive climate financing gap. Current funding for mitigation projects is only about one-fifth of what’s needed, while adaptation projects are receiving just 6% of required financing.

Cleantech ventures could help address this gap in two ways: By attracting international investments and climate financing and by reducing overall funding needs through cost-cutting innovations and local solutions.

The local landscape

To gauge the state of Pakistan’s cleantech ecosystem, it’s crucial to view it within the broader startup landscape. The overall startup scene hit funding peaks in 2022, but faced a slowdown in 2023, with 2024 shaping up to be even tougher.

This downturn hits the cleantech sector particularly hard, given its already modest footprint. Cleantech has accounted for only 2-3% of total startup fundraising over the past five years, with investments primarily focused on e-mobility and agritech. Moreover, the average deal size in the sector is less than half that of the overall startup ecosystem.

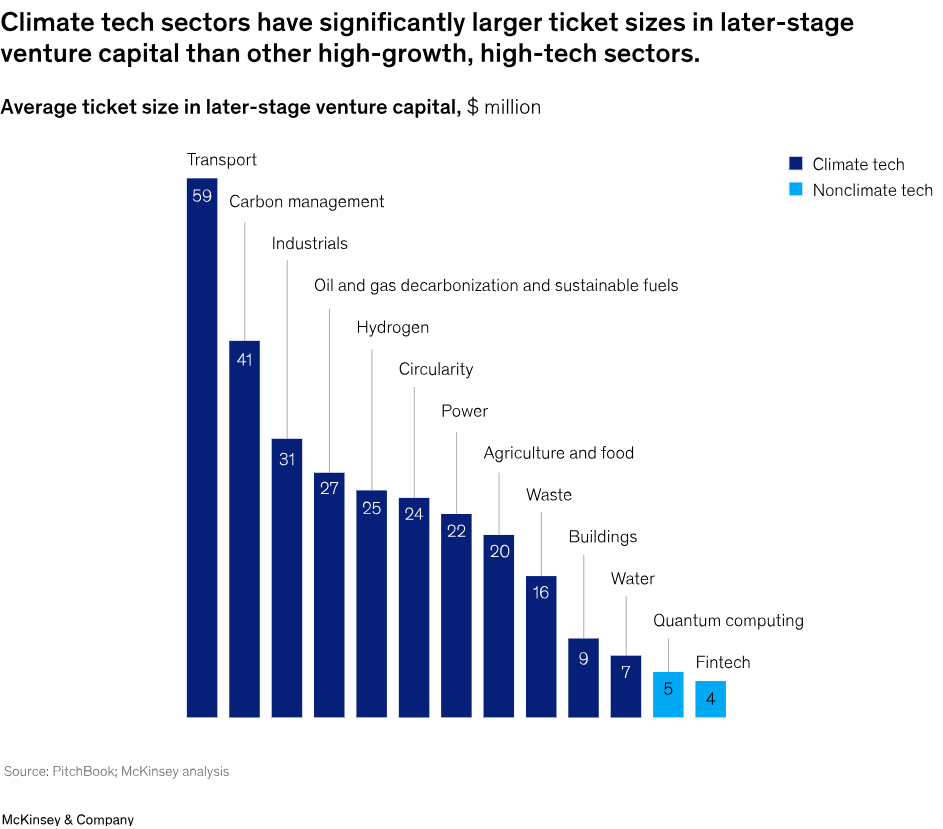

Now, that in itself is a problem. Cleantech businesses usually are more capital intensive and need higher capital injections (explained later) at multiple stages compared to conventional ventures. A trend that has been identified globally.

Nevertheless, the sector in the country presents significant untapped potential, as emphasized in the study “Cleantech Ecosystem of Pakistan” by USAID-PFAN. Key areas primed for growth encompass: Renewable energy – the escalating power tariffs are paving the way for solar and wind energy options.

E-mobility – the substantial fuel import expenses are fueling the demand for electric vehicles and associated infrastructure. Circular economy and carbon tech – the increasing emphasis on sustainability solutions is creating avenues in resource efficiency, waste minimization, and carbon capture.

But how are these startups unique for the Pakistani ecosystem?

Cleantech ventures face a unique set of challenges compared to conventional startups in the tech ecosystem. These challenges stem from the nature of the industry and the specific context of Pakistan’s market.

Firstly, these startups typically require more time to develop their minimum viable products and bring them to market compared to other tech-based solutions. This extended timeline can strain resources and test investor patience.

Secondly, Pakistan faces a significant shortage of specialized human capital, such as engineering talent for electric vehicles, and lacks the necessary infrastructure like specialized manufacturing facilities.

Many entrepreneurs in this sector tend to focus heavily on technology development, sometimes at the expense of building a viable business model around their innovations. This imbalance can lead to impressive technical solutions that struggle to gain market traction.

The high upfront costs associated with cleantech solutions present another hurdle. Customer adoption often depends on affordable financing options, which are currently scarce in the market. Solar energy systems and e-mobility solutions are prime examples of technologies facing this challenge.

Moreover, there’s a general lack of awareness and resistance to adoption among potential customers. This hesitancy can slow market penetration and growth for cleantech startups.

These ventures also typically require significant component imports, inventory, and working capital. Unlike software or other asset-light businesses, these startups need substantial capital in their early stages and generally take longer to break even and scale up.

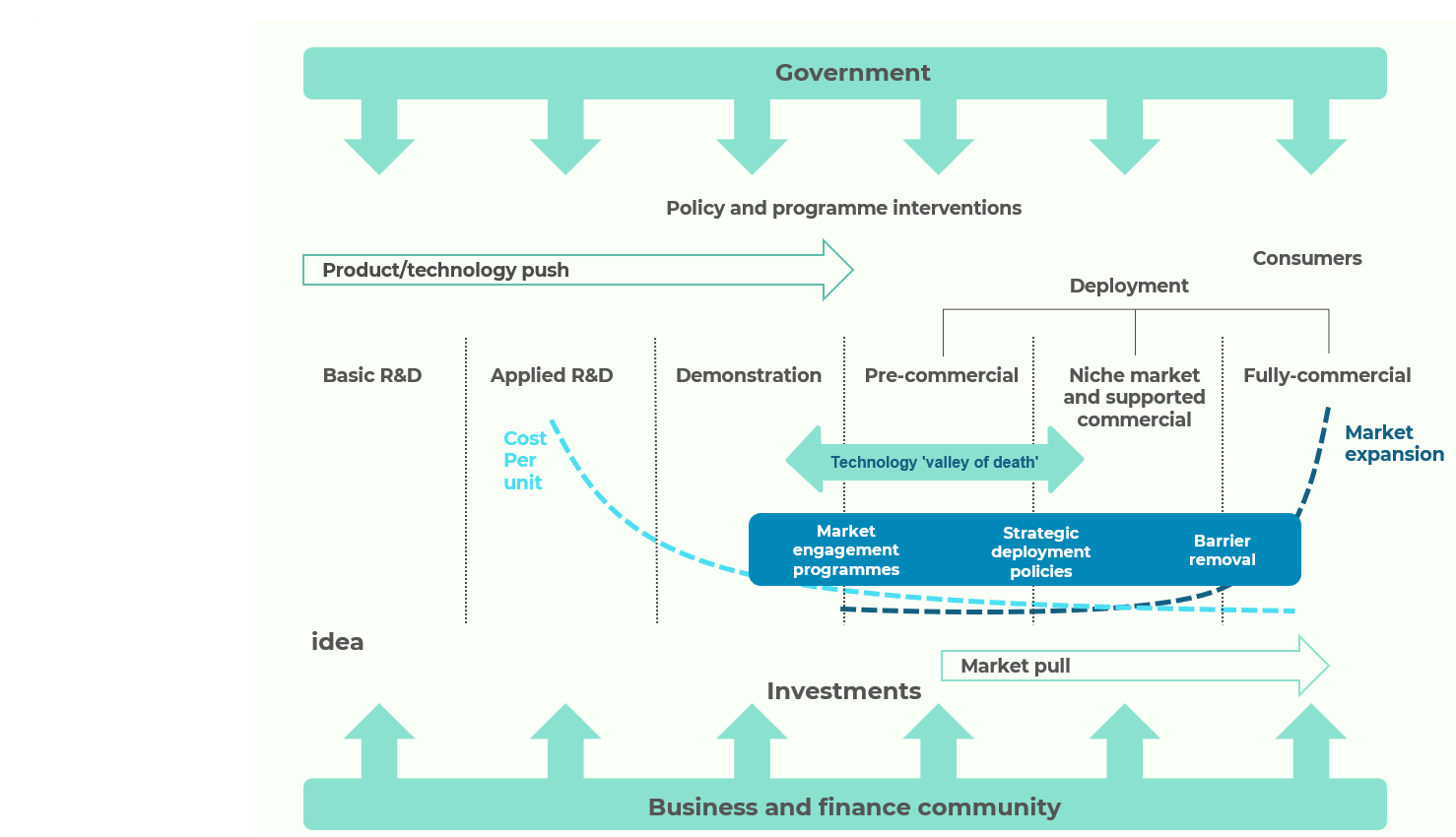

These challenges culminate in a critical issue: limited opportunities for market expansion. Many cleantech startups struggle to progress from the MVP stage to the commercial stage due to these compounded difficulties.

Furthermore, the niche nature of some cleantech solutions, whether due to cost or limited appeal, can restrict their market potential.

This limitation often discourages venture capital investment, as VCs typically aim for returns of 3x to 10x their initial investment—a target that’s extremely challenging to achieve within a confined market segment. A challenge that the e-mobility segment in the country is currently facing.

Source: World Bank

The end of the road? Not at all!

While challenges abound, solutions are within reach. Funding remains a critical issue, but impact funds like Acumen Pakistan’s GCF-anchored initiative offer a promising alternative to traditional venture capital.

Policy support is gaining traction, as evidenced by recent government allocations for electric bikes and energy-saving fans. These interventions, coupled with targeted monetary incentives for innovators, could significantly boost cleantech adoption.

Education and infrastructure development are equally crucial. Investing in specialized incubators, accelerators, and climate-focused curricula will build much-needed expertise.

Meanwhile, creating testing facilities can bridge the current knowledge gap, fostering more efficient technology development. Localization presents another key strategy. By developing ancillary industries and focusing on local production, costs can be reduced for both businesses and consumers, making cleantech more accessible and economically viable.

Despite economic headwinds, Pakistan’s cleantech sector shows promise. With proactive measures, it stands poised to drive both environmental sustainability and economic growth.