In a historic shift, Nvidia will replace Intel on the Dow Jones Industrial Average on November 8, ending Intel’s 25-year run on the prestigious index. This change underscores Nvidia’s rapid ascent as a leader in AI technology and highlights Intel’s ongoing struggles to maintain its position in a rapidly evolving semiconductor market.

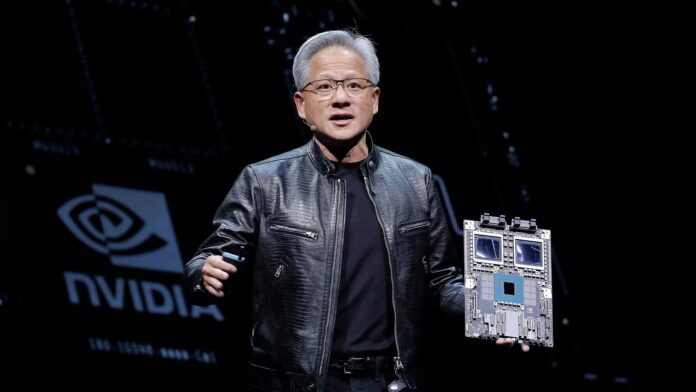

Nvidia, valued at approximately $3.32 trillion, has experienced an explosive rise in recent years, fueled by its dominance in AI chip technology. Demand for Nvidia’s GPUs has surged among tech giants like Microsoft, Amazon, and Google, driving a remarkable seven-fold increase in the company’s shares since 2023. This year alone, Nvidia’s stock has more than doubled, closing recently at $135.37, reflecting investor confidence in its role at the heart of the AI revolution. Nvidia’s recent 10-for-1 stock split also made its shares more accessible, aiding its eligibility for the price-weighted Dow index.

In contrast, Intel has faced steep challenges, particularly in the AI market where Nvidia now holds a significant lead. Intel’s stock has plummeted by 54% this year, making it the worst performer on the Dow. Its revenue has declined nearly one-third since 2021, and the company is expected to post its first annual net loss since 1986. Intel’s market capitalization has dropped below $100 billion for the first time in three decades, starkly contrasting Nvidia’s substantial gains.

The reshuffle in the Dow index reflects the broader shift in the tech landscape, with Nvidia now taking Intel’s place as a barometer for the industry’s future. Nvidia’s entry is expected to further boost the Dow’s tech presence, following other recent tech additions like Amazon. Intel, meanwhile, continues to focus on recovery, aiming to reclaim lost market share through cost-cutting measures and strategic partnerships in chip manufacturing. As Nvidia steps onto the Dow, the move signals a win for AI-driven growth and a critical moment for Intel as it navigates its transformation amidst fierce competition.