A Delaware judge ruled on Monday that Tesla CEO Elon Musk is not entitled to a $56 billion compensation package, despite a June vote by shareholders to reinstate it.

The decision by Chancellor Kathaleen McCormick of the Court of Chancery follows her January ruling, which deemed the pay package excessive and rescinded it, creating uncertainty about Musk’s future at Tesla.

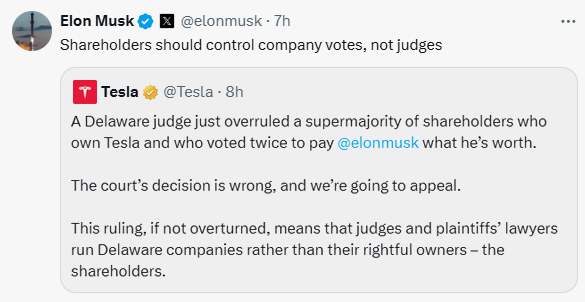

In a post on X, Musk said, “Shareholders should control company votes, not judges.” Tesla quickly responded, calling the ruling “wrong” and stated, “We’re going to appeal,” claiming that the judge had overruled a supermajority of shareholders.

Musk and Tesla can appeal to the Delaware Supreme Court once McCormick issues a final order, which could happen this week. The appeal process may take up to a year.

Tesla has argued that the judge should acknowledge a subsequent shareholder vote in June that supported Musk’s compensation and restore it, citing Musk’s key role in driving the company forward.

McCormick disagreed, stating that Tesla’s board was not entitled to “reset” Musk’s pay package. In her 101-page opinion, she said, “Were the court to condone the practice of allowing defeated parties to create new facts for the purpose of revising judgments, lawsuits would become interminable.”

She added that such ratification votes should take place before a trial, and a company cannot ratify a transaction involving a conflicted controller, as she found that Musk controlled the pay negotiations. Furthermore, McCormick said Tesla had made material misstatements in its proxy statement and could not justify restoring Musk’s pay.

Following the ruling, Tesla’s shares dropped 1.4% in after-hours trading. Gary Black, managing partner of The Future Fund, which owns Tesla stock, expressed confidence that the Delaware Supreme Court would be more pragmatic. He wrote on X, “I doubt this ruling will be resolved anytime soon, and it will likely be overturned by a more moderate court along the way.”

Musk’s pay package, initially valued at up to $56 billion, granted stock options tied to performance and valuation goals. Since Nov. 5, when Donald Trump won the U.S. presidential election with Musk’s support, Tesla shares surged by 42%, raising the value of the package to around $101 billion.

This ruling comes as Musk has been appointed by Trump to lead efforts to create a more efficient government by cutting spending. Musk’s role as co-lead of the Department of Government Efficiency would be informal, allowing him to keep his position at Tesla and his other ventures, including SpaceX.

Musk has become a close adviser to Trump, supporting his election campaign.

In a separate development, McCormick ordered Tesla to pay $345 million in attorney fees to the law firms representing the plaintiffs, though the amount is far less than the $6 billion initially requested. The fee is one of the largest ever in securities litigation, and Tesla may pay it in cash or stock.

After McCormick’s January ruling, thousands of Tesla shareholders submitted letters to the court, expressing concern that rescinding Musk’s pay could lead to his departure from the company or the creation of competing products. Musk’s supporters, including small investors, rallied behind the June vote and voiced their opposition to Monday’s decision on social media.

In January, McCormick had found that Musk improperly influenced the 2018 board process that negotiated the pay package, which was described as the largest executive compensation plan ever, valued at 33 times greater than the next largest. The package granted Musk stock options based on Tesla achieving ambitious operational and financial goals, but with no guaranteed salary.

Plaintiff Tornetta argued that shareholders were not properly informed about the ease with which these goals could be achieved when they voted on the package.