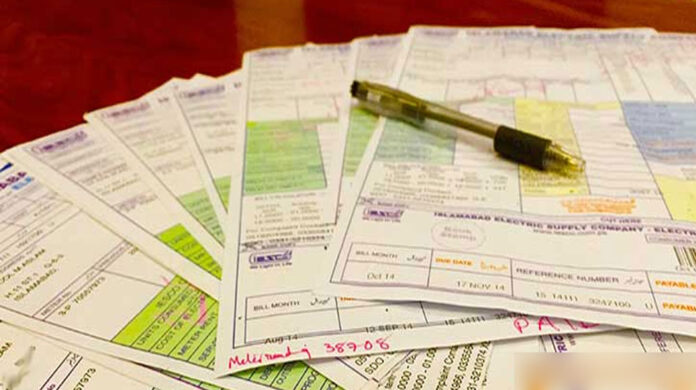

The International Monetary Fund (IMF) has turned down a formal request by Pakistan’s Ministry of Energy to reduce sales tax on electricity bills, citing commitments under the current loan programme, according to Express News.

The decision deals a blow to government efforts aimed at easing the financial strain on consumers.

The Ministry of Energy had sought IMF approval for a reduction in sales tax rates, arguing it would provide much-needed relief to electricity consumers.

However, IMF officials maintained that granting exemptions or reductions on new taxes would jeopardize Pakistan’s ability to meet its tax collection targets.

Currently, an 18% Goods and Services Tax (GST) is imposed twice on electricity bill, once on the total bill amount and again on fuel cost adjustments. The IMF insists that these taxes remain intact to ensure compliance with fiscal targets under the loan agreement.

In a separate move to align with IMF conditions, the federal government has agreed to impose a levy on captive power plants. The levy will be implemented gradually to mitigate a significant reduction in gas supply to these facilities.

The report suggests that the IMF has shown flexibility on gas cuts to captive power plants but emphasized that the levy must be introduced before the release of the next funding tranche.

This development underscores the government’s challenges in balancing economic reforms with public relief amidst mounting pressure from international creditors.