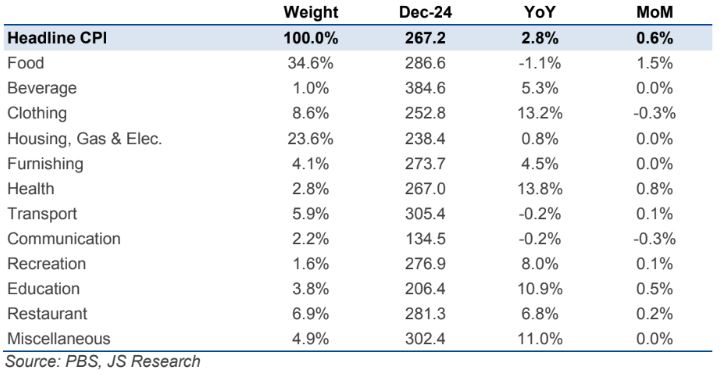

Pakistan’s Consumer Price Index (CPI) inflation is projected to drop to 2.8% in January 2025, marking its lowest level since November 2015, according to a report by brokerage firm JS Global. This sharp disinflation is primarily attributed to a high base effect from the previous year, despite a month-on-month increase of 0.6%.

The report noted that the average inflation for the first seven months of FY25 (July–January) is expected to be 6.7%, a significant decline from the 28.7% average recorded during the same period last fiscal year.

JS Global forecasts full-year FY25 inflation to average 6.3%, assuming stable global oil prices and no major changes in the petroleum development levy (PDL). However, an immediate addition of Rs10 per liter in the Petroleum Development Levy (PDL) could slightly raise this projection to 6.4%.

Food inflation, which accounts for 35% of the CPI basket, is anticipated to decline 1.1% year-on-year in January compared to 25% in the same period last year. However, sequential price increases in items such as chicken, tomatoes, oil, and sugar are expected to push food inflation up by 1.5% month-on-month.

Meanwhile, core inflation—excluding food and energy prices—is projected to remain in double digits at 10% year-on-year, with urban core inflation at 8.1% and rural core inflation at 10.7% in December 2024.

Despite a cumulative 900 basis points (bps) reduction in the policy rate over the last six months, real interest rates remain high due to the sharp decline in inflation.

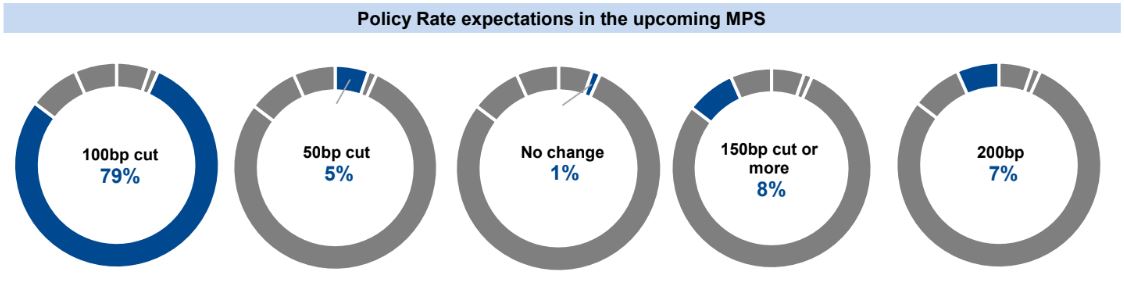

The report highlighted that the Monetary Policy Committee (MPC) is likely to announce another 100 bps cut in the upcoming monetary policy meeting on January 27. Market consensus, based on a recent survey conducted by JS Global, aligns with this forecast, with expectations for the policy rate to reach 12% after the upcoming cut. A small portion of respondents anticipated a more aggressive 150–200 bps reduction.

The brokerage firm anticipates inflation to remain on the lower side through May 2025, further supporting the MPC’s case for continued monetary easing. However, any depreciation of the Pakistani rupee or adjustments in the PDL could pose upside risks to these inflation forecasts.

The report concluded that Pakistan’s disinflationary trend and high real interest rates create room for further easing, as policymakers aim to stabilize the economy while ensuring sustainable growth.