ISLAMABAD: Sui Northern Gas Pipelines Limited (SNGPL) has formally requested Pakistan LNG Limited (PLL) to address the issue of surplus Re-gasified Liquefied Natural Gas (RLNG) cargoes anticipated for 2025. The request was made following an email from the Managing Director of PLL on January 20, 2025, which highlighted the surplus LNG situation.

In its communication, SNGPL stated that it had already raised concerns with the Power Division, proposing an upward revision of RLNG demand for the peak summer months of June, July, and August 2025. However, the National Power Control Center (NPCC) responded on January 21, 2025, confirming that power sector demand would remain unchanged due to reduced electricity consumption.

SNGPL has now urged PLL to engage with ENI, a key LNG supplier, to explore options for diverting surplus RLNG cargoes during 2025. The letter reiterated a similar proposal sent earlier by SNGPL on January 16, 2025, emphasising the importance of effective management of excess LNG volumes to avoid operational inefficiencies and financial losses.

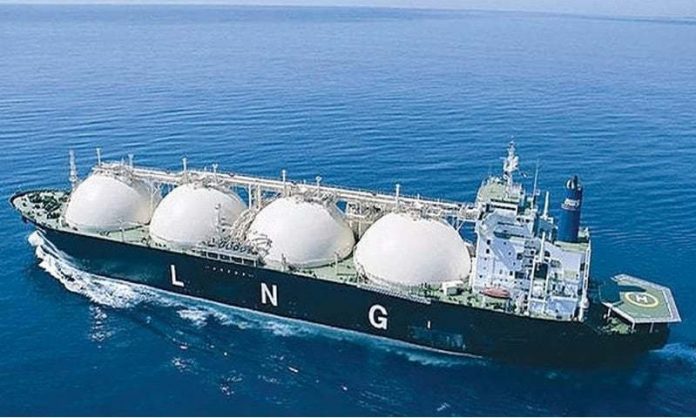

Pakistan imports 10 LNG cargoes monthly, with nine secured under long-term contracts and one through an agreement with ENI. However, a decline in electricity demand—driven by rising tariffs and a growing shift to solar energy—has left the power sector unable to fully utilise its allocated LNG.

PLL has informed SNGPL that ENI is willing to divert some cargoes without additional costs, though this depends on favourable market conditions. Thus far, February and March shipments have been diverted, but uncertainty remains over the summer months.

Industry sources suggest ENI’s willingness to divert surplus LNG is contingent on maintaining profitability. Although a full diversion of the 12 surplus cargoes for 2025 is unlikely, favourable spot prices may enable partial redirection of the supply.

The development comes at a time when the energy sector faces mounting challenges, requiring innovative strategies to balance supply and demand in an evolving market landscape.