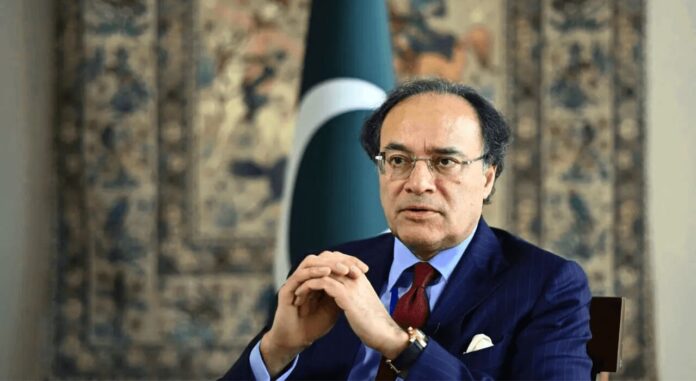

Finance Minister Muhammad Aurangzeb announced that Pakistan is preparing to re-enter international capital markets, starting with the issuance of a Panda bond, expressing optimism that the inaugural bond issue could occur before the end of the year, with further exploration of global markets like GMTN possible as credit ratings and spreads improve.

Aurangzeb made these comments at the CIPFA-ICAP Public Financial Management Conference 2025, held at the Serena Hotel on Wednesday. He shared plans for a visit to China next week with Prime Minister Shehbaz Sharif, during which discussions about Pakistan’s return to international markets, including the Panda bond, are expected to take place.

Weeks after quickly finalising a trade agreement with the United States, which was hailed as a major boost for bilateral trade and investment, the finance minister refrained from sharing key details of the deal, prompting concerns about transparency and potential undisclosed costs.

The finance minister noted that if credit ratings continue to improve, Pakistan could explore other international markets, including GMTN, within this fiscal year. He also highlighted the alignment of the three major international rating agencies—Fitch, S&P, and Moody’s—as a sign of positive sentiment and external validation for the country’s economic journey.

Aurangzeb emphasized that economic stability is a means to an end, stressing the importance of staying the course and avoiding the boom-bust cycle.

On climate change, the finance minister called for support in identifying investable and bankable projects. He conceded that Pakistan had failed to present bankable projects to international donors, preventing the full materialisation of pledges made in the aftermath of the 2022 flash floods.

Regarding taxation reforms, Aurangzeb clarified that the Federal Board of Revenue (FBR) is not involved in policymaking, which falls under the Finance Division. He also addressed State-Owned Enterprises (SOEs) reforms, noting that 24 SOEs are currently under the Privatisation Commission and advocating for privatisation and rightsizing to reduce corruption and save the national exchequer.

He concluded by reaffirming that the private sector should lead Pakistan’s growth, with the government’s role being to create a conducive environment for business.