At nearly 548,000 square feet of leasable space, Dolmen Mall in Clifton, Karachi is one of the biggest in the country, and – given its location in the country’s economic capital, yet located in the one corner of one of the city’s most elitist neighbourhood (Clifton) that is the farthest from any working class dwelling – it may quite possibly be one of the most exclusive places in the country.

Entry is technically free, but it is not quite as simple as not needing any money to get in. There are guards at the door, whose job is less about security and more about keeping people out who do not ‘seem to belong’ there. Sure, the mall can claim that 10 million people visited in 2019, but that is not 10 million unique individuals: that is 10 million unique person trips. If you went there 20 times, that counts at 20 towards that 10 million, even though you are one individual.

There is a place in the food court on the upper floors of the mall from where you can see almost every single person entering the vast mall. And while it does attract people from varying socio-economic backgrounds, there is – almost every week – at least one, and usually more, families who are clearly there for the first time, dressed in some of the best clothes (pressed and clean, but perhaps slightly old-fashioned), for whom the outing represents much more than just a shopping trip. It is a small, but significant step that they are taking in showing themselves as much as the rest of the world that they have arrived: that they belong there, along with all of the other economically comfortable people there, even though some of those wealthier customers will spend in one shopping trip what this family earns in a month.

By global, or even regional standards, Pakistan’s most upscale malls are far from the swankiest. Most of the brands you find there are part of ordinary middle-class high streets in major cities in Europe or North America. But for that family, to be able to be around even this level of consumption represents the first time they have been able to put their head above water: to have just a little more money than subsistence living. For the first time, perhaps ever in their lives, after having paid for food, housing, utilities, school fees, and other essentials, there is a little bit – just a little bit – left over for them to think about purchasing something just because they want to, and not because they need it.

The point of talking about families like this is not to exoticise them, but to point out the following fact: the cautious way they go up the elevators to the upper floors of the mall mirrors in physical form the process they metaphorically undertook to get there: a place in the Pakistani middle class is highly precarious, the amount of time any family can be there is highly variable, and their fall from grace can be sudden, swift, and completely not their fault.

It is easy in the abstract to talk about how the government of Pakistan’s decisions on matters of economic policy can have an impact on individuals and households throughout the country. It is a rude awakening to see the numbers in how that translates onto the incomes of individuals and how it sharply vary from year to year, depending on how well or badly the economy is doing.

For this article, Profit undertook an analysis in collaboration with Elphinstone, a financial services company (disclosure: the author of this article is the founder of Elphinstone), in order to analyse data on Pakistan’s income distribution, average incomes, and the rate of growth in incomes over the past two decades utilising data from a variety of different data sets compiled by the Pakistan Bureau of Statistics. We included a note on our methodology for those who may be interested in learning about this, but feel free to skip over the next section if you just want to dive straight into the results of the analysis.

Methodology note: who is part of the middle class?

This is a perennially difficult question to answer, and candidly, we cannot say we have an original response to it. For the purposes of this analysis, we used the World Bank’s definition of middle class: individuals who make more than $10 a day, which we rounded off to $300 a month on average over the course of a given year.

The data sets we utilised were the raw microdata sets from the Household Integrated Economic Survey (1999, 2002, 2005, 2006, 2008, 2011, 2012, 2014, 2016, 2019), the Pakistan Social and Living Standards Measurement surveys (2009, 2013), and the Pakistan Labour Force Survey (2018). We calculated the size of the labour force as a percentage of the total population, using data from the population census and the Labour Force Surveys.

For years for which we did not have data, we did straight-line projections between the two closest years for which we did have data.

We understand that mixing and matching varying data sets is not ideal, especially given the fact that they can have differences in methodologies, but we felt that the questionnaires and methodologies were sufficiently close to at least provide a reasonably accurate directional picture of what has happened to Pakistan’s income distribution and growth over the past two decades.

In particular, we were interested in getting as much data as possible that would help us get an impression of what we consider economic inflection point years. For example, 2018 was a critical year since it marked the end of the Nawaz Administration and their economic policies, in particular holding the rupee at a near-fixed exchange rate to the US dollar. Hence, examining how incomes changed between 2018 and 2019 was important for us to understand. But the Household Integrated Economic Survey only had data from 2016 and 2019, which would not give us an accurate view of what happened between those years, which is why we used the raw microdata from the Labour Force Survey for 2018 to supplement our understanding of what happened at the end of the Nawaz Administration (which will become a significant part of our analysis later on).

One more methodological note: we are aware that income surveys in Pakistan – like similar surveys around the world – vastly undercount both the number of people as well as the incomes of people at the top end of the income spectrum. Umair Javed, an assistant professor of politics and sociology at the Lahore University of Management Sciences (LUMS), estimates that these surveys undercount as much as the top 8-10% of the income spectrum of Pakistan.

In fairness, the statisticians at the Pakistan Bureau of Statistics try to correct for this undercounting by adding estimated weights to each individual observation so that the spectrum can be observed in full, but we acknowledge this shortfall in our analysis based on the limitations of the data: we are likely underestimating the absolute size of the Pakistani middle – and especially upper middle – class, but are probably still close to being directionally accurate in terms of the growth rates and changes that have taken place over the course of the past two decades.

On the upper middle class: we chose to define it as individuals who make in excess of $10,000 a year. We chose this benchmark because it comes closest to giving us a view of people in Pakistan who have individual incomes equal to the per capita income that the World Bank defines as average for high income countries (which is about $12,000 per year).

Finally, we chose to look at individual incomes rather than household incomes, in part because we wanted to examine trends that captured how much people are able to earn as individuals. Household data would have introduced the additional complication of the number of earners being different from household to household, as well as across time. Individual income data allowed us to control for that problem.

The good news: Pakistan’s middle class is growing

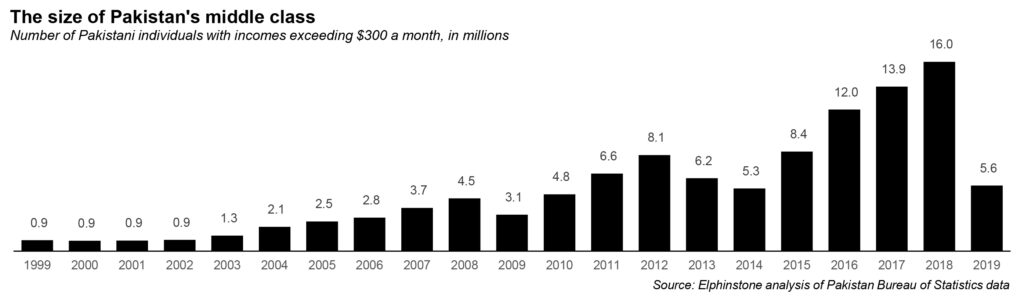

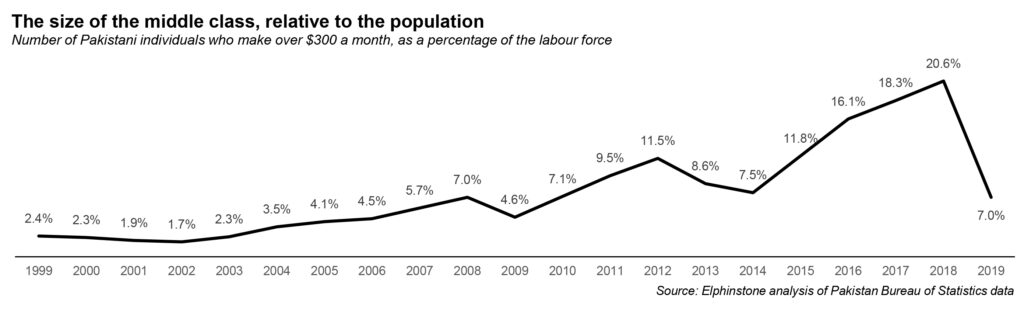

Let us start off on an optimistic note. The data unambiguously shows that – over the course of the full two decades – Pakistan’s middle class has been expanding, both in terms of absolute number of individuals who make in excess of $300 a month, and the percentage of the Pakistani labour force that exceeds this threshold.

Indeed, the number of people who exceeded our middle class benchmark of $300 a month reached a peak of 16 million people by 2018, before falling down sharply in 2019 to just 5.6 million people. (We think the fall in the numbers in our analysis is somewhat exaggerated, so we would not read too much into it, but we do think it is accurate to say that the number of people who are technically part of Pakistan’s middle class has fallen sharply in 2019.)

Just how fast has the middle class been growing? Between 1999 and 2018, the number of individuals who count as part of the middle class grew by an average of 16.2% per year, which is well above the population growth rate of approximately 2.4% during this same period. Even if one looks the much more muted 2019 number, that growth rate from 1999 to 2019 comes out to a very respectable average of 9.4% per year, or nearly 4 times that growth rate in the population as whole.

As result, the number of individuals who can be classified as being middle class earners as a proportion of the labour force also grew, from just 2.4% in 1999 (yes, we really were an abysmally poor country back then) to a peak of 20.6% in 2018. The 2019 number is about 7%, which again, we think may be artificially deflated, and is likely higher.

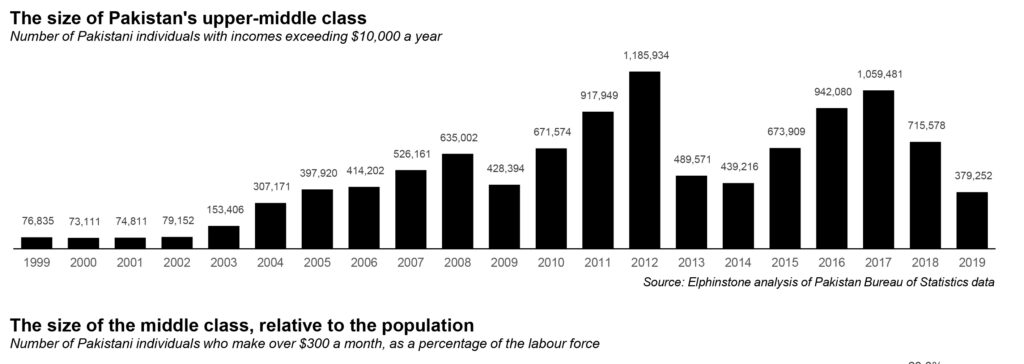

The numbers on the upper middle class tell a similar story. The estimated number of Pakistani individuals who make more than $10,000 a year went from just over 76,000 in 1999 to a peak of 1.1 million in 2017 before falling back down to just under 400,000 in 2019. We have less confidence in this number for the reason highlighted in our methodology note: income surveys dramatically undercount the number of people who constitute the top 8-10% of the income distribution.

This, of course, also means that we are likely underestimating the size of the upper middle class as well as the middle class itself. Nonetheless, the focus of this analysis is two things: how the share of the middle class has changed relative to the labour force – and, by extension, the total population – over the past two decades, and how incomes have changed during that same period.

In other words, we acknowledge that our estimates of absolute levels may be flawed, but we believe the rates of change are probably accurate. And those rates tell a remarkable story.

The roller coaster ride to middle class status

The average growth rates that we laid out in the previous section, of course, belie a much more volatile picture from year to year. We will start with a discussion of average incomes, because they capture just how much government policy can affect income growth from year to year. The changes are stark, and they reflect a simple reality: economic cycles affect people’s pocketbooks in even the best of times, but can be especially damaging when the economic cycles in question are exacerbated by government policies dramatically distorting economic incentives.

The central premise we are working with is one that Khurram Husain once wrote about in his column in Dawn, when he quoted an anonymous source as saying: “They give you economic growth for a few years, but then they take it all back in inflation.” Our data analysis finds this statement to be largely true, and we can demonstrate just how closely the link is between government policy and the changes in average income levels of the workforce.

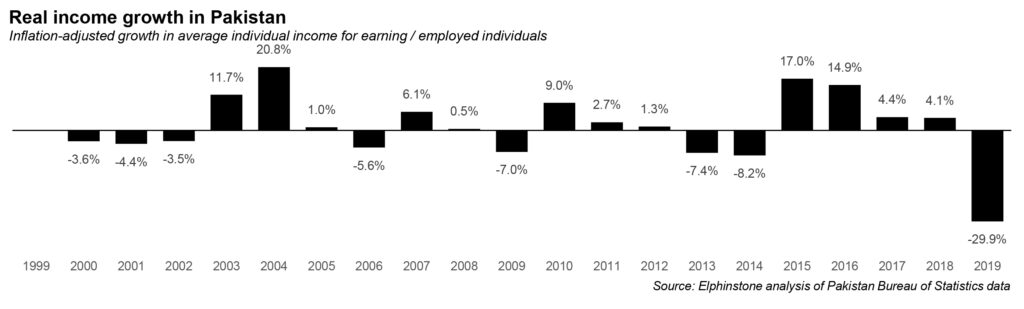

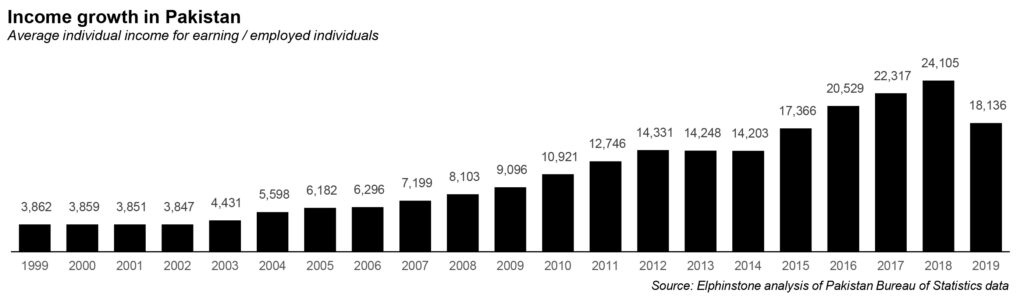

Let us start off with the topline numbers: in absolute terms, average income in Pakistan has gone up from Rs3,862 per earning person per month in 1999 to Rs18,136 per earning person per month in 2019, which represents a growth rate average of 8.0% per year. That sounds reasonably impressive until you realise that inflation during that period has been 7.4% per year, which means that real income growth – that is, in inflation-adjusted terms – is just 0.6% per year for the past two decades.

During this time, there have been several years of staggering income growth, such as 2004, when the average real income grew by nearly 21%, or 2015 and 2016, when it grew by 17% and 15% respectively. But here is where the problem starts: those income growth spurts never end up being sustainable, because they are always reliant on artificially propping up economic growth by indirectly subsidising essential items – usually energy (either electricity or petrol, and often both together) – through artificially holding the exchange rate constant.

This point is especially hammered home in the case of the most recent Nawaz Administration, which lasted from 2013 through 2018. The first year – fiscal year 2014 – saw inflation-adjusted average incomes decline by 8.2% as the Nawaz Administration having to make structural adjustments to correct the mess left by the outgoing Zardari Administration. The next four years saw robust per capita income growth, even in inflation-adjusted terms, as the economy grew rapidly on the back of cheap imported oil kept artificially cheaper by holding the dollar at Rs100 through foreign borrowing.

Unfortunately, all those loans were timed to come due right after the 2018 election, and when they did, the whole structure came collapsing down. The exchange rate could not hold, collapsing by about 40% over the course of two years, which meant that cheap imported fuel went away, and the debt crisis induced by the excessive foreign borrowing further slowed down the economy.

As a result, real income growth collapsed, and in 2019, the average inflation-adjusted income for a Pakistani earning individual went down by an astonishing 30%.

Let us put some real numbers on that. The average income number in 2013 was Rs14,203 per month, which rose to Rs18,136 by 2019, which represents an annual increase of just 4.1%. Not coincidentally, that is actually less than the average 5.2% inflation rate during that period, meaning the third Nawaz Administration functionally delivered less than zero income growth in inflation-adjusted terms (-1.0% per year to be precise), once one factors in the results of the structural adjustment that took place when they left.

And it is not just the Nawaz Administration: every single administration over the past two decades has done this: artificially propped up prices in the beginning of its term, and then watching it all inevitably collapse towards the end of their term, since nobody ever plans for life after one term in office.

In the case of the Zardari Administration, which lasted from 2008 through 2013, the numbers were only very slightly better. True, the Zardari Administration inherited a mess from the Musharraf Administration, but they made no real effort to improve the economy during their tenure. Income growth was negative 7% during their first year in office as cleaned up Musharraf’s mess, followed by three years of positive, but progressively diminishing growth, followed by a collapse in the last year that turned into a downturn that lasted into the first year of the following administration.

When all is said and done, income growth averaged 9.3% per year during the Zardari years, but inflation averaged 10.1%, meaning inflation-adjusted income actually declined 0.7% per year on average.

Even the supposedly golden Musharraf years followed the same pattern: started off low as they engaged in reforms to try to clean up their predecessors’ mess, following by growth from 2002 through 2005, a hiccup in 2006, growth again in 2007, followed by a crash in 2008 and 2009.

The ending record ended up being positive: average inflation-adjusted income grew at 0.9% per year during the Musharraf years. A far cry from the peak of the 20%+ growth that they witnessed during the boom years.

A tenuous foothold in the middle class, and how to make it firmer

You can see the effects in not just average income levels, but in the number of people who get pushed into the middle class during the boom years, and get pushed right back out during the inevitable following recession, as illustrated in both the middle class and upper middle class charts that accompany this story.

This is not to suggest, of course, that such moves do not happen even in the most stable developed economies. They most certainly do. But the problem is that in Pakistan, the government keeps on interfering into the economy specifically with respect to just their own tenure, which is why all of the economic downturns coincide almost exactly with changes in power, when the incoming administration yells and screams about pitchhli hukumat, cleans house a bit, and then goes right back to artificially goosing the economy through controls on the exchange rate, energy prices, etc. to make their own numbers look good just long enough until it comes time for them to be re-elected.

That family we discussed in the beginning of this story? Maybe they are gingerly stepping onto the escalator because they intuitively know just how tenuous their place is in Pakistan’s middle class, and maybe they do not want to get too excited, or too used to being a part of it. And that is a tragedy that needs to change if the economy is to move forward sustainably.

To that end, several people – most notably former federal finance minister Shaukat Tarin – have advocated for a Charter of the Economy between all of the major political parties that would commit them to at least some measure of policy continuity on macroeconomics, while retaining the ability to undertake different policies depending on their political ideologies and viewpoints.

It is an elegant idea, but does not solve for the core problem: no government in Pakistan has figured out the right balance between doing things that are required in the long run for the economy as well as doing things that will be popular in the short-run, and thus good for their own electoral needs. And no, clearly military dictatorships do not solve for this problem, because the cyclical pattern timed with regime change was almost exactly the same, even under Musharraf.

No, a real solution means discovering means of populism that do not damage the economy in the long-run. Oddly enough, the one government that had the best approach to this was the Nawaz Administration: they had a love affair with physical infrastructure, which they were absolutely thrilled to inaugurate.

Even when financed completely with public debt, infrastructure has the virtue of increasing the productive capacity of the economy, and hence will likely lead to sustainable economic growth. From a politician’s perspective, it has the virtue of being popular with voters as well.

In short, the Nawaz Administration’s record would have looked a lot better – and their electoral prospects no worse off – if they had stuck to the infrastructure strategy and left their price controlling antics alone. If the rupee had kept on declining just a little bit every year, rather than a lot all of a sudden towards the end of their tenure, income growth might have been slower, but there would have been no corresponding drop off, meaning their average numbers would have been better.

If Pakistan’s economy is to progress, the electoral-cycle induced crashes have to stop. The economy will still have booms and busts, but if they are natural rather than created by politicians’ injecting the equivalent of heroin into the economy’s bloodstream (short-term boost in energy levels, followed by a terrible crash), maybe we might actually have average inflation-adjusted income levels rise by an appreciable amount.

If we do that, maybe those entering the middle class for the first time – like that family in the mall – will have just a little bit more confidence that their foothold is more solid. Because we are very glad to see them there, and we hope they can stay.

Wow. Worth analysis. Sir, believe me, I am in the exploration of such a study and you worked out in a thoughtful way. I am in the hustle to share in my friends’ sphere.

Excellent analysis… We need more studiesike this in Pakistan on various things to improve and analyze our status and point to weakness

Great analysis

Great analysis.

Awesome report

Excellent Analysis

good report

You, conveniently ‘forgot’ to mention the impact of the socalled Security or the Establishment has on the nation’s economics. Despite the fact that the last military dictatorship was so long ago, the Security Apparatus ( SecAp) has continued to have a lion’s share ( est 37 percent ) of the development funds of the nation. They have invested this in ‘their’ own, growing middle class status, supported by subsidized public / private housing and other magnanimous perks. This is bound to have a terrific and dominant repercussion on the funds available for the rest of the nation.