On March 26, Fatima Fertilizers announced their financial results for the year ending December 31. Keen observers noticed something interesting: the company’s gross margin went up despite their lower revenues.

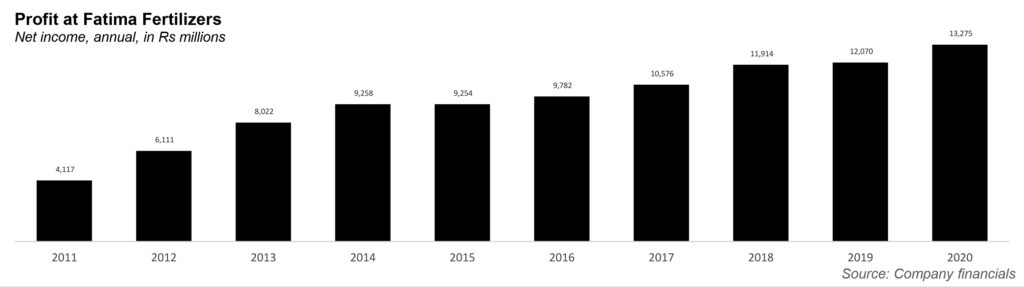

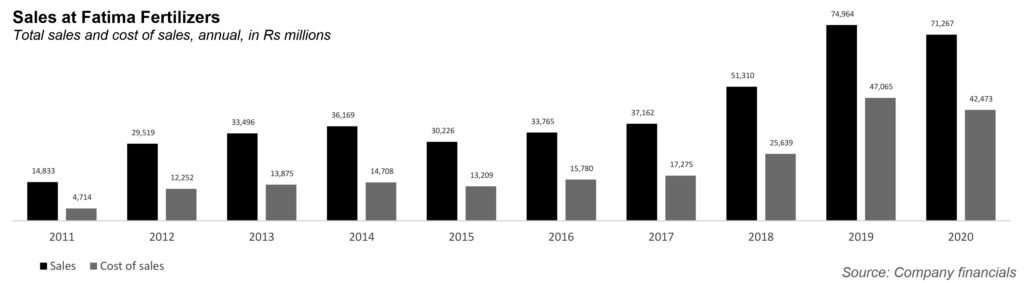

In 2020, their sales stood at Rs71.2 billion, while sales in 2019 stood at Rs74.9 billion. But somehow, their gross profit was higher, at Rs28.7 billion, compared to Rs27.9 billion in 2019. And, in the same vein, their final net income in 2020 stood at Rs13.3 billion, compared to Rs12.1 billion in 2019.

Somehow, the company’s cost of goods sold actually fell, from Rs47 billion in 2019, to Rs42.5 billion in 2020. Now, a fertilizer company’s costs consist in large part of natural gas costs. The acute natural gas shortage in the country and rising gas prices for everyone then begs the question, what is going on?

First, some context on the company. While the company is called Fatima Fertilizers, it is in fact a joint venture between two major business groups in Pakistan, the Fatima Group and Arif Habib Group. Both Arif Habib, and Ali Mukhtar are prominently displayed in an equal frame in the company’s annual report. Arif Habib related companies hold a cumulative 16.11%, while the Fatima Group companies cumulatively hold 22.92%

Fatima Fertilizers makes two intermediary products – ammonia and nitric acid – and three final products, which are urea, calcium ammonium nitrate (CAN) and nitro phosphate (NP). The company, which was incorporated in 2003, has three units in Punjab: the Sadiqabad plant, Multan plant and the Sheikhupura plant.

The oldest plant of the three, Sadiqabad, had its foundation stone laid in 2006, while commercial production began in 2011. The 1,095 acres complex has a dedicated gas allocation of 110 MMCFD from Mari Gas Field and has 56 MW captive power plants in addition to off-sites and utilities. Under its revamped capacity, it can produce 500,000 metric tons of urea, 470,000 metric tons of CAN, 490,000 metric tons of NP. The ammonia plant’s current daily production capacity stands at 1713 MTPD.

The Sheikhupura Plant was acquired by the company in 2015. It is capable of producing 445,500 metric tons per annum of urea. Finally, the company acquired its third plant in Multan from its associated company, Pakarab Fertilizers Limited, in September 2020. It can produce 846,900 metric tons per annum of mixed fertilizer product.

So, what happened in 2020? The company’s annual report, released on April 5, offered some clues. First, production went up. But this was less because of some miracle, but because the third plant in Multan was acquired in September 2020, increasing production capacity. The Sadiqabad plant also had one whole year of operations without any disruption.

The plant that was disrupted? Sheikhpura, which remained out of operations for eight months because there was no gas. Turns out the gas shortage in Pakistan did end up affecting Fatima Fertilizers after all.

“With all the three plants in operations at Sadiqabad, Multan, and Sheikhupura, your company is committed to ensure a continuous supply of its products to the farmer community through a cumulative annual nameplate capacity of 2.57 million MT per year,” the company tried to say, reassuringly.

So, sales revenue fell 5% year-on-year. According to Fatima Fertilizers,this was due to a a reduction in NP and DAP prices especially in the first half of the year. Prices started improving sharply in the second half of the year. Urea and NP were the dominant contributors to the sales revenue with 34% share each, followed by CAN and DAP with 19% and 12% respectively.

But the kicker is that the cost of sales of the company declined by approximately 10% compared to last year. Turns out, there is an advantage to one of your plants not running: you don’t have to pay for its operations. In fact, manufacturing costs did not shoot up until the production plants of Pakarab Fertilizers were bought in September.

Fatima Fertilizers was also helped by the release of subsidy from the Government of Pakistan for the prior year amounting to Rs 5.7 billion, as the difference between full RLNG price billed to the Company relating to its Sheikhupura plant by SNGPL, and the Gas price capped by GOP for fertilizer plants operating on RLNG.

Fatima Fertilizers also gained a temporary gain on remeasurement of the already booked provision for the Gas Infrastructure Development Cess (GIDC), amounting to Rs877.51 million. It also has also temporarily recognized a loss allowance of Rs360.24 million on remeasurement of subsidy receivable from the Government of Pakistan.

And that is how all the cards fell in place for Fatima Fertilizers, and how it managed to have its net income to increase by 10% year-on-year, from Rs12.07 billion, to Rs13.27 billion. Not bad for a company that had one dysfunctioning plant, and another it did not acquire until well into the financial year.