Wasim Akram might be about to make some money. But the former Pakistan captain is not about to make bank on a lucrative commentary deal, nor is he accepting the many offers for coaching that he regularly gets. Instead, the source of his soon-to-be fortune is his investment in a little known logistics and delivery company called blueEX.

Founded in 2005, blueEX is a logistics company that initially came onto the scene to compete with organisations like TCS, but in the recent past has made an active pivot towards providing eCommerce logistics solutions. A few days ago, it was announced that it was looking to raise Rs445.7 million through an initial public offering (IPO) on the Pakistan Stock Exchange’s Growth Enterprise Market (GEM) board.

The move is a bold one, which is precisely what makes this story so interesting. Pakistani companies are currently going through a funding fever-dream fueled by the success of numerous Pakistani startups, particularly tech startups. In this climate everyone wants a slice of the massive venture capital pie that has turned its attention towards Pakistan. For blueEX to then go for an IPO, and that too on the PSX’s GEM board means one of two things. It could either mean that the people behind blueEX have had an inspired moment of brilliance, or that they have failed to raise money through the traditional VC route, and are now going to the PSX as a second resort.

Given the cast of characters running blueEX, the latter is a more likely possibility. At the helm of the company is Imran Baxamoosa, who despite being CEO does not have a lot of skin in the game with only 5% ownership of blueEX. The majority stakes of the company lie with Safina Danish Elahi, whose husband Danish Elahi is the CEO of the Elahi Group and got sentenced to time in the slammer for embezzlement.

As one can clearly see, blueEX isn’t exactly a venture capitalist’s dream project. Not only do the people heading it not exactly inspire confidence, there is also the issue of there being a lot of competition in the logistics space and blueEX not quite showing what sets them apart. However, despite all of these misgivings, one thing that goes in the favour of blueEX is that they have not taken this lying down. The decision to go for an IPO is a brave one, and it has set off a lot of wagging tongues. The question now is whether blueEX can beat the odds, and how they got to this position in the first place.

Finding capital mid-way

Everything about blueEx seems to scream middle-ground. If you place it in the context of Pakistan’s logistics market it enters the timeline somewhere around the middle. Companies like TCS have been around since 1983 while newer startups like Swyft have only been around for a couple of years. Companies like TCS are now making a change towards eCommerce backed by their decades long legacy, while the startups have been geared towards this model from the very beginning.

blueEX had to make a complete pivot and turn itself around to become an eCommerce logistics company. That is why perhaps it is not so strange how instead of losing itself in the race to get venture capital money, bluEX is going for an IPO and that too on the GEM board. Growth Enterprise Market Board is a listing platform aimed at facilitating Growth oriented businesses whether small, medium or greenfield businesses to raise capital to fund their growth and expansion plans. It is designed particularly to facilitate small enterprises, startups and green field companies that are aspiring to raise funds through capital markets but cannot fulfill the cumbersome conditions for listing on the Main Board of PSX. Essentially, this means that the PSX now has an undercard where high-risk companies can put themselves up for IPOs and investments.

Normally, startups try to get funding from individual venture capitalists, VC firms, or angel investors in different rounds. Since startups are not developed enough to meet the criteria for being listed on the stock exchange, the GEM board provides a way to utilize the exchange without going through the old fashioned way of raising money in public markets. The GEM Board allows growth companies to quickly raise capital in public markets without the complexities associated with a full-scale initial public offering (IPO), but does not allow all public investment.

The Pakistan Stock Exchange introduced regulations for the GEM Board listing purely for high-risk, small and medium scale companies and startups to raise funds. Compared to the listing on the main board, GEM Board listing is less costly with the post-issue minimum paid up capital requirement of Rs25 million compared to Rs200 million in the case of listing the company on the main board.

The GEM listing, because it is designed for new and growth companies, comes with a lower listing fee and tax incentives. But because this listing is designed for new and growth companies, the investment is high risk which is why the Securities and Exchange Commission of Pakistan has restricted the participation in GEM Board listing to accredited investors, institutional and individual. The institutional investors could be financial institutions and companies, whereas individual investors that are eligible to invest in such companies going public should have net assets worth of Rs5 million and should be registered with the National Clearing Company of Pakistan (NCCPL) Limited, the company that provides settlement and clearing services to the stock exchange. The shares are traded at the exchange like in the case of a full-scale IPO but the regulations require the company to issue a fixed share price to reflect the true value of the company instead of the market value.

In what is going to be the second GEM listing and first listing ever of a logistics company in Pakistan, blueEx is planning to raise Rs445.7 million (approximately $2.67 million) by issuing 6,857,000 ordinary shares, which is going to make up 25% of post-issue paid up capital, at Rs65 per share. The listing, if successful, is going to value blueEx at Rs1.78 billion or roughly $10.5 million. In contrast, some competitors in the space, Rider and PostEx have announced raising $2.3 million and $1.5 million respectively. Reportedly, one of the competitors in the space, Swyft Logistics, is in the process of raising $100 million along with sister company Cheetay.

The GEM listing is the middle-way for blueEx, and trying to stay in the middle also perhaps runs in its DNA because it also now calls itself a ‘technology logistics’ company, in an effort to keep a legacy business relevant in the world of technology. However, the blueEX listing is going to be significant in two ways: this is going to set precedent for small companies particularly startups to explore avenues of raising investment other than VC funding and learn from the blueEx IPO. Secondly, it is the first public listing of a logistics company and a delve into financials of a company in a sector which has remained closed for decades for any scrutiny.

We have given fair consideration to the merits of a GEM listing. This is all very new of course, which is why the move is also audacious. But what makes it more interesting is the very real possibility that the decisions may have been made after failed attempts to get VC funding. As mentioned earlier, the company is majority owned by Safina Danish Elahi, and the CEO owns only 5% of it. Both of these would generally be considered red flags for VC investors.

You see, VC investors are less likely to invest in a company in which the CEO has very less shareholding.That is because VCs then feel that the person running the show doesn’t really have a lot of skin in the game. If the CEO is simply there for a salary, they are more likely to either play it safe or not be as zealously invested in turning profits for the company. However, Imran Baxamoosa asserts otherwise. “Because we founded the company with solid foundations and a solid balance sheet and P&L and bootstrapped, in their scheme of things, GEM listing was the right way to move forward,” he says.

“Private valuations are given by the last investor and do not make sense sometimes,” says Imran Baxamoosa. That is another part of why the decision to list on the GEM board is so stunning. In the process, blueEx are revealing their financials and provoking scrutiny instead of choosing a VC route of funding which is the spirit of the day with startups and especially technology related businesses as they identify themselves as. However, Baxamoosa takes a more measured approach. “We do not want to make it overhyped. We want to keep it underwhelmed which is why we are doing a fixed priced IPO. Everything is calculated and in front of the public. There is a lot of conservatism instead and that is because we are looking at a long term horizon.” .

What else might have been problematic for the company to raise VC funding is the fact that the majority investor in the company, Safina Danish Elahi, is the wife of Danish Elahi, a controversial Karachi-based businessmen who recently settled a case out of court against him filed by Bank Islami for alleged embezzlement and irregularities in his bank account. So even if Baxamoosa’s big talk is right, there is indication that if blueEX wanted, securing VC funding would not have been the easiest route for them. And that might have helped push their GEM board decision along.

The Danish Elahi angle

Last year in September, the Federal Investigation Agency (FIA) of Pakistan registered a case against a former employee of Bank Islami and officials of a private company in an embezzlement case and subsequently jailed them, according to media reports. One of the officials named in the case was Danish Elahi, the CEO of Karachi-based Elahi Group of Companies.

The Elahi Group of Companies had started off as a small electronics company known as Elahi Electronics in 1971. Since 2016, Danish Elahi has also served as the director and co-owner of Daewoo Pakistan, with a 50% share in the private company. He has a 50% stake in Kiran Builders and Developers; a 70% stake in E&U Foods; is a director at Opal Laboratories since 2019; a director and co-owner at TripKar; and even a shareholder in the Sehat Kahani app.

The Bank Islami episode was not the first controversy stirred by the Elahi Group CEO. Earlier, he is reported to have defaulted on a Rs1.4 billion loan from the same bank. Surprisingly, on November 5, less than two weeks before the IPO of blueEX, Danish entered into an out of court settlement agreement with Bank Islami, disposing of any complaints and litigation.The timing of the settlement also lends credence to the fact that because Elahi was embroiled in a court case, raising funds would have been difficult. Quite simply, not only VC investors but any investors investing in a company would want it to be as clean as possible, because any association of a company with persons that are controversial are not just a VC investment risk but an investment risk overall.

The add-on is that the accounts of blueEX were not audited by one of the big four auditing firms. The big four auditors have a distrust of the Pakistani market because of the rampant frauds that emerge every now and then at businesses in Pakistan. These firms do not make much from their services to Pakistani businesses and coupled with the risks, Deloitte left Pakistan earlier this year.

The state of blueEX

blueEX, a brand of Universal Network Systems (UNS), was incorporated in 2005 as a courier company which shifted its focus towards eCommerce Logistics in 2011. The company provides local and international cargo shipment services and courier services under which it delivers letters and documents, and eCommerce deliveries.

The biggest component of the business is courier services, forming about 96% of the company’s income, while only 3% comes from the international freight segment and 1% from providing cargo services to international airlines, according to an Information Memorandum published by the company.

Under the GEM Board listing rules, companies planning to list are not required to issue a prospectus which is the case in case of full-scale IPO. Instead, they are instead required to provide an Information Memorandum (IM) which is a document providing a comprehensive overview of the business.

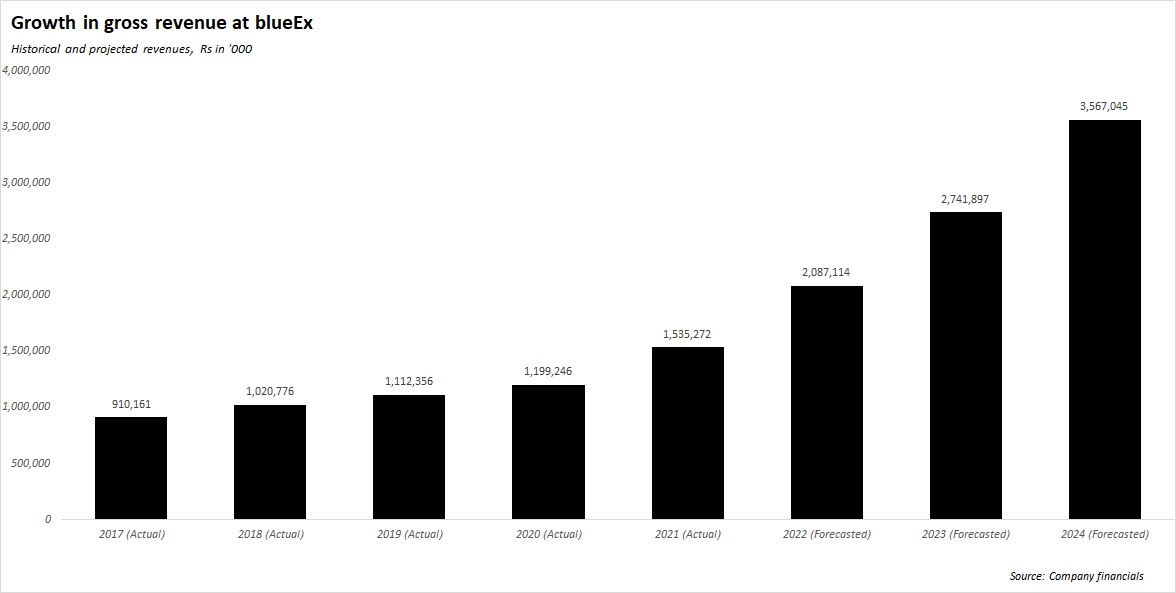

The financials released by the company show that its revenues have been growing since at least 2019, when the company generated Rs 508.3 million. In 2020, the company generated a revenue of Rs1.17 billion whereas blueEx closed the year 2021 at Rs1.53 billion.

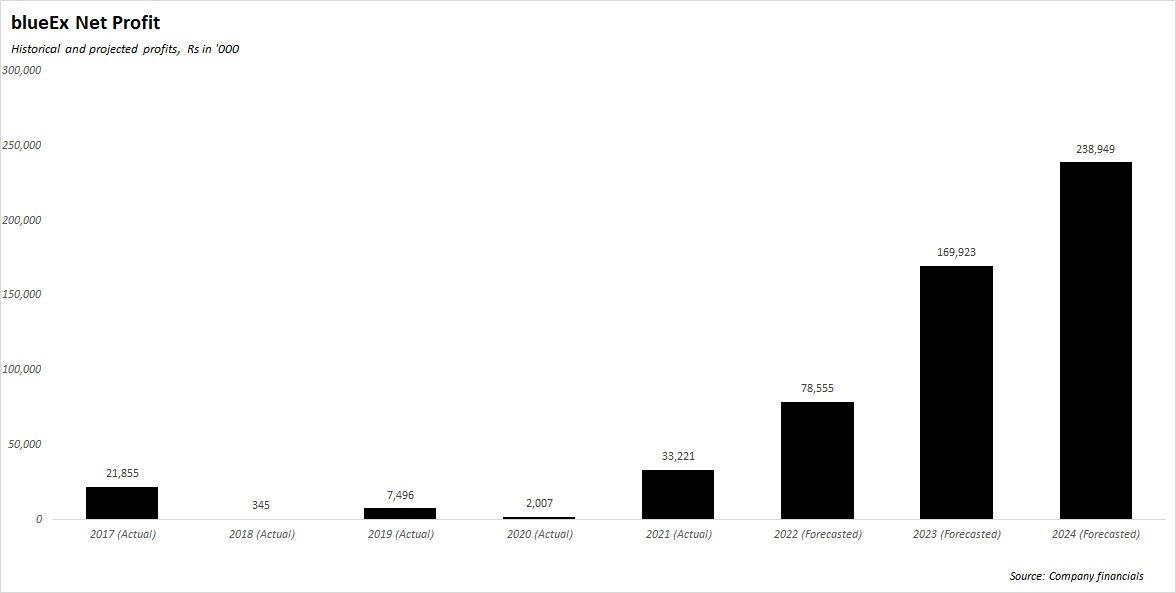

On the net profit side, the company generated a net profit of a tiny Rs7.49 million, with a dip in 2020 when the profit after tax was only Rs2 million. The net profit, however, increased by over 1,500% in 2021, with the company reporting net profit of Rs33.22 million for the latest year.

Post 2021, the company projects its profits to more than double each year, with projected revenue in 2022 to be Rs78.5 million, 169.92 million in 2023 and 238.9 million in 2024. Consequently, the earning per share (EPS) for investors also more than doubles each year onwards. According to the IM, the EPS for 2021 was Rs1.61, increasing to Rs8.71 in 2024.

“The increase in EPS is rich for the initial share price of Rs65 for a growth company,” notes an analyst. “The company income and profits are increasing which are all good indicators but the question then is will the company be able to execute on these projections,” he adds. The price-to-earning (PE) ratio, trailing at 53.71 (FY2021) and forward at 22.72 (FY2022), according to an analyst, indicates that the company was overvalued for a logistics company given the competition in the space, which we discuss below. “The forward earnings are on the higher end and likely exaggerated,” says one analyst.

On the other hand, KASB Securities, a Karachi-based securities trading firm, in its report endorsed that the sponsors and management of BlueEx have strong experience in sectors of supply chain, warehouse, courier and bulk cargo which, they think, make it a dominant player in the sector. “We think the public offering is a good way for institutional and accredited investors to get exposure to this area of ecommerce enablement,” the report read.

The problem, however, is that while the blueEx management would have the requisite experience in logistics and supply chain, the company hasn’t been able to create a serious space for itself in the market that is currently dominated by TCS and Leopards. From blueEx’s research presented in the IM, it currently owns only 6% market share in the courier business, whereas Trax, which was founded in 2017, has a market share of 13%, almost double than blueEx.

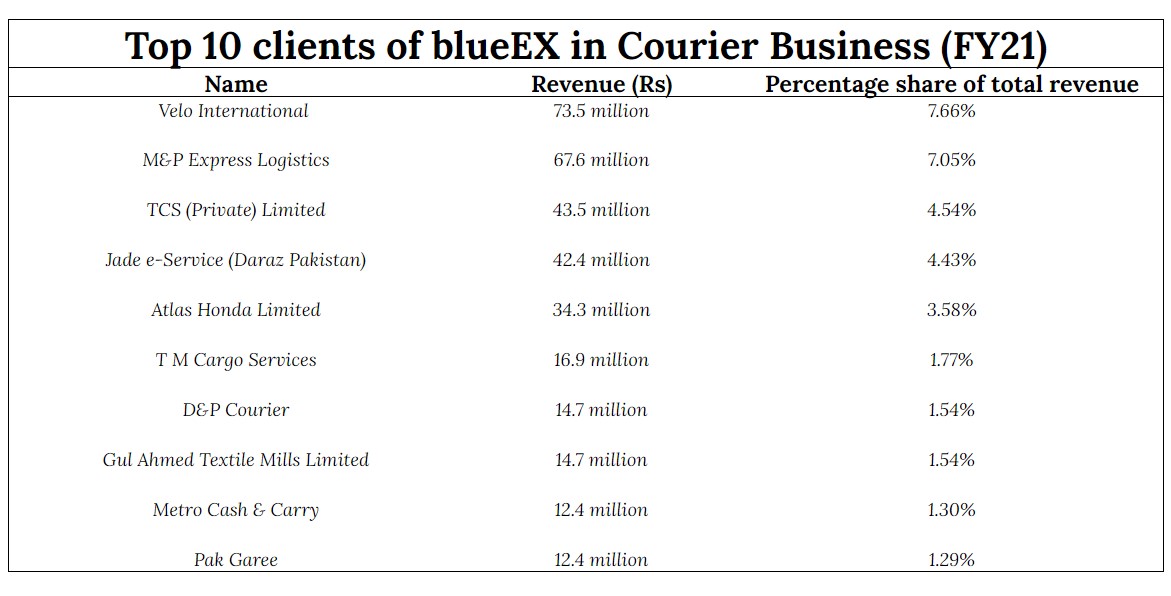

In the eCommerce logistics as well, which blueEx says is its niche and which is booming helped by the pandemic and hence provides the opportunity for growth for blueEx, the company is not in the top 5 eCommerce logistics providers. In fact, revenue-wise, the top ten clients of blueEX in the courier business include only Daraz, Metro Cash n Carry and AlKaram Textiles for which blueEX handles eCommerce deliveries.

But here’s the kicker: blueEX’s biggest eCommerce client Daraz is also the biggest eCommerce company in the country in e-tailing, and handles 70% of its deliveries through its own delivery network under Daraz Express. The remaining 30% is handled through 7 third party logistics providers like blueEX, TCS and others. Last year, Daraz was doing 50% of its deliveries through Daraz Express while the remaining was being handled by third party logistics companies.

The increase in eCommerce deliveries through its own logistics infrastructure shows Daraz’s commitment to grow its logistics arm. The fact that the biggest eCommerce company in Pakistan which constitutes the bulk of e-tailing volume does most of its deliveries itself which it will grow to 100% in the times to come, is a serious limitation for the growth not only blueEx but other eCommerce logistics companies as well. And as I have come to know, Daraz plans to not only do all of its deliveries in the future, it also plans to become a third-party logistics provider for all eCommerce deliveries in Pakistan, for Daraz as well as others.

This effectively makes Daraz a competitor to all other third party logistics companies and an earlier article by Profit also highlighted why Daraz could be a threat to all eCommerce logistics companies.

After Daraz, the biggest e-tailers by volume are most likely big clothing brands like Khaadi, Sapphire, Gul Ahmad and Al Karam, which have presence in offline retail as well. While all of these retailers saw a boom in eCommerce deliveries during the pandemic, in a recent interview with Profit, officials from Khaadi told us that the trend of shopping from their brand has seen a surge in in-store shopping and a dip in online sales as the pandemic restrictions have eased.

On the other hand brands Sapphire and Al Karam also saw a surge in their eCommerce sales because of store closures but since September this year in the case of Al Karam and October in the case of Sapphire, they have witnessed their online sales come down and the footfall at brick-and-mortar stores going up.

However, Gul Ahmad says that there has been an increase in brick and mortar sales, it is not coming at the expense of eCommerce sales at their brand because they say that their strategy is focused on increasing eCommerce sales along with brick and mortar sales. At Gul Ahmad too, the brand does eCommerce deliveries through 7 logistics partners, one of which is BlueEX and the favourite, and on top of their brand is also the logistics behemoth TCS, which is not going to be easy to displace as highlighted in an earlier piece by Profit.

The fall in eCommerce volumes as pandemic eases insinuates that the going is going to get tough for blueEX in its niche, and more so because it was never among the top in terms of market share. While there are no solid numbers because of a lack of independent market research, market estimates put TCS and Leopards on the top spot, followed by M&P and CallCouriers, and then rank the startups Rider, Swyft and Trax, younger than blueEx in the ranking pyramid for eCommerce deliveries.

The revenue-wise breakdown of the top 10 clients in courier business of blueEX does not give an encouraging picture but it is quite possible that blueEX has on boarded many small customers for eCommerce deliveries which eventually add up to a significant number. In the Information Memorandum, blueEX has claimed to have over 11 thousand customers for courier service but Imran refused to disclose how much of their business came from eCommerce deliveries for us to ascertain if their eCommerce numbers were serious for a niche.

What is further problematic is that the company pays for the eCommerce orders upfront to its merchants and buys the inventory. Such a model can end up restricting the cash flow of blueEX instead of the merchant if cancellations of cash-on-delivery orders are even a small percentage.

A technology company that does logistics?

It is perhaps because of the inability to create a serious dent in logistics that blueEx now calls itself a tech logistics company, trying to stay relevant in the market that is dominated by bigwigs and now saturated by the entrance of VC funded startups, which have their own claims of being the tech titans in logistics.

Anything tech is booming these days. The old guard, the likes of Systems Limited and TRG, have their stocks booming on the PSX. The new guard, the startups, are raking in record rounds of funding. To recall, blueEx’s competitors Rider recently announced completing a raise of $2.3 million, PostEx announced $1.5 million in its recent round.

Whereas Swyft Logistics is planning a $100 million raise collectively with delivery company Cheetay, all on the back of being a tech company. It does not at all come as surprising then that spinning a logistics company to make it look like a tech company obviously comes with gains: attracting investors is one of them.

At the face of it, blueEx is a logistics company that uses technology to make its processes efficient. That, however, would not qualify blueEx to be called a tech logistics company, just like it does not make Unilever using some technology or increasing technology in its processes a tech FMCG company. What, however, does make it a technology company is what blueEx says is its in-house technology products which it sells to different clients, besides using its solutions in the company’s own operations.

“Tech is at the forefront of everything at blueEx. When we started off in 2011, we were the first company to come in and formalise COD. We gave a booking portal in the very beginning which is now defacto. Anyone who does COD shipments has a booking portal. Earlier it was all manual,” says Imran. “As of today, it’s not only the technology that we developed and use at BlueEx, we have also outsourced that to other players in the market. One of our clients uses a solution developed by blueEx to execute their eCommerce. Their website is built on our technology stack. When the order comes in, and it gets processed in one of their outlets, the picker app also uses our technology and when the order gets processed, again it goes through our technology,” says Imran.

It is because of the focus on technology that the company chose to classify costs incurred on the production of softwares as assets instead of expenses, turning the overall loss into profits. For instance in 2021, the company incurred Rs59 million in expenses for the production of software but was accounted as an asset which is going to bring economic benefits to the company. Had it been classified as an expense, it would have turned the net profit of Rs33 million into a net loss of Rs26 million, thereby making it unattractive for investment. Strangely, however, the company assumes that the economic benefit is going to be indefinite and has not accounted for the depreciation of the software.

“That is besides the overall orientation of the business. Or if you want to connect your website with our warehouse management system, our plugins are ready for warehousing and logistics. So all you have to do is download the plugin on the platform you are on and it gets connected. That is why we are a technology logistics company,” he adds.

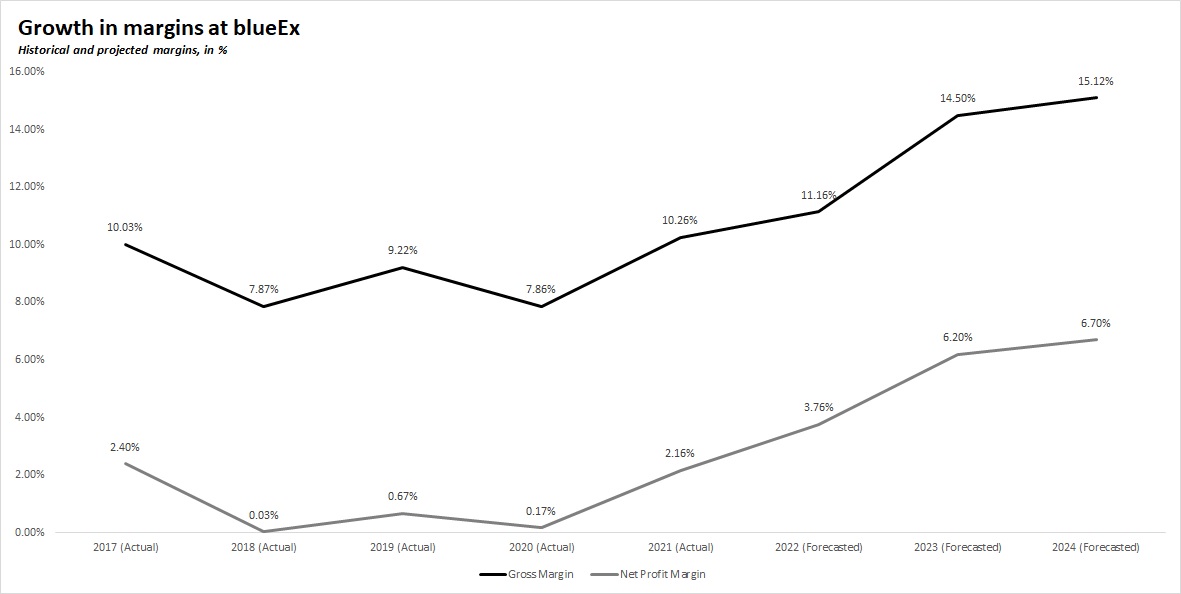

Imran, however, did not disclose how much of their business came from the tech component of the business but margins have a story to tell. For the year 2019, according to full financials available publicly, blueEx’s gross margin was 20.17%. It was 8% in 2020 and 10.27% in 2021. Company’s net profit margin was 1.47% in 2019, 0.17% in 2020 and 2.17% in 2021. “These margins do not represent a sustainable tech company which usually has a net margin of over 10% and gross margin of 40%,” notes one analyst.

Imran, however, affirms that their raise is going to help the company move towards businesses that have more depth in margins, rather than chasing market share. And because they are not chasing any further market share, they are not worried about any funding coming into other startups.

Projections also show that the company’s gross margins are going to be over 15% and net profit margins are going to reach close to 7% by 2024, but it is unclear how much of the growth in margins is because of the technology solutions it provides to clients, let alone if growth in margins would be possible because of the dynamics in eCommerce logistics.. Segment wise revenue numbers show that the company is betting on the growth in eCommerce delivery volumes. And owing to the lack of transparency from their company on the tech side of business, the question then is will blueEx as a ‘tech logistics’ company be able to grow in a market, in which it has not earlier been able to show a promising growth as a ‘logistics only’ company?