The Finance Act 2022 has increased the advance tax on passenger transport vehicles plying for hire that the Federal Board of Revenue collects under Section 234 of the Income Tax Ordinance, 2001.

Passenger transport vehicles plying for hire are now subjected to tax based on their seating capacity and whether or not the vehicle is air conditioned.

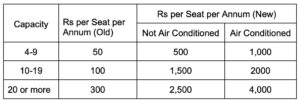

The new tax structure for transport vehicles plying for hire is as follows: