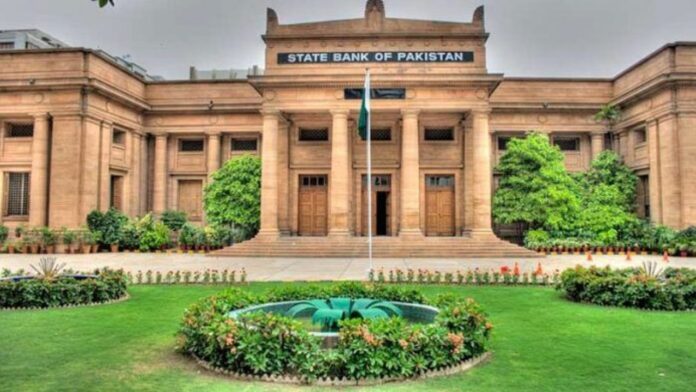

KARACHI: The State Bank of Pakistan (SBP) on Monday maintained the status quo by keeping the interest rate on hold at 15%.

According to the details, the central bank’s monetary policy committee (MPC) met under the chair of Deputy Governor Syed Murtaza and reviewed the economic indicators. The meeting decided to maintain the interest rate for the next six weeks.

The status quo decision taken by the MPC Is primarily because of administrative steps taken to curtail imports and plans for strong fiscal consolidation in FY23.

In a statement, the SBP said that recent inflation developments have been in line with expectations, domestic demand has begun moderating and the external position has improved. As a result, “the MPC felt that it was prudent to take a pause at this stage.”

“Looking ahead, the MPC intends to remain data-dependent, paying close attention to month-on-month inflation, inflation expectations, developments on the fiscal and external fronts, global commodity prices and interest rate decisions by major central banks,” read the statement.

The SBP noted that since the last meeting, headline inflation rose to 24.9% in July as per expectations, the trade balance fell sharply in July,the rupee reversed course during August, and the board meeting on the ongoing review under the IMF programme will take place on August 29th. It is expected that the Fund will release a further tranche of $1.2 billion. The central bank claims the release will “catalyse financing from multilateral and bilateral lenders.”

In terms of international developments, the MPC noted that both global commodity prices and the US dollar have fallen in recent weeks in response to signs of a sharper than anticipated slowdown in global growth and nascent market expectations that the US Federal Reserve tightening cycle may be less aggressive than previously anticipated; more emerging market central banks have started to hold policy rates in their recent meetings.

On balance, the MPC noted that some greater slowdown in global growth will not be as harmful for Pakistan as for most other emerging economies, given the relatively small share of exports and foreign private inflows in the economy. As a result, both inflation and the current account deficit (CAD) should fall as global commodity prices ease, while growth will not be as badly affected.

The decision is in line with market expectations. Most analysts had earlier developed consensus that the bank would maintain the rate at the current level, the highest since November 2008.

It may be recalled that the committee had raised the benchmark policy rate by 125 basis points (bps) to 15% during the last meeting in July. Besides, it tied interest rates of the Export Finance Scheme (EFS) and Long-Term Financing Facility (LTFF) to the policy rate, giving it a 500-basis point discount relative to the policy rate to encourage exports.

Although a number of economists claimed that Pakistan’s trade deficit decreased by 18% YoY and 47% MoM during the month of July 22 mostly as a result of a decrease in import costs, weekly inflation hit a record high of over 42% in the week ended on Friday.

Data released by the Pakistan Bureau of Statistics (PBS) shows that the benchmark CPI inflation spiked to a 14-year high at around 25% in July.

So far in 2022, the central bank has held five MPC meetings. A hike in the policy rate was notified in three of these meetings, to a combined hike of 525 basis points.