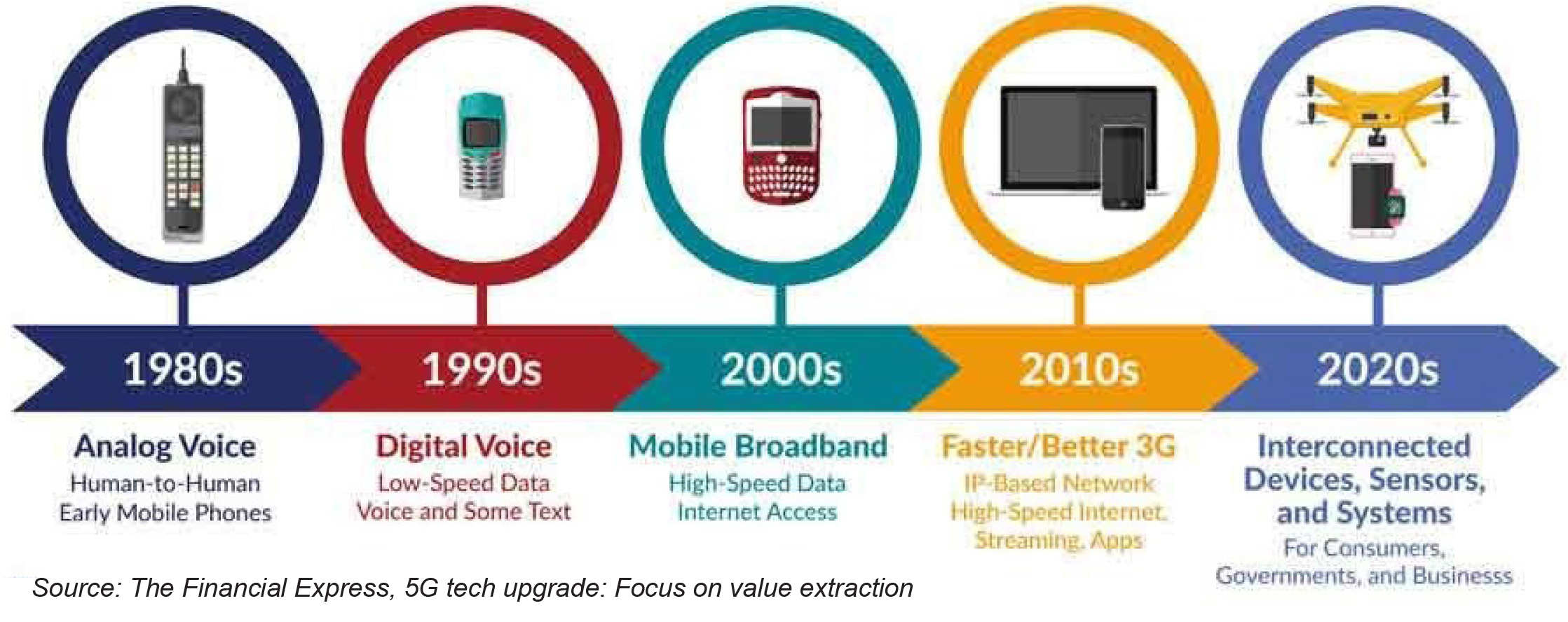

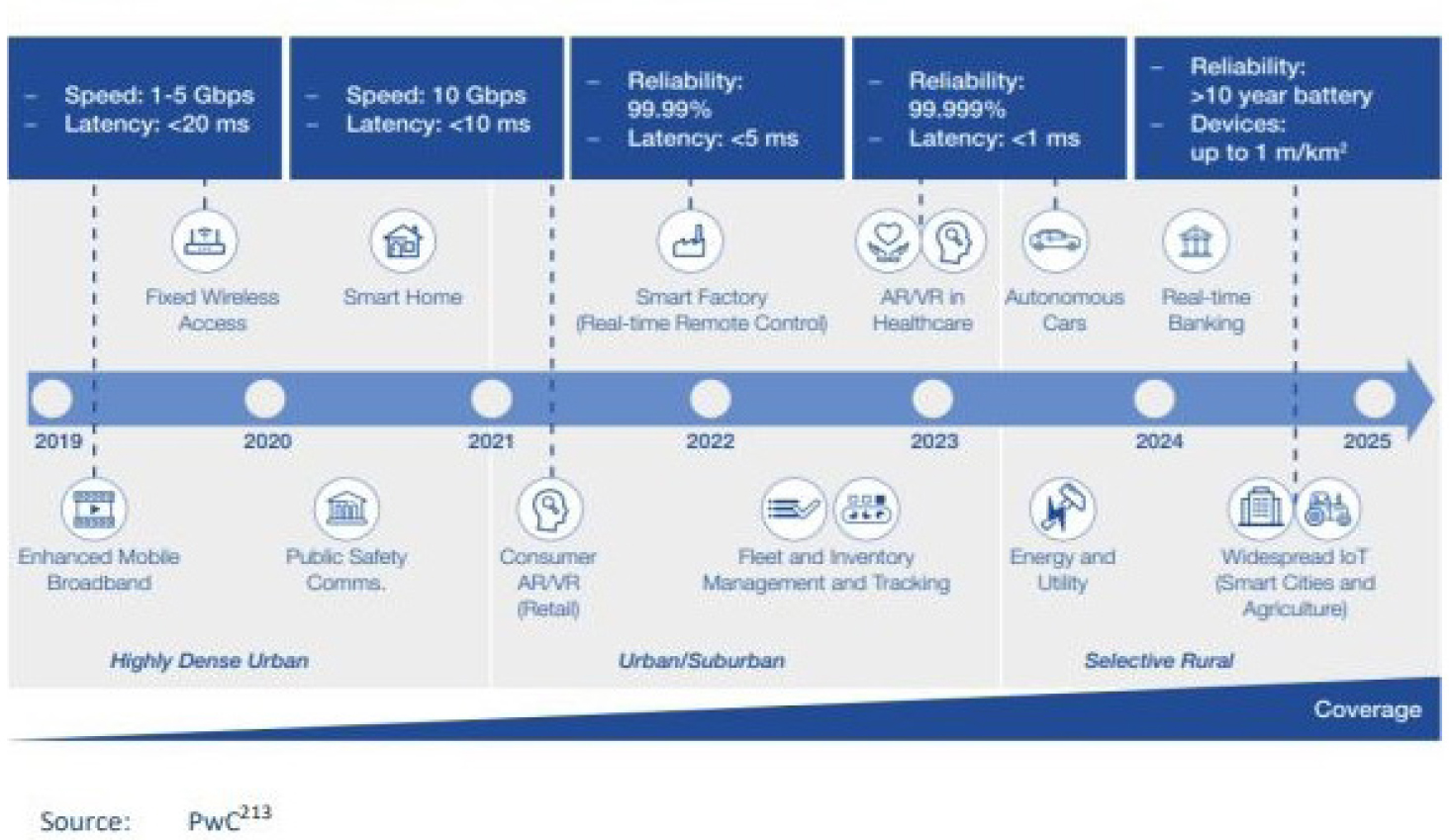

The latest buzzword in the Telecom sector is 5G. However, for many countries, it has become a reality. These countries, mostly developed ones, are riding the wave of technological advancements enabled by the successful launch of 5G services.

Yet, the 5G revolution hasn’t arrived in its true sense as large chunks of the global population are still awaiting access to the Next Generation of Mobile Technology.

Further, a key region that can propel the global 5G revolution is South Asia. Two major economies in the region, Bangladesh and India have already auctioned the 5G spectrum, with the operators prepping for mass in their respective countries. Bangladesh auctioned the spectrum for around $1.2 billion in March this year while India also conducted a successful auction earlier this month for $19 billion.

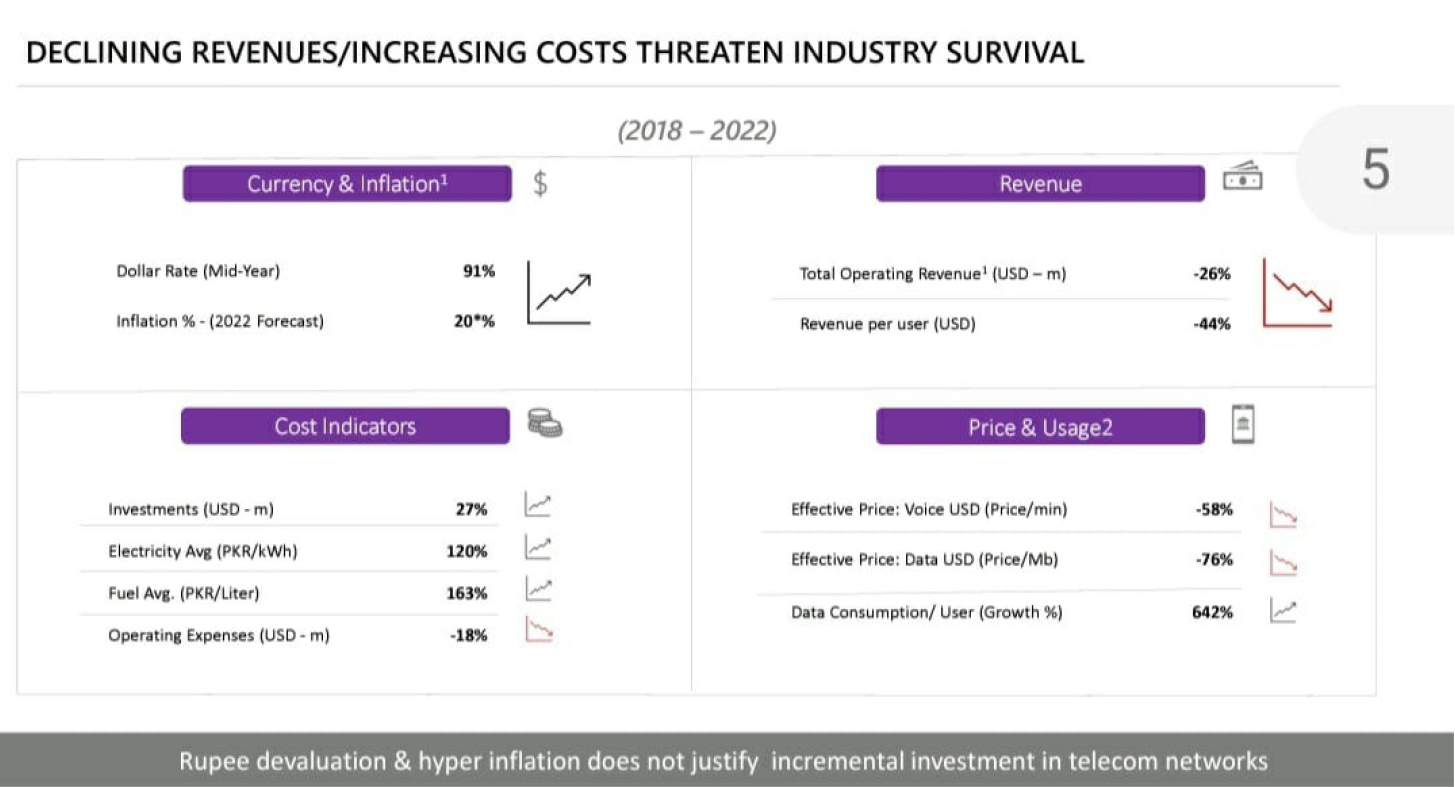

The case is a bit different for Pakistan, however. Initially, it was planned that the auction would be held in December 2022 which was subsequently pushed to March next year. However, amid growing political uncertainties and the country’s economic woes, an auction in March seems unlikely. And this is just one part of the problem. The primary issue is the unwillingness of the Cellular Mobile Operators (CMO) to participate in the 5G auction as they believe that currently, the business case for such roll out doesn’t exist.

However, before diving deeper into the feasibility aspect, let’s take a look at the possible economic benefits that the country can leverage from the mass adoption of the 5G technology.

5G enabled Economy

As per a research paper published by the Pakistan Institute of Development Economics (PIDE) last year, “5G will help the digitalisation of Pakistan by connecting people with robust purpose-built technology opening up opportunities for industries as well as individuals. They are expected to benefit from future innovations in distance learning, public safety, manufacturing, transportation, health, etc.”

“The introduction of e-governance will enhance the enabling role of the government and bring about transparency and efficiency in processes. 5G will increase the demand for fiber as each building needs a fiber connection and a small antenna/base station for a cellular company. It will increase demand for mobiles that are compatible with 5G technology and we also need new devices to operationalise 5G in our country.” The document further added.

Pakistan’s 5G case and impediments

The unwillingness of the operators stems from their opinion of Pakistan’s infrastructure and regulatory framework which they believe do not allow for a viable 5G business case.

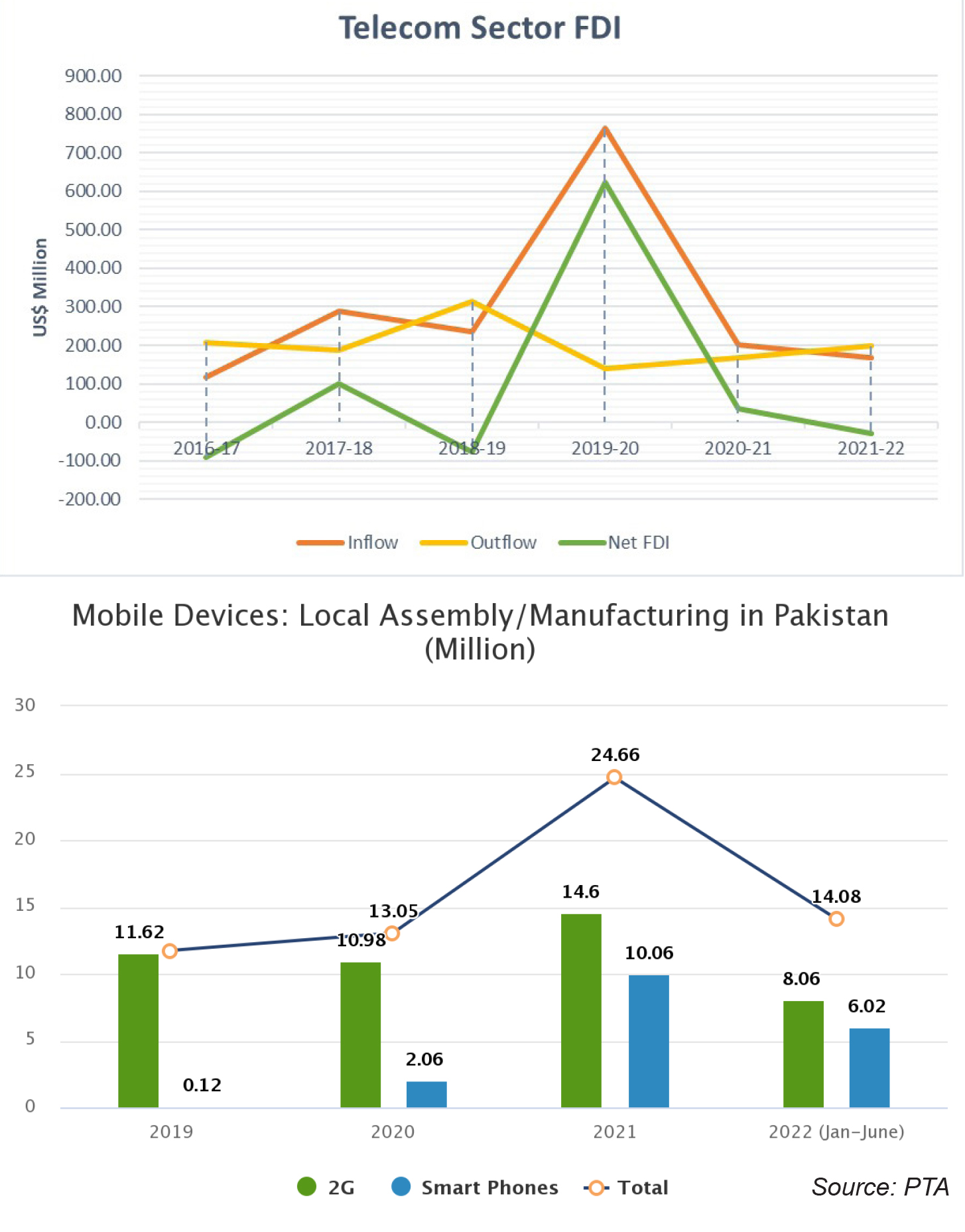

“Currently, there are around 1% to 2% users on our network that have 5G handsets. Even if the spectrum is provided for free, still the business case for 5G in the country is quite weak. We launched 4G around eight years ago, and still, 50% of the handsets being sold today are 2G. Therefore, we need to focus on 4G for all before thinking about 5G for a few,” stated Aamir Ibrahim, CEO of Jazz.

The Jazz’s head honcho was right in pointing out that there is room for improvement on the 4G front and before achieving that we cannot indulge in a discussion about 5G. South Korea, for instance, rolled out 5G services only when 4G penetration reached 80%. In Pakistan’s case, the figure is around 50%.

Not everyone agrees, and some experts have a different take on this matter.

“I strongly believe that we should auction the spectrum next year. Basically, market readiness is contingent on multiple factors and it can be achieved through a continuous process. However, the policy/regulatory initiatives are extremely important to ensure that the CMOs participate in the auction.” Parvez Iftikhar, Senior IT consultant and Founding CEO of Pakistan’s Universal Service Fund (USF).

“It is no secret that we were late in launching 3G by a good five to six years. We cannot afford such complacency in the case of 5G,” he emphasised.

Yet, if the market is analysed from a totally commercial perspective, which would also be the perspective of the CMOs, the situation looks bleak.

As per the World Bank’s 5G readiness Plan for Pakistan, “Pakistan’s current telecommunications market has been analysed in this report to determine readiness for 5G through comparison with neighbouring countries and global benchmarks. Based on the analysis, and comparisons with other comparable markets it is possible to conclude that the Pakistan market as at August 2021 is not yet 5G ready. There exists a considerable number of factors to address in facilitating Pakistan’s market readiness especially the lack of large contiguous blocks of affordable spectrum, broader access to fibre backhaul and widespread availability of affordable 5G smartphones and other devices which are necessary preconditions in order to make 5G a success.”

Though the report refers to the situation a year ago, unfortunately, no significant change has occurred that invalidates the aforementioned findings.

Further, the CMOs. when contacted, almost all of them were of the view that active participation in a 5G auction next year seems unlikely as the industry is dealing with serious sustainability issues and cannot splash huge amounts of cash at the whim of the regulator.

Though Profit was unable to obtain a figure for the requisite investment for 5G in Pakistan. However, we can look at other economies, for instance, South Korea. As per the Financial Express, “Upon incurring a cost of $20 billion in setting up 215,000 5G base stations for offering low-end services to 45 percent population, South Korea figured out the need for $370 billion to roll out the fastest 5G services for all citizens.”

The Way Forward

The auction, if held next year, might see all the players opting out of it. Ufone is likely to not even participate in the upcoming 2100 MHz 4G auction as stated by PTCL’s Group president and chief executive, Hatem Bamatraf, in a board meeting in July. Therefore, the bidding for 5G seems like a far-fetched dream.

The same auction would most probably see Telenor take up the 4G spectrum and the company going for a 5G spectrum immediately after that seems unlikely and highly contingent on what benefits the 2100 MHz spectrum can bring in for them.

Jazz has been quite vocal about the fact that 5G is not an option for at least the next two years and if it stands by this theory, the company won’t be bidding for the 5G spectrum anytime soon. However, Zong might be an exception to this as it has more strategic interest in Pakistan than commercial ones. Further with a cash-rich parent company in the form of China Mobile and synergies brought in by other Chinese companies like Huawei and ZTE, Zong might just take a leap of faith in the 5G spectrum.

However, if that happens, it would add to a string of auctions that went uncontested. (In 2016, 2017, 2021, and the 2022 4G auction would most likely see only Telenor bidding).

The Pakistan Telecommunication Authority (PTA), responded to Profit’s queries, “when policy directive is issued by Federal Govt, Spectrum Auction will be conducted by PTA. However, the time frame between the decision of GoP to introduce 5 G and the launch of 5G will be approximately 6 to 8 months. The entire process involves the hiring of an International Consultant to analyze market readiness, spectrum pricing, spectrum auction design, the conduct of the auction and culmination of the process by the award of a license to successful bidders.”

“All the related queries regarding price benchmarks for different bands would only be determined after market assessment by the consultant, hence it is too early to determine price at this stage. Similarly, as far as participation of CMOs in auctions to acquire 5G spectrum, it would largely depend upon the overall business / economic environment in the country and the terms and conditions associated with the auction.” PTA further added.

Yet, even if not next year, the government needs to focus on bringing in the next generation of mobile technology as soon as possible.

For that to happen, the industry needs some major reforms. Starting with a significant reduction in spectrum price so that the Telcos are encouraged to invest. The government currently decides the base price on its own, but as per experts, the most efficient method would be leaving it to the market forces to ascertain the price.

To support the case for this recommendation, the example of the 2004 auction is presented which is considered one of the most successful in the country’s history. The government was expecting to earn $100 million from the sale of each license but was able to generate $291 million as the auction was left to the market forces to decide the price.

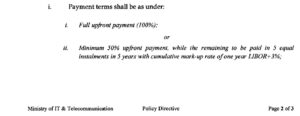

Further, the license fee is supposed to be paid in 5 years with interest charges added. This problem might also need to be addressed. For instance, Bangladesh in the recent 5G auction has collected only 10% in fees upfront and has allowed its companies to pay the remaining figure over a period of 9 years.

India has gone a step further, as per an article published in Communications Today, “ The (Indian) Telecom Ministery introduced structural reforms to boost cash flow in the industry. It introduced a four-year moratorium for the payment of adjusted gross revenue by operators and a policy of non-levy of spectrum usage charges acquired through auctions after September 2021.”

Further, there is a need for fiber proliferation on an urgent basis as currently, only 10% of telecom towers in the country are connected to fibre which is essential for deploying 5G.

As per Tabadlab working paper, The Fixed Broadband Challenge, published in January 2022, “It isn’t possible to roll out next-generation technologies on existing and (in many cases) outdated infrastructure, which is why investing into a fibre optic infrastructure is essential.”

India here can again serve as an example, As per the figures of the Telecom Regulatory Authority of India, 34% of its telecommunication towers are fiberised compared to Pakistan’s 10% as per PTA. India is further expanding its fibre network under the National broadband mission which aims to connect all Indian villages to the network and provide fibre optic coverage to 70% of telecom towers.

Moreover, the government needs to remove handsets and data taxes to facilitate the rapid adoption and uptake of services. Also, it is high time that we sunset 2G/3G phones and develop cheaper 4G and 5G smartphones to create an enabling environment for the launch of 5G.

The importance of compatible consumer-end devices cannot be ignored. Case in point, Telenor bought 850MHz spectrum for 4G in 2016 which was supported by a few high-end handsets back then and was contradictory to Telenor’s low-pricing strategy to attract rural consumers.

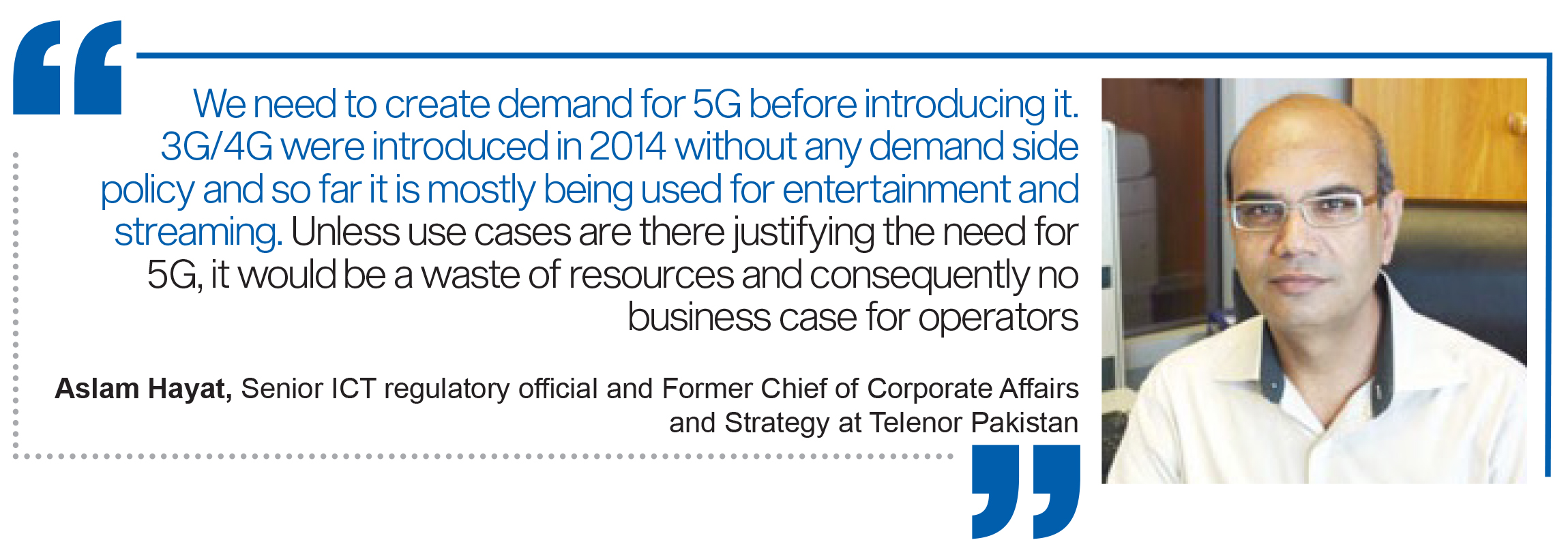

As the current situation stands, the government only seems to be fixated on earning the maximum dollars out of spectrum auctions. However, it is ignoring the fact that nurturing the demand side is as important.

“We need to create demand for 5G before introducing it. 3G/4G were introduced in 2014 without any demand side policy and so far it is mostly being used for entertainment and streaming. Unless there are use cases justifying the need for 5G, it would be a wastage of resources and consequently, no business case for operators,” said Aslam Hayat, Senior ICT regulatory official and Former Chief of Corporate Affairs and Strategy at Telenor Pakistan

He further added, “The government should come out with a demand-side policy before the supply of 5G. The last comprehensive demand-side policy in the shape of the IT Policy was made in the year 2000. There is a need to work on 5G use cases especially in increasing agricultural productivity, improving remote education, smarter logistics, advanced healthcare, efficient manufacturing operations, smarter government management and services, autonomous vehicles, and IoT.”

However, this does not mean that we are the only country that is facing challenges in deploying 5G effectively. As per an article published in Light Reading by Gagandeep Kaur, “In the short term, as 5G services are launched in metros and major cities (of India), there is no killer use case for consumers.”

Furthermore, Bangladeshi operators are in a conundrum as they need to import equipment for the 5G roll out, but the country is facing a foreign exchange crisis and is seeking IMF’s help.

Yet, when compared to the region, Pakistan lags behind. As per the Global Inclusive internet Index 2022, “Despite a rank of 79 globally, Pakistan ranks last out of 22 countries in Asia. The country’s overall score is brought down by low scores in both Availability and Relevance – Pakistan ranks last in Asia for both categories.”

Page wed very interesting. Please continue to inspire those who visit our website in the most positive way. You can visit my website

Outclass Post Very Interesting Article

5G will need time as currently most of the medium range devices in market are 4g only,only high end smartphones have 5g. Hence the ecosystem needs to be in place alongside 5 g launch.

Yesterday India launched 5G which will help a lot of stuff. Including medical robotic surgeries automation driving a lot of stuff, Pakistan should launch 5G in mega cities right now, I am sure it will help a lot.

I have perused every one of your posts and all are exceptionally enlightening. Gratitude for sharing and keep it up like this.

사설 카지노

j9korea.com

The world has been using 5G internet already, everything has been widely deployed and used by everyone.