The stock market crashes of 2005 and 2008 were an example of the markets doing all that they could in their own favour at the expense of the investors and getting away with it scot free as they had captured the board of Karachi Stock Exchange and, by extension, the SECP. The lessons that had been learned in the crash of 2000 (read article published in an earlier issue of Profit titled “Anatomy of a stock market crash) had been forgotten and as the markets were rallying again, it was felt that there were checks and balances which would protect from another crash.

Sadly, that was not the case.

What was seen was a perfect example of how the big market players looked to game the system for their own personal gains and when things did get out of hand, they protected themselves and evaded any accountability or punishment. SECP also played its part in the crisis by sleeping at the wheel while the crisis was approaching, letting the market players act on behalf of the whole market and in the end put in a few paltry actions which were reactive at best and ineffective at worst. It was the capture of the KSE and the motive of profitability which characterized the crisis primarily.

Adeel Zafar, a prominent investor and former broker at Lahore Stock Exchange, states that “SECP has failed to provide a level playing field on a consistent basis to the investors and brokers against the big market players. Due to this, the small investors have always been let down.”

The lead up to the crash of 2005

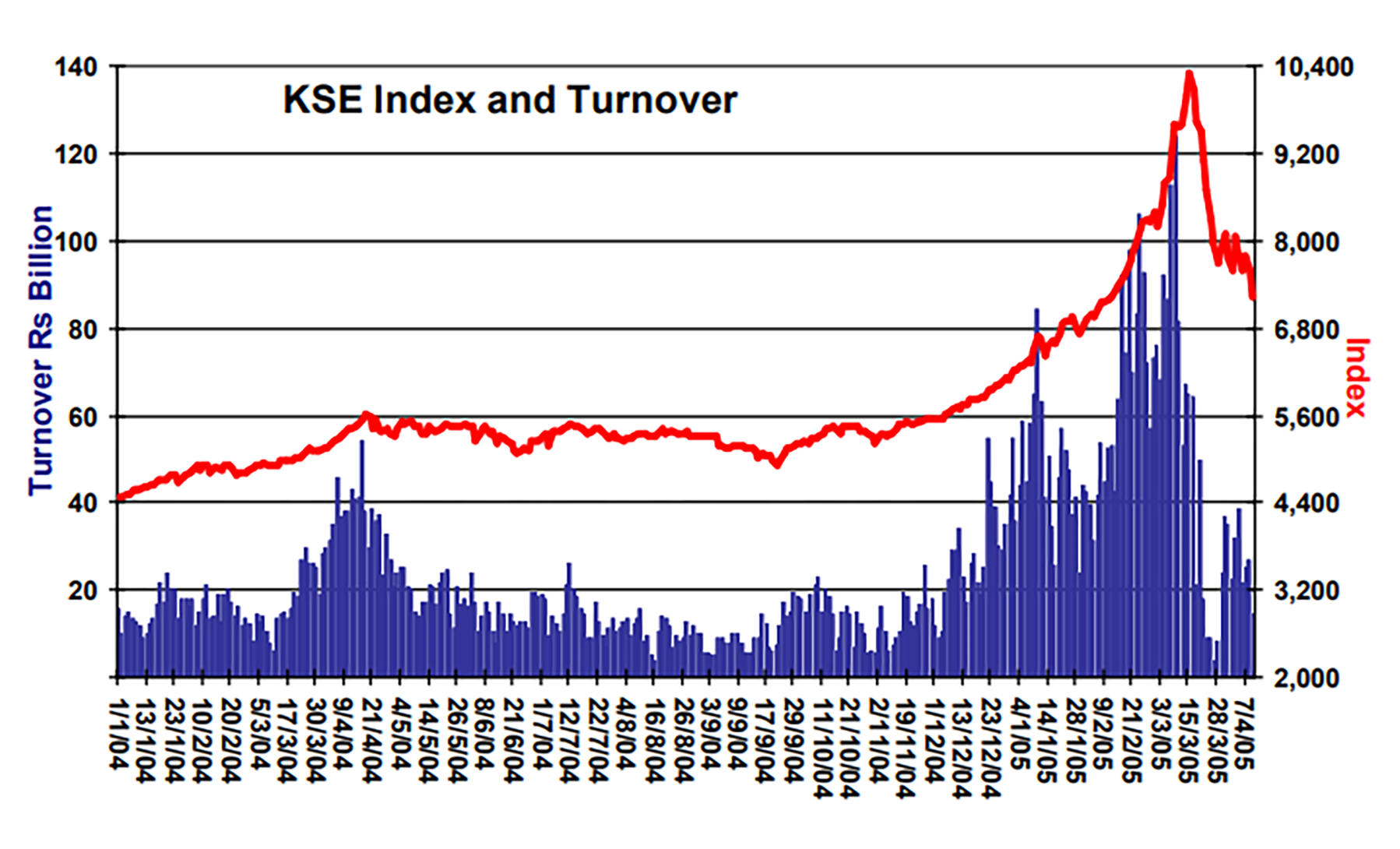

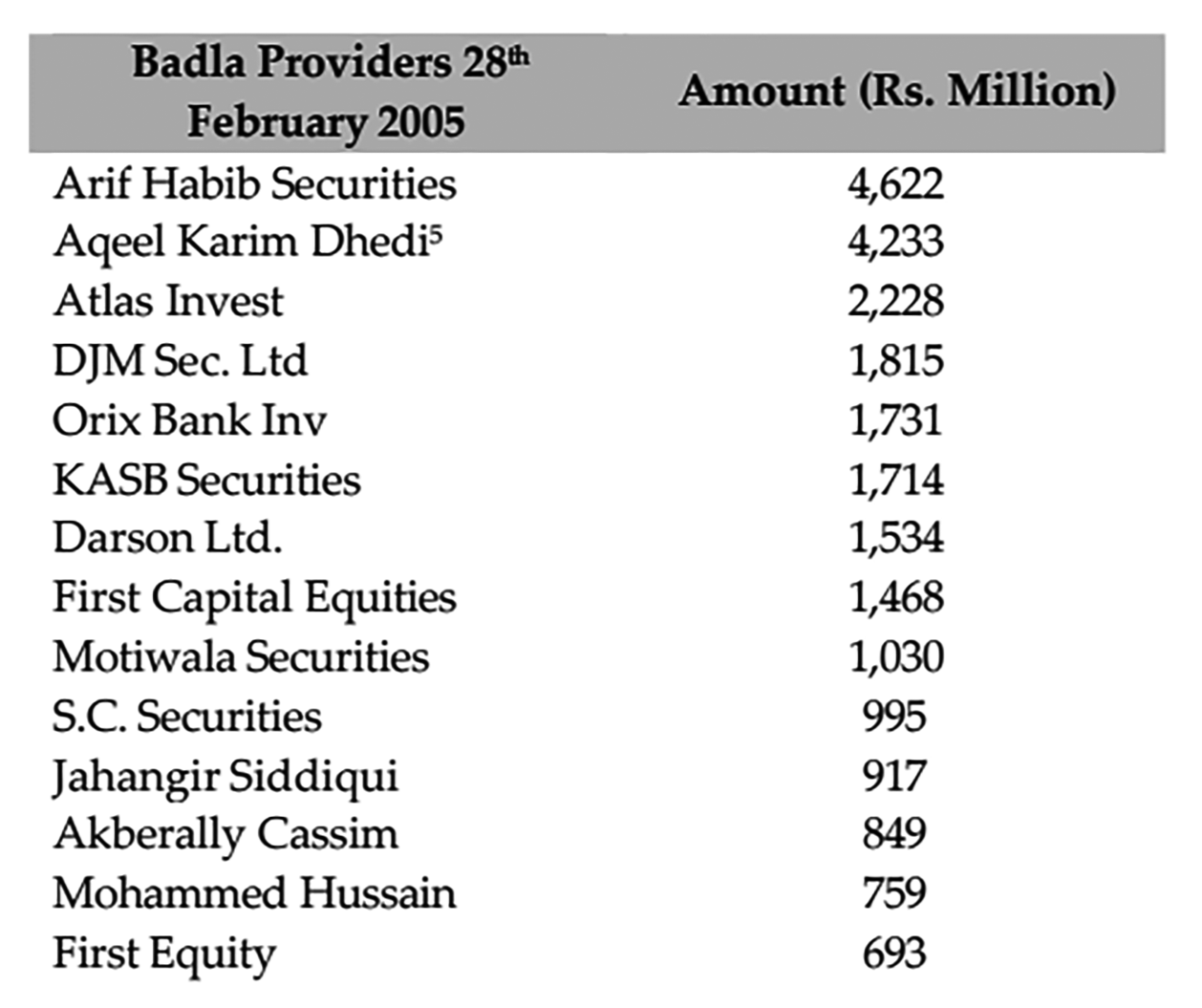

The period leading up to the crash saw a major bull run as the macroeconomic conditions of the country were improving. The time before the crash saw an increase in remittances, low interest rates and above average corporate results which were reflected in the form of stellar IPOs being carried out in the capital markets. From December 2004 to March 2005, the KSE index rose by 65% from 6,218 to 10,303 and value traded at the markets skyrocketed from Rs. 20 billion per day to Rs. 50-100 billion a day. As there had been no action taken against badla or carry over trades after 2000; the market rise was fueled by badla financing in conjunction with the futures market. With the low level of investment required in the futures market and use of badla financing, the ability to leverage the position grew exponentially. The positive sentiment prevailing in the market was expected to continue and it was predicted that the macroeconomic trend will trickle into the capital markets.

Before we begin, an explainer (skip if you already know this)

Futures trading

A basic understanding of future markets is required to understand what happened as future markets in tandem with the badla market, played a huge role in this crash. Futures trading is when an individual makes a commitment in advance that at the end of the month they will either buy a share or sell it. For example, suppose the month is currently June. A trader can sell shares in the futures market where he makes a commitment that at the end of July, he will deliver the shares to the one who is buying the futures contract from him right now. The futures market is a derivative market and allows for an individual to buy a share in the future by not putting up the whole payment in one go and allows him to delay his payment until the settlement of the trade is carried out on a future date. The incentive for the buyer is that he is getting a position in a stock right now with the use of fewer funds by buying it in the future when he will be able to procure the payment. There is also an opportunity for the buyer to sell at a later date which will be against the purchase he has made and the sale will be met with the purchase carried out. He can do this when the price of the future market has increased and he is willing to book a profit. The incentive for the seller is that the price quoted in the future market is mostly above the one being quoted in the regular market (a premium is attached) and if the seller feels that he is making a significant enough profit, he can sell shares in the future. The seller also has an opportunity to close out his sales position earlier if the share falls in value and the seller feels he has made a considerable enough profit to allow him to close out his position.

The rot of the crisis seeps in

According to the investigation carried out by SECP, it was seen that the big players had created a nexus amongst themselves to perpetuate the bull market. With rumors circulating in the market regarding a new reserve discovery from OGDCL and privatization of PTCL, the conditions were primed for manipulation.

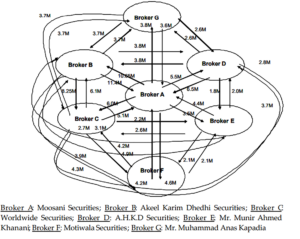

The market was already being artificially maintained at unsustainable levels and rumors like these made sure the positive sentiment never left the markets. Most of the volumes being traded in the exchange were between a few brokers who kept trading amongst themselves in order to post higher volumes. An estimate is that 0.1% of the investors in the market were responsible for 98% of the trades. This was facilitated by brokers having trading accounts with other brokers. During a day, a scrip would be cycled through the accounts of several brokers which would give a false sense that huge volumes had been traded which was synthetic rather than organic. In its report, the task force states that Worldwide Securities (Pvt) Limited traded over Rs. 115 billion worth of shares in the month of March which accounted for 6% of the total value of trade carried out for six of the leading securities being traded for the whole month.

This created a bubble in the market which was being pumped through continuous and excessive funding being carried out and the market bubble growing further. Once the funds dry up, the bubble cannot grow anymore and starts to shrink as prices fall. Someone who has bought shares on borrowed money has to earn a return where they can pay back the interest on the borrowing and make a profit. When prices fall, they end up making a loss and will have to pay interest on their borrowing leading to a further loss.

In addition to that, as demand for funds was high and supply fell, it was seen that the borrowing rates, which had been capped by KSE at around 18%, were actually around 100% in LSE. Investigation carried out after the crisis claimed that many of the financiers, who were providing funds to the market, started to remove much of this funding. Between March 7th and 15th, a total of Rs 5.7 billion or 17% of the financing was withdrawn.

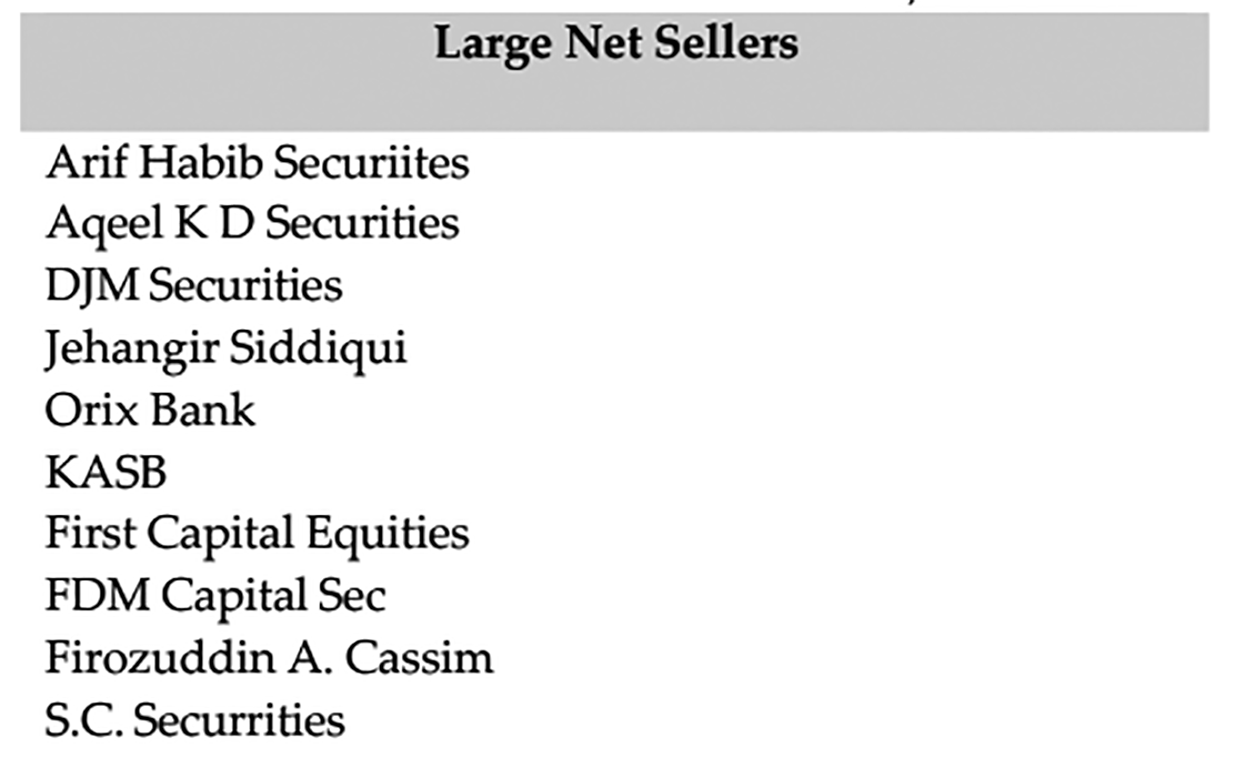

The reason for the withdrawal of funds was that many of the financiers had carried out short selling in the futures market and it was in their interest for the market to fall. They wanted the prices to fall to earn a profit and by deflating the bubble, they were able to cause the market to fall. This precipitated into a market crash as the market started to fall without any stop in sight.Such a crash means that the investors who have entered the market seeing a bull run end up making a loss.

On the other hand, the bigger players of the market end up making a gain on both occasions at the expense of small investors. When the market is going through a bull run, they are able to earn a relatively risk free return as investors borrow from them. Once the bubble bursts and the shares begin to slide, they are able to take a short position in the futures market and are able to earn a profit as prices fall.

Actions taken by KSE during the crisis

Once it was understood that the markets were going to fall substantially, KSE looked to address the situation themselves while the SECP gave legitimacy to any actions being carried out. In order to protect themselves, the KSE stepped in and all that was said was that risk management controls had to be strengthened to avoid any default. These claims were unfounded and the exposures and deposits would have countered any adverse situation. The KSE put in the controls based on their own decision making process rather than providing rationale and reasoning for these decisions. No record of meetings and telephonic conversations was provided to the SECP initially and later to the task force. There was a feeling that these records would solidify the claim that KSE was working as an alliance to earn profits while creating havoc for the investing community.

Recommendations of the task force

As brokers were making the rules for themselves as they were part of the board of KSE, the task force recommended structural reforms to be carried out which included demutualization of all the exchanges. Demutualization would result in enhanced governance and transparency at the stock exchanges and greater balance between interests of various stakeholders by clear segregation of commercial and regulatory functions and separation of trading rights and ownership rights This would have lessened the influence of the brokers who wanted a problematic status quo to persist.

In addition to this, it was suggested that proprietary trading would be regulated and brokerage houses could not trade through other brokerage houses to pump up the volumes. Trading was also regulated as brokers could not front run their clients and put them at a disadvantage. Front running is when brokers have important information and they use it before disclosing it to their clients. SECP was asked to carry out regular audits and set fines for breaches in line with the offense of the brokers. Badla financing was again seen as a huge evil and it was suggested to phase out carry over trades as they were unregulated and open to manipulation.

Role of SECP

The SECP had a distanced approach to the crisis where it gave out directives and carried out meetings with the major actors in the market but did little to nothing to make sure these directives were enforced. The monitoring and surveillance wing which had been set up failed at its first hurdle as it was not able to supervise the markets properly and allowed the crisis to happen. A robust surveillance system would have looked at the volumes being traded in the market and the constant increase in prices should have raised some alarm at the SECP.

SECP failed to take cognizance of any such irrational trading activity. In terms of the actions taken by KSE, the SECP did little to hold them accountable to the decision making process that it had used. No records backing the decision-making were asked for by the SECP and as KSE took actions as they seemed fit. The SECP did not carry out an independent review on the circumstances being presented to it. The SECP took guidance from KSE and went along with whatever justification had been concocted by the brokers and eventually the board of KSE.

SECP had also failed to regularize the research reports that were issued by the brokers essentially. An example of this was when on 11th January 2005, Al-Falah Securities claimed that they had sources inside PTCL which were telling them the revenues of the company would increase. In simple words, this was tantamount to insider information being sold in the garb of research and was against the rules.

The small investors left unprotected yet again

The regulatory body failed to meet the needs and demands of the investing community yet again because of their self-serving hamfisted approach doing their job, or lack thereof. Since the crash of 2000, the market players had developed mutual funds, proprietary trading, extensive use of badla financing and investing in the futures market. All these spheres of the market could have been checked on but SECP left a regulatory vacuum. Some foresight at the initial stages of development of these tools mirroring other developed markets around the world could have helped. SECP could have carried out case studies and researches and developed a regulatory framework. On the contrary, the SECP again went with their approach of falling in a ditch rather than spotting the ditch beforehand to learn from mistakes made by others. As brokerage houses ventured into these areas, they identified the loopholes and then took advantage of them.

While the crisis was going on, the SECP again looked to the KSE to provide the information and guidance in order to develop a direction in addressing the crisis. SECP should have taken the lead by carrying out an independent investigation while the crisis was going on in order to check whether the information being given to it was true and backed by economic reality. SECP failed to carry out any such investigation during the crisis and assigned a task force after the crisis to find the causes for the crisis. This achieves little to alleviate the fears of investors who have lost their investment and damages investor confidence in the market. SECP should also have been more stringent on the accountability aspect by asking the KSE to provide proof based on which they made their decisions and punish the culprits of the crisis.

The market freeze of 2008

The market freeze of 2008 was unique in the context of not only Pakistan’s capital market but for the capital markets around the world. It was not the crash itself which was seen to be the problem but the measures taken in order to curb the bleeding which hampered the investors’ confidence and trust in the markets. The scars of the freeze are still present in the investment community to this day. The move carried out can be encapsulated in the statement given to Dawn on 9th of January 2012 by Simon Cox of Hong Kong based Emerging Markets Stock Invest Fund, in respect to what the KSE did, that “I have gone through the record of stock exchanges and never since the oldest stock exchange in the world at Amsterdam was established in 1602, I could locate an example where a stock exchange had ever blocked the exit in violation of basic principles of free market mechanism.”

Foreign portfolio investment fell as a result of this and Pakistan was removed from the MSCI Emerging Markets Index due to the deterioration of basic equity market operations caused by the imposition of the floor and virtual shutdown of the Pakistani equity market. Later when Pakistan applied to be included in the MSCI Frontier Markets Index, MSCI stated that it needed an assurance that a measure like the market freeze carried out in 2008 would not be repeated for their proposal to be considered. The exclusion from Emerging Market index to Frontier Market index was a downgrade in itself which shows the impact that the decision had on Pakistan.

The bears are here to stay

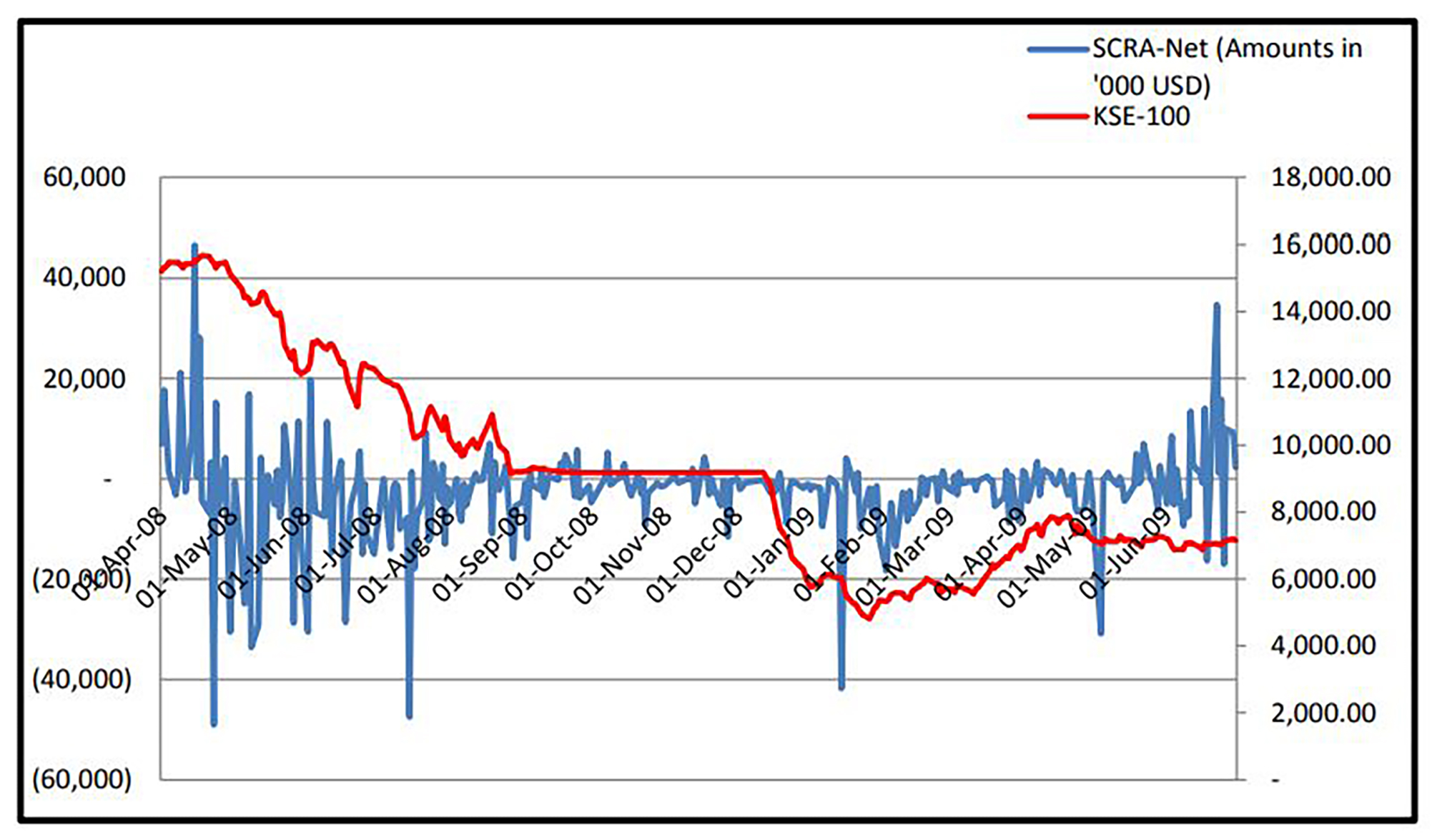

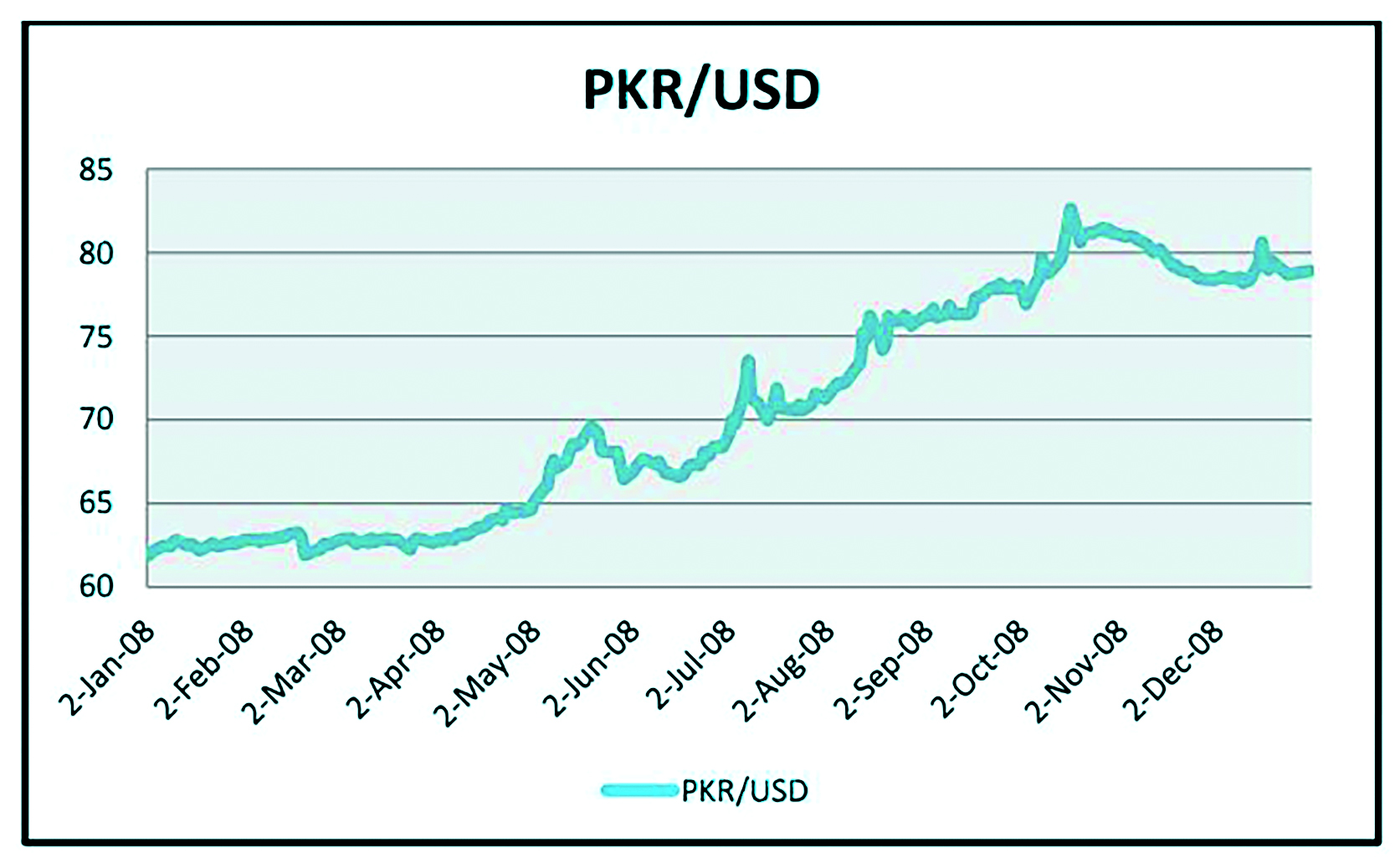

The period leading up to the stock market crash started in April of 2008 which was characterized by political and economic uncertainty. On the economic front, foreign reserves were falling, rupee was depreciating, credit agencies were downgrading the debt rating and the final nail in the coffin was the State Bank of Pakistan increasing the policy rate by 150 basis points to 15%. The depreciation in the currency was causing capital flight and foreign portfolio investment in the market kept falling, leading to a decrease in the KSE index.

The start of the slide saw the index lose 554 points in April which led to a loss of Rs. 156.21 billion in terms of the market capitalization. In addition to the economic conditions, there were fears that the government would impose a Capital Gains Tax in the market to address its revenue deficit. This saw the market slide further by 2,992 points in May leading to a further depletion of Rs. 888.57 billion in market capitalization for the month. The negative sentiment sustained at the KSE for a prolonged period of time and saw a member of KSE default on May 26th. With the SECP and KSE taking steps to strengthen the risk management systems, it was felt that adequate measures had been carried out to protect the system from the default of one member. Still, there was a feeling of unease in the market that a bigger crisis was looming.

Circuit breakers revised

Initially, the KSE carried out small fixes in order to address the situation in the market itself. As the markets kept sliding, the KSE revised the circuit breakers which were -5% to +5% and changed them to -1% and +10%. A scrip could have fallen or risen by 5% before a circuit breaker was triggered and trading in the scrip was stopped. The revision meant that a scrip could only fall by 1% but increase by 10% before trading in the scrip was halted. This was a cosmetic change carried out for a short term relief but limited the ability to trade freely. It would actually have been better to carry out some bloodletting to allow the markets to fall to the levels which could be justified economically. The circuit breakers impacted the volumes which were hovering around 240 million shares on a daily basis in 2007 and fell to around 20 million shares per day which was a 10 year low for the market. Additional measures put in place prohibited short sale and a proposal was in the works to set up a Market Stabilization Fund of Rs. 30 billion in order to cushion the fall being seen in the market.

This would have stabilized the markets and given some impetus for buying to be carried out. By putting controls on the downside in the market, it was evident that rather than make the markets efficient, the KSE and SECP were looking to move the market in a single direction which goes against its role as a regulator.

The crisis takes shape

The impending crisis which was foreseen in May was finally realized when August saw the index fall by 1,376 and broke the psychological barrier of 10,000 touching 9,853 points on August 4th. As explained earlier, when a bubble is building, investors are expecting that the share prices will keep increasing. As they are confident of prices increasing, they start to buy more shares and use these shares as collateral against the borrowing. Once the bubble bursts, the share prices crash. This means that the investors who had borrowed need to put up more collateral as their previous collateral has lost value. When prices keep falling, there is a risk that borrowers’ collateral will run out and the borrowers will start to default.

The board of KSE was now getting prepared for a full blown crisis and held a meeting on 5th August. They had to decide whether to close the market, delay the opening or freeze the market totally. As the situation was becoming critical, the Board of KSE took the lead and decided in a meeting held with the members on 27th August to place a floor in the market. This was backed by 100 of the 103 members who attended this meeting. The market floor meant that shares could be traded within a narrow band and could not be traded at a price lower than the floor price set at the prices seen on 27th August. The wisdom and rationale of this decision was later clarified and justified at different forums. It was argued that such a drastic measure was taken to galvanize the government to step in and correct the situation prevalent in the market. It failed to do so. The measure was not meant to last more than a few weeks but as the measure failed pathetically, the market saw a freeze for four months.

KSE takes the lead

The decision that was taken by the KSE was approved by majority and later the Board ratified this decision. It is important to note here that all five broker directors of the Board wanted to impose the floor while the three non-member directors opposed it. One of the SECP’s nominated director’s position was vacant while another one was on leave. If these non-directors had voted with the other SECP appointed brokers, the tie would have been broken by the Chairman of the Board who was against this imposition.

This might never have led to the imposition of the floor taking place. Imposition of a floor meant that local and foreign investors could not easily sell their positions. This not only impacts the current investors but also creates doubt in the mind of prospective investors who fear that such a drastic measure could be carried out again. Before this, there was no other example in the 400 year history of the world where a market was frozen. Even today, the damage is being felt where investors fear that an ad hoc decision like the one which was carried out then could be done again.

The Board of KSE informed SECP regarding the decision made by itself and stated that they would be placing a floor in the market. When the other exchanges were provided this information, LSE responded by opposing such a measure as it would have long term repercussions on investor confidence. Mr. Nadeem Ejaz, who was the Director at Lahore Stock Exchange, remembers his role during that time where he was given an option by SECP to do what they saw fit for their exchange while the SECP was going to ratify the decision made by the KSE. “When we implored the SECP to consider the ramifications of the decision, we were told to only consider the interest of LSE rather than dictate the SECP on how to take care of the situation” he said.

Considering that such a decision was going to be taken by the KSE, the other exchanges also looked to put the same action in place rather than create a distortion in the market and to maintain the uniformity. The investigation carried out afterwards states that the decision was made in haste, the approval of the other markets was not meaningful as they were strong armed into such a decision. The minutes of a KSE Board meeting held on October 25th mirror this sentiment as one of the board members stated that “if the floor had never been imposed, a limited number of members’ default would have occurred. However, with the passage of time the financial position of a large number of brokers has gotten worse and they are on the verge of default leading to a collapse of the entire system.” The floor was finally removed on 15th December 2008 when the KSE received the directive from SECP. The period after the removal saw a drastic fall in prices as the market fell from 9,187 on December 15th to 5,751 at the closing of January 1st 2009.

Impact of the imposition of the floor

The damage that was felt by the foreign investors was that they had little trust in the market, there was distortion in terms of price discovery and they faced restriction in entering and exiting the market. They also had to look for alternate sources of liquidity as they could not sell their holdings and had to face illiquidity in terms of being able to sell their positions.

These investors had to rely on off market transactions where many of the foreign investors ended up selling their positions at huge losses and discounts. There was a distress sale of MCB at 55% and PSO at 60% carried out by two foreign hedge funds which was carried out through the off market. This meant that they sold their shares at prices 45% and 40% less than the prevailing price respectively, in order to sell their shares and leave the market. As large foreign investors were able to liquidate their position, this also created anxiety in the mind of investors who were too small to sell their positions and saw such a deep discount being applied to some of their own holdings.

As the market was frozen, many of the brokerage houses also started to use their client’s holding and assets to fulfill their own settlement and margin financing obligations. This was a breach of the trust the clients had placed with the broker as the broker was using the assets of the clients without their knowledge or approval. The total implications and impact of the crisis are still ongoing as many brokers defaulted since the market freeze of 2008. They were left vulnerable due to the market freeze being put into place and in the period since the freeze, many of them have defaulted their clients and fled from the market as a result.

The emotional and psychological wounds of the freeze are still felt to this day.

eventually PSX is controlled by big fishes which leaves the market with lack of confidence and trust amongst new entrants and small investors

Best article written nice sharing