LNGFlex and China National Chemical Engineering (CNCE) have forged a partnership to establish regasified liquefied natural gas (RLNG) and virtual liquefied natural gas (VLNG) at various offshore locations near Karachi, Pakistan. The two terminals are designed to deliver a peak capacity of 750 mmscfd. The terminals will also circumvent the Public Procurement Regulatory Authority to allow all parties allowed to privately import LNG and distribute it to customers in Pakistan.

As part of this agreement, a master engineering procurement construction and finance (EPCF) contract will oversee the design, construction, and financing of both terminals. The cost of these ambitious projects is expected to surpass a whopping $500 million. However, an official estimate beyond this half a billion mark remains undisclosed, as the final quote hinges on the cost at the time of construction.

“We are honoured to join forces with LNGFlex in this endeavour, aiming to mutually enhance and diversify Pakistan’s liquefied natural gas supply capacity,” says Armand Long, General Manager (Pakistan Branch) at CNCE.

CNCEC is committed to supporting LNGFlex in implementing its LNG project in Pakistan, encompassing aspects such as funding, technology, and social resources. Over the span of nearly two years, we have engaged in close cooperation and communication with LNGFlex, establishing a solid foundation for collaboration. Currently, two technical teams are collaboratively working on devising a comprehensive implementation plan for the project,” Long adds.

Likewise, “We are thrilled to reach this historic milestone of getting a step closer in our journey to provide energy to Pakistani customers efficiently and reliably. Both projects are technological breakthroughs and will benefit the consumer in Pakistan at no risk and cost to the public and the government,” explains Shahid Karim, CEO of LNGFlex. .

Now then, who are these entities, what are these terms, and more importantly what does all of this entail?

Vernacular at hand

RLNG is the conventional way of importing LNG. It involves receiving LNG at terminals, where it is re-gasified and transported through pipelines to end-users. VLNG, on the other hand, is an innovative way of importing LNG. It involves storing LNG in cryogenic tanks or containers, which keep it in a liquid state at -162 °C and reduce its volume by 600 times compared to its gaseous state. These tanks or containers can then be transported by road, rail or sea to remote or off-grid areas, where they can be re-gasified on-site or used directly as fuel.

The RLNG project entails setting up a long-distance natural gas pipeline supply chain, incorporating LNG receiving terminals, gasification units, long-distance pipelines and supporting infrastructure in the Port Qasim area of Karachi. The VLNG project involves establishing a “virtual pipeline supply chain”, featuring an LNG receiving terminal, onshore LNG storage tank area, filling facilities and associated infrastructure in the Karachi Port area.

It is over here that we mention that there is a party involved in all this — Tabeer Energy. LNGFlex, and Tabeer Energy are the two subsidiaries of UAE based Bison Energy. Bison Energy is a company that primarily develops solar farms, with 73 operational in Japan and Australia and more under development in Taiwan, Romania and Italy. This is their first venture in LNG, which is likely why they have partnered with CNCE.

“China is blessed with the world’s largest and most extensive gas infrastructure, of which CNCE constructed virtually 60% of that, including a dozen or so LNG terminals,” explains Karim. Tabeer Energy was given a licence to construct a merchant terminal in 2021 and will be responsible for the RLNG side of the business. LNGFlex will handle the VLNG side of the business and will use its own delivery mechanism for now.

The question then is if this will work?

Odds of success

Yes — if everything goes according to plan.

Pakistan, once self-reliant in natural gas due to abundant domestic reserves and low production costs, is projected to become more reliant on imports as local supplies dwindle. The Oil & Gas Regulatory Authority estimates that Pakistan currently faces a gas shortfall of about 38-40 billion cubic metres (bcm), which could soar to as high as 70 bcm within the next decade if infrastructure development lags behind.

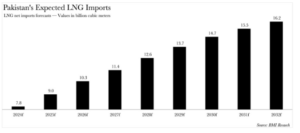

Pakistan began importing LNG for the first time in 2015, following the inauguration of its first LNG import terminal, Engro LNG in March 2015. According to forecasts, Pakistan’s LNG imports are set to see a near 60% increase over the next decade. So the opportunity is there. However, that’s not to say there aren’t challenges the projects are set to encounter.

“The prospective challenges will be in acquiring on-grid and off-grid industrial, household, and heavy transport sector customers, followed by third-party access in the pipelines owned by Sui Southern Gas (SSGC)/Sui Northern Gas Pipelines (SNGPL), and investment in the supply chain infrastructure for both projects,” explicates Sheikh Imranul Haque, former Managing Director and CEO at PSO and former CEO Engro Vopak.

The Bison subsidiaries have already been allocated 300 mmscfd apiece by both the Sui Companies at the time of writing. “They (the Sui Companies) don’t have to keep the network empty. There is a lot of idle capacity currently, and if they can make money from a wheeling charge, then why wouldn’t they want to avail the opportunity,” exclaims Karim.

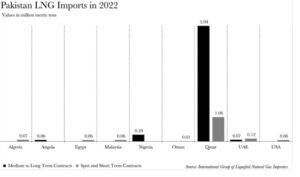

In terms of Haque’s concerns regarding finding customers, those are warranted. Pakistan currently has access to LNG at approximately $11-$12 per mmbtu through its long-term contracts, which include agreements with Qatar Energy, Qatargas II T1, and a recent agreement with Azerbaijan. Nonetheless, Pakistan has not shied away from the spot market.

According to data provided by the International Group of Liquefied Natural Gas Importers, Pakistan has obtained LNG cargoes from the spot market from Egypt, Malaysia, Oman, Qatar, the UAE, and the USA. More recently, Pakistan has bought spot cargoes from Trafigura and Vitol for December, and from OQ for January.

The consortium is betting on the aforementioned domestic gas crisis to be the tipping point. “The issue was always affordability. However, with the revised tariff regime, effective from the first of November, the playing field is levelled,” asserts Karim. “The domestic top tier consumer is paying a hefty $14-$15 per mmbtu for gas, while the cement companies are hardly paying any less. Moreover, they are not even getting the gas they pay for, due to the chronic shortages,” Karim elaborates.

Haque’s apprehensions about the investment outlay are justified. The consortium will not only have to deploy the initial capital to kick-start the project, but they will also have to deliver 7-8 LNG cargoes per month at competitive prices to recoup their investment. The payment mechanism for the consortium will undoubtedly be a litmus test, given Pakistan’s perennial foreign exchange crunch. It is unclear whether the payment for the cargoes procured will be settled abroad or not. However, they have until 2026 to figure this out.

As for the sovereign risk, the consortium’s main concern will not be their own account, but rather the Government of Pakistan. “From a policy perspective, the Ministry of Energy needs to urgently address the pressing issue of gas shortage, otherwise both projects will remain on the drawing board for another five years,” warns Haque.