Few entities in Pakistan’s corporate circles have mastered the art of arbitrage as well as our commercial banks. They are so good at it that, despite the economic turmoil, the sector as whole has managed to achieve record profitability. Most of it can obviously be attributed to the healthy interest margins enjoyed by commercial banks, thanks to a prolonged high policy interest rate set by the central bank.

Furthermore, the government’s reliance on deficit financing has presented banks with an opportunity to boost their profitability without having to take much risk. The investment-to-deposit ratio of the sector, a measure that shows the extent of investments that banks made in government bonds, exceeded 90% in November 2023.

Despite these advantageous conditions, financial institutions have consistently sought out additional opportunities to make a quick buck. One standout example is the currency market, where banks have faced accusations of engaging in speculation. However, they had managed to avoid any repercussions for these activities— until recently.

On November 15 2023, the caretaker government approved the imposition of a 40% windfall tax on the banking sector’s foreign exchange income, through Section 99D of the income tax ordinance. A week later, the Federal Board of Revenue, (FBR) issued a Statutory Regulatory Order (SRO), which outlined the formula for calculating the windfall gains accumulated by banks between tax years 2021 and 2023. If implemented, this one-time tax could generate a revenue of more than Rs 40 billion for the cash-strapped federal government.

As anticipated, the banking sector contested these measures and appealed against the order. Asad Ladha, partner at Raja Mohammad Akram and Company, told Profit that various banks approached different high courts, according to where they file their tax returns. For instance, Askari Bank approached the Islamabad High Court (IHC), while Habib Bank Limited approached the Sindh High Court (SHC) on November 28. Similarly, Soneri Bank and Allied Bank approached the Lahore High Court (LHC) on November 29 and 30 respectively.

Consequently, the higher courts granted a stay to halt the implementation of the tax. The first stay order came on November 29 in the writ petition filed by Askari Bank by IHC. LHC followed course by granting a stay to two other banks.

Speculative spectacles

The federal cabinet’s endorsement of the windfall tax was a response to intense criticism of banks, which reportedly made substantial profits of Rs110 billion in 2021 and 2022 through allegedly speculative rupee-dollar trading.

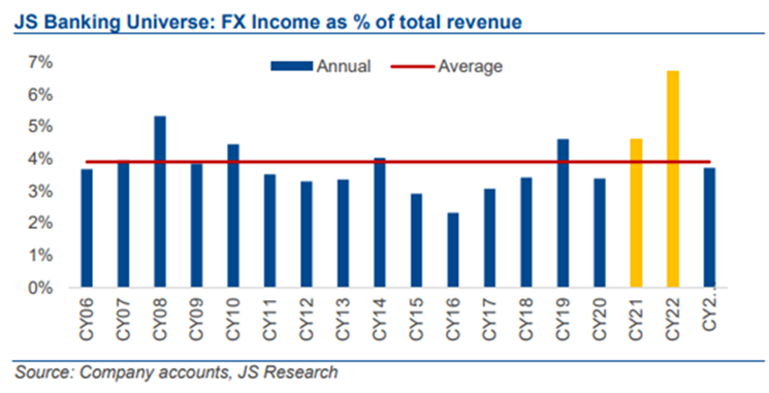

According to a JS Global Capital report titled ‘Banks – The first sector to be hit by Section 99D’, “almost 4% of the sector’s total revenue, encompassing both net interest income and non-interest income, stemmed from earnings derived from foreign exchange dealings on an annual basis. However, in 2022, the scale of this income notably surged due to heightened fluctuations in forex rates, resulting in its contribution spiking to 7%.”

Note: The calculations are limited to major banks covered by the brokerage house

Profit has previously covered the modus operandi of the banks to carry out these speculative trades. Simply put, banks in Pakistan make money in the foreign exchange market through LCs, but they face restrictions on spreads buying and selling rates set by the State Bank of Pakistan (SBP). Allegedly, banks have tried to circumvent SBP regulations. According to the Foreign Exchange (FE) Manual issued by the SBP, banks are prohibited from charging a margin that exceeds the limit specified by the SBP. However, some banks have exceeded this limit, with margins reaching well above the allowed threshold.

What led to this increase? A banking industry insider revealed to Profit that banks raised the rates for forward LCs due to prevailing market sentiment. For instance, when individuals sought a forward LC for imports, the bank would quote a higher rate than the current forex rate. For instance, if the forex rate stood at Rs 295 on that day, the bank might propose Rs 305 for the forward LC. This strategy was driven by significant fluctuations in the forex market. Hence, customers agreed to these rates, thereby enabling banks to widen their profit margins.

This, however, hasn’t gone unnoticed. Successive finance ministers have accused banks of manipulating exchange rates. In November 2021, the advisor to then PM Imran Khan, Shaukat Tarin lashed out at banks for manipulating exchange rates.

Similarly, Tarin’s successor, Miftah Ismail, who served as finance minister from April 2022 till September 2022, said in a podcast that eight commercial banks made a profit through speculation – while assuring the SBP that they were making a loss.

“The National Bank of Pakistan (NBP) sold dollars to Pakistan State Oil (PSO) at the rate of Rs 242 the day when the market closed at Rs 230,” he said while explaining the role of the banks in currency speculation.

A source from NBP, on condition of anonymity, told Profit that the state-owned bank used to charge PSO “an arm and a leg”. This source revealed that they used to charge LIBOR + 5% even though the norm was charging LIBOR plus 1.7%.

Ismail was replaced with Dar in October last year, who pledged to take action against banks accusing them of manipulating exchange rates and making substantial profits. However, no visible action was taken against any bank during his tenure.

The only information that surfaced was a briefing to the Senate’s Standing Committee on Finance, where the SBP governor disclosed that eight banks had received notices for their alleged involvement in manipulating exchange rates. However, no further details or outcomes were made public following the issuance of these notices.

Yet Dar managed to insert Section 99D in the budget for fiscal year 2024, which would subsequently be leveraged by the caretaker government to penalise the banks.

The first casualty of Section 99D

Section 99D of the Income Tax Ordinance empowers the federal government to impose an additional tax on a company operating in a specified sector on windfall income, profit or gains arising due to economic factors for any of the last three years preceding the tax year 2023 and onwards, i.e, the tax years 2021, 2022 and 2023. The tax rate, however, can not exceed 50%.

The caretaker government assumed office in mid-august 2023 and was faced with a daunting task of upholding the agreed-upon targets under the International Monetary Fund’s (IMF) Stand-by Agreement (SBA) signed in June.

One of the main concerns of the fund revolved around the massive fiscal deficit recorded by the federal government. A large chunk of it is attributable to interest servicing costs which have soared in the past two years. However, the government had limited options on that front, so it opted to maximise revenue.

Hence, on November 15, in a federal cabinet meeting, the Caretaker Prime Minister Anwar ul Haq Kakar accorded approval on the recommendation of FBR to impose a 40% tax on windfall profit earned by banks on the foreign exchange transactions during the years 2021 and 2022.

Following this approval, FBR released a notification SRO1588 of 2023 (SRO) on November 21 notifying a 40% additional tax on windfall profits of banks arising from foreign currency deals throughout 2021 and 2022, corresponding to tax year 2022 and 2023 respectively.

The due date for the windfall tax payment was November 30. However, taxpayers had the option to request an extension of up to 15 days. The SRO outlined a formula to determine the windfall income, profit and gains of banks. It stipulated that the payment of the additional tax should be made to the federal treasury via a prescribed challan or a computerised payment receipt.

(Banks maintain their financial records from January to December, adhering to the calendar year. However, tax regulations operate on a fiscal year basis, spanning from July to June of the following year. This means that even though banks close their books in December, they file taxes for that year in the subsequent June. For instance, profits from the calendar year 2021 are taxable in the fiscal year 2022, with banks closing their accounts in December 2021 but paying taxes for that period in June 2022)

The retrospective perspective

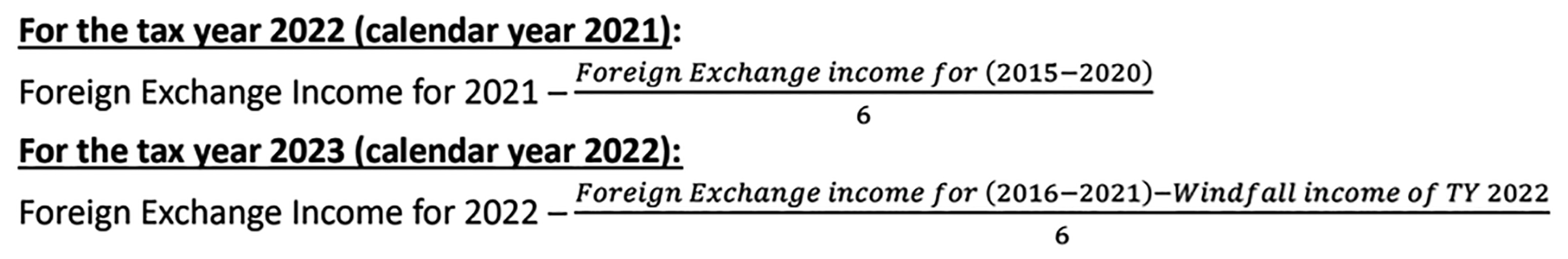

For the tax year 2022, banks’ “windfall income” is calculated as the difference between how much money the bank made from foreign exchange in 2021 and the average amount the bank made in the six years before that (2015-2020).

Now, for the tax year 2023, the calculation is slightly different. The windfall income of the tax year 2022 has been reduced from the sum of foreign exchange incomes of the preceding six years to calculate the average of the preceding six tax years (2016-2021). This figure is then deducted from the foreign exchange income for the calendar year 2022.

It also stated that if there is a negative windfall income in tax year 2022, it will be considered as zero when calculating the windfall income for tax year 2023. Additionally, if there’s an exchange loss in any year, that year won’t be counted when calculating the average exchange gain, reducing the total number of years considered. For example, if there was a loss in tax year 2017, it wouldn’t be factored in, making the denominator 5 instead of 6 for the calculation.

The tax’s impact

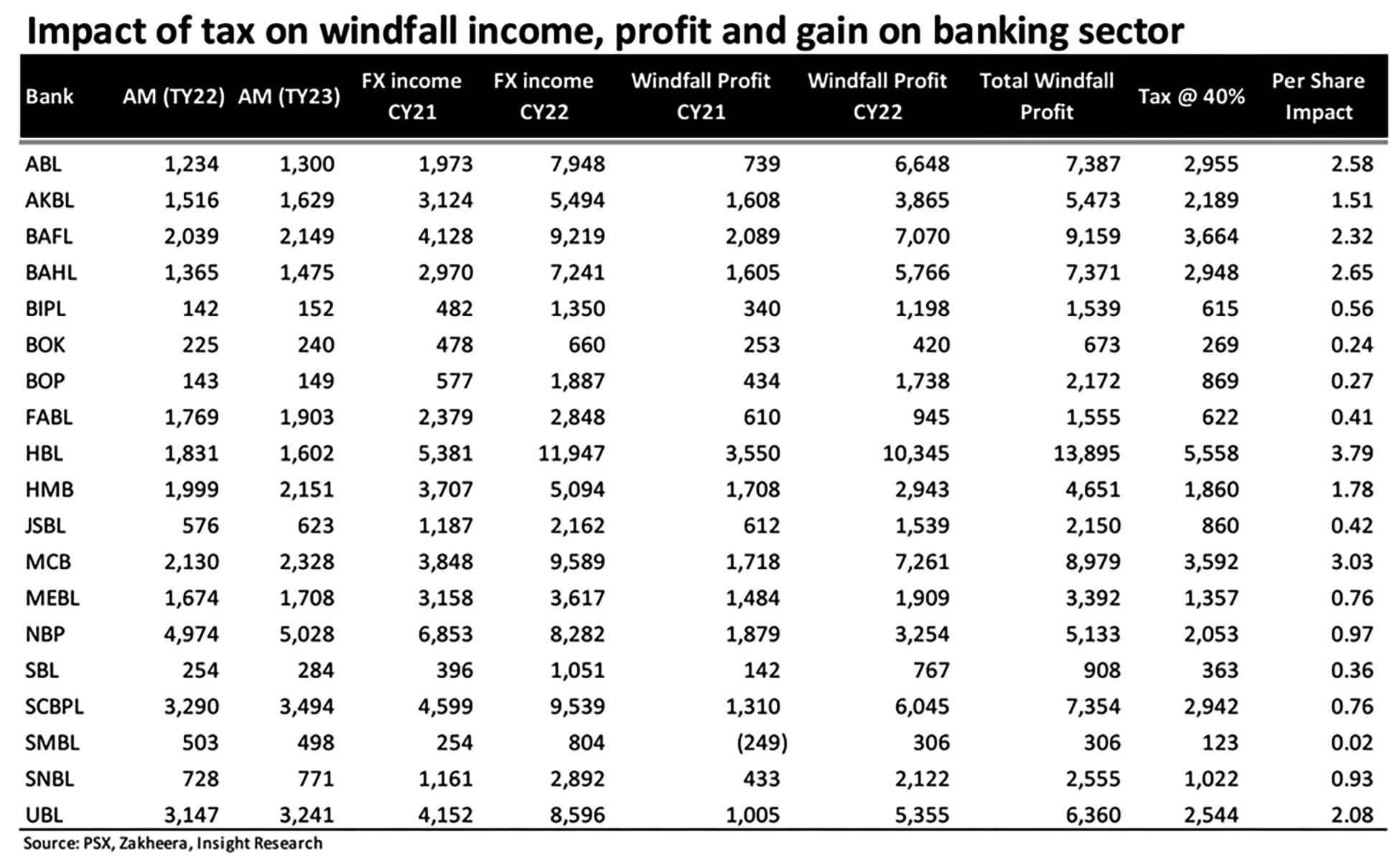

As mentioned earlier, this one-time tax could generate a revenue of more than Rs 40 billion for the cash-strapped federal government.

For the banks, this additional tax could adversely affect their earnings per share. According to the JS Global Report, the additional 40% tax on retrospective foreign exchange income would adversely affect earnings per share by 9% on average, which, if transpired, may raise some concerns about some banks’ payout capacity for the last quarter of the calendar year 2023, assuming they do not utilise available CAR buffers for the same.

The banks retaliate

While the notification was dated November 21, Dr Ikram ul Haq, partner at Huzaima Ikram and Ijaz, informed Profit that it was updated on the FBR’s website on the evening of November 22. This left banks with only a brief period of six to seven days to comply with the additional tax requirement.

The reaction of banks to the FBR’s notification was swift. Understandably, banks raised objections. As mentioned earlier, several banks contested the tax in various high courts across Pakistan. While most banks challenged the new taxation, a few might have opted to pay the additional tax. Haq noted that government-owned institutions such as the National Bank of Pakistan and Bank of Punjab might comply with the tax, while private banks are more inclined to legally challenge it.

Ground taken

Profit consulted two lawyers, Haq (petitioner on behalf of Soneri Bank and Bank Al Habib), and Ladha (petitioner on behalf of Askari Bank and Allied Bank). (Haq told Profit that Farogh Naseem will be filing a petition on behalf of five banks in SHC).

Firstly, the objection was raised regarding the caretaker cabinet’s approval of the tax, which operates under different constitutional definitions than the federal government. “Federal government is defined in article 90 of the constitution whereas caretaker government is defined in article 232 of the constitution,” said Haq. He added that the basic principle of tax can be derived from article 77 of the constitution which says ‘no taxation without unless by the act of Parliament’. “We call it ‘no taxation without representation’ in simple words”, added Haq. He mentioned that the caretaker government can only attend to day-to-day affairs and cannot extend its authority to a fresh taxation measure.

Secondly, and more importantly, the notification lacked specifics of ‘economic factors’ that led to windfall gains for the banks. “Section 99D says that the notification will specify the economic factor based on which the windfall income has arisen. Whereas the SRO 1588 does not mention economic factors,” highlighted Ladha. Haq reiterated that by not specifying economic factors, they (the federal government and FBR) have not fulfilled the conditions set forth for levying windfall income tax.

Thirdly, according to Section 99D (3), the notification imposing an extra tax on windfall income must be presented to the National Assembly within 90 days. This assumes the existence of a National Assembly. The deadline for submitting the notification to the National Assembly is February 19, 2024. With the general elections scheduled to take place in the coming months, the formation of the National Assembly is unlikely to occur before the February 19 deadline. This raises questions about the validity of the FBR’s notification and the enforceability of the windfall tax.

Fourthly, Section 99D lacks clarity regarding the consequences if the National Assembly rejects the government’s calculation of windfall income or its chosen tax rate. This ambiguity ultimately leans in favour of the taxpayer.

Finally, if the National Assembly disagrees and doesn’t approve the notification issued under Section 99D, the additional tax becomes invalid. If the tax had been collected earlier, the banks would face a loss for the interim period, during which the federal government is unlikely to pay any interest on the amount that they have taken as tax. This scenario, according to the banks, is considered an irreparable loss due to the temporary loss of the taxpayer’s funds without compensation.

(In 2022, the Government introduced the concept of a super tax on high-earning individuals through the Finance Act. Slab-wise rates were prescribed for the 2022 tax year, with a maximum rate of 4%.)

The banks challenged the SRO based on these reasons. On November 29, the IHC gave interim relief in the form of stay order and suspended the SRO in the hearing of the petition filed by Askari Bank against the SRO.

Justice Sardar Ejaz Ishaq Khan of the IHC issued notices to the revenue division secretary and others for the upcoming hearing on December 8. During Askari Bank’s hearing against the SRO proceeding, the FBR’s lawyer argued that the legislation would remain in effect until declared otherwise. However, the judge acknowledged the petitioner’s argument that interim relief was sought specifically concerning the SRO—an executive act, not legislation.

Consequently, Justice Khan ordered, “The foregoing submissions, therefore, demonstrate not only a prima facie case but also that the ingredients of the balance of convenience and irreparable loss operate in favour of the petitioner. Resultantly, the operation of the impugned SRO shall remain suspended till the next date of hearing.”

This stay order was followed by the LHC, which also suspended this notification on December 30 for two banks until it gains approval from the National Assembly (given other legal grounds supporting the government thereafter). SHC, too, followed suit in granting a stay against the SRO to the aggrieved banks on December 1.

Equitable taxation?

- Amayed Ashfaq Tola, an advocate of High Court and the president of Tola Associates, which provides tax and corporate advisory, explained to Profit that the normal tax rate for banking companies is 39% for the tax year 2023 (35% for 2022), whereas banks are subjected to 10% super tax year for the tax year 2023 and 4% for the tax year 2022.

This means the bank will be subjected to 89% tax in case of its forex income in tax year 2023 (79% for tax year 2022). This 89% still does not include the effect of administration expenses (which may be 20-25% of the income) incurred by the banks, which if accounted for, may make it a ‘confiscatory taxation’ and may also lead to litigation by the aggrieved parties (banks).

“In the calculation for windfall income, only one factor (i.e. currency fluctuation) has been incorporated, while other factors (such as economic growth and inflation) which may impact the overall income of the banks have not been incorporated,” added Tola. He also highlighted that retrospective application of section 99D may unlawfully vitiate past and closed transactions.

Ladha referenced the precedent set by the Islamabad High Court’s decision on Super Tax in Writ Petition No 4027 of 2022 for Fauji Fertilizer Company Limited vs. The Federation of Pakistan and others. He stressed that charging retrospective taxes is not permissible since the companies have already paid taxes for those corresponding years and made investments with the remaining funds. According to him, reopening previous books is not an option.

The decision of the respective High Court read, “4C, as read down, will have prospective application only, and will not apply to any transactions or events past and closed on or before 30th June 2022.”

Read: Amendments to Super Tax in Finance Act 2023 challenged in IHC

In an article for Business Recorder, Tola wrote, “Currently, Banks will be affected by this tax as they may have reported windfall profits on account of currency fluctuation. However, the currency exchange companies have been left out for now, even though they may have made windfall profits on account of currency fluctuation as well.”

“It is also likely that this windfall tax will discourage corporatisation if extended to other sectors of the economy, since it is only applicable to companies. In a business environment that already suffers from a lack of documentation, this windfall tax may not make things any better”, Tola added.

Between rock and a hard place

While the axe has fallen on the banking sector, other sectors are likely to be next as the government is left with few alternatives due to years of fiscal mismanagement.

At a forum held on November 27, Shahid Hafeez Kardar, ex-governor of SBP and the ex-provincial financial minister said, “There is nothing wrong with borrowing as long as you are creating assets to generate returns through economic and commercial activity. In our case, the problem has been that we have been funding wasteful and unproductive expenditure. The reality today is that the servicing of external debt, and in my opinion also the domestic debt, looks increasingly unsustainable”.

The government debt has crossed the Rs 60 trillion mark and two-thirds of it pertains to domestic lending. Additionally, in the last few years, the government doubled down on borrowing by offering short-term securities in the domestic market. This has negatively impacted the maturity profile and resulted in exposure to high debt servicing costs.

During July-October of fiscal year 2024, interest payments rose to Rs 2.3 trillion, equal to nearly one-third of the annual allocations. This has been the single largest drag on the national exchequer in the past few months.

On the flip side, banks made whopping profits primarily by lending to the government. According to an Arif Habib report ‘Commercial Banks Bumper profits YTD, more in the offing’ published on November 7, there has been a 97% year-on-year increase in profitability between January and September 2023. This milestone resulted in an unparalleled peak in dividend distributions and overall profitability within the banking sector for this timeframe. “Additionally, the upswing in the banking sector’s profitability was primarily fueled by a substantial increase in net interest income, which posted an impressive 67% year-on-year surge during nine months,” read the report.

This was enough of a prompt for the government to take its share from the extraordinary returns generated from primarily a rent-seeking sector. Kardar, in his address, highlighted that as domestic debt restructuring is pretty much off the table, the government is likely to carry on with taxing the banking sector to mitigate the fiscal impact of high debt servicing costs.

While speaking to Profit, S.H. Irtiza Kazmi, an ex-banker, opined that banks have made money through government securities so they should also pay taxes. Perhaps this is precisely what the government had in mind.

However, Ladha told Profit that FBR, for the time being, cannot recover additional tax from banks due to multiple stay orders. Moreover, as mandated by Section 99D, the SRO requires approval from the National Assembly by February 19, 2024.

However, the government, in its efforts to find quick fixes, is likely to explore additional options for taxing the formal sector, as there has been a lack of action for expanding the tax base for decades.

Excellent article. The writing style which you have used in this article is very good and it made the article of better quality.