We don’t know if the air conditioning was working at the State Bank of Pakistan (SBP) in late September, but the bank treasurers that were filtering in and out of the central bank’s offices during this time all came out sweating.

Eight major banks went through a dimly-lit interrogation at the hands of the SBP after being issued show-cause notices for allegedly manipulating the foreign exchange markets. As the treasury homeboys shuffled into the SBP to offer their explanations to the regulator they were given a dressing down that all but sent them to bed without dessert.

“About eight banks have been summoned so far,” whispers an informed source at the SBP on condition of anonymity. “Treasurers and their teams were getting earfuls from the Supervision Group Directors,” he adds softly. This chewing out allegedly went on for 45 long and very painful minutes. The SBP, it turns out, was being taken for a ride. It is these just these banks, he illustrates holding up eight fingers, that have been called in. “Banks had charged excessive premiums where the spread had become significantly higher than normal.” Their names, however, remain a mystery for now.

The first inklings that there was something afoot came when the now erstwhile finance minister, Miftah Ismail, announced that the SBP had issued a show-cause notice to banks over currency-speculation allegations. The SBP was looking to investigate banks that had opened letters of credit (LCs) at higher rates than the spot rate. The banks have autonomy over how and when they issue their LCs, but since the SBP regulates these banks they get to determine the rate of exchange at which these LCs work.

“While banks are not required to run losses, they are regulated by the SBP and have to follow banking regulations. If you’re manipulating the market, action should be taken – even PM Sharif has asked for strong action,” Ismail told Profit. This comes at a time when the rupee has shed nearly 60% of its value in absolute terms in the calendar year to date.

What do the rules say?

It is a question of dollars. When two trading partners engage in a deal and there is a lack of trust between the two parties, they ask banks to act as the middleman. In short, the bank issues a letter of credit to the person selling their goods, saying that they will bear the risk if the person buying defaults on the payment. This normally happens in particular on the trade of natural resources such as oil and LNG. Banks make money off of these transactions, but they are also bound by what is known as a spot rate — which is the price quoted for the immediate settlement of a commodity or for the rate of exchange.

To put it even more simply, banks rely on LCs to make money on the foreign exchange market. However, they are restricted by the spot market and exchange rates which are set by the SBP. That is where they have allegedly been trying to run circles around the SBP.

As per chapter 2 of the FE Manual issued by the SBP, banks are barred from charging more than a defined margin set by the SBP. In point number 11 of chapter 2, the SBP states the Authorised Rates of Foreign Exchange. If you explore the manual further or have industry experts comment on it, they will tell you that Section 4(2) of the Act states that unless otherwise directed by the SBP, authorised dealers, authorised money changers and exchange companies are free to determine exchange rates for the conversion of Pakistani currency into any foreign currency or vice versa.

The SBP has granted general permission to authorised dealers which enables them to determine their own rates of exchange, both for ready and forward transactions for the public. This, however, is subject to the condition that the margin between the buying and selling rates should not exceed 50 paisas per US dollar or its equivalent in other currencies.

Now here’s the sticky wicket. Market sources anonymously reveal that the spread between the margin exceeded 50 paisas and had in some cases jumped well above Rs2. In fact, it had even gone up to Rs5. This news has spread both far and wide.

An SBP spokesperson says that the permission granted to authorised dealers to set their own rates of exchange do not apply to inter-bank transactions. “The show cause notice that the SBP has taken is primarily over the previous drastic slump in the PKR. Businesses had also come out complaining against the spread banks charged while retiring LCs. Following this, the SBP went on to investigate. They have sent a show cause notice to eight banks. I do not know the name of those banks nor did I ask,” adds Ismail.

When questioned about the banks’ actions, he was non-committal; “It is premature to say that the banks were right or wrong, an investigation is being done by the SBP. Banks are stating their stance.”

On the defensive

Banks were obviously defensive. Sources refusing to be named state that the dollar liquidity was extremely low at the time and the reason was that they were buying dollars at expensive rates in the interbank to deal with import transactions. In order to offset their losses, the banks engaged in such acts. A treasurer at a leading bank, also requesting anonymity, added, “At the end of the day, my job is on the line if I don’t make the bank money.”

Another source candidly admitted that banks felt they would be able to get away with it, considering the rarity of the situation and the circumstances they were in. But “Anything that goes against the market trend is investigated,” said a source in the SBP, so how could they have ever thought they could swing it is the 64-million-dollar question.

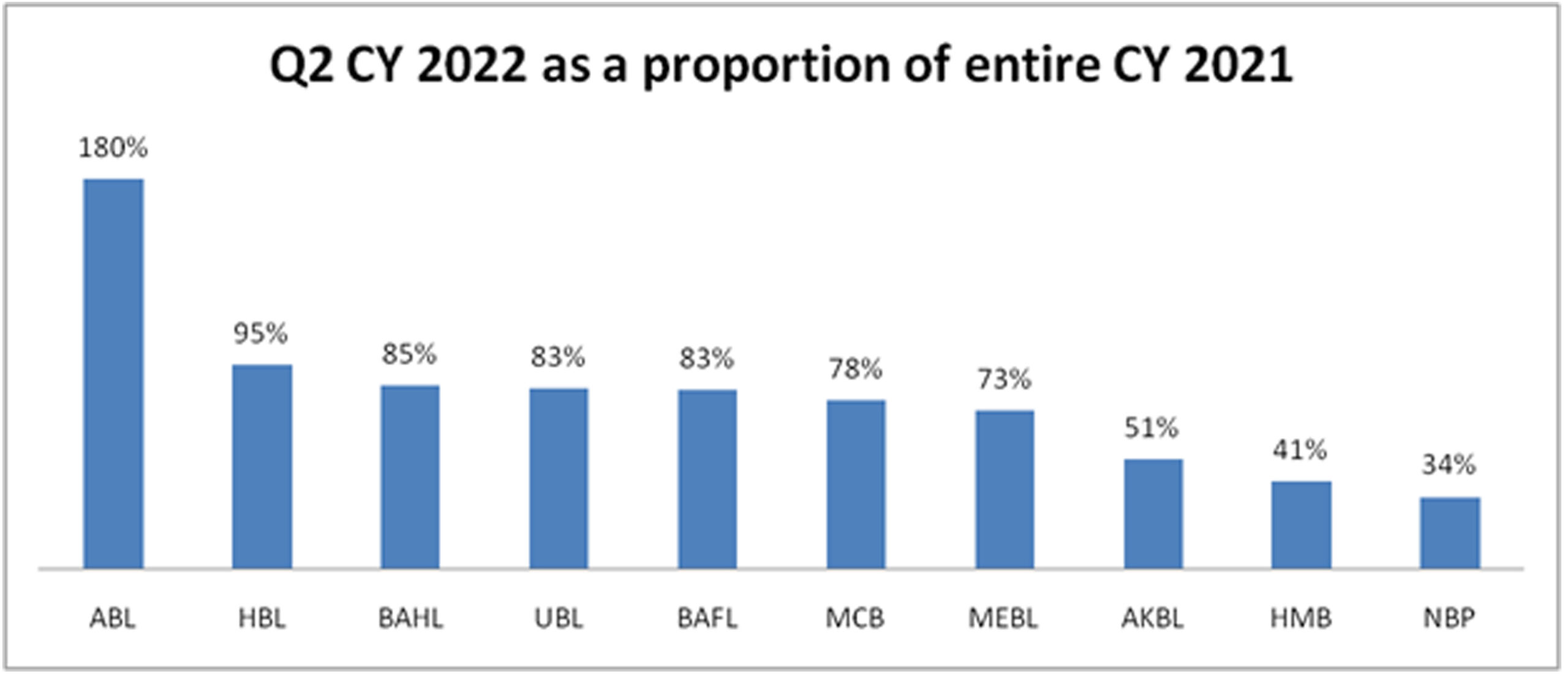

To put this in perspective, we will compare the FX earnings banks accumulated in the calendar year 2021 vs just the second quarter of CY2022. In the span of three months, HBL was able to make 95% of the total it made in CY2021. Allied Bank was able to make 180%, meaning it not only made the same amount it did in 2021 but also almost doubled it within the span of a quarter. While not all FX income is made from these premiums, the fact that premiums did shoot up, the rupee shed value, and the banks have increased their FX earnings does raise lots of eyebrows.

An industry expert has an interesting take on what has happened. “It felt as if the banks had colluded together. In normal circumstances, they compete with each other over providing the best rates possible to clients. However, following instructions to incur losses, it looks like banks went rogue, just in a different way.”

Why did the banks think they could do this?

“The profits from these acts are greater than the fines imposed. At the end of the day, banks think about what maximises their earnings,” says a source at the SBP. This could explain why banks would take such a risk.

There is more to it, of course. The first rule of business is to never show all your cards, especially not early in the game. The government and the SBP seemed quick to do so. In December 2021, the term Koonda went viral after Shaukat Tarin threatened banks regarding their bids in the market treasury bills and Pakistan investment bonds auctions. Despite the threat of an action, banks nonchalantly continued as normal, and even pushed yields up.

Expecting banks not to be greedy is naïve. However, expecting them not to be greedy after showing a weak position is like expecting snow in Karachi.

In June 2022, the SBP held a top secret meeting with the treasurers of the eight to 10 leading banks in the country. Again, names are shrouded in mystery and people present do not want to say anything on record. But what we do know is that the room was extra chilly that summer afternoon and what transpired is that bank treasuries were called to the SBP because the finance ministry expressed displeasure with the borrowing rates and the current exchange rate. Banks were then cautioned, almost in cold blood, on their FX activities and told to bring the exchange rate down in the interbank even if it meant incurring losses. They were told that it was an issue of national importance and that incurring losses was part of having the privilege of running banking businesses.

A source present at the meeting anonymously explained that the SBP had asked banks to sell dollars to customers without being allowed to buy them back from the interbank market. This exposes banks to changes in the FX rate, which could also mean a potential loss of money for them. Moreover, bank treasurers present in the meeting were warned that if banks did not comply, bank presidents would be called in for a one-on-one meeting for a severe “dressing down” by the SBP.

Now, some months later, and despite the above-mentioned actions, almost the stuff of nightmares, hearing the minister complaining about banks seems mind-boggling.

Has the government revealed itself to be in a weak position?

The SBP, on the other hand, has borrowed FX from the interbank market. It has undertaken FX swaps with commercial banks which means that it is borrowing USD from commercial banks based on the USD deposits put in by customers, said investment banker, Fahd Sheikh.

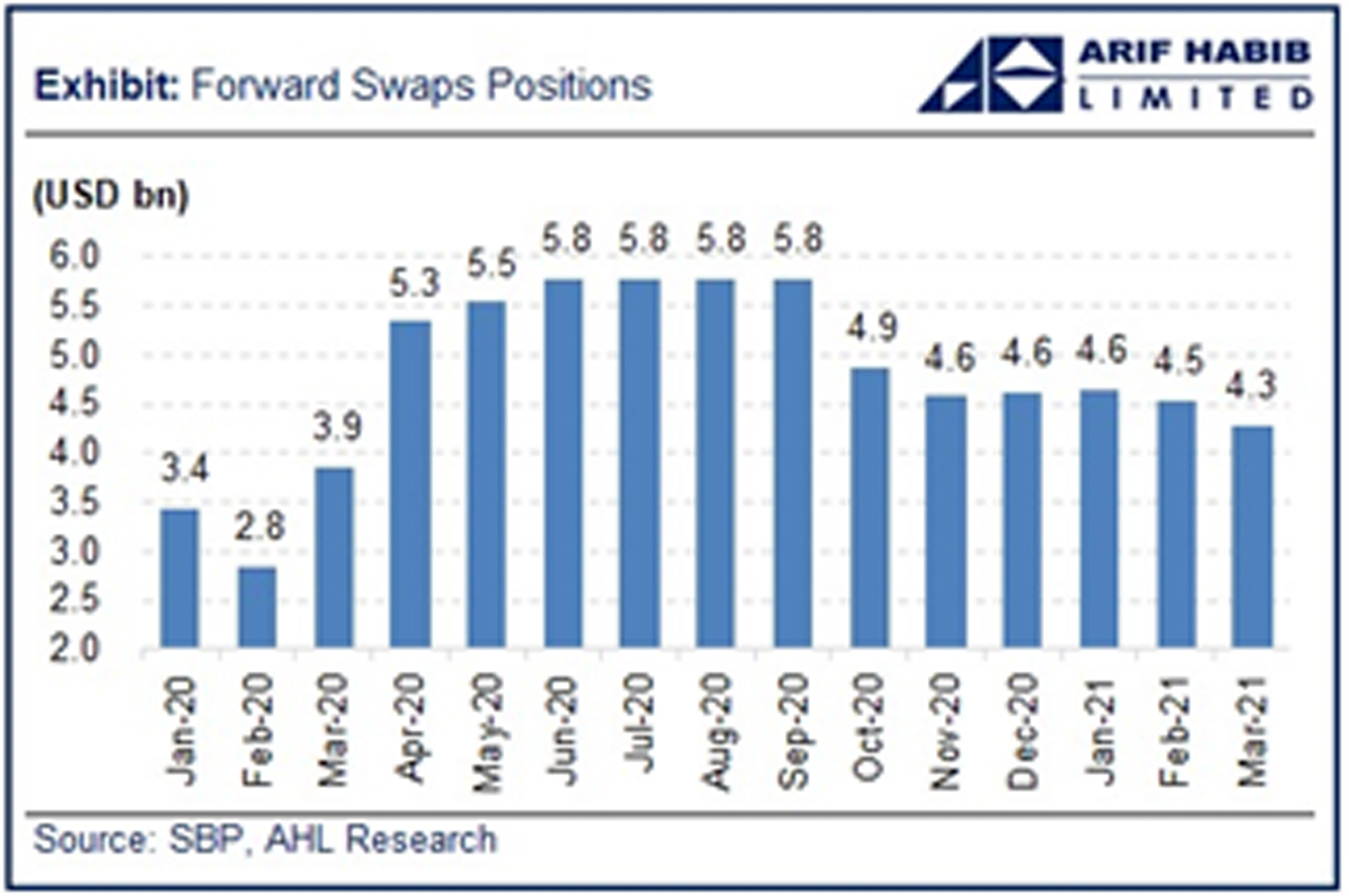

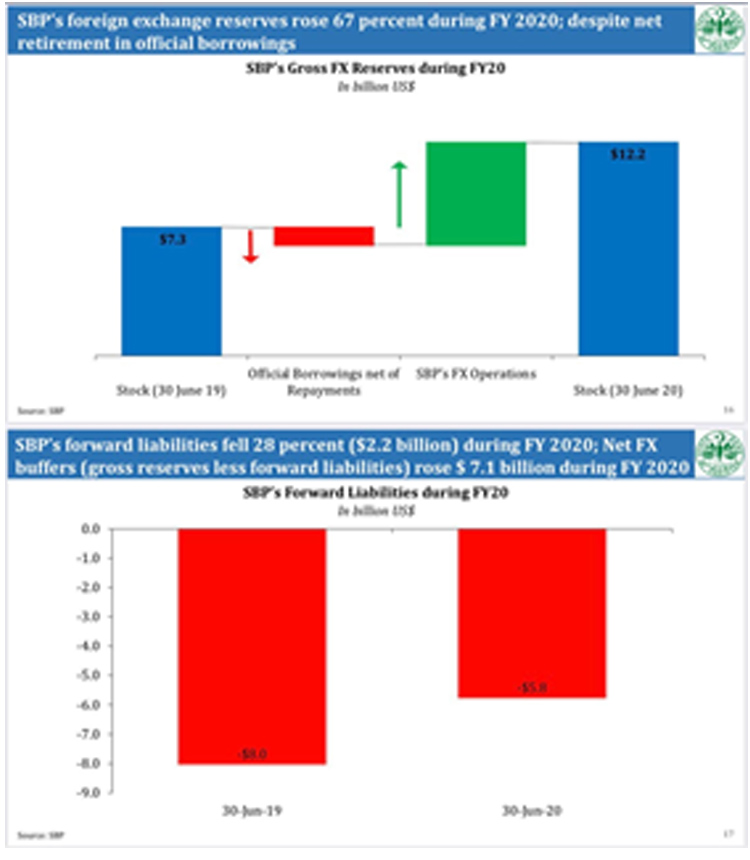

While it is unknown how much exactly is undertaken through swaps, market sources claim it would be around $4 billion at the moment. For context, the SBP’s forward liabilities on June 30, 2019 were $8 billion, and $5.8 billion in 2020, added Sheikh.

This implies that the SBP is a net borrower of FX from commercial banks. This also means the SBP should not be calling the kettle names. It is not in as strong a position to dictate terms to commercial banks today as it was during, let’s say, Feb-2020 when it was a borrower of only $2.8 billion from commercial banks. Maybe some retrospection along with a little bit of introspection would be helpful.

Thanks for sharing this piece of information with us, i haven’t found this anywhere else.

can you please share names of eight banks

what about the other banks, currency exchangers and border controls.

It is not the owner of bank is involved such practices. The staff of treasury department are doing all such illicit and wrong doing to earn hefty amount. The SBP should conduct impartial investigation against such black sheep to avoid financial instability of Pakistan

I’m truly impressed with your blog article, such extraordinary and valuable data you referenced here.

사설 카지노

j9korea.com