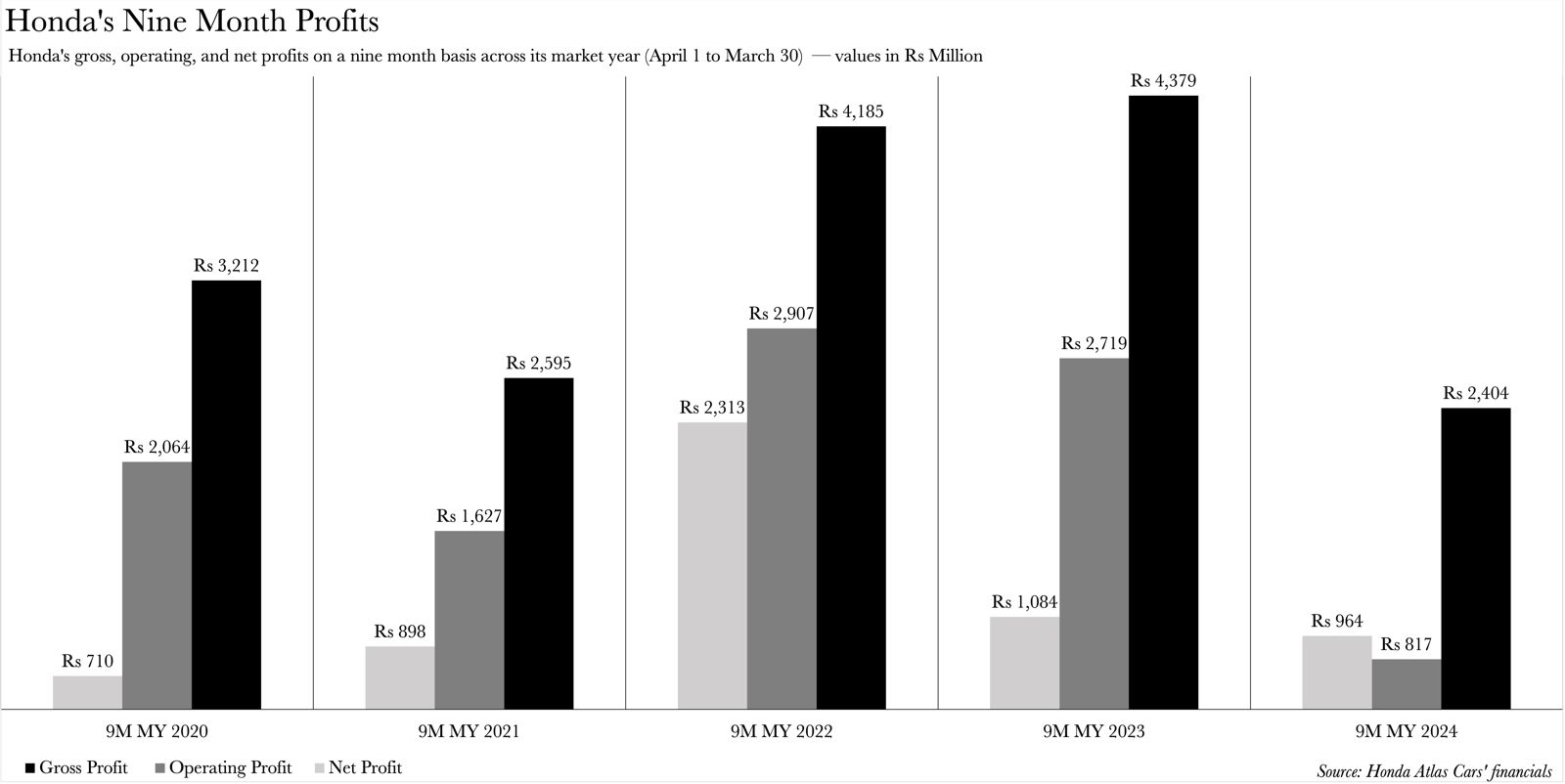

Honda, officially operating as Honda Atlas Cars in Pakistan, has experienced its most lacklustre performance in terms of sales revenue, gross profit, and operating profits for a nine-month period of a market year, over the past half-decade. Yet, paradoxically, this seems to be of no consequence. It has astonishingly achieved its third-highest final profit in the same duration for a nine month period. Moreover, it has also registered its most impressive gross and net profit margins.

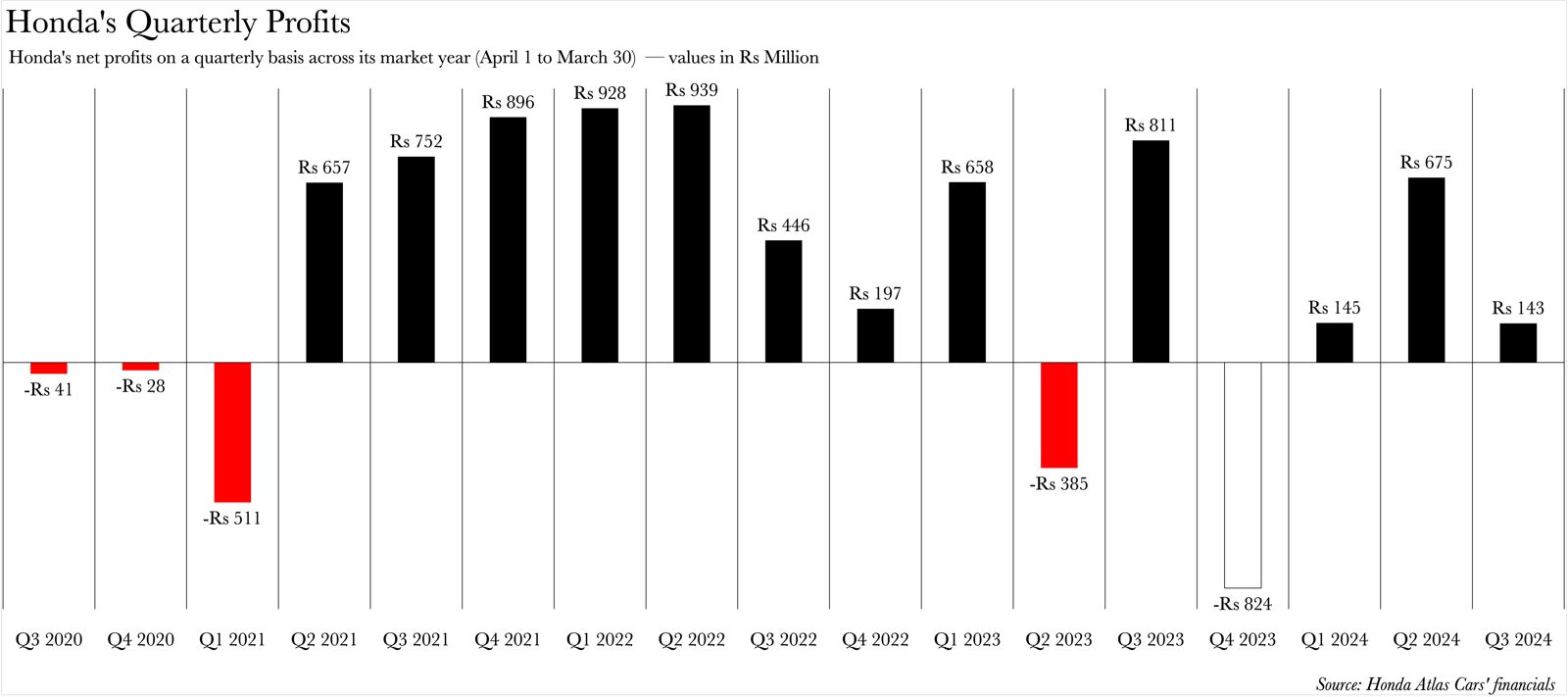

Honda has concluded the third quarter of its market year, commencing from April 1 to March 30, with a profit amounting to Rs 143 million. This has culminated in a cumulative profit of Rs 964 million for the nine month period. Judging by the sheer numbers, this is the worst quarter for Honda in a quarter that it has not incurred a loss over the past five years — it’s the lowest profit they have ever made whenever they have made a profit over the past five years.

It is only when we look at Honda’s cumulative final profits for the nine month period that we understand Honda’s success. On a net profit basis, Honda is currently basking in its third-best nine-month period in the past five years. This is despite its revenue for the nine months ending December 31, at Rs 30 billion, being 59% lower on a year-on-year basis when compared to the same period last year.

“It’s a commendable result considering the very low sales. They’ve managed to achieve this by maintaining higher prices,” elucidates Yousuf Farooq, Director Research at Chase Securities.

Farooq’s remark encapsulates the crux of the situation. It is actually its plummeting revenue that paradoxically reveals how well Honda is actually doing. The diminished demand, coupled with the inflated prices of Honda’s products, is one of the factors propelling the soaring profit margins. Margins are pivotal here, because Honda is thriving on this metric.

Its gross profit margin ranks second over a five-year span, while its net profit margin tops the list. Only its operating profit margin seems to lag behind, but that also reveals the source of its earnings.

|

Honda Atlas Cars’ Profit Margins |

|||||

| 9M MY 2024 | 9M MY 2023 | 9M MY 2022 | 9M MY 2021 | 9M MY 2020 | |

| Gross Profit Margin | 8.0% | 6.0% | 5.4% | 5.8% | 8.2% |

| Operating Profit Margin | 2.7% | 3.7% | 3.8% | 3.6% | 5.2% |

| Net Profit Margin | 3.2% | 1.5% | 3.0% | 2.0% | 1.8% |

| Source: Honda Atlas Cars’ financials | |||||

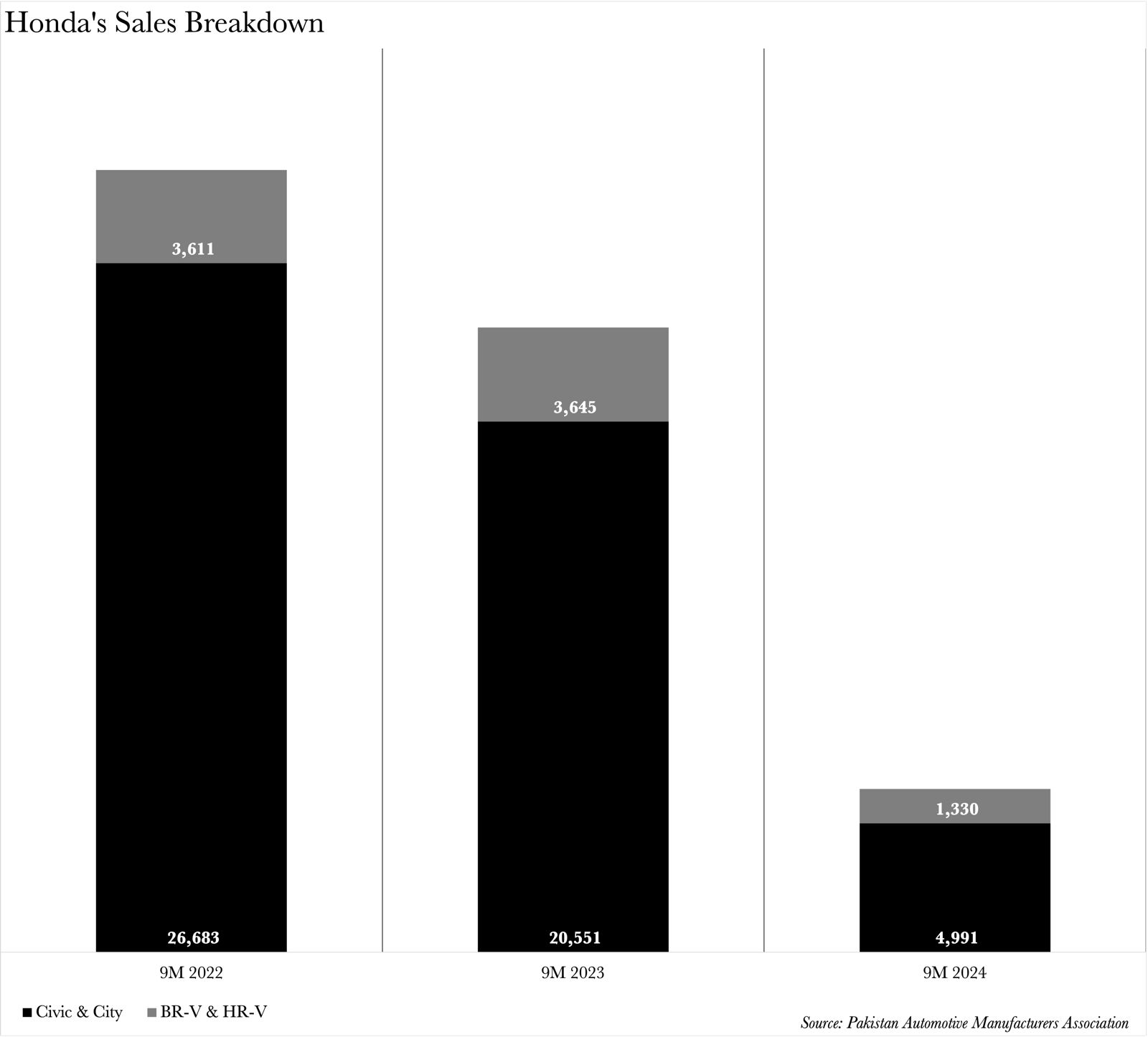

Honda’s sales composition has also undergone a subtle metamorphosis. Its crossovers, the BR-V and HR-V, now constitute 21% of the total sales volume. This is the highest proportion they have ever achieved in the last three years. What does this imply? They are, on average, pricier than Honda’s sedans, which bolsters the aforementioned high-pricing strategy that Honda is employing. This is how Honda secures its gross profit margin.

Now, net profit margin. The secret behind this impressive figure is simple: ‘other income’. Honda’s ‘other income’ for the nine-month period stands at a staggering Rs 2 billion. This is the highest level it has ever reached over a five-year span. It’s a 27% increase on a year-on-year basis, and almost a 900% leap from the ‘other income’ Honda registered in the nine-month period ending on December 31, 2019. What’s truly astounding here is that Honda could have, in fact, reported an even loftier ‘other income’.

“It’s logged a lower ‘other income’ compared to its preceding quarters,” notes Mustafa Mansir, the Director Research and Business Development at Taurus Securities.

Honda’s ‘other income’ for the third quarter of the fiscal year 2024 is the solitary instance it has dipped below Rs 500 million, with it recording Rs 897 and Rs 903 million in the two preceding quarters respectively.

Do Honda’s financials going into the final quarter pose any cause for concern for the future?

“The issue is with the volumes. Everything else is shipshape,” clarifies Mustansir. Is there anything Honda can do about this? Its scope of action is limited, however, there are now hopes that external assistance is on its way.

“A significant catalyst for sales could be the decline in interest rates over the ensuing year, and as volumes incrementally ascend, so too will the overall profitability,” asserts Farooq.

Whether this surge in volumes can materialise before Honda concludes its fiscal year on March 31 is anyone’s guess. However, Honda has clearly found a winning formula to weather the storm that is the current automotive slump.

when pakistani technicians touch anything to fabricate or repair then consider it the beginning of a new problem, thats the situation of assembly in honda atlas.

what is this other income.