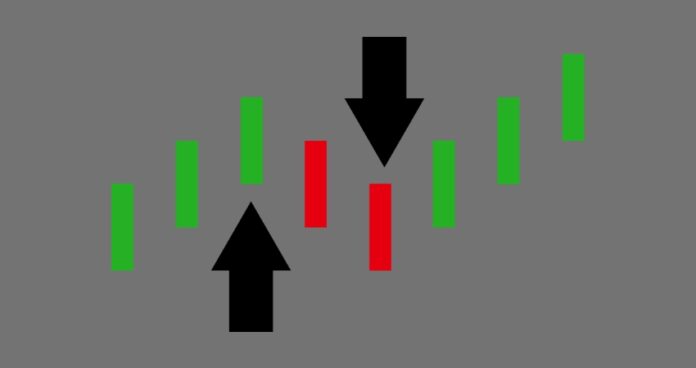

Bears extended their dominance at the Pakistan Stock Exchange (PSX) as the benchmark KSE-100 Index experienced another day of significant downturn plunging by approximately 750 points on Wednesday.

This decline added to the previous day’s losses, marking a concerning trend for the market.

According to the PSX website, the benchmark index fluctuated within a narrow range, but a wave of selling emerged in the last trading hour, closing the index at 64,048.44 points, a drop of 753.26 points or 1.16%.

The index even touched an intra-day low of 63,856.51.

Sectors such as refineries, automotive, and cement industries were hit hard, showing significant losses.

Analysts suggest that the late sell-off was driven by investor caution in anticipation of the upcoming monetary policy announcement from the State Bank of Pakistan (SBP) scheduled for Monday.

In the political arena, Pakistan’s new government is gearing up for negotiations with the International Monetary Fund (IMF), amid speculations that another financial rescue package will be a key topic of discussion.

The IMF delegation is set to arrive in Pakistan for the final review of a $3-billion standby agreement. Successful completion of this review, which starts on Thursday, could unlock a disbursement of about $1.1 billion.

The stock market’s volatility is largely attributed to the uncertainty surrounding the central interest rate.

Just the day before, the PSX witnessed intense selling pressure, causing the KSE-100 Index to fall below the 64,801.70 mark by over 900 points, which analysts described as a much-needed ‘technical correction’.