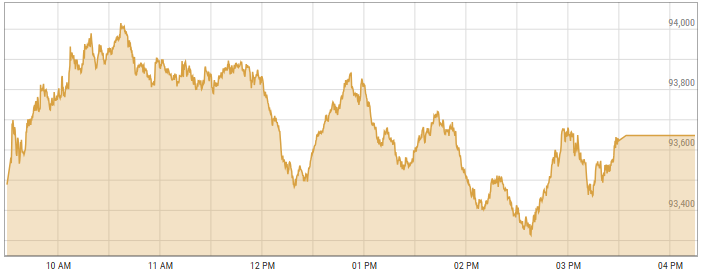

Bull run continued at the Pakistan Stock Exchange (PSX) on Monday with the benchmark KSE-100 crossed the 94,000 level for the first time during intra-day trading on Monday.

The index closed at 93,648.32, reflecting a gain of 356.64 points, or 0.38%, from the previous close of 93,291.68.

During trading, the index reached a peak of 94,020.02 before settling just below this milestone level. The day’s trading volume was robust, with approximately 468.86 million shares traded, valued at PKR 28.31 billion.

Key sectors, including automobile assemblers, commercial banks, oil and gas exploration companies, power generation, and refineries, saw buying activity. Index-heavy stocks such as PRL, SSGC, OGDC, KEL, and CNERGY traded in the positive zone.

In a positive development, Pakistan’s worker remittances surged 24% year-on-year (YoY) to reach $3.052 billion in October 2024, from $2.463 billion in the same month last year.

According to the latest data released by the State Bank of Pakistan (SBP) on Friday, remittances rose by 7% month-on-month (MoM) in October, up from $2.86 billion in September.

For the first four months of the fiscal year FY 2024-25, total remittances surged to $11.8 billion, indicating a 35% increase compared to the $8.8 billion recorded during the same period last year.

Meanwhile, the IMF’s urgent mission is scheduled to visit Islamabad from November 11 to 15, to assess fiscal performance and discuss potential corrective measures, including the introduction of a mini-budget.

The PSX has been on a winning streak for some weeks mainly supported by increased investor confidence and improved economic indicators.

According to AKD Securities, ongoing monetary easing amid a disinflationary environment and improving macroeconomic indicators is expected to make equity investments more attractive, with the market currently trading at a P/E of 4.2x and a dividend yield of 11.0%.

These factors, along with reduced external financing needs under the IMF program, are likely to sustain foreign investor interest. However, a modest economic recovery may limit potential gains for cyclicals.