Red overshadows THE Trade Screen

LAHORE

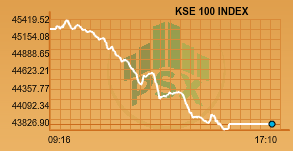

The Pakistan Stock Exchange (PSX) resumed trading after the long weekend with weak sentiments. Low investor confidence was evident on raising political temperatures, and the trade screen was covered in red. As the opposition parties join hands to stage a sit-in in Lahore on Wednesday, the benchmark KSE 100 index dropped 3.35 per cent intraday falling below 44,000 level.

The KSE 100 index at the time of closure, was trading at 43,899.45 points, down 1,389.04 points with only 5 scripts in the green.

The KMI 30 index depreciated by 3.77 per cent and the KSE All Share Index nosedived 3.11 per cent.

Only 39 of the scripts traded today ended with gains as 326 declined. The market volumes were recorded at 191.37 million.

It was not the best of the days to make an announcement. The PSX has been notorious for its awry ride. Since its inclusion in the MSCI index, it has been performing contrary to expectations. The index climbed to an all-time high of 53000 points and has now declined to 43000 points. The abysmal performance of the stock market is another example of capital markets hate political uncertainty and how investor confidence suffers from bounded rationality.

Crescent Steel & Allied Products Limited (CSAP -5.00 per cent) sunk to its lower circuit breaker price on the day it announced financial performance for the year ended June 30, 2017. The company reported extension in sales of 38 per cent to Rs 10.21 billion which is a 104 per cent growth since 2013. The gross profit margins deteriorated to 18.21 per cent from 28.91 per cent in FY16. With net profit margins of 9.92 per cent, the company announced earnings per share of Rs 13.04 up only 0.54 per cent year-on-year.

International Steels Limited (ISL -4.24 per cent) having the share price jump 259 per cent during the year (FY16-17) failed to put up a good show despite massive improvement in FY17 financials. Sales of Rs 33.73 billion is a surge of 65 per cent compared to the previous year and 92 per cent growth in 5-years. Net profit clocked at Rs 3.04 billion which converted into per share earnings of Rs 7.00.

Maple Leaf Cement Factory Limited (MLCF -4.14 per cent) has decided to partially finance its additional grey cement line of 2.3mntpa by way of a right issue. For this purpose, the company has announced a 12.5 per cent right issue at a price of PKR 65 per share. According to the company’s financial projections, earnings for MLCF are expected to grow by 15 per cent and 27 per cent to PKR5.5bn and PKR7.1bn during FY18 and FY19, respectively. However after materialization of industry’s expansion in FY20 and onwards, the company projects earnings to post a sustainable growth rate of 8 per cent per annum.