Fauji Foundation and Kot Addu Power Company Limited (KAPCO), one of Pakistan’s largest independent power producers, have jointly expressed their intent to acquire a majority stake and gain joint control of Attock Cement Pakistan Limited.

In a formal communication to the Pakistan Stock Exchange (PSX) on Tuesday, KAPCO stated that Integrated Equities Limited, acting as the Manager to Offer (MTO), has submitted the Public Announcement of Intention (PAI) on behalf of the acquirers. This move aligns with the provisions outlined in the Securities Act, 2015, and the Listed Companies (Substantial Acquisition of Voting Shares and Takeovers) Regulations, 2017.

“The Board of Directors of Kot Addu Power Company Limited (the Company) has approved the acquisition of shares and joint control of Attock Cement Pakistan Limited (ACPL or the Target) by the Company and Fauji Foundation (FF) under the Securities Act, 2015 (the Act) and Listed Companies (Substantial Acquisition of Voting Shares and Takeovers) Regulations, 2017 (the Regulations), KAPCO said in its notice to the PSX.

The acquirers, Fauji Foundation and KAPCO, intend to buy 84.06% stake (Fauji Foundation 42.03%, KAPCO 42.03%) of Attock Cement Pakistan Limited. This move is subject to the completion of necessary corporate and regulatory formalities.

The official announcement is set to be published in newspapers within two working days, adhering to the regulatory framework. Copies of the announcement have also been shared with the PSX for public record and transparency.

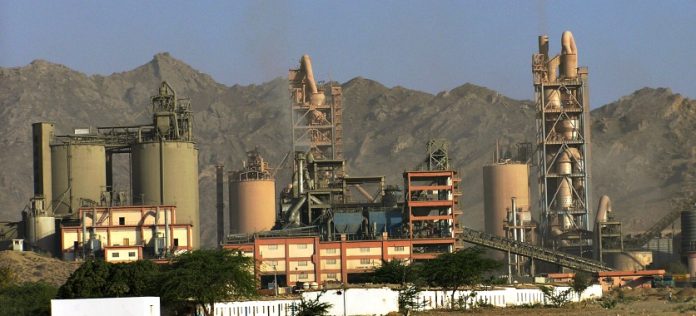

Founded in 1981 and listed on the PSX, Attock Cement operates from its manufacturing base in Hub, Balochistan, with a production capacity of over 3 million tonnes annually.

The company is known for its Falcon brand and has a footprint in both domestic and export markets, particularly in East Africa and the Middle East.

This development comes amid reports that Pharaon Investment Group Ltd. (PIGL), a Lebanon-based conglomerate, is considering a strategic exit from its stake in Attock Cement Pakistan Ltd., drawing interest from several prominent players in Pakistan’s cement and energy sectors.

According to a Bloomberg report citing people familiar with the matter, prominent suitors include Cherat Cement, Bestway Group, and Kot Addu Power Company (KAPCO), with the latter reportedly considering a joint bid in partnership with Fauji Cement.

Attock Cement’s parent, Pharaon Investment Group, is part of a diversified business empire with holdings across oil and gas, financial services, real estate, and hospitality.

The potential divestment by Pharaon Investment Group comes as Pakistan’s cement industry begins to witness renewed consolidation moves, driven by recovering demand, operational synergies, and renewed investor interest amid macroeconomic stabilisation.

Pharaon’s exit plan was first hinted at last year when the group began evaluating strategic options for its cement investment in Pakistan. The renewed investor interest now suggests that the transaction may be moving into a more formal phase, with binding offers expected in the coming months.

Meanwhile, stepping into the fray, Alpha Cement Company Limited (ACCL) has also announced its intention to acquire an 84.06% stake in Attock Cement Pakistan Limited. Arif Habib Limited, acting as Manager to the Offer, submitted a Public Announcement of Intent to the PSX on behalf of Alpha Cement.

According to the notice, the company plans to acquire 84.06% of Attock Cement’s shares through a share purchase agreement, with an additional public offer to acquire 7.97% of the paid-up capital.