In continuation to its earlier instructions, State Bank of Pakistan (SBP) has advised banks/development finance institutions (DFIs) to not discriminate any segment of the society and follow SBP’s instructions issued earlier which required banks/DFIs to desist from adopting discriminatory practices on the basis of trade, region, gender, ethnicity, specific profession, class and/or group of citizens e.g. lawyers, politicians, security officials and law enforcement agencies etc.

State Bank has stressed upon banks/DFIs in its circular issued today that Politically Exposed Persons (PEPs) have time and again raised their concerns regarding the adoption of discriminatory practices by banks in providing consumer finance and general banking facilities. The SBP has further asked banks/DFIs to explicitly convey reasons of refusal in writing to the applicant and keep a separate file of all approved and rejected cases of PEPs.

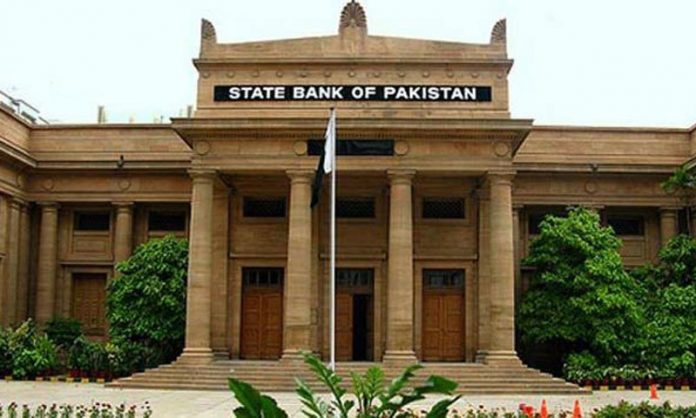

Such practices are against the spirit of fundamental rights ordained by the Constitution of Pakistan and regulatory instructions on the subject and that these complaints have been viewed seriously at the central bank of the country.

SBP has further stated in the circular that any violation of the instructions will attract punitive action under relevant provisions of Banking Companies Ordinance, 1962.