KARACHI

The deposits of the banking sector have gone up by one per cent in the first quarter (Jan-Mar) of the calendar year 2017 in contrast to 0.6 per cent contraction in the same quarter last year, while banks’ borrowing from SBP has grown by 23.5 per cent owing to liquidity needs to sustain asset growth.

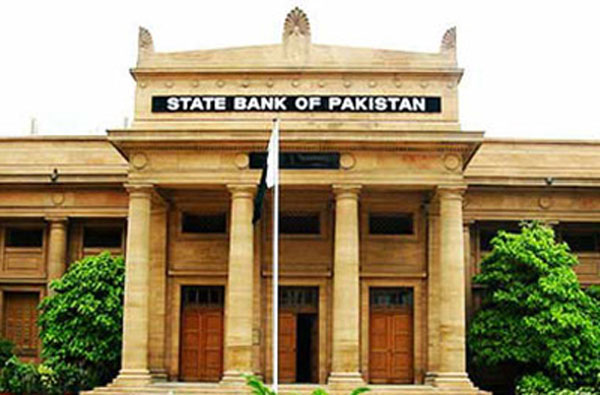

SBP’s report said that the banking sector has posted a profit after tax (PAT) of Rs 49 billion during first quarter 2017 compared to Rs 52 billion in 1st quarter 2016. Banks are well positioned from solvency standpoint as the prevailing CAR is well above the minimum required level of 10.65 per cent, the report said.

In its Quarterly Performance Review (QPR) of the Banking Sector for the quarter ended March 31, 2017 State Bank of Pakistan (SBP) has said that gross advances (domestic private) have surged by a higher rate of 2.4 per cent during first quarter CY17 as against 0.78 per cent during the same period last year.

Flow of funds has largely been seen in savings (Rs 54 billion), current account-remunerative (Rs 44 billion) and others categories. Apart from deposits, borrowings from financial institutions provided the funding necessary for asset expansion.

“Interestingly, most of the growth results from Islamic Banking Institutions (IBIs) which added Rs 102 billion of fresh loans in the quarter under review,” the SBP report said. The major thrust (in volume terms) has come from the sugar, automobile/transportation, electronic and electrical appliances sectors.

Relatively higher growth in advances compared with the increase in deposits has led to an improvement in Advances-to-Deposit ratio (ADR), elevating it to 47.5 per cent in first quarter 2017 from 46.6 per cent in fourth quarter 2016.

Contrary to contraction witnessed in consumer finance portfolio in first quarter 2016 and 2017 observed a growth of 4.4 per cent, largely on the back of auto finance followed by mortgages.

All categories of consumer finance (credit cards, auto finance, mortgage finance, personal loans) have seen positive growth, the report claimed.

“Auto financing has been on the rise since last few years and its share in consumer financing has been increasing as well. This higher growth in auto financing is due to added interest of banks in secured financing where margins are relatively higher. In the backdrop of declining interest rate environment, it is attractive for consumers too.

Similarly, mortgage financing portfolio is continuously growing since 3rd quarter 2014 and there is no coming back since then.

The mortgage financing, nevertheless, provides immense opportunities to banks and it is imperative that they take measures for enhancing its share in the overall loan portfolio, the report added.

The performance report said that the banking sector continues to invest in infrastructure which is reflected in the absorption of new employees, a rise in Point of Sales (POS) machines and ATMs cards etc.

Moreover, the branch network has recorded a slight decline, mainly due to the consolidation of branch network post completion of the merger of two banks in the last quarter of 2016.

The advances of the banking sector are expected to grow in line with historical trend during 2nd quarter 2017. The growth momentum is likely to be supplemented by favorable macroeconomic conditions (i.e. low interest rates, strengthening aggregate demand and uptick of industrial activity), an increase in wheat procurement operations and positive outlook (CPEC related projects gain steam).

The investments are expected to rise given that government has announced auction targets both for PIBs and MTBs. Government’s development outlays are expected to gain momentum towards the end of the fiscal year. On the funding side, deposit growth would be determined by both the anticipated withdrawals due to upcoming Eid ul Fitr and the growth of advances.

The profitability of the banking sector is expected to see some recovery given anticipated increase in both advances and investments. However, it may remain modest given the shift of banks from long maturity high-yielding bonds towards short maturity low-yielding ones.

The banking sector continues its steady expansion as both investments and advances are showing growth. Against the usual pattern of the seasonal retirement of advances during first quarters of a calendar year, Q1CY17 witnessed an uptick in private sector advances. Interestingly, Islamic banking industry took the lead inflow of credit.

The SBP said low interest rates and build-up of low yielding stock of short-term government bonds has moderated the profitability of the banking sector.