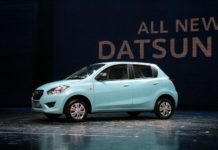

Reported at upwards of $35 billion, the external account deficit for the fiscal 2016-17 was the highest in the history of the nation. A not-too-small chunk of it – in specific terms Rs20 billion or $200 million – was consumed by the imported, mostly Japanese, small to medium-sized cars.

Apart from splashing red over our external balance sheet, it is making the local assemblers see nothing but crimson.

At the same time, it is providing value for money to buyers, which is generally not the case with locally assembled cars. Another aside, black money has also found an avenue through it.

For its part, Profit has tried to evaluate from all angles whether the mind-blowing loss to the exchequer worth the ‘value for money’ the general public gets on the imported secondhand vehicles.

And, made for the Japanese roads, these cars are not without their downsides. The worst nightmare for a motorist driving a Daihatsu Mira or Honda’s N-One or some similar low-height car in Karachi is they would often have the underbelly of their cars violently scratched with improvised, unmarked speed-breakers popping out of nowhere.

At the top of it, spare parts are a tad difficult to find, and, when one does locate them, these are super expensive. Costing an arm and a leg to replace, side-mirrors meanwhile are the most prized picks by thieves around the metropolis.

Some months ago, Tariq Hussain, a businessman, lost side-mirrors of his Toyota Vitz and later of Honda N-One right under the nose of his apartment building’s watchman in the wee hours on both occasions, in PECHS Block 2.

Toyota Vitz side mirrors cost him Rs 10,000 while N-One side mirrors were selling at whopping Rs 44,000 then but he went for cheaper, Rs 4000, improvised side-mirrors, for fear of losing them again.

But that hasn’t kept him from retaining N-One and later he also bought Daihatsu Mira. “N-One is small, yet the interior feels like a newly bought sedan. It’s spacious. The same goes for Mira and obviously also for Vitz,” Hussain said. “In the past, I also had locally assembled Suzuki Alto, 1,000 CC, but there’s no comparison between the performances of Japanese and locally assembled cars.”

Cars made in Japan and landing in Pakistan are replete with different functions. The drive is simply luxurious. Safety features like air-bags are there even in 660CC cars. Those who have driven locally assembled vehicles and have now switched to Japanese cars are all united in their opinion – they would rather prefer the imported variety and quality.

Manipulation of law

At least quite a few, if not all, the importers of these cars have a rather murky background!

A passport of a person who has lived abroad for a couple of years is abused to import second-hand cars either through the transfer of residence, baggage or gift scheme for commercial purposes. This particular relaxation in the law was provided to benefit expatriate Pakistanis and their families and friends back home.

But a massive 65,000 used units were imported in fiscal 2017, mostly for commercial purposes, and taken from the wharf straight to the showroom!

Moreover, for above 1,800CC there is only a fixed duty for all used Japanese cars, the sales tax being zero. Legally, a car must be registered prior to hitting the roads. Post-import on an external passport, these vehicles are not registered for months, and can be spotted with Test Drive (TD) number plates.

If imports are through proper channel, then varying duties for all derivatives shall apply as vehicles are evaluated on true value before duties apply. Duties increase with the increase of the rates of cars, giving a bigger sway to the taxman. On top of various duties, 17% sales tax has to be paid. According to insider information, the sales tax is seldom paid.

It is also not legally binding as these imports are on the basis of Transfer of Residence, Baggage or Gift scheme. But this facility was not meant to be commercially exploited – something now actually happening.

The government is now tightening its policy, making the transfer of residence (TR) mandatory for such imports.

Local automakers’ lack of sensitivity

From a general perspective, this massive import of Japanese units was inevitable as the automakers having captured the market were neither willing to upgrade nor innovate. The most glaring flaws were in safety features, which were not in line with contemporary international benchmarks. There’s a classic example of Suzuki Mehran, which has seen no change at all, apart from a slight facelift and a bit of upgradation in the engine after 2013 – 24 years after it was last done in 1989!

Pakistan is not alone in importing second-hand cars, the UK and other developed nations do that too – but the latter do it after stringent evaluation about their road-worthiness.

Despite windfall profits over 30 years of total protection, in urban centers, the local automakers seem to have lost the psychological battle to the secondhand Japanese offerings – quite apparent from the overwhelming buyer preference.

A manager at Sasoli Motors, Syed Anjum said that people coming from interior Sindh and remote areas prefer locally assembled cars. “It suits them because compared to the Japanese locally assembled cars have their underbelly well above the ground. But the urban patrons are sold on Japanese cars despite the low underside issue hurting them owing to speed-breakers.

“It could only be because even a 660CC Japanese car has several features –like power windows, power steering, and extreme fuel efficiency of eco-idle. The one-third difference in consumption between lowest denominators – 660CC Japanese giving a 20 kilometer run per liter while 800CC Mehran only averages around 13 kilometers,” said Anjum.

“Loathing for automatic cars has shifted to manual, owing to high-density traffic. Now someone with a low budget of Rs0.6 million would inquire about an automatic car,” he said.

Automatic cars are all the rage for Uber and Careem captains, for they have to stay long hours on the wheel and managing automatic cars in the bumper-to-bumper mad-rush in Karachi and Lahore is far less cumbersome than driving a manual. And fuel economy shaves costs, thus increasing profitability.

The cat amongst the pigeons

The government’s plans to slash the import bill has set the proverbial cat amongst the pigeons – the reports an anathema to the ears of those now weaned to windfalls from import. No wonder the latter is critical, attaching motives to the move – like blaming it on local assemblers – whom they dub as ‘a cartel’ – on pressurizing the government for a fillip.

The Pakistan-based automakers seem to have made the most of government’s restrictions car imports, as seen in the 25.4% increase in the sales for the July-October 2017 quarter compared to the last year’s figures. Last year, the industry sold 55,889 units during the July-October 2016 quarter while the first three months of the ongoing fiscal 70,040-mark was hit.

“Since the main source of their income comes from used-car business, 90% Pakistanis in Japan will have to return,” said CEO Shah Global Motors, Shah Muhammad Shah.

“The government pushed us towards illegal means, send dollars to Japan using hawala and pay government duty from there,” he said. If the government goes ahead with its plans, Shahji maintains, then it would only raise the cost of imports.

The importers/dealers are also of the view that if the government wants to maintain or increase foreign exchange reserves then it should do it the appropriate way, by raising exports.

“The government ought to let the business flourish. If it was not illegal then, how is it illegal now?”, said he.

The chairman of All-Pakistan Motor Dealers Association (APMDA) HM Shahzad has been in contact with government officials and, he says, he has bought some time – to be precise till Dec. 31 so that the consignments in the pipeline reach the Pakistani shores.

Shahzad’s suggestion: The federal ministries of Commerce and Finance, the State Bank and the FBR should together and devise a suitable mechanism for payment of duty in dollars.

Wasif Safdar, an importer, said that imposing the duty in dollars was not pragmatic and that the government was only beating about the bush.

“Mark my words, no one would trust sending dollars abroad into someone’s account, expecting he would then pay it back to Pakistan government from there as the duty. This act could easily be challenged and won in the Supreme Court,” said Safdar.

He said, even if it could devise such a plan, for the government it would be a lose-lose situation.

“Around 6,000 cars dock in Karachi every month and on average each of them pays around Rs600,000 cumulative duty. Multiply 6,000 by 600,000 and multiply the figure again with 12 and you would arrive at government’s average annual earnings from the imported used cars,” he said.

New rules to push prices up, steeply

A direct consequence of the shift from personal baggage to Transfer of Residence scheme would be a steep upward revision in prices. Under personal baggage scheme, the passport of a person living abroad for six months could be used for import of a car. But in Transfer of Residence, the expat must have lived abroad for two years, and have a valid license.

“We were dishing out Rs8,000-Rs10,000 a pop to the expatriate. But someone qualifying for TR (Transfer of Residence), would have to be paid a whole lot more,” shared an importer on condition of anonymity.

In the changed milieu, with the new rules coming into force, it could be 10-15 times higher, meaning thereby that the importers would have to cough up Rs100,000 to Rs150,000 to the expat for using his passport. Not allowing any cut in their profits, this cost shall definitely be transferred to the buyer – pushing the price of each imported second-hand vehicle by around 15 percent.

Black money

According to an insider, the ones sitting on a pile of cash either through tax evasion or some shady business, buying high-expense big-brand secondhand car is a piece of cake compared to buying one with similar features but new. Secondhand does not raise the hackles of tax authorities, keeping the ones with black money off the radar.

“When a brand-new car imported the legal way, it warrants sales tax. For instance, when a car worth Rs20 million is bought, the government officials instantly get activated and question the person to disclose his means of purchasing such a car after the transaction. But if the same person opts for an identical imported secondhand car offering the same features, he would be avoiding government’s attention and pay a lesser price to boot.”

Why does it happen? It is because lots of duties are not imposed on secondhand vehicles. And the dealers don’t even have to pay sales tax since it was imported on either personal baggage, gift or Transfer of Residence scheme,” an importer told Profit on the condition that he remains incognito.

He also disclosed that the Land Cruisers and Prados one sees higher echelons of bureaucracy and politicians driving around around may have been bought through black money.

“Almost new two years old vehicles are imported to benefit from duty exemptions on the basis of depreciation. And the fixed duty remains the same, whether the luxury jeep is worth $55,000 or $95,000. The worst thing is that the government looks the other way.

“All in all, it is a massive scam, costing the exchequer Rs20 billion – which is at best a conservative estimate. It could actually be much more than that.”

biased writer…get paid by auto makers…

Comments are closed.