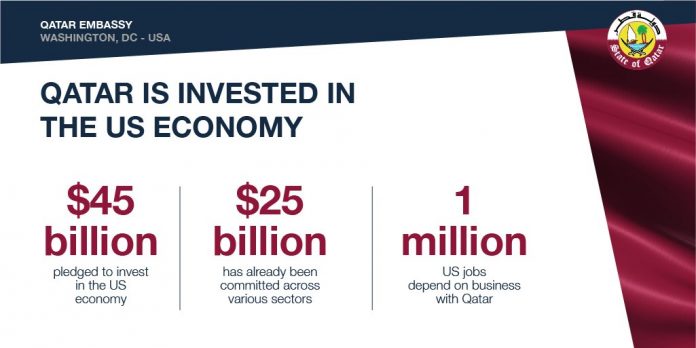

DOHA: Qatar Investment Authority aims to raise investments in the United States (US) to $45 billion in the next two years as it rebalances its portfolio of assets away from Europe, its chief executive said on Sunday.

The sovereign wealth fund has built up a huge European portfolio through stakes in companies including Deutsche Bank, Credit Suisse, London Stock Exchange and Volkswagen.

QIA currently has about $30 billion invested in the US, Mansour Ibrahim al-Mahmoud told reporters on the sidelines of a conference.

“We are talking about $45 billion for the US market..we are on track for this over the next two years,” he said.

Mahmoud’s predecessor Sheikh Abdullah bin Mohamed bin Saud al-Thani in 2015 committed to invest $45 billion in the US over a five-year period.

“Our objective is to balance our portfolio…currently we have a little bit of concentration in Europe and having this allocation toward the US market is to balance the portfolio,” he said.

In the US, QIA was looking at fundamental sectors such as real estate, technology or US exchanges, he said.

In one such US deal, QIA and hedge fund Elliott Management Corp in December 2017 took Gigamon Inc, the US networking software company, private for $1.6 billion.

Mahmoud was speaking as US Secretary of State Mike Pompeo visited Qatar on a tour of the region.

Qatar is at loggerheads with Saudi Arabia, United Arab Emirates, Qatar and Egypt, which have cut off diplomatic and transport ties with Doha, accusing it of backing terrorism and cosying up to Iran.

Qatar denies supporting terrorism and its government is seeking to use the sanctions enforced by its neighbors as an opportunity to develop its own industry and its relations with other countries.

The value of bilateral trade between Qatar and the US has doubled in 10 years, Qatar’s trade minister Ali al-Kuwairi said at the US-Qatar Strategic Dialogue conference. He said the US tops the list of exporters to the Gulf nation.

Kuwari said bilateral trade volume reached $6 billion in the period from January to October last year.

The minister didn’t give the equivalent figure the previous year but this would be higher than the value for all of 2017, which was about $4.3 billion in bilateral trade, according to the United States Census Bureau.