LAHORE: Much to the government’s relief, the trade deficit during the first seven months (July-January) of the current financial year 2018-19 contracted 9.66% to $19.3 billion compared to $21.324 billion recorded during the same period of FY18.

According to data released by the Pakistan Bureau of Statistics on Monday, the trade deficit plummeted 31.7% year-on-year (YoY) in January clocking at $2.5 billion compared to $3.6 billion in the same month last year.

On a month-on-month basis (MoM), trade deficit posted an increase of 4.1% to $2.5 billion compared to $2.4 billion in December last year driven by a rise in imports MoM to $2.5 billion in January.

Imports touched $4.5 billion in January, registering a decline of 19.1% YoY compared to $5.6 billion in January 2018, which was a major contributing factor in the fall of the trade deficit in January to $2.5 billion.

Interestingly, imports posted a growth of 1.3% on a MoM basis in January to $4.5 billion compared to $4.4 billion in December 2018.

In the first seven months of FY19, imports contracted 5.5% to $32.5 billion compared to $34.3 billion in the same period of FY19.

Correspondingly, exports posted a 2.2% increase or Rs13.2 billion during July-Jan FY19 compared to $12.9 billion in the same period of FY18.

And on a MoM basis, exports contracted 1.8% to $2.0 billion in January against $2.1 billion in December last year.

Despite repeated government efforts to prop up exports, the extension of subsidies to five zero-rated industries in the shape of lower gas and power tariff has failed to yield a tangible result.

However, as per the Ministry of Commerce, its interventions to effectively rein in the fast-widening trade deficit has started paying dividends.

During July-January FY19, these measures have contributed to a saving of $2 billion to the national exchequer.

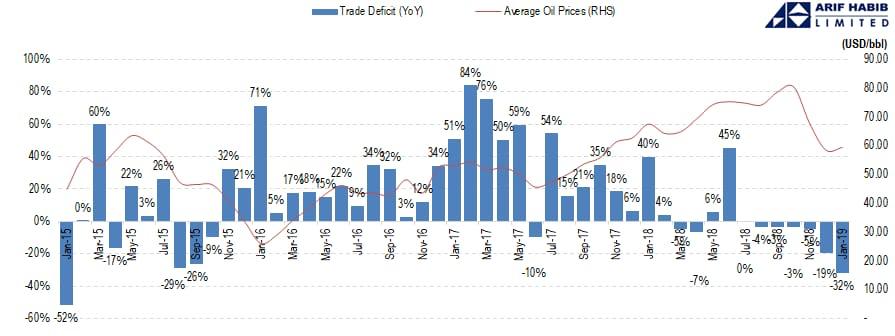

According to Arif Habib Limited (Research), the trade deficit has declined by the most in the four years as the chart below illustrates:

Seemingly, the decision to allow the rupee to depreciate by around 28% against the greenback since December 2017 hasn’t stimulated growth in exports, as anticipated.

Export growth remained sluggish during July-Jan of FY19, indicating the provision of major subsidies to the sector hasn’t paid dividends in the last few years.

While talking to Profit about the decline in the trade deficit, Senior Advisor Tundra Fonder A.A.H Soomro explained that the J-curve effect theoretically takes 2-3 quarters before we’re in the upper gradient.

“Primarily, our exports are primary materials without ample exportable surplus.

The government has recently reduced duties on imported raw materials, offered regionally competitive gas and energy prices, that should markedly push exports into double-digits,” he added.

He criticized the policy of bolstering exports via devaluation and termed it ‘foolish’ since international buyers will immediately ask for more discounts.

Mr Soomro urged the government to improve the skill-set of human capital by offering apprenticeship programs akin to those enacted by Germany and South Korea to truly enhance the knowledge-intensive manufacturing base.

When asked about Pakistan’s vulnerability to acute changes in global oil prices and the increase could impact the governments plan to curtail the import bill and if the deferred oil payment facility may provide a cushion, Mr Soomro said, “Deferred oil price facility is absolute in nature, not volume based. So, the increase in oil prices would definitely eat up the cushion earlier than expected.”

He explained that higher oil prices equate to lower credit facility as a percentage of total oil imports.

According to Mr Soomro, if prices of Arab Light crosses $80 today, the government would be seriously cash/dollar strapped and would find it difficult to introduce pro-growth economic for next one to two years.

Moreover, he believes these “external vulnerabilities” would derail the investment case and the only way out is the hard-earned globally integrated economy with a truer accumulation of forex reserves; exports, FDI and remittances.