Crude oil plunged on concerns the global economy would weaken further after President Donald Trump ended a tariff ceasefire with China. The president said additional tariffs of 10% on the remaining $300 billion in Chinese goods would be added in September.

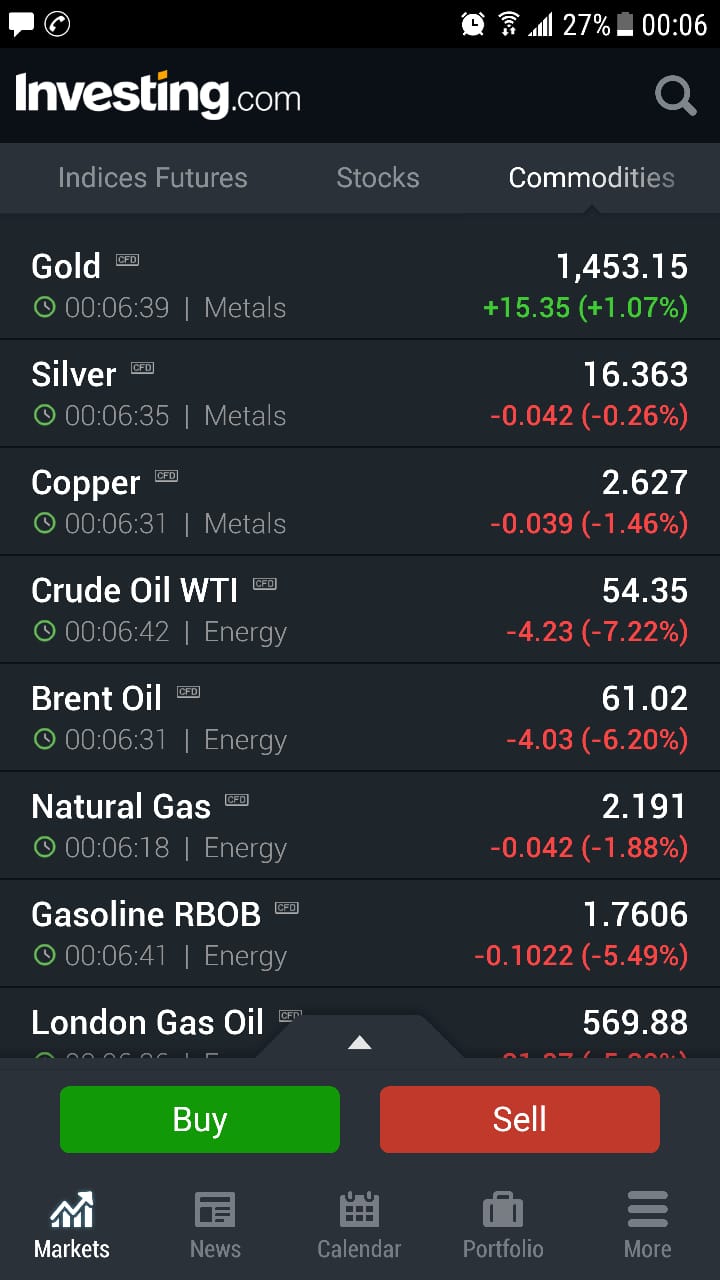

Brent crude futures LCOc1 slumped more than 7% on Thursday, their steepest drop in more than three years. U.S. West Texas Intermediate (WTI) crude futures CLc1 fell nearly 8%, posting its worst day in more than four years,

The collapse ended a fragile rally built on steady drawdowns in U.S. inventories, even as global demand looked shaky because of the trade dispute.

“Trade talks are continuing, and during the talks the U.S. will start, on September 1st, putting a small additional Tariff of 10% on the remaining 300 Billion Dollars of goods and products coming from China into our Country…We look forward to continuing our positive dialogue with China on a comprehensive Trade Deal, and feel that the future between our two countries will be a very bright one!” Trump said in a tweet on Thursday that triggered international tensions and the fear of a trader war and global oil recession.

Although the trade war with China has been going on for over a year, in May, President Trump hiked tariffs to 25% from 10% on $250 billion in Chinese goods. China immediately retaliated with tariffs on U.S. goods.

Trade talks resumed this week in Shanghai and although the White House called the talks “constructive” Trump said “sadly, China decided to re-negotiate the deal prior to signing” which caused him to impose new tariffs.

Earlier on Thursday, oil was down because the Federal Reserve dampened hopes for a string of interest rate cuts. The Fed lowered interest rates 25 basis points on Wednesday but did not signal it was entering a deep easing cycle.