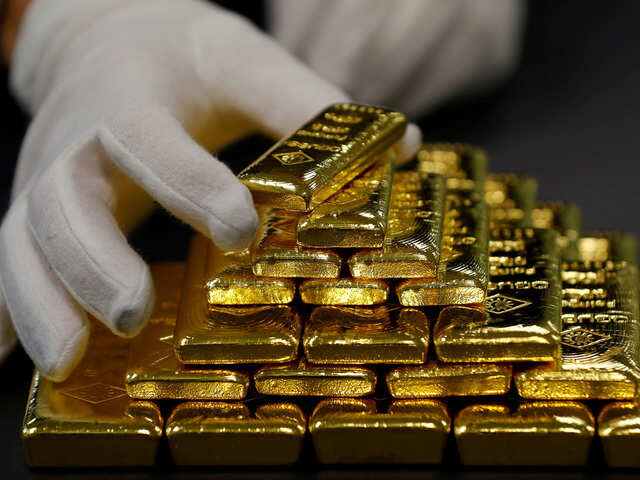

KARACHI: Domestic gold price hit a new record peak of Rs88,300 per tola and Rs75,703 per 10 grams, up by Rs950 and Rs815 as compared to rates prevailing on Aug 10.

The All Sindh Saraf Jewellers Association (ASSJA) attributed the fresh hike in rates to increase in world gold price by $16 per ounce to $1,514.

Gold trading remained suspended from August 12-14 on account of Eidul Azha holidays.

Jewellers said gold prices are going up owing mainly to rising world prices while rupee-dollar parity had not shown any big fluctuation for the last few weeks.

Internationally, gold extended gains on Thursday after climbing 1 per cent in the previous session, as concerns that an inversion in the US government bond yield curve was signalling recession fuelled interest in the metal as a haven from risk.

At the day’s peak of $1,523.91, gold was back to within $11 of Tuesday’s six-year high, hit on fears of a global downturn as investors fretted over a US-China trade war, unrest in Hong Kong and a slide in emerging-market assets.

Spot gold was up 0.2pc at $1,519.71 per ounce by 09:46 GMT, while US gold futures were up 0.2pc at $1,530.60.

The slide in government bond yields has been an alarming signal in terms of recession fears, said Norbert Ruecker, head of economics and next-generation research at Julius Baer.

“The overall uncertainty from the trade dispute is high and we also expect some central bank action for recession-fighting to come over the next weeks and months,” Ruecker said. “This should support the gold price at current levels.”

The US yield curve was inverted for a second straight trading session on Thursday. The yield curve inversion, which has historically signalled a looming recession, triggered an extensive flight to safety.

World shares held at 2-1/2-month lows, though Wall Street was set for a firmer open as investors bet the US Federal Reserve and other central banks would respond strongly to recession warnings emanating from bond markets.

On the trade front, senior US officials on Wednesday said China has made no concessions after Washington delayed tariffs on some Chinese imports, the latest sign that the trade saga is going nowhere.

Spot gold has gained over 8pc, or more than $100, since the beginning of the month amid the heightened trade tensions and a slew of disappointing economic data globally.

“We think gold could rise to as much as $1,580-$1,600 over the remainder of the year we think risks are skewed to the upside and would not rule out a temporary breach of the upper end of that range,” analysts at UBS said in a note.

Markets are awaiting US retail sales data due later in the day, which could further hint at the strength of the world’s largest economy.

Indicative of investor interest, holdings of the world’s largest gold-backed exchange-traded fund, SPDR Gold Trust, rose 0.9pc to 844.29 tonnes on Wednesday.

Elsewhere, silver rose 0.3pc to $17.26 per ounce.

Platinum dipped 0.1pc to $839.33 an ounce and palladium was 0.1pc higher at $1,425.77.