It is an industry in which it is the dominant player, and one where demand from industrial customers currently exceeds domestic production capacity. Yet Lotte Chemical Pakistan wants to wait for the purified terephthalic acid (PTA) industry to expand significantly before it invests in capacity expansion, according to its management.

During an analyst briefing announcing the details of the company’s financial results for the third quarter of calendar year 2019, Lotte Pakistan’s management said that they could only justify investments in capacity expansion if they could increase capacity to 800,000 tons, up from the current approximately 500,000 tons that their plant based in Port Qasim can produce.

Purified terephthalic acid (PTA) is an essential raw material used in the production of polyester fiber and polyethylene terephthalate (PET) plastic bottles. Lotte Chemical Pakistan Ltd considers itself a world-class supplier of PTA. A trendsetter in industrial investment in Pakistan, Lotte’s PTA plant was constructed in 1996/97 and started production in June 1998.

The company began its existence as a subsidiary of ICI Pakistan in 1995, before being spun off as an independent entity in 2000 named Pakistan PTA. In 2008, AkzoNobel, the Dutch chemical giant bought ICI worldwide, and briefly became the parent company of Pakistan PTA. In September 2009, the company was bought by the South Korean conglomerate Lotte, following which the name of the company was changed to its present name.

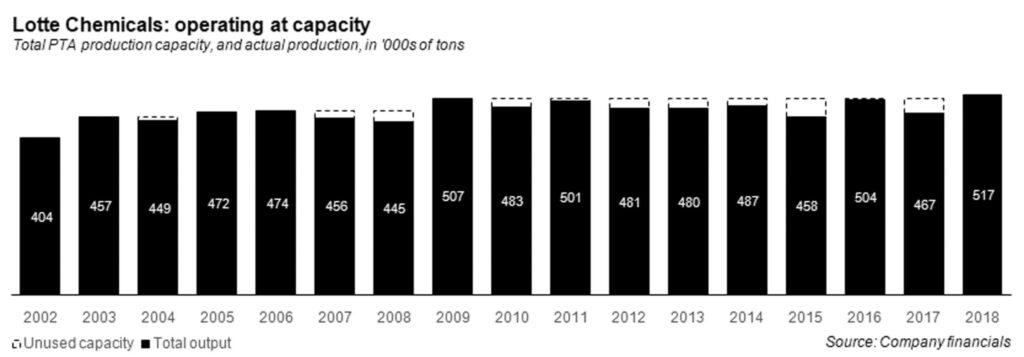

Last year in 2018, the company managed to produce at more than 100% of capacity, turning out 516,000 tons of PTA, despite their declared maximum capacity of 506,000 tons. One would assume after hitting this mark, the company would want to go only forwards, and in fact consider expanding their capacity and taking over some of the share that imports hold on the PTA market.

“Pakistan’s current PTA demand hovers around 800,000 metric tons where Lotte Chemical’s has a capacity of 500,000 tons and the rest of the demand is being met by imports,” wrote research analysts at BIPL Securities, a securities brokerage firm, in a research note issued to clients on November 22.

“As per the management, future PTA expansion depends primarily on demand growth and downstream expansion of polyester staple fiber (PSF) and filament yarn market that are currently operating at 79% utilization level,” wrote the BIPL analysts. “Currently, the company does not have any plans for expansion, however, should the demand for PTA crosses 1 million tons, Lotte would expand by 800,000 (at an estimated cost of $400 million) which would take the cumulative rated capacity to 1.3 million tons per annum.”

However, while the company is not yet ready to leap into an expansion, there does appear to be room for optimism for the PTA industry, which has seen demand increase over the past three years, particularly from textile manufacturers.

“Demand for PTA increased notably during 2015-2018 owing to improved power supply to textile customers of Lotte (75% of the total customer base). This was also reflected through improved an polymer operating rate (capacity utilization of textile customers) from 69% in 2015 to 89% in 2018. However, the operating rate is expected to reduce to 79% during the current year,” wrote Muhammad Nabeel, a research analyst at Pearl Securities, a brokerage firm, in a research note issued to clients on November 22.

The reason Lotte is citing for the slowdown in demand in 2019 is the implementation of the new computerised national identity card (CNIC) requirement for buying product above a transaction value of Rs50,000, which has hampered the ability of informal traders and unregistered manufacturers to buy their product.

According to Lotte, the reason they will be closing the year at under 500,000 tons of production in 2019 is that the new CNIC requirement has meant a fall in demand of PTA, especially in the Punjab, which was easily their largest market.

Nonetheless, the company management of Lotte Pakistan is confident that the company would regain 100% capacity come next year in 2020. However, this is still not indicative of the expansion that the government would like to reduce the imports that are making up for the remaining demand at the moment.

But with the CNIC regulations set to take full effect in February 2020, along with the company setting aside Rs5.0 billion for GIDC provisioning, and the company’s Port Qasim plant set to be closed for maintenance for 15-20 days in March 2020, the road ahead may be not necessarily bumpy, but is also not conducive to the expansion that the government would desperately love to spruce up their numbers.

Meanwhile, the company does expect margins to improve somewhat over the coming calendar year. “The management expects PTA margins to improve from existing $90 per ton to $110-140 per ton during 2020,” wrote Nabeel.

The trade war between China and the United States is certainly not helping stability of PTA prices. Lotte management believes that regional prices of PTA have been unusually volatile over the past year owing to shifting expectations of the trade war between China and the United States.

China controls the bulk of global PTA production, and hence the industry in China effectively sets global prices. When demand from China is expected to decline, prices for PTA would decline as well. However, if the US is expected to continue buying PTA and polyester fiber from Chinese manufacturers, then PTA prices would expect to rise.

Given the volatility in US leadership on the issue – with tweets from US President Donald Trump moving markets on practically a moment’s notice – global markets have faced considerable uncertainty, optimistic one moment and pessimistic the next.

That sort of mercurial temperament from the US president has far-reaching consequences for the global economy, including for manufacturers in Pakistan, such as Lotte, and investors in publicly listed companies such as Lotte and others that are dependent on global prices affected by the US-China trade war.