A customer described to Profit a typical way insurance is sold in Pakistan. He walked into his main bank branch for unrelated work regarding his bank account. After wrapping up his work, an agent walked up to him about a ‘saving investment scheme’. The agent made a pitch about getting high returns after a few years, after depositing a sum of Rs200,000. The customer thought it sounded like a good idea, and was also told that, by the way, this comes with some insurance benefits.

The customer also assumed the agent was a bank employee, and went along with the scheme, as after all, he trusted his bank. He was told, again in passing, that he might not be able to access that Rs200,000 sum for a few months, but this was not made super clear to him. This would become a problem, because a few months later, during a financial crunch, he asked to get his money back. Whoops – that money was actually stuck in a life insurance scheme, and he would have to wait five years to access it.

Almost everything about this anecdote is typical of how insurance is sold – that is, it is not sold as insurance. In fact, it is sold as an investment vehicle.

Therein lies one among the many problems facing the insurance sector in Pakistan: the industry does not know how to sell its own product and has hence routinely relied on providing misleading information to its customers and highly skewed incentives to its employees and distributors.

This embellishment of the truth that can often veer into outright lying on the part of some insurance salespersons is unlikely to do the industry any favours in a country where the overwhelming majority of people have never even considered getting insurance for themselves for any purpose.

We do not say this lightly. But it is a fact: that the penetration of the insurance industry in Pakistan is absurdly low, even when compared to other countries with similar per capita income. In 2019, the insurance penetration in Pakistan was at 0.9% of the gross domestic product (GDP, or the total size of the economy). This is much lower than India’s penetration, at more than 3.6%, the region’s average of 2.2%, the emerging markets average of 3.2%, and the global average of 6.3%. Before one despairs, that figure is still a massive improvement on what it was previously: in 2012, it stood at a measly 0.67%.

Which leads to the obvious question: what happened? Why are we struggling to insure 200 million Pakistanis? And whose fault is this? This, primarily, is a story of nationalization, lost time, lazy selling, and desperate attempts to change how Pakistanis change their spending habits (and that is harder than you think).

History of insurance in Pakistan

In the great annals of insurance ads (bear with us), the ad ‘Ae Khuda Meray Abu’ from the 1980s has achieved some kind of cult gold status. It is included in the kind of YouTube suggestions for ‘PTV nostalgia’ or ‘old evergreen ads’, the kind featured in boomer longing for purana Pakistan.

In the ad, a 10 year old, complete with barrettes, clasps her hands and sings ‘Ay Khuda mere Abu, salamat rahay’ (Dear God, keep my father safe). The reason for her joy: turns out the very mustachioed Pakistani-looking father has bought an insurance policy. The daughter then hugs her beaming parents and the ideal, insured Pakistani family go out on a family outing on a paddle boat. Reminiscent of old wedding videos, the daughter’s head then floats about on the screen, still singing, along with a rotating State Life logo. The final frame freezes on the paddle boat, and the voice over reminds us: “the guarantor of your future: State Life.”

Almost every source Profit contacted for this story asked if I remembered this iconic ad. [Aside: I did remember it, only because it was my parents who discovered it again on YouTube – thanks “PTV nostalgia”]. But Profit asks you, the reader, if you remember this ad, because here is what we posit: that this ad was the last innovative thing that the insurance industry of Pakistan ever accomplished in marketing before resorting to outright misinformation.

The two biggest insurance players in Pakistan have traditionally been EFU Insurance, and Adamjee Insurance. EFU was set up in 1932, by businessman Ghulam Mohammad in Calcutta, with financial assistance from the Aga Khan III and the Nawab of Bhopal. The company then switched over to Pakistan after Partition. Meanwhile Adajamjee Insurance was set up in 1960, by the industrial family of the Adamjees, whose conglomerate has existed since 1896.

Now back to that ad, commissioned by State Life. Today, State Life insurance is the largest life insurance company in Pakistan. But it was not always that way. In 1972, 32 insurance companies were forcibly nationalised, and folded into one State Life Insurance under Prime Minister Zulfikar Ali Bhutto and PPP’s nationalization agenda.

EFU then operated solely as a general insurance company, and was subsequently renamed EFU General Insurance Ltd. Today, the company is owned by the JS Group.

The state of affairs would stay this way, until 1992, when private insurance players were allowed back in the game, under then Prime Minister Nawaz Sharif, and his privatisation process. This allowed for players like Jubilee Life Insurance, which was incorporated in June 1995. The company is a subsidiary of the Aga Khan Fund for Economic Development.

Today, Pakistan has 36 insurance companies, of which seven are life insurance companies. Those seven life insurance companies have a disportionate hold on the entire industry, accounting for around 63% of total gross premiums. The total size of the industry is Rs308 billion.

The three major companies – EFU Insurance, Adamjee Insurance (which is now part of the Nishat Group, the conglomerate owned by Mian Muhammad Mansha) and Jubilee – have maintained a quasi triopoly on the market.

Among life insurance, the largest player is State Life with a 50% market share, followed by Jubilee Life, then EFU Life, and then Adamjee Life (a subsidiary of Adamjee Insurance). In the general insurance, or non-life insurance space, Adamjee dominates with a 26% share, followed by EFU General Insurance at 24%, and Jubilee General Insurance at 12%.

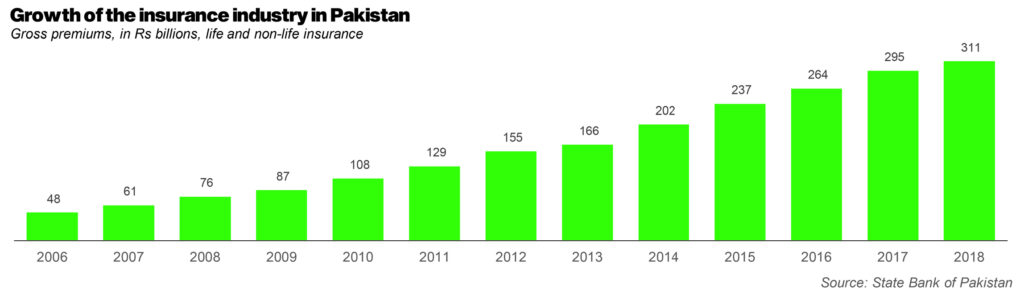

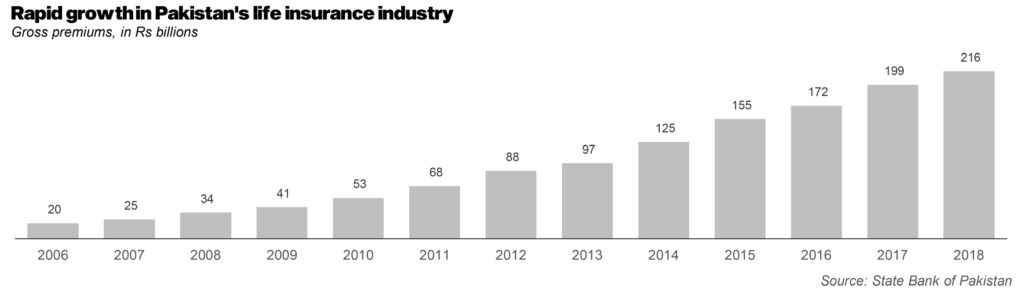

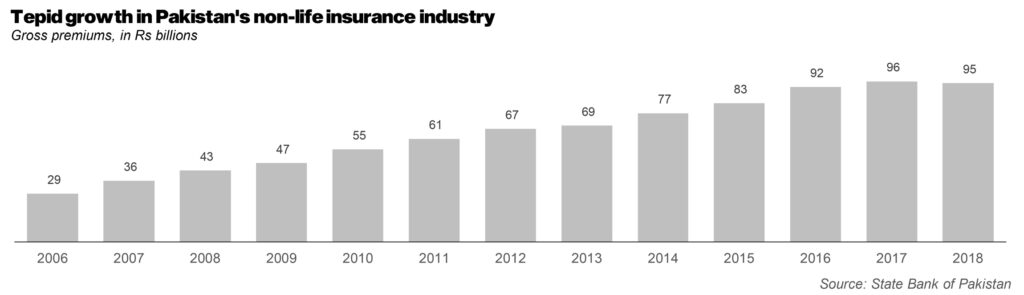

Despite the low penetration rate, on the bright side, the gross premiums of Pakistan’s entire insurance industry has a five-year compounded annual growth rate (CAGR) of 17.7%, from Rs136.3 billion in 2013, to Rs308 billion in 2018. Life insurance has a CAGR of 17.5% while non-Life grew at a relatively lower CAGR of 9.6%.

According to Nilofer Sohail, assistant general manager at EFU Life, and head of digital initiatives there, it is a miracle that these three companies even exist to begin with.

“These companies basically started from nothing, around 1994, to grow into what they have become today,” she says. Consider: State Life has a network around 80,000 to 90,000 agents across the country. EFU has only 7,000, Adamjee around 1,000 and Jubilee around 4,000. According to Sohail, that stark contrast in numbers can be attributed solely to the lost years of nationalisation.

But the insurance industry has also grown in fits and spurts. Since the 1990s, there have been two big ‘nudges’. The first nudge happened in the early 2000s, when bancassurance as a concept really took off. Bancassurance is when a bank and an insurance company form a relationship to offer insurance products to the bank’s customers, and split the commissions.

Sohail says the advent of foreign banks in Pakistan, like Standard Chartered and ABN Amro, had successfully introduced the concept in other markets, and decided to try it out in Pakistan. It was wildly successful. Consider that bancassurance accounts for 88% of gross premiums in Jubilee, 90% in Adamjee Life, and 60% in EFU Life.

The second big ‘nudge’ happened in the late 2010s, and is continuing to this day. This is when microfinance banks really took off, and the State Bank of Pakistan (SBP) and the Securities and Exchanges Commission of Pakistan (SECP) both heavily pushed digital payments as a solution.For decades, insurance companies had been targeting, middle income and above.

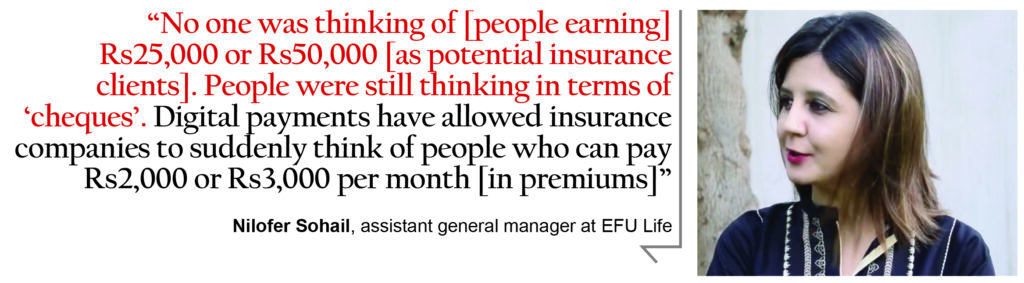

According to Sohail, that meant those earning around Rs70,000 to Rs80,000 a month. In the last three years there has been a definitive switch. “No one was thinking of Rs25,000 or Rs50,000,” says Sohail. She says people were still thinking in terms of ‘cheques’. Digital payments have allowed insurance companies to suddenly think of people who can pay Rs2,000 or Rs3,000 per month, and in some cases, like EFU’s partnership with Easy Paisa, as little as Rs1 or 2.

The challenge is not necessarily innovation – almost every company is trying out new and interesting ways of selling insurance. The problem is that the main channel through which insurance is sold – third party agents at banks – needs to be broken.

Mis-selling

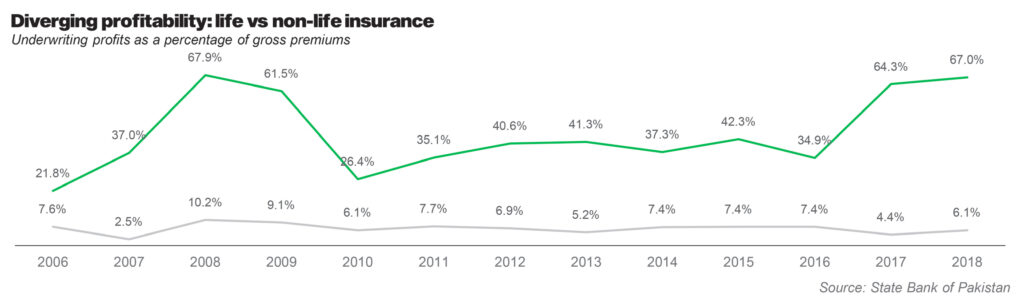

Look back at the earlier split of the insurance industry – almost 63% is dominated by life insurance, while the remaining by general insurance. In developed markets, the inverse is true – life insurance is a minority. But Pakistan, like other emerging countries, continues to rely on life insurance.

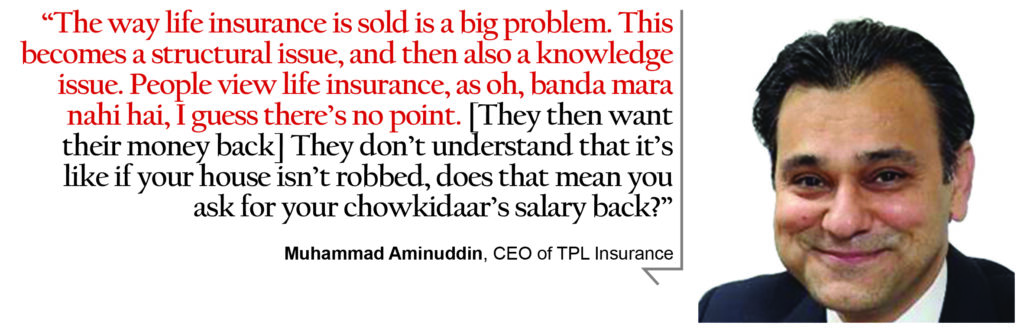

For Muhammad Aminuddin, the CEO of TPL Insurance, the way life insurance is sold is a big problem. “This becomes a structural issue, and then also a knowledge issue,” he says.

Because people are not informed of how insurance works, they often begin to view insurance as something that will give returns, with insurance as a side benefit, as opposed to what it actually is – a way of mitigating risk.

“People view life insurance, as oh, banda mara nahi hai, I guess there’s no point. [They then want their money back] They don’t understand that it’s like if your house isn’t robbed, does that mean you ask for your chowkidaar’s salary back?” says Aminuddin.

Industry sources say the problem of mis-selling is rampant. The problem has nothing to do with education level, or socioeconomic level. One insurance executive said he had both his finance friends come up to him, to his driver’s sister, whose money was stuck in a similar insurance scheme for three years.

And it almost becomes like a chicken and egg problem: bank agents sell insurance in this mamner to customers, who then believe the lie of (insurance = investment), who then do not buy or understand other types of insurance, so insurance companies continue to sell insurance as if its an investment in order to make sure customers still buy it – and so on ad infinitum.

This can lead to a trust deficit. Because customer’s money is stuck in insurance, they also are less inclined to tell their friends or family about buying insurance, instead viewing the entire industry as a nuisance.

So why do banks and insurance companies go along with it? Well, because the commissions are extraordinarily high, touching 55% of total premiums in some cases. This stands in contrast to commissions in other countries, which are considerably better regulated, with some markets having commissions restricted to even 5-10%.

So mis-selling is common because it does not really affect profits, it allows insurance companies to be replaced, and it allows this bancassurance system to remain unchallenged, and in some cases, uninnovative.

To be fair, the SECP has recently become aware of this problem in the last two to three years. According to Sohail, every agent must now call back customers and ask seven or eight scripted questions about whether the customer has understood the terms of the insurance product. These also now include several references to the fact that money might be stuck in the insurance products for some years, before it can be accessed.

“The complaints ratio has now fallen to 1 to 2%,” claims Sohail, saying that was a normal rate for any industry.

Cultural norms and awareness

Before the interview with Sibtain Jiwani, the founder of insurance startup Smartchoice, even began, he asked: “Do you have insurance?” I did not. But I am not unusual, as Jiwani pointed out, because not only did I not have insurance, but neither did my friends, nor my cousins, nor had it ever been a family topic of discussion. This is emblematic of the typical Pakistani experience: insurance as a conversation or a feature of our lives simply does not exist.

The problem with insurance companies is not just their lazy attitude towards getting profits. They also did a lousy job of advocating for insurance. And they desperately need to, if they are ever going to combat how Pakistanis view protecting themselves.

“India is not really a comparable market,” says Aminuddin. “The savings abilities of India is much higher whereas Pakistanis are very ‘live it up, don’t’ worry about it. We are a very consumption-based economy”.

That attitude plays into how we view the future. “There is no awareness of risk mitigation, and therefore it is faith-based. Our idea of insurance is a kala dhaga, and the Ayat ul Kursi,” he says drily.

This is unfortunate, because events such as the COVID- 19 pandemic have shown how crucial insurance can be in solving financial challenges. “When you have health insurance, you don’t have to raise money from your mohalla, or bemoan and say you are destitute,” said Aminuddin.

Jiwani also brought up India as a comparison. “India is way ahead of us in terms of financial literacy, and there is also a lot of domestic travel for work within the country,” says Jiwani. As more and more young Indians settle in different cities, they often have financial responsibilities thrust upon them earlier in life.

Jiwani, who is in his mid-30s, said he did not think really about managing money or a household until he was 28. “Financial responsibility comes a lot later in Pakistan,” he says, which explains why people simply do not factor in insurance, whether that is life, house or car.

Jiwani is hopeful that this attitude is changing, as more young Pakistanis are self-employed and working as freelancers, and typically even have some money saved on the side during university. But are insurance companies thinking of reaching out to a new generation? And what if they were just forced to?

The government’s role to play

A lot of insurance companies’ lives would be made a lot easier, if it was simply mandatory to buy insurance. That would automatically increase the number of Pakistanis insured – and it would solve the problem of Pakistanis not knowing what insurance exactly is.

Pakistan is unusual in many ways for not mandating insurance for large purchases. Take car insurance for example. It is not just the fact that car insurance is not mandatory in Pakistan – it is the fact that up until 15 years ago, the industry barely existed. As Aminuddin describes, the motor insurance industry came about, again, because of a ‘nudge’. In the turbulent Karachi of the mid 2000s, carjacking was on the rise, and companies like TPL Insurance sought to sell motor insurance.

The regulator could easily make this mandatory, but chooses not to. “The legal infrastructure is there, but the implementation has been lacking,” according to Aminuddin. “NADRA has the single largest database at its fingers – enforcing it would be a breeze – but it’s about priorities.”

Jiwani says it could be easy to make car insurance mandatory, as it already is in India and the UK. “Every time you buy a car you have to have third party insurance,” he says,” You could pay Rs2,000, Rs3,000 per month for third party insurers – not only do you protect citizens from accidents, but you could get more people involved in insurance.”

For Jiwani, the net spillover effect is very real. “You’ll get people in the mindset of insurance. If an insurance company is paying for damages, then road par fazool jhagray will stop happening.”

That spillover effect could happen at the workplace, for instance. If the government mandated that all employers must provide their employees health insurance, then it would become a social responsibility. If an employee can see the benefit of receiving insurance when someone else is paying for it, he or she might be incentivised to then consider buying life insurance for their family. “You can alway bring more people into the insurance ecosystem, but you have to give them a reason”, says Jiwani.

If the plan is so great, why has the government not done it yet? According to Sohail, for the last few years, the SECP has annually gone to the Ministry of Finance to ask them to consider changing insurance laws. And every year, the answer is the same – the government of Pakistan is concerned about burdening the taxpayer. In a country as poor as Pakistan (so the government’s thinking goes), can Pakistanis afford to pay insurance premiums?

The future

So what does the future hold for the insurance industry, if government-mandated insurance is not on the cards yet? Well, that depends. For some, the future of insurance will be defined by insurance companies aggressively pursuing the consumer sector, in an attempt to get maximum coverage. So far, non-life insurance companies had been courting corporate clients. That is set to change.

Or perhaps the future will look a little like what Jiwani is attempting with Smartchoice. The insurance startup, only a few years old, serves as a comparison website for different insurance products and policies. Smartchoice has partnered with 10 different insurance companies, and customers can buy different types of insurance by simply comparing different policies. The agent in this scenario becomes obsolete.

“Insurance companies are coming to the realisation that alternative channels exist, that you can make innovative products which are bitesize,” says Jiwani. “More millennials are entering the workforce, and saving and investing money – insurance can help in protecting your future from uncertainty.”

To get there though, might be a bit of an uphill struggle. Pakistan’s insurance industry will have to finally get on the digital payments bandwagon, stop their overreliance on agents, and spend extra time and effort educating their customers. The days of “Ay Khuda Mere Abbu’ should finally be left behind.

same happened with me

Jubilee do take digital payment.they also lie in regards to the policy return. They told me if I deposit 4 lak every year for 5 years. Once the 6th year begins I can withdraw double the amount i paid in. Thay was false.as now their saying I have to make the payments for 5 years,and can withdraw double the amount after 10 years.

And I was also told that I’d have to wait till I’ve made 2 payments if I wanted to withdraw the money. If I withdrew the money before 5 years I would only get my investment and 20 percent.wich was a lie as I tries to cancel after 4 years.theyve said u can only have 12 lak out of the 16 lak you’ve paid. Jubilee mis sells you policies.now I’ll wait till the 6th year begins and if I dnt get my money I’m going to kick some jubilee staffs teeth in

7% a year return will double your money over 10 years. you can easily get 7% just by putting your money in a common bank savings account. problem is inflation is even higher than 7% so your real returns will be negative. basically it’s very hard to get real returns in pakistan. even fixed deposit products barely pay out 1-2% over inflation and that inflation is for an average basket of goods. your consumption pattern may differ.

Life insurance basically is a protection plans, purely protection plans. But there are separately protection plans available. Insurance is itself not bad idea to invest. But people don’t know which plans is better for them. Even no body educate them about proper insurance. So kindly if any one need to buy life insurance make sure he or she knows about what insurance and how it works. There are term and conditions, surrender charges, unit allocation charges, Admin charges, people don’t have time to read to study about charges funds. In Pakistan who ever buy life insurance totally depend on the insurance advisor. That’s the reason they loses their money. First read, understand about the insurance which and what type of insurance you need to buy. Then go for it. Thanks

Sir you are the first who did good job

You’re talking about investing a lump sum amount, however, with these insurance policies, you pay a certain amount annually or semi-annually, which brings into account the time value of money.

Additionally, I think at the end of the day, if you don’t understand what you’re buying or investing in, then you’re at fault. Life insurance policies are protection policies, first and foremost, however, you can use them as an investment vehicle but it is most profitable if you ride out the whole policy period by making regular payments.

these policies are just sold to earn commissions and incentives, all investment made in funds which are also managed by same companies which again get fee on managing the fund. If fund not performed well the customer has to suffer not the companies and there commission partners. The unit link system is made to protect the companies stake rather in benefiting customer. In last year due to BAD Performance of fund many policies didn’t achieve break-even after paying 6 to 7 years regular premium with only 4 to 5 premium multiple coverage. In this scenario companies are making huge profits as fund performance will only effect customer savings. Further death coverage or life insurance benefit is not much attractive when he or she only get 10 times or less then 10 times coverage of the premium with all other conditions written in insurance agreement signed by person at the time of buying. There are many products which can provide life coverage by paying less then these polices which has huge commission (100%) over the term of policies.Companies are making huge profits by earning fee and insurance income. There should be strict regulation regarding fund and commission (should reduce to 10 %) of sellers.the regulator is only focused on sales process and after sales service not on the product benefits or commission structure. there should be strict regulation like Mutual Fund industry where spreads are lower.on the side state life has a conventional method of policies which are much greater protected then these private sector.

Askari life assurance ltd is best company which offered more than 12% return.I have jubiiee life ploicy after 8 years i am not at break even so its my personal expreince right now Askari life assurance is best available option in Pakistan.

where is the active life insurance offered by IGI. How can this article skip my insurance which I have bought from and I am a customer of Vitality offered by IGI Life Insurance and I know what kind of changes it is bringing within the insurance sector of Pakistan. I think you shoudl have taken that into considerate as well. Keeping me fit and healthy with Vitality app and secures my family’s future..

State life is the best all of compniys

Haram hay yeh sub

There should be much more transparency, regulation on post-sale support and protection of consumer benefit/rights and fee caps for insurance companies and their fund management.

Exact same thing happened to me, i was told in 10 years i will get Upto 3 times the money depending on the company’s performance.