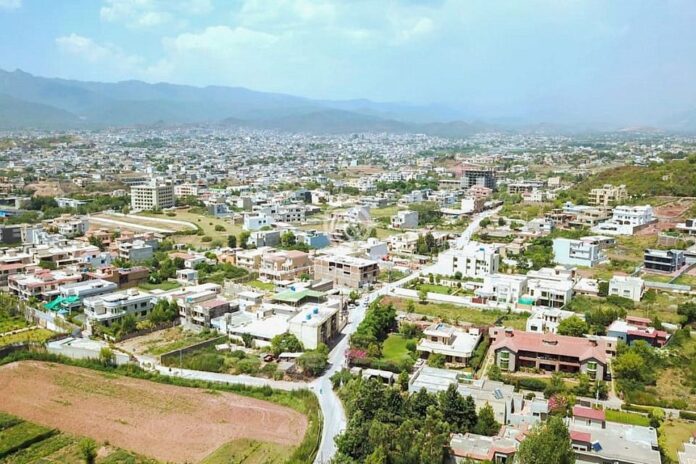

ISLAMABAD: The federal government is considering imposing a luxury tax on houses located within the limits of Islamabad Capital Territory (ICT).

According to sources privy to this development, there shall be a luxury tax levied on ICT properties belonging to different categories (areas).

In the residential category, sources said that Rs100,000 tax would be levied on 2-4 kanal houses having a covered area of more than 6,000 square feet, while Rs200,000 tax has been proposed for 5 kanal or above houses with a covered area of over 8,000 square feet.

Meanwhile, in the farmhouse category-I, sources said that there would be no tax on a four-kanal property. However, an annual tax of Rs25 per square foot (covered area) has been proposed for farmhouses having a covered area between 5,000 to 7,000 square feet.

Likewise, Rs40 tax per square foot has been proposed for farmhouses with a covered area between 7,000 to 10,000 square feet, while Rs50 tax per square foot has been recommended for farmhouses having a covered area of over 10,000 square feet.

In the farmhouse category-2, sources said that there would be no tax on a four kanal property but an annual Rs60 per square foot tax has been proposed for farmhouses with a covered area between 5,000 to 7,000 square feet.

Meanwhile, Rs70 tax has been recommended on farmhouses with a covered area between 7,001 to 10,000 square feet and Rs80 tax on farmhouses with a covered area of more than 10,000 square feet.

Sources said the above-mentioned taxes shall not be applicable on houses occupied by widows, adding that the ICT’s Excise and Taxation Department has been tasked to collect the said tax in a prescribed manner.

Totally absurd. What about inherited property?

How about checking ongoing corruption, for a change?

What about current and retired government servants living BEYOND THEIR MEANS?

Inherited properties should never be taxed that way unless the same were procured using illegal means in the first place.

Usually, however, people who inherit such properties may be working hard to make ends meet. Taxing them further may mean exposing them to further stresses in a society that, quite literally, supports illegal practices in trying to earn a living.

At the very top of such attitudes are those running the government departments. Very unfortunate, but very true!

Dear concern !

I desire to know the price for plot of different size alongwith exact location n oblige