The beginnings of the microfinance sector in Pakistan can be traced back to the very earliest rural development projects funded by donors. As a category, microfinance are financial services that target individuals and small businesses who lack access to conventional banking and related services.

Microfinance is a classic method of uplift in low-income and rural communities. Not only does it inject investment into these areas, it does so in small doses and directly to the local community. What many may not realise is that microfinance as it is known today started in Pakistan and was the result of a collaboration between Pakistani social entrepreneur Akhtar Hameed Khan and the United States Agency for International Development (USAID). The first program they ran was called the Comilla Model, which started in 1959, on the outskirts of Comilla, East Pakistan (now Bangladesh).

Following the 1971 war, microfinance in Pakistan took a backseat until it was revived by the Aga Khan Foundation, which launched the Aga Khan Rural Support Programme (AKRSP) in 1982 to help improve the quality of life of the villagers of Gilgit-Baltistan and Chitral.

Akhtar Hameed Khan himself had not given up on the idea either, having worked to help launch the Orangi Pilot Project in Karachi, also in the early 1980s, which sought to help alleviate poor living conditions in a working class neighborhood in Karachi and among the tools it utilised was microfinance.

As international focus and funding grew, the importance of using microfinance to uplift rural areas steadily grew in Pakistan during the 1990s. Other Non-Governmental Organisations (NGOs) replicated the model of the AKRSP all across Pakistan. This would eventually become a major driving force for the establishment of specialized microfinance institutions in the formal sector: microfinance banks (MFBs).

Profit, sat down with Ghazanfar Azzam, the Chief Executive Officer (CEO) and Chairman of Mobilink Microfinance Bank, which claims to be Pakistan’s largest digital bank with 20 million registered and 7 million active users, to talk about the future of microfinance banking in Pakistan, and how telecom company-based branchless banking is becoming a game changer.

The first steps of microfinance in Pakistan

The entire decade of the 1990s would go by, and it would not be until 2000 that the Khushhali Bank Ordinance was issued under the Musharraf Administration, establishing Khushhali Bank, Pakistan’s first specialised microfinance bank. The ordinance was fast followed by the 2001 Microfinance Institutions Ordinance, which paved the way for establishment of new microfinance banks in the country.

As Ghazanfar Azzam explains it, the ordinance is the cornerstone of MFBs and the microfinance sector in Pakistan, and regulates microfinance institutions, aiming to protect the interests of depositors and borrowers. The ordinance defines the area of operations for MFBs, capitalisation requirements, regulation and supervision conditions by the State Bank of Pakistan (SBP), and penalties to be imposed on MFBs in case of non-compliance with the ordinance.

The regulations allow the microfinance sector to provide financial solutions to low-income households – defined by the State Bank as people earning Rs500,000 a year (Rs41,667 per month) or less – or microenterprises that employ fewer than 10 people (including seasonal labour) and have a net income of Rs500,000 or less.

It is important to look at it closely exactly because microfinance in Pakistan has been touted by many as the solution for the financial problems of a vast number of working class people, and the most efficient way to empower poor, rural areas. By targeting small businesses and investors that want to form grassroots connections and establishments in their local communities, the microfinance sector has been aiming to financially include marginalised communities, and have achieved at least some degree of success in that goal.

In recent years, the branchless banking segment has enabled the government and other entities to reach large numbers of people and make payments with great ease and speed. This telecom-led branchless banking is the latest addition to Pakistan’s microfinance scene.

Over the decades, microfinance institutions in Pakistan have been a key factor in driving financial resources towards informal sectors, have improved the financial access for women, rural and ignored areas and populations, and increased the banked population of the country. They have also financially educated the people through their vast network. With the new telecom-based approach, these benefits could spread faster and wider than ever before.

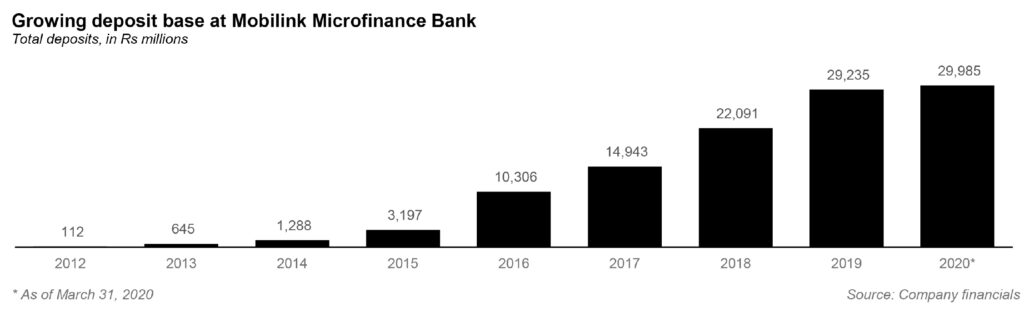

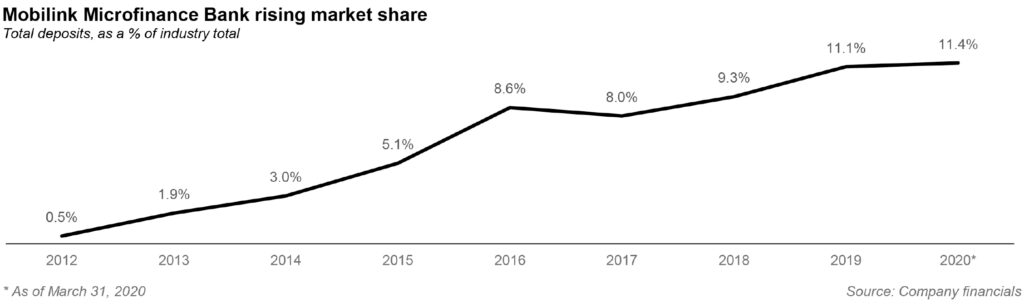

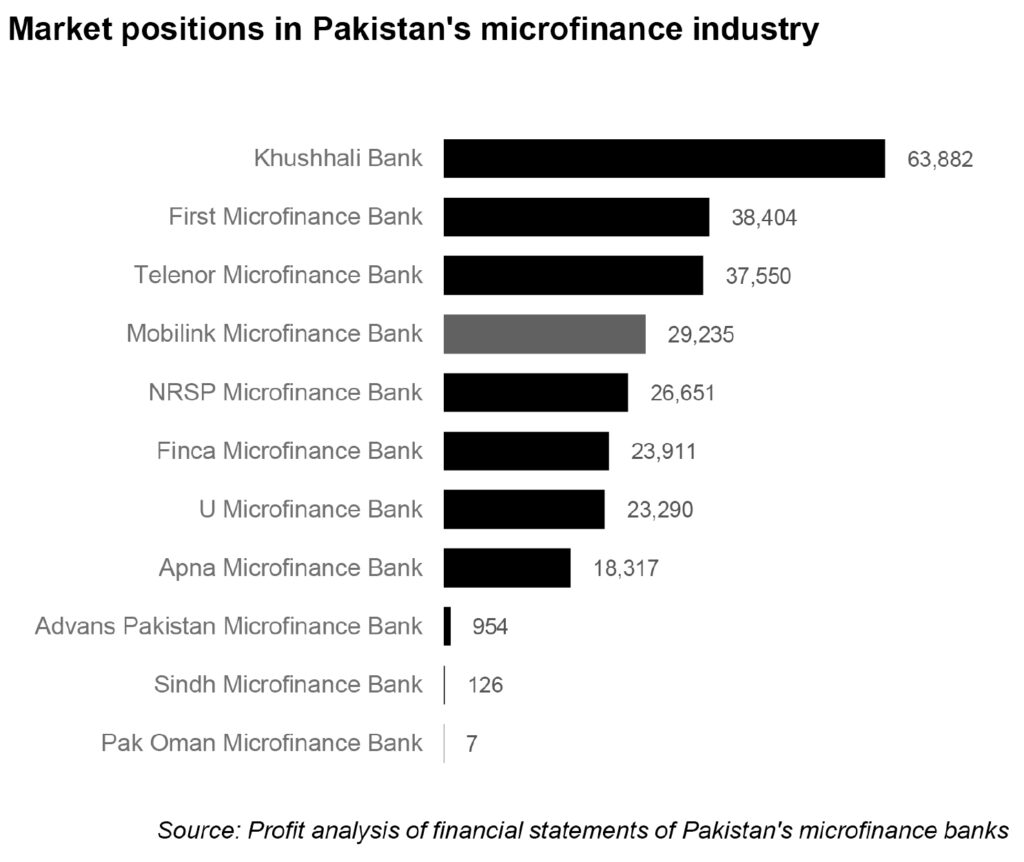

Microfinance in Pakistan now consists of 10 financial institutions, and three of those are backed by telecom companies: Telenor Microfinance Bank (Telenor Pakistan), Mobilink Microfinance Bank (Jazz), and U Microfinance Bank (Ufone). And since 2012, deposits for the sector have grown at an average of 41.5% per year, compared to an average of just 11.8% per year for the banking sector as a whole.

Yet, there is still a long way to go. As of March 31, 2020, the industry has an estimated deposit base of Rs263 billion, which is equal to about 1.8% of the mainstream banking industry’s deposit base. For context, Soneri Bank – the 15th largest bank in the country – has more deposits (Rs306 billion) than than the entire microfinance industry combined.

Mobilink Microfinance

Mobilink Microfinance Bank currently has 74 branches, and 91,000 branchless banking agents. Branchless banking essentially involves unconventional banking methods, in which financial services are provided not through bank branches, but through agents and relying on information and communications technologies to transmit transaction details – typically card-reading point-of-sale (POS) terminals or mobile phones.

The concept is fast gaining traction generally, but is particularly fruitful when it comes to microfinance banks, something that is clear in how Mobilink is planning to expand the number of banking agents they have out in the field. Backed by Veon, an Amsterdam-based global telecom giant, Mobilink Bank’s brick and mortar branches and branchless banking agents offer micro enterprise loans, micro housing loans, savings, domestic remittances, utility bill collection, mobile wallets, life insurance & G2P & B2P payments through a strategic alliance with Pakistan’s largest telecom operator Jazz under the umbrella of Jazzcash.

“On the branchless banking front, we plan to add 100,000 new branchless agents and we have now started our QR-code merchants for payments. While on the branch banking front we are going to double our branch number just in the year 2020,” Azzam tells us.

“We, here at MMBL, feel that considering the market dynamics of Pakistan we need to move forward both on digital and conventional banking fronts. As adoption of digital channels grows by our customers, the need for traditional or brick and mortar branches would decrease and eventually completely transformed into just digital.”

However, the focus on digital is a place where Mobilink Microfinance is a little ahead of the curve in Pakistan, or at least they claim to be, saying they are the largest digital bank in Pakistan. The metric they use for this claim is their over 20 million registered and 7 million active mobile wallet customers who can use their mobile wallet for basic banking services such as savings, money transfers, utility bill payments, receiving welfare payments, paying taxes and fees and buying airtime.

“A mobile wallet is basically a digital bank account and with the largest customer base in wallets, we can very justifiably claim to be the largest digital bank in Pakistan,” Azzam explains. “In recognition of our position in the industry, we were conferred with the Bank the Unbanked Awards in 2018 and 2019 in a row in annual banking awards by the Governor of the State Bank of Pakistan.”

This metric, while useful, needs some context: while Mobilink may well have a significant number of active users, by deposit mobilisation, it is the fourth largest microfinance bank in Pakistan, with Rs29.2 billion in deposits as of March 31, 2020, the latest period for which financial data is available.

One thing that Azzam is right about, however, is that traditionally in Pakistan, commercial banks have primarily focused on corporate, commercial and consumer banking segments from the very beginning. Micro entrepreneurs and farmers remained by and large unserved. The government tried to bridge this gap by establishing specialized banks like ZTBL & SME bank, but these institutions were not able to perform as per desired objectives. Small farmers in Pakistan still lack proper access to finance. While this is all disheartening to hear and think about, it is also an opportunity and a market, one that Mobilink seems ready to seize.

“We, at Mobilink Bank, saw this as an opportunity and focused our resources towards this segment. Our loan for small farmers called the “Khushhal Kisan Loan” has become our flagship loan and holds 52.62% share in total loan book. This loan does not need any physical collateral and is very easy to get. We also launched other loans like Livestock loan, Tractor loan and Passbook Loan for the same market segment and they too were well received and have been quite a success,” Azzam tells us.

The bank’s total lending book stands at Rs16.2 billion as of the end of the first quarter of 2020. Yet despite the relatively light lending conditions, Mobilink Bank’s loan portfolio appears to be largely healthy: the bank’s non-performing loan ratio is just 3.8%, much lower than those of most mainstream banks.

“Since the commercial banks generally don’t focus much on financing small businesses, State Bank of Pakistan has recently opened this space for selected microfinance banks in Pakistan. Mobilink Bank is one of those microfinance banks that have welcomed the opportunity and we consider MSME as a key growth segment in our future Business Strategy.”

Another very important and popular loan package that they have is targeted towards empowering women. Generally, microfinance is supposed to uplift not just the lower classes that usually would not have access to banking, but the marginalised within those classes. Their most popular programme for women is the ‘Bint-e-Hawa’ scheme. “Not only have we made the account opening process simpler, we also have waived fees and special saving rates are offered on this account. We also have hired female loan officers at our branches and have provided them the bank vehicles to go in the field and provide financial literacy to working women and help them get into the banking system for their financial needs,” says Azzam.

“Nearly 18% of our borrowers are females and we hope and accept this number to grow in future for more inclusive growth. There is a long way to go as far as female financial inclusion is concerned but we’re very happy that we are doing our bit and would keep adding more and more to it.”

Growth strategy

Ghazzanfar Azzam has a natural air of optimism that surrounds him. CEOs tend to project an air of confidence about their products and the abilities of their team and company, but Azzam exuded a real sense of hope. And with that hope comes a very aggressive growth and expansion strategy.

“With the population approaching 220 million, the 5th largest in the world, Pakistan is a land of opportunity and full of potential both in microfinance and branchless banking terms,” he says. “We have a very aggressive growth strategy and we believe we will continue to increase and improve our contribution in improving access to finance in Pakistan in a big way.”

One of the things that Azzam and Mobilink will be banking on is their view that the rapidly increasing use of smartphones will become a major catalyst in promoting digital banking in Pakistan. Being the subsidiary of Pakistan’s largest telecom player, Jazz, they could very well be poised to take complete advantage of this.

“We hope to have over 50 million customers in our fold in a few years compared to the 20 million that we have in our portfolio at this point in time. We are also striving to enrich and expand our products and services menu and adding more use cases to make mobile wallets or digital accounts as the key enablers of digital financial services.”

The direction of and priorities of Mobilink Bank have been shifting since 2012, which is when Azzam came on board at Mobilink over from FINCA as its inaugural CEO.

“Our strategies and tactics have evolved overtime since we launched Mobilink Bank in 2012. However our overarching goal and ambition has remained the same from inception and that is ‘Serve the underserved’ and ‘Bank the unbanked,’” he tells us. His words are picked carefully, in a way that Azzam becomes almost indistinguishable from even the organisation’s past before him. However, there have been changes.

“Eliminating paperwork, reducing turnaround time and improving delivery has been some of the other key priorities. The idea is to serve customers on a real-time basis with flawless processes, maximum accuracy to ensure great customer experience,” he says about how Mobilink Bank has been changing post 2012.

Personally, Azzam has had an impressive career. In a career spanning over 30 years, Ghazanfar worked for some of the best banks in Pakistan including HBL, Union Bank, Prime Bank, and Bank Alfalah. A Fulbright scholar at Penn State between 2000-01 under the Hubert Humphrey Fellowship, Ghazanfar has also worked with Shore Bank International, a leading international consulting company in SME and microfinance based out of Washington DC and operating globally, as a senior consultant and Head of a USAID funded SME downscaling project in 2005-7.

It was from here that his journey in microfinance really began, and his first major ‘Pakistan’ posting and project was FINCA. And the ethic he established there, was brought over to Mobilink with him. “When we started FINCA (then Kashf Microfinance Bank) in 2008, our idea was to serve the underserved segments through traditional delivery mechanisms i.e. brick and mortar branches and increasing our geographical footprint.”

“At Mobilink Bank, though our market focus is more or less still the same, there is a huge departure in terms of operating strategy,” he tells Profit. “Having a world class technology group behind us, our focus is to reach out to the majority of Pakistan’s over 100 million adult population through digital technology and offer products and services that can be accessed by customers while sitting in the comfort of their homes and workplaces. No matter whether big or small, banking is going to be very different in coming years than it used to be or is even today. Self-service banking is the future.”

Financials

The year 2019 has been a good one for Mobilink Microfinance Bank. The company saw growth in their branch network, adding 13 new units. Their gross loan portfolio increased by 21% from the previous year, and they closed their net advances at more than Rs15 billion. Meanwhile, deposits saw an increase of 32% from the previous year and it closed at Rs.29.2 billion as of December 2019. Net income clocked in at Rs921 million, a 12.6% increase over the previous year. Azzam is satisfied with the performance, impressed even, saying that the bank has performed exceptionally well.

“Mobilink Microfinance Bank stands at number one position in return on equity, return on assets and profit margin among all microfinance banks in Pakistan for the year 2019. Considering the age of our institution, this is a huge achievement, and it shows how efficiently and effectively we have been using our resources,” he says.

And while the bank’s loan portfolio is healthy overall, non-performing loans did tick upwards sharply in 2019, from Rs162 million to Rs584 million, a rise of 261% over the course of a single year. The non-performing loan ratio went up from 1.3% to 3.8.

Azzam says that this is simply a high-risk high-reward scenario. While some increase in NPLs was bound to happen, the bank pins some of this on 2019 being a very difficult year for the economy due to double digit inflation and falling incomes. “NPLs significantly increased in the entire microfinance sector,” says Azzam, “however, our NPL was far less than other microfinance banks and our credit quality remained better than the rest of the sector.”

This kind of problem, however, seems to be one that comes with the business of microfinance. Microfinance is globally more expensive due to smaller ticket sizes and higher delivery costs. Furthermore most of the microloans are generally unsecured and therefore highly risky. Most of the intuitions are still young and lack scale. In addition to this, a bad economy and high interest rates constantly impact them.

“On top of all of that is a high inflationary economic environment that makes cost of funding of the microfinance institutions. Interest rates are therefore high and will remain high till underlying conditions remain as stated above,” says Azzam.

There are other things, such as changes in banking laws and courts that the microfinance sector would like to see to help it grow. While the State Bank has been very helpful and key enabler in development of the microfinance and branchless banking sector in Pakistan according to Azzam, there are still various measures that are still required to enable microfinance banks to play a higher and better role in the Pakistani economy according to Azzam.

“For instance denial of scheduled bank status is disadvantageous to micro banks in resource mobilization compared to commercial banks. Higher capital adequacy ratio requirements reduce the growth potential of microfinance banks. There are several other issues that once resolved will provide a more conducive role for growth and expansion of microfinance banks in Pakistan.”

But for now, what is clear is that Mobilink and other microfinance banks want to grow, to this end, they are ramping up their outreach efforts, and their focus is on maximizing the use of technology to bring down operational costs, promote the paperless environment, improve credit quality further and so on to cut waste and improve profitability.

“Profitability in turns helps in freeing up resources for further growth, providing more jobs and creating more value. Continuous improvement in all areas of our operations therefore it is an ongoing task reduces cost, improves profitability and benefits all stakeholders.”

Comments are closed.

How Mobilink Bank’s Credit Division work digitally ?

A customer can apply for a bank account or loan, through our digital application which is then forwarded electronically for processesing/ approval to the headoffice. There is no manual processing or documentation involved.

Team MMBL

what about the credit risk evaluation stage , dont you require any document for a micro enterprise loan specially>

which digital application are we talking about ? how can i apply for loan digitally? website has no such link?

I have submitted my refunds claim application in DHA Lahore office office of mobilink microfinance bank on 28/03/2020, since than waiting for refunds. Still pending status showing in computers. Its digital time and taking around 3 months to process. Even helpline is helpless. And email also not accepting by thier systems.,, many time visits office even in lock down, Ramzan and heat waves. My contact 03004126722.

exellent presentation of microfince history in pakistan and the role played by Mobilink Microfince Bank ltd and its achievements .