It started out, as things these days do, as a tweet. After a complaint was sent to Transparency International’s Pakistan chapter on July 15, the organisation was now demanding the cancellation of Pakistan Post’s Rs118 billion alliance with the country’s largest bank, Habib Bank Ltd (HBL).

This 20-year ‘strategic alliance’ had been announced earlier on June 8, and was ‘aimed at furthering financial inclusion in the country by leveraging digital technology’. In reality, what this meant was that Pakistan Post would provide branchless banking services to its customers, using HBL’s own branchless platform ‘Konnect’. HBL would also get to set up ATMs and cash deposit machines around the country at various Pakistan Post locations.

It was a win win for both parties: as HBL’s own press release put it, HBL Konnect’s distribution footprint would expand from its current network of more than 40,000 agents to more than 53,000 locations across Pakistan.

Now, some context: Transparency International is a non-government organization founded in 1993 in Germany, which calls itself a global coalition against corruption. It is famous for its Corruption Perception Index which tracks the perception of public sector corruption (it is an interesting group, to say the least: for instance it stripped its US chapter’s accreditation in 2017 for being too ‘corporate’). The NGO’s Pakistan chapter was formed in 2001, and registered as an NGO under Pakistani law in 2002.

Within Pakistan, the group is particularly keen on highlighting public procurements in the country, in an effort to make them as transparent as possible. For instance, it has been keeping track of the Sindh government’s procurements during the pandemic. The rules of the Public Procurement Regulatory Authority (PPRA) are front and centre on the chapter’s website.

And that is what Transparency International Pakistan was concerned about: that Pakistan Post awarded the ‘contract’ to HBL without following the PPRA Rules. The complainant’s letter specified that no public tenders were invited by the Pakistan Post prior to this contract being awarded. Additionally, the evaluation report required under Rule 35 and the contract document required under Rule 47 have also not been made publicly available, as they are required to be. If so, then the contact can be declared a misprocurement under PPRA Rule 50, and can be cancelled.

The original tweet caused a spate of concerned news articles. And as far as Profit could tell, the procurement document was also not on PPRA’s website.

That is because it is not a procurement, at least according to the Pakistan Post. On July 17, in letter to the addressed to the chairman of Transparency International Pakistan, Director General Muhammad Akhlaque Rana said that it “it is very distressing to receive the aforementioned complaint as the facts narrated in the complaint appears to be either misunderstood or misconceived.”

According to Rana, the Pakistan Post agreement with HBL is not a contract. It is actually a ‘strategic alliance’ under the Post’s agency function. Under the alliance, the Pakistan Post gets to be a ‘super agent’ of HBL, under the SBP Branchless Banking Regulations 2008.

This semantic difference is key: it means the alliance does not fall under PPRA rules because no public funds and no government equity is involved. That means that neither Rule 35, 47, or 50 are applicable, which also explains why the documents are not available publicly – neither HBL nor Pakistan Post are required to show the agreement’s details.

That being said, Pakistan Post did share some details in the letter: around 27 financial institutions showed interest, of which 10 submitted business proposals, of which five (three banks and two telcos) submitted detailed proposals. The list was narrowed to two, and HBL was selected after third-party financial evaluation. The draft agreement was vetted by the ministry of Law and Justice.

This version of events is also backed by HBL, more or less. In a written statement to Profit, the bank said: “Pakistan Post invited Expressions of Interest (EOI) from Pakistan’s established financial institutions. This relationship is intended to allow Pakistan Post to utilize the resources, services and expertise of a financial institution, with robust digital financial platforms, to establish digital infrastructure at Pakistan Post. This relationship is intended to enhance Pakistan Post’s compliance, KYC [know-your-customer] and AML [anti-money-laundering] capabilities, including with respect to FATF [Financial Action Task Force] requirements. HBL expressed interest in establishing a relationship with Pakistan Post upon the invitation by Pakistan Post of the said EOI.”

“HBL participated in a competitive process with multiple other financial institutions and commercial entities whereby the shortlisting was on the basis of a pre-defined and extensive criteria specified by Pakistan Post. This process of the shortlisting and selection by Pakistan Post has been carried out in accordance with the law. As such, any process of the establishment of a relationship between HBL and Pakistan Post has been carried out in strict and absolute accordance with all applicable laws and regulations.”

You may be wondering: exactly what is an agency function? According to Imran Raza Khawaja, the Deputy Director General of Special Initiatives at the Pakistan Post, the “agency function is a separate screen, under which we have been doing post office functions since 1890 – since before partition. Pakistan Post is the oldest department of the country. We are governed and ruled by various manuals, for example Post Office Act 1898…agency functions include functions [such as] paying pensions for various organizations such as CDA [Capital Development Authority], PTCL, etc. and we get commission on that. We are renting this service on behalf of these organizations.”

Khawaja also reiterated that neither PPRA nor the Public Private Partnership Authority (PPPA) rules and regulations were reflected in this agreement. “We are not going to spend a single penny during this agreement on HBL,” he claimed.

Ok, so pause: so if government money is not being used, where is this investment portfolio of Rs118 billion coming from? Is that entirely HBL’s money? And surely that is an unusually large number to help digitize Pakistan Post? For its part, Pakistan Post said that ‘billions were required to develop a digital platform.’ At the time of publishing, HBL had still not responded to Profit’s queries on the matter.

And do not expect further details. So far, the most information has come from that one letter sent form Pakistan Post to Transparency International Pakistan. Though the letter does a fine job of responding para-wise to the allegations, as pointed out, there is no obligation to make any documents public. This was a view repeated by Khawaja, who said, “We are all civil servants and we have a duty to our country then to our department and then to our people. We have no intention to keep this information hidden. So after we have done due diligence, we will consider [emphasis ours] making it all public”.

We at Profit bring up this incident, and the subsequent communication, because it serves as an example of the perils of creating private-public partnerships in Pakistan – or as in this case, an ‘alliance’. The alliance might very well be in accordance with the law (as HBL and Pakistan Post claim it is) but this whole matter is a relative non-issue (really, how hard is it to make a document public?)

And it would be a shame to be opaque about those details, because a partnership like the one between HBL and Pakistan Post could actually be a great success, and one that could have served as a blueprint for other partnerships with commercial banks (particularly Islamic banks as the demand for them is so high in the country). This was a point raised in the June staff notes from the Economic Policy Review Department of the State Bank of Pakistan (SBP).

And it is not just commercial banks: based on its reach, affordability and trust, Pakistan Post could learn from the post offices of India, Japan, Russia, China and Brazil, and really promote financial inclusion in the country.

The Post as it stands today

Despite the name, and the fact it serves around 20 million people a year, Pakistan Post is not particularly good at its main job. According to the Pakistan Economic Survey of 2019, the Pakistan Post had around 10,496 post offices in the country in fiscal year 2019, compared to 12,339 outlets in fiscal year 2015. The number of letter boxes also fell from 19,136 letter-boxes in fiscal year 2009 to 12,803 in fiscal year 2019. Obviously, these numbers did not bode well. In fiscal year 2016, it recorded a loss of Rs7.5 billion; this increased to Rs9.3 billion in fiscal year 2017.

But one should not look at Pakistan Post just through the prism of actual post; the company also provides critical financial services, and it has been doing so since it was created under the British Raj.

The Government Savings Bank Act of 1873 allowed for the creation of postal savings banks across the subcontinent. Postal life insurance was started for employees in 1884 (this was later opened up to the general public in 1947). The actual act that formalised and set up the postal service in India actually came later, under the Post Office Act of 1898. These two acts form the backbone of all Post laws and policies in India, Bangladesh and Pakistan today.

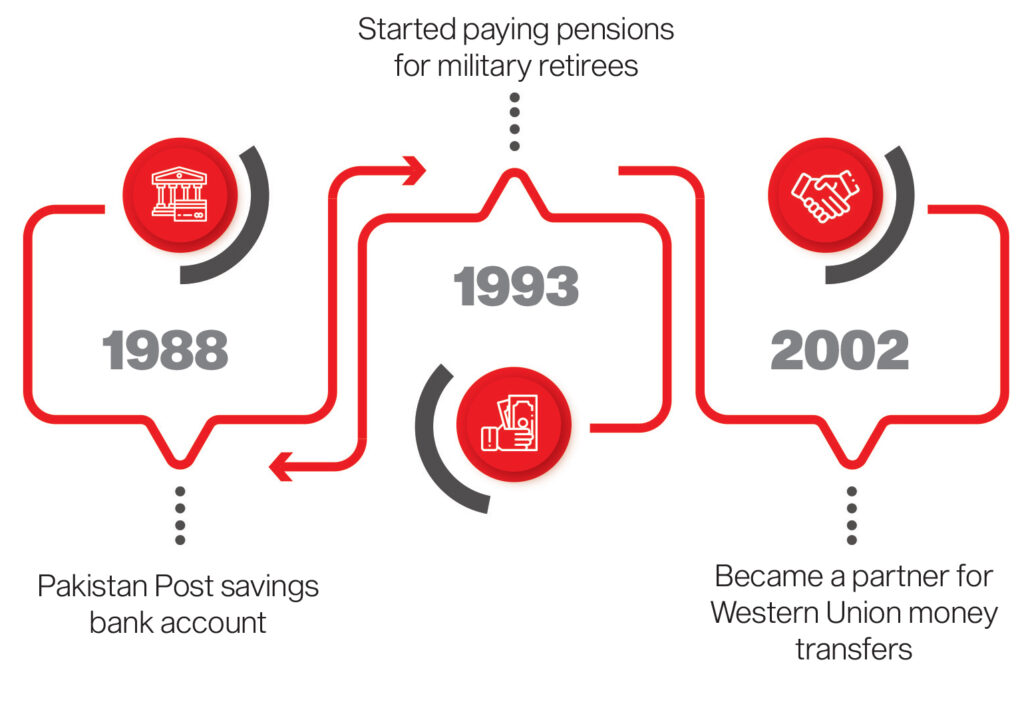

Pakistan Post, after partition, started a savings bank account in 1988, paid pensions for military retirees in 1993, and became a partner for Western Union money transfers in 2002. As of 2018, the Post Office had 2.15 million postal bank accounts, with assets in these accounts worth $1,386 million.

Today, the Post Office helps transfer money within the country, and remittances from abroad, but this is a declining business. In 2008, around 9.3 million transactions were recorded; by 2017, the number had dropped to 4.8 million.

And even the postal life insurance business of Pakistan Post is in decline: in 2009, the company issued 30,968; again the number declined to 15,458 by 2018.

Most importantly, the Post Office provides buying and selling of instruments on behalf of the Central Directorate of National Savings (CDNS). In fact, Pakistan Post contributes 25% to inflows of all gross investment in national savings schemes, a share that has stayed consistent between 2008 and 2018. This is Pakistan Post’s ‘saving’ grace (literally); for comparison, over the same time period, banks have only contributed 3%.

The financial landscape

That last bit shows that Pakistan Post cannot be underestimated. Pakistan’s low savings rate is well documented: in 2017, only 21% of Pakistanis had access to or had interacted with the financial sector, compared to 74% in Sri Lanka and 80% in India.

The staff notes attributed this to the fact that “formal financial activities are often clustered around bigger hubs of formal economic activity, and that the country is large and diverse with a bulk of population engaged in the informal sector.” Well-intentioned programmes like the National Financial Inclusion Strategy (NFIS) of 2015 have not borne results either.

This is where the Pakistan Post, or indeed, any post network of a country comes in handy. Pakistan Post has four qualities going for it: it is affordable, accessible, trustworthy, and practical.

First, Pakistan Post is a very good conduit for getting people, often in rural areas, to use financial services since it is so cheap. “Cross-country evidence indicates that post offices are likelier to accommodate the financial needs of individuals who are poor, less educated, or outside the labour force compared to conventional financial institutions,” the report noted.

Second, Pakistan Post is present, well, everywhere in Pakistan. Around 87% of its 2,400 delivery physical delivery offices exist outside of the five most populated cities of the country. Compare that to the 3,900 outlets of Pakistan’s entire microfinance industry. Besides, most of those microfinance bank branches are concentrated in Sindh and Punjab, already well-banked regions of the country. But the Pakistan Post has a considerable edge in Balochistan, Khyber-Pakhtunkhwa, and Gilgit-Baltistan.

Additionally, because there are such few bank branches to begin with, there is a lack of ‘trust’ that comes with even opening a new bank branch in a previously underserved area. That lack of trust however, does not exist for the Pakistan Post. As mentioned before, the post office was formally set up under colonial British rule, replacing the system of ‘runners’ that existed in the Mughal era. For whatever its faults, the Pakistan Post has always been there.

Finally, the post office is practical. It has already begun a number of services in the last year or so, which have proven that the post office can be used for further financial services. For instance, it launched a new remittance service in June 2019 with the help of the National Bank of Pakistan. Under the scheme, people could collect remittances from either 500 designated Pakistan Post branches, or 1,500 NBP branches. It gained at least some traction: between July and December 2019, around $30.9 million of foreign remittances was recorded through Pakistan Post.

Similarly, in March 2020, the Pakistan Post actually tried to upgrade, and attempted to distribute pensions to pensioners’ doorsteps (in order to stop gatherings at the post office during the Covid-19 pandemic). The scheme was only mildly successful, in part because pensioners are often very elderly, and have difficulty adapting to new systems, but still, the scheme garnered enough interest.

What did other countries do?

In trying to update or expand the Pakistan Post, there are several models one can follow, especially considering the scale of Pakistan Post, the size of the population it serves, and its general long history. The SBP report looked at five major countries to examine potential models: Japan, China, Brazil, Russia, and India. Like Pakistan, all of these countries have large populations, with very dense urban centres, and sparsely populated rural areas (except for Japan, where the whole country is mostly just one dense urban centre after another).

Japan had more or less the same start as the subcontinent. It started its postal service in 1871, and started financial services in 1875, with savings being invested in government bonds over time. In 1910, the government expanded into pensions services.

But unlike Pakistan, Japan Post was quick to figure out that inculcating good savings habits (such as designing postal savings accounts for school children in the 1930s) was key to a successful savings rate and healthy economy. High yield postal savings were extremely popular in the 20th century, and by 1999, accumulated postal savings in Japan was equal to 50% of the country’s GDP.

China’s postal bank was only started in 2007, but what it lacks in history it makes up for in sheer size: it has 40,000 outlets, which serves 600 million customers. Like Pakistan, a majority (70%) of these are located in towns and villages. This bank’s key strengths lie in focusing on agriculture and rural areas, and making sure it recruits graduates from those areas, thereby serving those communities better. The bank actually went public in 2016, and ranks 60th in the Forbes Global 2000 list of the world’s largest public companies.

Brazil’s postal service can boast of having existed since 1663, and has around 12,000 field offices. However, its postal bank is a relatively new affair: it entered into a 10 year agreement with a private bank in 2002 to start Banco Postal, that ended up serving 8.8 million customers that had previously been unbanked in the country.

Russia did more or less the same: it integrated its 40,000 post offices through an alliance with a private bank, to start its Post Bank in 2016. This postal bank offers traditional commercial banking services, like credit cards, loans, and insurance.

Finally, India. Like Pakistan, it realized in the mid 2010s that financial inclusion was lacking, and launched the National Mission on Financial Inclusion in 2014 (Pakistan’s NFIS was launched in 2015). Unlike Pakistan, India’s programme was actually extremely successful. In 2018, the India Post and Payment Banks was formally launched with a network of 650 exclusive branches, and 136,078 additional post offices with banking access points. This was not a public-private partnership, but owned entirely by the Indian government. By early 2019, the bank has managed to gain an additional 5.6 million unbanked customers.

Moving forward

Ambitiously, under the NFIS targets for 2023, the government wants to nearly double the number of accounts in the country, from 38 million in 2019 to 65 million in 2023, and for women accounts to rise from 14.4 million accounts in 2019 to 20 million in 2023.

“The NFIS was revisited by the government and its extended 2019-2023 action plan places key importance on leveraging digital financial services (DFS) to promote financial inclusion, including the digitization of the Pakistan Post. As such, the post office can play an important role in achieving the NFIS 2023 headline targets,” the report noted.

So, what would that look like? First, the scope of the postal savings bank could be expanded to offer more sophisticated financial products. As an example, currently life insurance products are offered, but perhaps crop loan and livestock insurance could also be offered. It is an easy way to improve financial literacy and know how in a country as well.

Second, people, especially young people, need to be educated and incentivized to use the accounts at postal banks. Anyone who gives a matric exam for instance, would have to have a postal savings account, By making postal saving accounts as part and parcel of life as say, a CNIC card, people would engage with financial institutions at a much younger age and be more comfortable with formal savings.

And finally, Pakistan Post could form strategic partnerships with commercial banks. This is the infamous alliance with HBL, that was signed in June.

In the letter addressed to Transparency International Pakistan, Director General Rana pointed out how normalized these partnerships were in the rest of the world. “Pakistan is a signatory of UPU [Universal Postal Union], the UN agency which emphasises that the Post Office may enter into partnership with financial agencies or FIs [financial institutions] to achieve SDGs [sustainable development goals] in light of UN Resolution. The 91% postal operators throughout the world have followed this principle and out of 201 member countries, 183 countries provide financial services either directly or in partnership with other leading FIs.”

But there is another global body that prompted the Pakistan Post towards a partnership: the Financial Action Task Force (FATF). Of the 40 recommendations the FATF gave to Pakistan, 13 were applicable to related financial services provided by the Pakistan Post.

The FATF required that all financial services be compliant to AML [anti-money-laundering] and CFT [combating the financing of terrorism] regulations, or that each transaction of each client be digitally screened. Most of Pakistan Post’s processes were manually operated, but it required a complete digital platform. Enter HBL, which could provide that digitization.

The SBP was not so interested in HBL, as it was of the possibility of Islamic banks potentially partnering with the Post afterwards.

“A sizable segment of the population cites religious reasons for the decision to not open a bank account. Thus, in a strategic alliance, the post office could help disseminate information relating to Islamic banking in general, and the partner bank’s offerings in particular. In return, the Islamic bank would have the opportunity to expand its clientele among customers of the Pakistan Post who have shied away from conventional banks on religious grounds,” the report explained.

So there you have it. We have a postal service as old as Japan’s. We have a population as large as Brazil’s. We have a national financial inclusion goal like India. And we have a private bank, or multiple private banks, willing to partner with the post office, like in Russia. In our best case scenario, theoretically, we could be as successful as the postal bank in China.

And yet, here we are: a Pakistan Post somewhat struggling to explain a simple alliance. Is financial inclusion even a possibility if there will always be avoidable snags like this? We say: make the agreement public, and get on with the job ahead.

Really good nice write up mairyum ali and masoma excellent i admire all true