ISLAMABAD: Federal Board of Revenue (FBR) has made significant changes in the taxation of capital gains on disposal of immovable property.

The changes have been made through an amendment in the Income Tax Ordinance 2002, through the Finance Act 2020.

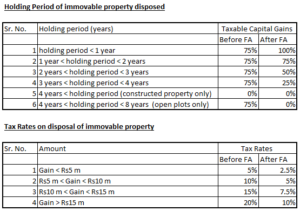

Capital gains are profits made from the sale of an asset with respect to the costs associated with it and are generally taxable throughout the world. In Pakistan, the aggregate tax applicable to capital gains on the disposal of immovable property is dependent upon the holding period and the tax rates.

The tax rate applicable to capital gains on the disposal of immovable property depends on the amount of capital gain earned.

A longer holding period indicates that a property was not bought for the purpose of making a profit on its resale, and hence, leads to lower taxes. On the other hand, a higher amount of capital gains earned is subjected to a higher tax rate by the authorities, leading to higher taxes.

According to a Circular No. 3 issued on September 3, 2020 by the FBR, holding period and tax rates on different amounts for computation of capital gains on disposal of immovable property (Section 37, Section 236C and Division VIII of Part I of the First Schedule) have both been reduced.

According to section 11 of the circular, the bifurcation of immovable property into plots and constructed property has been completely disallowed.

The maximum holding period attracting taxation of capital gains on disposal of immovable property has been restricted to four years and percentages of taxable capital gain have been rationalized with reference to holding period, FBR added.

Section 11 also dictates that tax rates for capital gains on the disposal of immovable property have been reduced and corresponding changes in section 236C have been made in respect of holding period and tax rates.

Income Tax Ordinance was promulgated in 2001, not 2002.

Still it’s too much.

Is 236c applicable before 30june2020 on sale of immovable property .PM imran Khan announced exemted but no notification pl.guide

Sir send me notification about 236cbefore 30june 2020.is applicable on transfers of property.

It is a common practice to spell out or describe an acronym when using the it the first time in an article. For a novice like me what does FA stand for and mean?

It is a common practice to spell out or describe an acronym when using it the first time in an article. For a novice like me what does FA stand for and mean?

FA = Finance Act

Is there CGT gain tax payable at the time of sale of an inherited property? (mutation by inheritance)

Yr iska jwab mjhy b dena plz.03055741161

I have sold proves of billions monthly corruption in FBR its a den of Corrupt mafia I have been fighting against corruption since 1975 and now I made every effort to PM Imran’s portal send him proves he did nothing and refer to FBR Two years going to elapsed no action taken many remider follow up. Issued of no use

Still tomuch…….

AoA

I feel mathematical symbols used here are at inappropriate places n confused the matter

greater than

I feel , it should have been

Holding period: 1 yrs

Is there any more concept for filer or non-filer in calculating the Capital Gain Tax? Earlier it was 1% for the filer a 2% for non-filer. If that is the case how we can calculate the CGT based on the % of CGT amount and the rate? Can anyone make some rough computation? CGT will be the difference of Purchasing value and the FBR evaluation, whereas the Withholding Tax will be 5% on the evaluated amount? in annual return the difference of both will be paid? Thanks in advance if anyone respond back.

Can anyone help out in mentioning that if a 20 year old property is inherited to siblings recently and sold right away, will CGT be applicable on that kind of properties. Kindly if anyone had clear knowledge about it. Let me know.

i have face the same issue. If you have some valuable information please share

did you guys find the solution?

Did you get info about your question

“if a 20 year old property is inherited to siblings recently and sold right away, will CGT be applicable on that kind of properties”

Yes , it is applicable.

this fbr is not a dept. it is gang of dacoits sitting looking how to cut throat of masses. first u pay tax on the purchase of property and then if u are required to resell it again u pay tax then there is property tax. and what is gov giving in return nothing everywhere u go u pay rishwat and get ur job done curse u dacoits.

Plz answer me what is the current position of gain tax on open plot which are sale after 5 years

My sister thinks she’s always right about literally everyone because she’s the only one with a PHD behind her name. She’s a psychologist and always seems to befriend people who have mental problems. Last night, her male “friend” called her in a panic and said he was going to kill himself because he just found out some really bad news. He said he had a gun and was going to shoot himself. My sister immediately drove to his house to help him, not knowing what type of situation she was going into and only called the police after going in the house by herself. My parents got into an argument with her because she didn’t seem to understand what was so reckless about what she did. She said “that’s my job to help people.” and when my mom said “he could’ve shot you in a panic.” she said “that’s a risk I have to take.” I think she has a god complex or she’s mentally insane but she thinks she’s doing a good deed to society. This isn’t the first time something like this has happened where she has put her “job” before her personal safety. Can I get her license revoked. How do I convince her that what she did was not professional by any means and she shouldn’t work in this profession. I really think there’s something wrong with her. She’s been like this her entire life.

Sir ma agriculture property sale krna chahta hn jo k mujy

Mery father ki trf sy 2021 ma inheritence ma mili hy

Mery father long period sy owner thy

Kia mujy capital gain tax lagy ga????