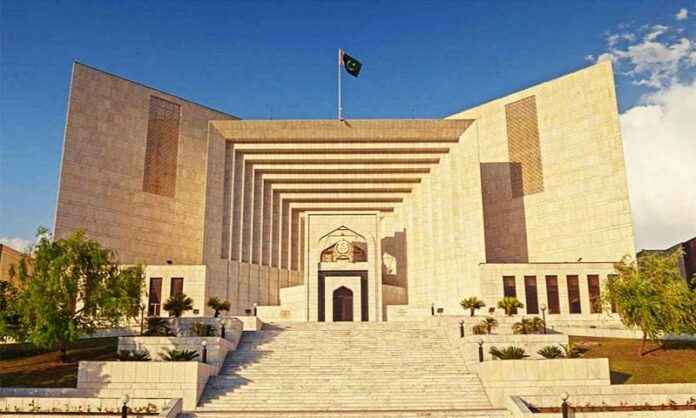

LAHORE: The Supreme Court of Pakistan on Monday dismissed review petitions in the Gas Infrastructure Development Cess (GIDC) case. However, it allowed the companies to pay the outstanding dues in 60 months instead of 24 months as decided earlier.

The fertiliser association had requested the court to spread the GIDC payments over the period of 120 months (10 years).

“The fertiliser players have received an extension of three years on GIDC payments, with 60 installments to be paid over five years as compared to 24 installments over two years as decided earlier by the court,” said Ailia Naeem, a senior research analyst at AKD Securities Limited. “This development is favourable for the fertiliser sector which is currently faced with liquidity issues – Fauji Fertilizer Bin Qasim Limited (FFBL) has cash to cover only 20pc of GIDC payment as per their latest financials.”

To recall, the fertiliser players had reportedly requested the recovery of outstanding GIDC dues (Rs109bn on non-concessionary gas) in 10 years, citing their worsening liquidity situation as the reason. The sector had also hinted at increasing urea prices by Rs500 per bag in case their request was dismissed.

“As per our initial working, we had chalked out a 48-month extension in GIDC payment for players worst affected by the SC’s initial decision,” Naeem said.

Meanwhile, Topline Securities Ltd stated that companies other than fertilisers, like textile and chemicals, had argued that they refrained from passing on the impact of GIDC to their consumers. The SC in the coming days is likely to release a detailed judgment where this matter (pass on or not) is likely to be elaborated, it added.

“Nonetheless, we believe extension to 60 monthly payments is a positive development for companies affected by the GIDC verdict like Engro Fertilizers Limited (EFERT), Fauji Fertilizer Company (FFC), Fauji Fertilizer Bin Qasim Limited (FFBL), Lucky Cement Limited (LUCK), Gul Ahmed Textile Mills Limited (GATM), Feroze 1888 Mills Limited (FML), Lotte Chemical Pakistan Limited (LOTCHEM), Engro Polymer & Chemicals Limited (EPCL), Balochistan Gas Limited (BGL), Maple Leaf Cement Factory Ltd (MLCF) and Century Paper and Board Mills Limited (CEPB) among others.”

It is pertinent to mention that GIDC was imposed by the government back in December 2011 to raise funds for development of gas infrastructure in the country.

The GIDC Act provides a legal framework which allows the government to levy and collect cess from gas consumers other than domestic sector consumers.

A very nice decision passed by the Honourable Supreme Court of PAKISTAN

but

Court should had kept in mind that Pak Rupees had been depreciated over 65 % since 2018 and these companies in next 5 years (60 months) hence, in my opinion must had added KIBOR rates on payment to be paid in coming years by the companies.

However, despite of it the best of the best decision from the judiciary.

I request the Honourable Chief Justice of Pakistan Justice Mr. Gulzar Ahmed Khan to

re-open the case HUDIYABA PAPER MILLS LTD., which is closed arbitrarily by the Bench Led by JUSTICE QAZI FAEZ ESA

If Honourable Supreme Court of Pakistan had done 120 instalment or 50% to 60% GIDC with 60 instalment that decision would have been better for survival of all sectors..

Now, Decision has come no more relief can get from the court. All industries union leader should negotiate with Govt, because this decision is not in favour of the GOVT too.

Negotiation should be base of the following points..

1)Low Tariff rate

2) Accept GIDC but with minimum rate

3) Sale Tax purely 17%

4) GIDC 30 to 40% maximum 50%

5) If GOVT accept this then 60 instalment is enough for us.

Abdul Basit.

Manager Fuel Zone CNG station Pajaggi road Peshawar.