In a speech to Parliament in 2016, current Prime Minister and then opposition member Imran Khan defended his ownership of a flat in London. This was the height of the panama papers, and under discussion were the different flats and apartments that then Prime Minister Nawaz Sharif did or did not own. During the speech, Imran Khan mentioned an anecdote in which when he had bought his own London flat back in the 1990s, he had told Mian Nawaz about it at a social gathering. Curious about it, Mian Nawaz asked what a penthouse was, and Khan diligently explained that it was the top floor flat of a building. To this, Mian Nawaz quite earnestly asked what Imran Khan would do if there was a tornado and the top flat was blown away in it.

The little story received bipartisan peels of laughter from the house, but what it also did was say something about the Lahori obsession with owning land, and the resultant aversion to apartments and vertical growth. Karachi is still the largest city in Pakistan, but by some measures, the greater Lahore metropolitan area may now be almost equal in size, if not already somewhat larger. Yet for most of its history, Lahore’s residents have shunned the notion of vertical expansion of their city’s size, which is why it is difficult to find apartments in the city.

This has largely been attributed to the ‘Punjabi mindset’ of wanting to own the land beneath your feet. And while this has been a seemingly reasonable cultural explanation for a long time, another explanation is that up until now, Lahoris probably never needed to depend on apartment living. With a smaller population and no need for a massive workforce, Lahore has been a metropolis that has largely maintained in its residential areas either cramped but flat enclaves, or large suburban living conditions in its more posh areas. But as the city expands rapidly, Lahoris are going to have to get used to apartment living.

In recent years, however, there has been a move towards changing that, with several real estate developers investing in building up apartment blocks in the city. And indeed, some of them have gotten to become quite high end: it is now possible to buy a $1 million apartment in Lahore, at least insofar as listed prices on Zameen.com are concerned. And while all of this sounds very promising, there are serious setbacks because of how the regulation of apartment buildings in Lahore works.

Lahoris are catching on

In Lahore, the Lahore Development Authority (LDA) has recently given permission for the construction of high rise buildings on plots of ten marlas, a move that has gotten investors deeply interested in the possibility of investing in apartments in Lahore. A ten marla space for an apartment means not just a lower investment and building cost, but also the construction of smaller apartments that are more in need since apartments are preferred by either young couples, students, or individuals rather than families. This also means that these apartments do not have to have facilities like a gated society, recreational areas, and strict rules that larger apartment complexes like Askari XI or Askari V do in Lahore.

It has also meant that now that lower budget projects can be done, Lahore’s real estate industry is up to its all tricks of guaranteeing payback to investors to reel them in. Well placed sources inside LDA are deeply concerned about amendments to the High Rise Buildings Act and the rapid rise of high-rise buildings in the city. They believe that the city’s infrastructure does not allow high-rise buildings.

“The biggest problem with an organization like LDA is that the staff here is far behind in regularization. Making laws and later regularizing them is a responsibility that does not happen here. Now, if we first talk about the profit-on-investment of the newly developed high-rise buildings in the city, then the LDA has no concern about these moves. However, it is the LDA’s job to inform the public about any advertisements related to real estate development or any such fraud. This is like an advertisement published by the LDA about illegal societies that such and such a housing scheme is illegal so the public should avoid any kind of buying and selling there, similarly, guaranteeing a return on investment is an illegal act on projects that do not yet exist, which the LDA should inform the public about it. We also receive daily reports that developers of many hotel apartments and residential and commercial apartments are guaranteeing a return on investment to the public.”

This is, of course, very typical of the great scam that is real estate in Pakistan. The first thing to look at is whether there is a financial institution behind this guarantee or whether it is an individual guarantee. If it is an indivisible guarantee then it has no value. If a developer does not return a profit to an investor despite having a contract, the investor cannot do anything. These guarantees are fake and have no value because no bank or insurance company is backing such projects, and when the sales team of these developers are asked where the guarantee will come from, they reassure the investor that the developer is a big party and because of that there is no question of giving a return on investment, which is not really an answer – just more words. “Zameen.com also urges the developers of the projects it markets to declare a guarantee on the investment, which is wrong. As you can see, many developers do not guarantee a return on investment in their advertisements but offer to those who contact them saying that investing with them will directly benefit the investor. Other agencies, including the LDA, need to check this scam,” continues our source.

The sources further said that the second major issue is the rapidly rising high rise buildings in the city as LDA had earlier allowed the construction of apartments on an area ranging from four kanals to one kanal and now a developer with an area of 10 marlas can build a multi-storey building. “If you look at the LDA rules now, it is clear that previously a covered area of one thousand square feet had to be left for parking a car, but now the same area has been increased from 1000 sqft to 1600 sqft. Now it is important to note that due to rising population and property prices, people prefer to buy a one-room apartment, and a one-bedroom apartment is about 500 to 600 square feet in size. Now, for example, if a small apartment is constructed on 600 square feet, it means that there is only one car parking space for three apartments. That is, if the owners of all three apartments have cars, the parking lot for one is in the building, but not for two other cars,” they said.

“An interesting question arises here as to where the other two vehicles will go, they will surely be parked on the road outside.In Lahore, earlier high rise buildings were mostly used for offices and in the evenings when these offices were closed, the building was also closed and there weren’t many parking issues but now most of the high-rise buildings that are being constructed are residential apartment projects that will be used 24 hours a day. Immediately, these laws may not have any effect, but in the next five to ten years, when hundreds of high-rise buildings will be built in the city, parking will become a big problem and by then nothing could be done about it. LDA officials should think about all these things before making policies.”

The third most important issue is that no authority or committee has been set up by the LDA for the annual audit and maintenance of all the newly constructed high rise buildings. This means that people who invest billions of rupees in these high rise buildings, eiter to live in or to rent out, may be at risk. If you have your money parked in such a building, and it does not fill up soon, then the building is likely to be in trouble and with it the money of investors. If you live in these buildings, then those buildings are in danger of being overrun.

What happens in foreign countries is that an audit committee is formed at the government level for high-rise buildings whose job is to audit the building annually. This audit checks to see if the building management or the developer has maintained the building as it should have. The average age of a building is usually ten years. If nothing is done there for ten years, it will deteriorate as a result, the value of the building where the investor has invested so much will be lost. Most of the issues, including the passage for fire exits for buildings built on small plots, indicate that no significant work has been done in the rules of high-rise buildings,” they informed.

How they get you

To get an idea of the minefield that investors face out there, Profit called a marketing representative for Zameen.com posing as an investor. The marketing representative of Zameen.com admitted that people were indeed dreaming of a guaranteed return on investment.

According to their representative, Zameen.com had two categories to invest in apartments, the first of which was to invest in residential apartments. The representative insisted that Zameen.com take responsibility for all investments made through Zameen. “We have two categories for investing in apartments. The first category is residential apartments. To invest in these apartments, Zameen.com gives the first guarantee that these apartments are approved by LDA and FBR. The other important thing is that there is a regular installation plan to buy such apartments and these apartments can be bought through easy installments,” they said.

“Now, if we talk about the purchase of an apartment, that is, the investment made in it and its return, the first thing is that the return on this investment will be received only when its installments are over. The guarantee of return on investment is that if there is a two and a half year installment plan and as soon as the plan is completed, the possession will be handed over to the owner. If for any reason there is a delay in getting this possession on committed time, the rent of this apartment will start getting to the investor from the next day even if the apartment is not used by anyone.”

When this scribe asked how much the rent would be and who would pay the guaranteed amount, the representative replied that 6 percent of the total amount would be paid to the investor in the form of rent. “For example, if the value of your apartment is RS 10 million, then six percent of the total amount is RS 0.6 million. Then we divide this 6 percent by 12 months and the monthly rent becomes RS 50,000. Rental checks are not issued every month, but four-month lump sum checks are issued,” they said.

“That is, every four checks are issued to an investor three times a year. However, this payment is binding on the developer and it is guaranteed that when the contract is written between the buyer and the developer, all these terms and conditions are written in it and return on investment is guaranteed in the form of rent. This method saves your investment. The biggest thing is that when an investor buys an apartment, he receives a receipt for the purchase from the developer and also receives a receipt from Zameen.com. Receipt from Zameen.com means that in case of any kind of fraud or misrepresentation with the investor, Zameen.com will also fully support the investor.”

When asked on what basis the developer is giving the guarantee, the Zameen.com rep said that the financial status of the developers is very good and giving return on investment is not a problem for them. “In Gulberg, for example, a project called 3Js has started. Zameen.com completes its work before taking responsibility for any project in which we first see if the land on which the project is going to be built is in the name of the developer. Now you can see that the developer of the said project is Sitara Heights which is a big developer. The said project is being built on an area of four-kanals, which is a common investment for the said developer. However, if anyone does not believe the said developer, then Zameen.com has its own personal projects where the return on investment is guaranteed. As Zameen.com has the credibility and trust of the people because there is not a single case of fraud in our projects. Our project in Gulberg is called Zamin Oram and in front of Lahore Gymkhana. We also have a project called Zamin Quarting which is a very suitable place for investment.”

Moeed added that the second type of investment is the hotel apartment in which if an investor invests today, he will start getting a return on investment after exactly 45 days. “For example, the Pearl Continental Hotel offers a variety of rooms. Whenever a hotel is built, the hotel management sells its shares in the market and the property becomes public property. Similarly, rooms of these hotels are also sold and the buyers get lifetime rent of these rooms in the form of return on investment.” Essentially, what happens is that these private hotels, whether they are Radison or Hotel 1, keep paying investors for the rooms regularly and they keep getting rent while the hotel operates and tries to make a profit.

Now, the interesting thing is that Zameen.com’s own project which was introduced under the name of Zamin Oram is claiming that 90% of the sales have been made in this project.

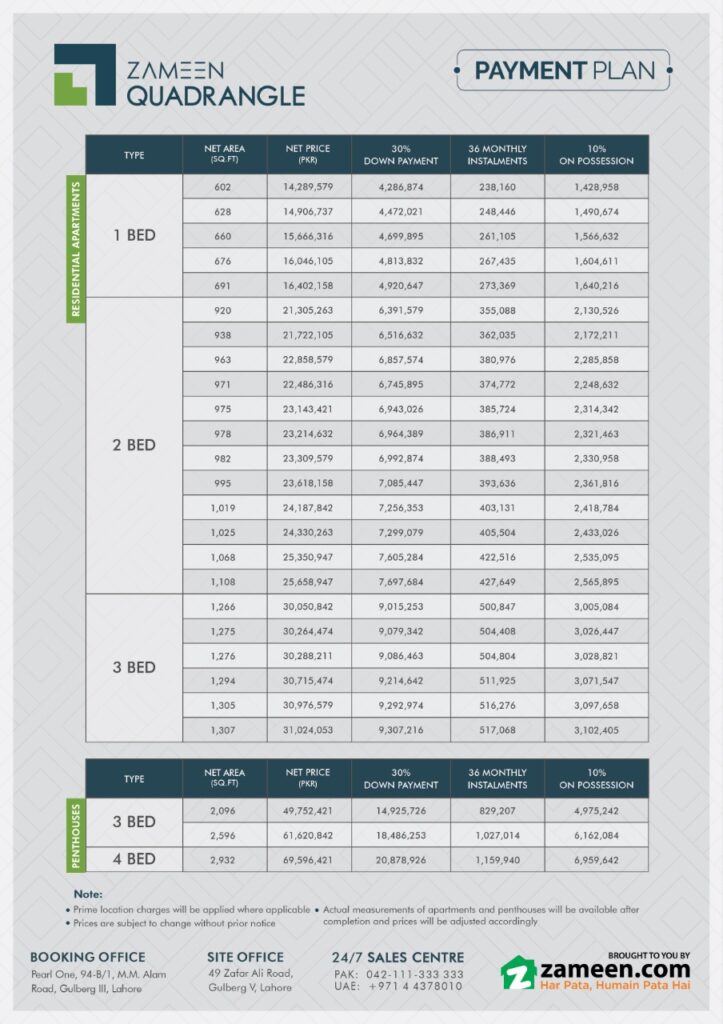

However, the project pamphlet Profit received from Zameen.com includes apartments and penthouses such as studios, one-bed, two-bed, three-bed, single-storey and duplex, in which single-storey apartments, including single and double-beds, have almost sold out. The value of these apartments ranges from around RS 10 million to RS 50 million. Installation plans have also been introduced for the sale of these apartments, in which these apartments can be booked by paying an installment of up to 36 months and depositing 10% of the total amount at the time of possession.

Similarly, the floor plans of the 3JAYS Tower project being marketed by Zameen.com are being sent to investors. The project has hotel apartments ranging in area from 351 square feet to 458 square feet. The cost of these apartments ranges from RS 10 million to RS 13.5 million. However, in this project the investor is asked to make a 30% down payment and the remaining amount can be paid in forty eight installments.

Is Lahore ready for apartment living?

Mian Haider, who is a property agent in the DHA Lahore area and has previously worked in Karachi and Islamabad, believes that apartment culture has not yet become very popular in Lahore, for a number of reasons. “In Karachi, we have seen that flat and apartment culture is very common, one of the main reasons for which is the high cost of property and the large population. People there are easily accommodated in apartments or flats. Constructing a palace-like house or mansion is a thing of the past there, it is just not just for everyone,” he says.

“There are many desires, but money is also necessary to fulfill it. In a flat or apartment, people can get accommodation according to their budget. All the amenities they desire become available, as well as some factors that prove the usefulness of a flat, such as the scarcity of land in cities. In this age, buying land in cities and building your own house is a very difficult task. First of all, land is not so easily found and even if it is found, it either does not fit in your budget or its location etc. does not suit your mind.”

He has a point. Making a house in the city is a cacophony of begging for approvals, always being over budget, having to build the house somewhere far away in a new society and never quite being completely satisfied with a house that you are paying too much money to build. From finding bricks to labour, it is all a massive, over priced, and overwhelming process. An apartment on the other hand, one buys or rents outright and sometimes you do not even have to worry about interior decor. Somehow, despite all this, Lahore and Punjab in general continue to favour houses over apartments.

“The situation in Punjab is quite different. The feudal culture and its traditions are also found in the lower middle class and the poor man who prefers to build his own house on his land rather than investing in a flat or apartment. Similarly, if we talk about Lahore, Gujranwala, Faisalabad or Multan, the main areas of the cities are very expensive, but some distance or a few distances from the city center, the land is still cheap in rates. If we talk about Lahore, then the lands in areas like Bedian Road, Jallo Mor, Harbanspura, Barki Road are very cheap as compared to the central areas of the city where people prefer to construct or invest in farm houses.”

In Lahore, since the government has approved the construction of high-rise buildings on small plots of land, developers have also started constructing apartments here. It is not that the apartment culture in Lahore is non-existent. If you look at areas like Ferozepur Road, Firdous Market, Ghalib Market, Ichhra, Jail Road, etc., there have been small hostel-like flats or apartments for almost the last twenty years that a common man can rent and buy. Similarly, apartments and flats were built at the government level to accommodate as many people as possible.

“We also take the example that there are Askari apartments in different parts of the city, but if you look at their buying and selling, those apartments are expensive, and they usually attract people that want to buy the apartments to live there rather than attracting investors. A big reason for this is the security provided by the Askari apartments and the beautiful environment in the residential population. The fact that Askari is a military project also means that people have more trust in the apartments, and that there is next to no chance of any fraud occurring. Compared to that model, new developers who are building apartments and attracting people to invest here are also having to resort to installment-like facilities to sell their apartments in the busiest areas of the city.

It is the same old fears that stop people from investing in apartments. The general impression here is that if the building is destroyed due to a natural disaster or accident after acquiring the ownership of the apartment, then where will the owner of the apartment find his place later as he has the ownership rights of the apartment but not of the land. Similarly, many apartments charge their residents a monthly stipend in the name of security, sanitation and other facilities. There are many factors that prevent an investor from investing in these buildings.

“However, an investor immediately invests in commercial apartments where reasonable rent is expected and the investor also sees a profit on his investment. Investing in hotel apartments is undoubtedly a good idea and this type of investment is being made all over the world but considering the frauds in the real estate sector in Pakistan, investors try to invest in a built-in hotel instead of Invest in a building that has just passed the map. It can be seen that the sales representatives of Zameen.com are also preferring to invest in such hotels which have not been constructed yet. Now the question arises that if an investor invests RS 30 million in a building which is not ready yet, then where is the profit return on investment being given to him in forty five days. Of course, this return is not from a profit to a developer, but the money paid by the investor will be returned to him in installments, which will be called profit,” Haider added.

Same old real estate tricks

As with all real estate related news in Pakistan, the biggest issue is always developers taking money from investors before they have completed them (which is illegal) by making grand promises, and then running off with the money. Speaking to Profit, Sajid Gondal, an official of the Securities and Exchange Commission of Pakistan (SECP), said that taking deposits from the public for projects which are not yet complete falls under the category of illegal deposit taking.

“There are two ways to guarantee a return on investment. The first method is an agreement between the two individuals and the second method is to take an investment from the public at large and guarantee a return on investment whereas the regulatory frameworks only look into matters of public at large. However, in order to collect deposits or investment from the public, it is necessary to obtain licenses from financial institutions, for example, banks and insurance companies and it requires a legal structure. In Pakistan, the SECP had started issuing licenses on an experimental basis in the name of crowdfunding. What happens in crowdfunding is that ideas for different businesses are pitched on a digital platform and then those business ideas are approved by a regulatory framework. After approval, investment can be obtained from people on approved business ideas, but this is the case with Public at Large. Now it is illegal for any developer or institution to guarantee and market a return on investment for hotel apartments or residential and commercial apartment projects. There were also such practices in Islamabad that people were shown an attractive dream that if an investor booked an office or a flat in a building and paid the full amount, he could get a return on investment only a month later. Now it is to be noted that the return on investment was given on a project which has not been completed yet and it is an illegal act on which the SECP has taken action several times. We call it illegal deposit taking because they are giving profits on public deposits. A similar example was the Master Tile’s La Ville De Paris scheme in Gujranwala. The SECP has also launched an investigation against that project,” Gondal informed.

Million dollar apartment in Lahore? Haha that must be a typo

There are so many blog i read right know but any one of them satisfy me but this one is so informative blog.