For anyone that has ever solicited advice in Pakistan about saving or investing small sums of money, chances are they have been told to invest in prize bonds. Prize bonds are a unique method of investment that are essentially lotteries backed by the government. Offered by National Savings under the State Bank of Pakistan (SBP), prize bonds have been around for decades and are considered an incredibly safe form of investment.

Essentially, it does very much work like buying a lottery ticket, except in case you don’t win, you still don’t lose any money. Let us say you go to the state bank and give them Rs 100, and in return they give you a prize bond worth Rs 100. Now, every three months, the government draws lots to see if any prize bonds win any money. If you happen to win, then you can cash in your prize bond and collect your winnings. If you do not win anything, you can either wait for the next draw or simply turn in the prize bond to the bank in exchange for the Rs 100 you paid for it. Since for the longest time prize bonds have not been registered, you could trade them easily and even use them as cash.

Sounds nice and simple, doesn’t it? Well, it isn’t. Almost everyone in Pakistan with a pretense towards investment and the money to do it will have bought a prize bond at some point to try their luck at winning. Despite this, understanding of what exactly a prize bond is, why the government issues them, and how they work is severely limited.

In short, prize bonds are financial instruments issued by the government. The government issues these bonds to raise money whenever it needs it. The only loss that the investor possibly makes is if their prize bond does not get drawn, and the value of the rupee falls in the meantime. This is why prize bonds are primarily for those people that do not fear losing the real value or purchasing power of money they’re saving and would rather take a chance at winning a lottery.

The entire structure behind prize bonds is a behemoth, with millions of prize bonds being bought, sold, traded, and claimed. There is a lot more behind this whole structure than meets the eye. For small investors that are looking for a safe way to possibly make some more money on top of their money, prize bonds are safe, but are they a smart idea considering rapid inflation and devaluation of money? More importantly, what are the chances that buying bonds will actually result in winning a prize? Profit explains the hows, whats, and whys of government issues prize bonds.

Details of Pakistani Prize Bonds

Let us begin by getting a few basics straight. The government issues prize bonds because it needs to collect money, and it has been doing so for decades. To make sure that the bonds do not go unsold, the government issues different bonds of different denominations in different series. You buy these bonds in the hopes that your bond number will be picked in a lucky draw and you will win a cash prize on your bond. The government issues these bonds in different ‘series’ that they mark by letters. This means the first series of prize bonds the government launches would be series ‘A.’ In each series the government issues 999,999 bonds – one short of a million each time.

To understand what a ‘series’ is, think of a series as a racetrack with a maximum capacity for the number of competitors. Each racetrack can house 999,999 prize bonds that are in the running for prizes. Out of these 999,000 only a specified number will win prizes. This means that simultaneously the government can be running different series or racetracks with 999,999 competing prize bonds on each track.

Let us, for example, assume that a person buys a Rs 100 prize bond with the serial number C350000. This means that the prize bond is part of series ‘C’ of prize bonds issued by the federal government (which would make it the third such series) and that the prize bond is number 350,000 out of the 999,999 prize bonds issued in that series. Now, if this person wants, they can go to the bank and redeem their prize bonds for the Rs 100 they paid for it anytime they want. However, if they wait, there is the chance that they might win a prize on the bond. How does the awarding of these prizes work?

Taking this example forward, let us say that the government needed money so it decided to launch a new series of prize bonds worth Rs 100. This will mean that 999,999 new Rs 100 prize bonds are entering into circulation and will be up for grabs. Now, out of these prize bonds, a fixed number will win prizes in a lucky draw that is held every three months. There are three categories of prizes: first prize, second prize, and third prize. For the Rs 100 bonds, the first prize is worth Rs 700,000 and is won by only one ticket in the entire series. This means that out of the 999,999 prize bonds that were bought, one of them will give a return of Rs 700,000 on the Rs 100 prize bond. The second prize is worth Rs 250,000 and only three out of the 999,999 prize bonds will have a prize of that amount. The third prize is far more common, with 1199 prize bonds being worth the Rs 1000 third prize.

These are some of the fundamentals of how prize bonds work. Out of the 999,999 prize bonds issued in a single series, on each draw at least 1203 prize bonds will win a prize. On the next draw, 1203 more will win prizes. Now, the way that the draw works is interesting and can (theoretically) produce some fantastical results. Remember, the 999,999 prize bonds we have been talking about are all in a single series. At this point, there are numerous series going around that the government has issued for different denominations of prize bonds.

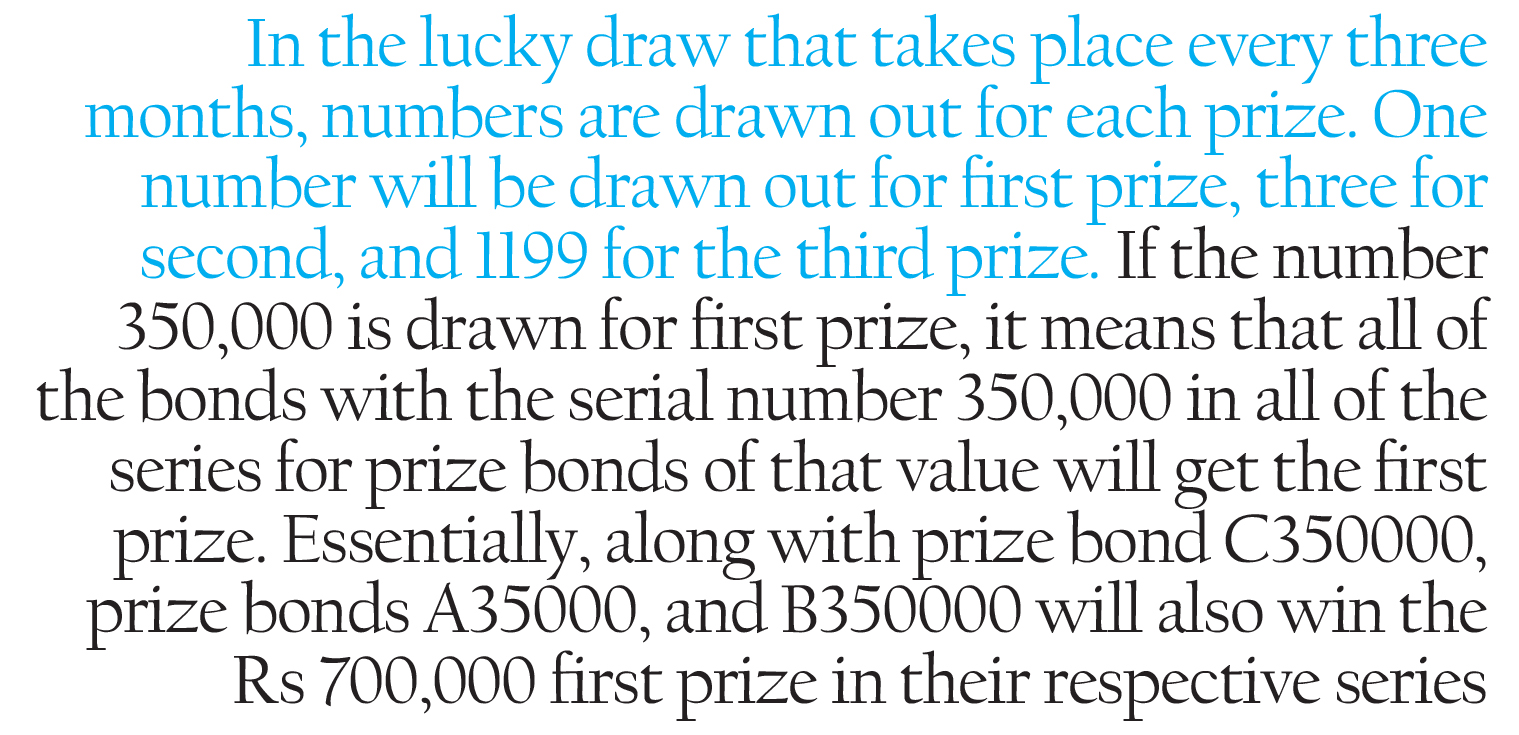

In our example, we had assumed a person had a Rs 100 prize bond from series C that had the serial number 350000. In the lucky draw that takes place every three months, numbers are drawn out for each prize. One number will be drawn out for first prize, three for second, and 1199 for the third prize. If the number 350,000 is drawn for first prize, it means that all of the bonds with the serial number 350,000 in all of the series for prize bonds of that value will get the first prize. Essentially, along with prize bond C350000, prize bonds A35000, and B350000 will also win the Rs 700,000 first prize in their respective series.

Similarly, three numbers will be drawn for the second prize, and 1199 numbers will be drawn for the third prize. No matter which series you belong to, if you have a prize bond with the winning number on it, you will get the prize that quarter. If you win a prize on your bond, you can simply go to the State Bank and they will give you the money, stamp your prize bond, and give it back to you. While it is highly unlikely, if the same number is picked again in the next quarter, it means you will win a prize on the same prize bond again. It is more likely for this to happen after a few years where the same number is drawn again.

Conceptually, this means that no prize bond ever really goes to waste. If a person waits long enough, their number will eventually be drawn as per the laws of probability. That could happen in a few draws or it could take years. The only downside is that it is possible the prize is so long in coming that when it does, money has lost its value to the extent that you end up making an overall loss because of inflation.

How do you get your hands on a prize bond?

This part is quite easy. You simply go to any SBP Banking Services Corporation (BSC) office, designated commercial bank branch, or National Savings Centers and buy them. All you have to do is submit an application form with a copy of your CNIC. Once you’ve bought the prize bonds, you keep them with you and wait for the quarterly draw. The prize bond draw itself is conducted by a committee constituted by CDNS, and the event is open to the general public. The winning prize bonds are drawn through hand operated draw machines, which are operated by special children in front of committee members and the general public. The machines can also be inspected by the general public before the draw to make sure there is no tampering.

If you win a prize, you have to fill out a claim form, submit a copy of your CNIC, and the winning prize bond. You can claim smaller prizes at SBP BSC offices, Commercial Banks, and National Savings Centers. However, bigger prizes are only claimable at SBP BSC offices. After you win, the face value is credited into your account and the SBP keeps the bond. Once you get your prize, you can get your bond back after it has been stamped. If the bond number is drawn again, you can win a prize on the same bond again.

What are your chances of winning?

Let’s simplify this and take the example of a Rs 100 prize bond. Let’s say you only have one bond. In every series, there will be one first prize winner of Rs 700,000, three second prize winners of Rs 200,000 each, and 1199 third prize winners of Rs 1000 each. There are 999,999 bonds in a series. This means there is a 0.0001% chance of winning the first prize, a 0.0003% chance of winning second prize, 0.1199% chance of winning third or 0.1203% chance of winning any prize. Your chances improve based on the number of bonds in a series you hold. For instance, if you hold 5000 bonds worth Rs 100 each in a series, your chances of winning any prize rise to 6.01%.

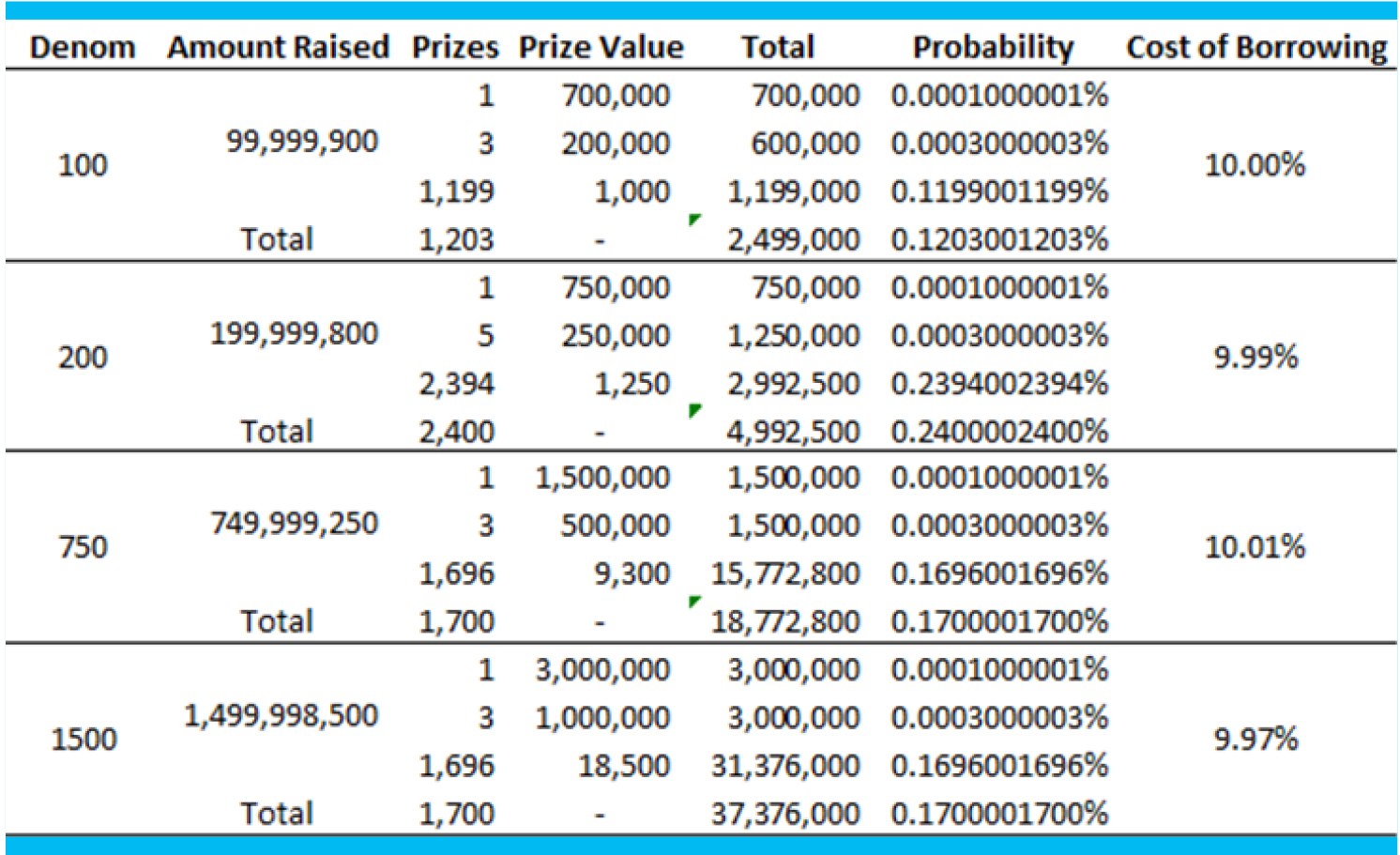

We’ve attached a table to show you the odds of winning for each bond.

“Big investors invest in huge amounts and buy more prize bonds; therefore their probability of winning prize money is greater than the individuals who purchase a single prize bond,” is an answer on the SBP FAQs list for the question, “Why the small investors don’t win prize and big prizes goes to big investors?”

Some people are trying to crack the code to determine which bonds may win the next draws. The authenticity of these methods and whether they actually work becomes questionable considering the nature of the draw.

As per Profit’s analysis, by dividing the amount paid out to winners in a year (the total of one draw x 4) by the total amount raised, we get 10%. For a country like Pakistan that usually has a high interest rate, there are times when the cost of borrowing for prize bonds is less than the benchmark interest rates, or times like now when the cost of borrowing is higher.

Getting rid of bigger denominations

On the 30th of May this year, the federal government announced that it had extended the last date for encashment, conversion and redemption of prize bonds of denomination of Rs25,000 and Rs40,000 until Sept 30, 2021. Currently, there are four denominations of prize bonds in circulation: Rs 100, Rs 200, Rs 750, and Rs 1500.

There is a very particular reason for larger prize bonds being discontinued. In February 2017, Profit had reported that ill-gotten money earned from illicit businesses by smugglers, abductors, drug peddlers, blackmailers, and others was once again being whitened by the decades-old method of purchasing high value prize bonds from bond winners. The way this scheme worked was that people that wanted to launder money would pay prize bond winners more money than they had won, and would then use the prize bonds to collect money from the government and claim that is how they acquired it – giving them a verifiable money trail. Back then, it had been discovered that a man won 135 times on the country’s prize bond schemes in a short period of 29 weeks.

In order to exit the FATF Grey List, the government has come up with various ways to control money laundering and financing of terrorism. As a result, bigger denominations of prize bonds have been discontinued starting with Rs 40,000 and then moving on to Rs 25,000, Rs 15,000 and Rs 7,500.

This is because Prize Bonds are bearer instruments and not registered. Whoever has the bond, owns the bond. These bonds often change hands multiple times and are also sometimes used as a form of payment just like cash.

Similarly, if you lose a bond there is not much you can do about it. The SBP FAQs state, “Prize bond is a bearer instrument. Its ownership belongs to the holder of the instrument just like currency notes.”

As a result, the undocumented economy largely relied on bigger bonds to keep their money off the radar or conduct transactions. The only time they’d have to disclose a bond in their ownership would be if they claimed a prize themselves.

Similarly, individuals that do not wish to disclose their source of income are also often found purchasing bonds from bond winners and paying them more than the prize they won for the bond. They would then use this bond to legitimize their money and make it white. An example of this is when a man claimed to have 135 times within a span of 29 weeks. Either he was extremely lucky, had cracked the code, or was turning his money into white money.

Keeping that in mind, the bigger denomination bonds were discontinued. Holders have time to encash their bonds and any prizes they may have won by the end of this year. The government has also issued Premium Prize bonds where the holder has to be registered. In addition to the probability of winning a prize, the holder will get a biannual fixed profit.

With input from Ammar Habib.

great explainer!

Absolutely.

Yes

Nice Post

Ariba, my question is that prize bonds are floated by state bank to collect money for its needs and pays back a meagre amount ti prize winners then why is it unislamic and de lared haram by ulema?

If I won I prize money in April 2017 but date on stamp of bond is Nov 2017 can I claim this prize?

It is a form of gambling cos it is lottery. You are investing and betting. And Quran speaks loudly and unambiguously about gambling declaring it haram. There can not be any debate on the commandments of Allah.our creator.

So this is not allowed in shRiah

Muhammad shaban

Prize bonds isn’t an investment but a bet. You invest 1000 PKR in a Bond and if you keep it in your home for say 2 years, it is already devalued at say 20% to 30%, what is the point of investing then?

imo my parents and some of the people I know who invested into bonds have one thing in common ‘they are very concerned about losing money and they are above age of 40’

Be smart and invest in somewhere where you can get a good return like real-estate, starting a business, or invest it in place from where you have earned it from.

Pakistan economy is already in bad shape so even if you planning to save money, save it in dollars.

sir dollar main investment krny ka matlb hy mazeed hum apny pak rupee ko barbard kry gy

real-estate is one of the best investment

sir dollar main investment krny ka matlb hy mazeed hum apny pak rupee ko barbard kry gy

real-estate is one of the best investment