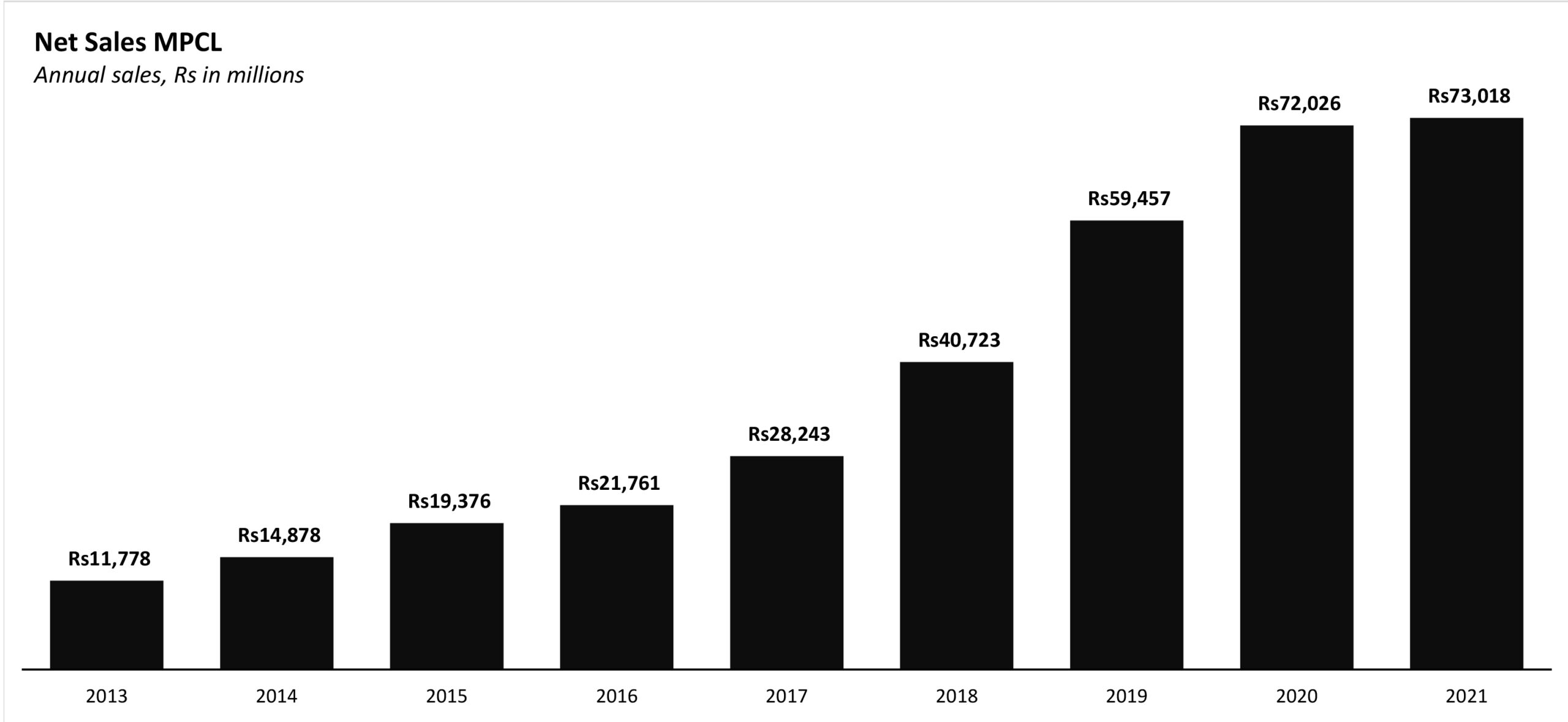

Mari Petroleum has managed to outdo itself. According to its latest annual report, the 2021 fiscal year has been exceptional to say the least. The company recorded its highest sales at about Rs73 billion. While that is only a leisurely increase of 1.4% from the previous year, it is still impressive considering the dicey economic environment created due to the global pandemic.

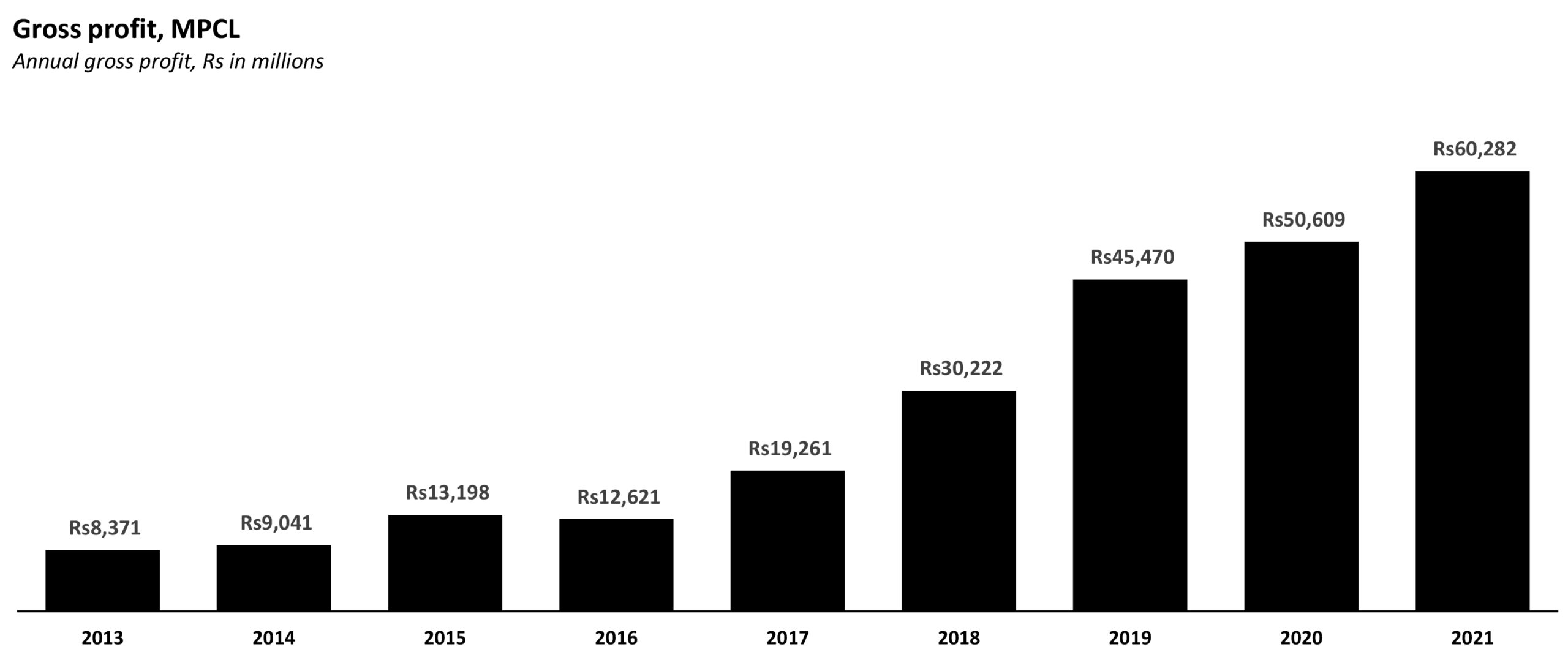

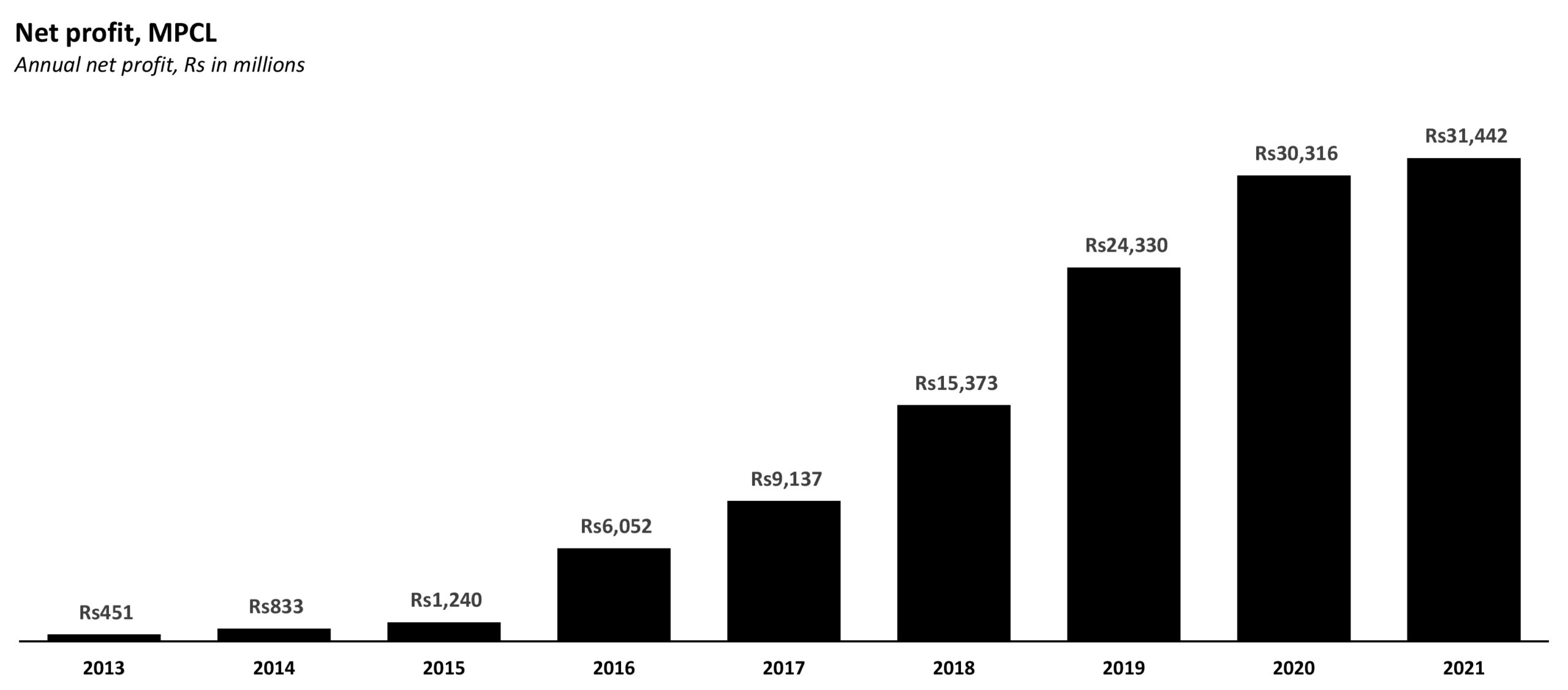

In fiscal year 2021 the company also clocked its highest net profit margin, standing at 43.1% of sales, or an increase of 3.7% from the previous year to Rs31.4 billion. Furthermore, its gross profit rose by 19% from Rs50.6 billion in 2020, to Rs60.2 billion in 2021 – its highest recorded gross profit yet.

And that isn’t even the best news. In a recent decision, the Economic Coordination Committee of the Cabinet approved the lifting of Mari’s dividend distribution cap in February 2021, allowing the company to determine dividend payout in accordance with applicable laws and internal funding constraints. This was a welcome change for all shareholders who had been urging for higher payouts considering Mari’s success, and the new management of the company did not disappoint, doling out a hefty Rs141 dividend per share. It is a sharp contrast from the years between 2015 and 2020, when the average dividend per share had been Rs 5.68.

It is another feather in the cap of an already successful history. To recall: Mari Petroleum’s genesis was as the Mari Gas Field, which was originally owned by Pakistan Stanvac Petroleum Project, a joint venture formed in 1954 between the Government of Pakistan (with a 49% share) and Esso Eastern Incorporated (a 51% share). The Pakistan Stanvac Petroleum Project first discovered gas in 1957, while production from the field started in 1967.

The company changed form, when in 1983, Esso Eastern sold its entire share to the Fauji Foundation. The company was converted into a publicly listed company in 1984, where Fauji Foundation had 40% shares, the Government of Pakistan had a 40% share, and the Oil and Gas Development Company owned 20% (today, the Government of Pakistan has an 18.4% share, while the other two shareholding remains the same).

Initially, the company only operated as a gas production company. But in 2001, the company was granted a license for exploration of oil and gas in addition to production activities. The name of the company was also changed from “Mari Gas Company Limited” to “Mari Petroleum Company Limited in 2012, to reflect its diversified business operations and expanded activities. It became a fully integrated exploration and production (E&P) company in 2013, when it set up its own 3D seismic data acquisition unit and processing centre, instead of outsourcing their work to other E&P companies. The government was keeping note, and extended the Mari lease twice, in 2014 and again in 2019.

These incremental steps, and then revamping in the last decade, have paid off. Essentially, the company is now in control of the country’s largest gas reservoir (in terms of remaining reserves), the Mari Gas Field near Daharki, Sindh. It is Pakistan’s second-largest gas producer, with a 21% market share, and the second-largest reserves base.

Mari has a unique position in Pakistan’s exploration and production (E&P) industry, with the largest devoted client base, which is predominantly made up of fertilizer manufacturers which use natural gas as a feedstock. Mari Field’s gas has a chemical composition that makes it perfect for urea production. As a result, natural gas provided by Mari accounts for more than 90% of urea production in the country.

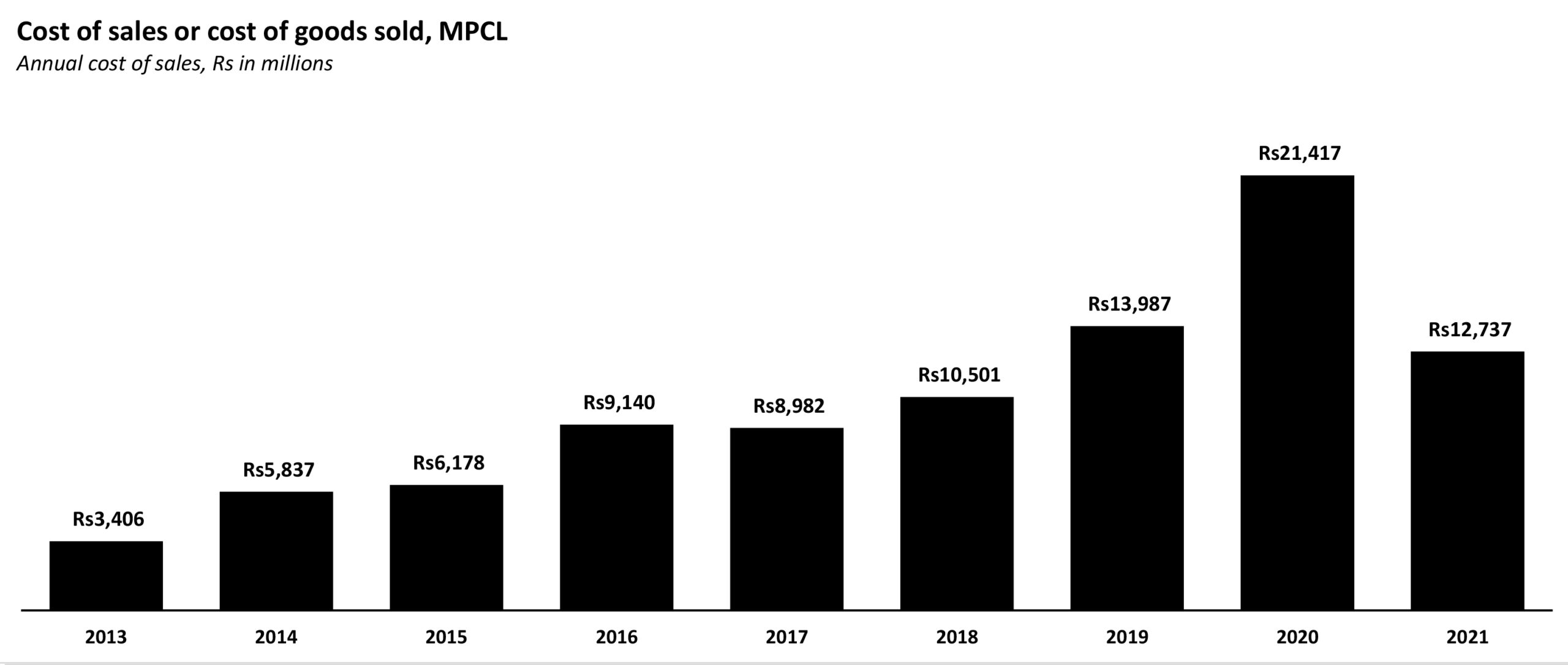

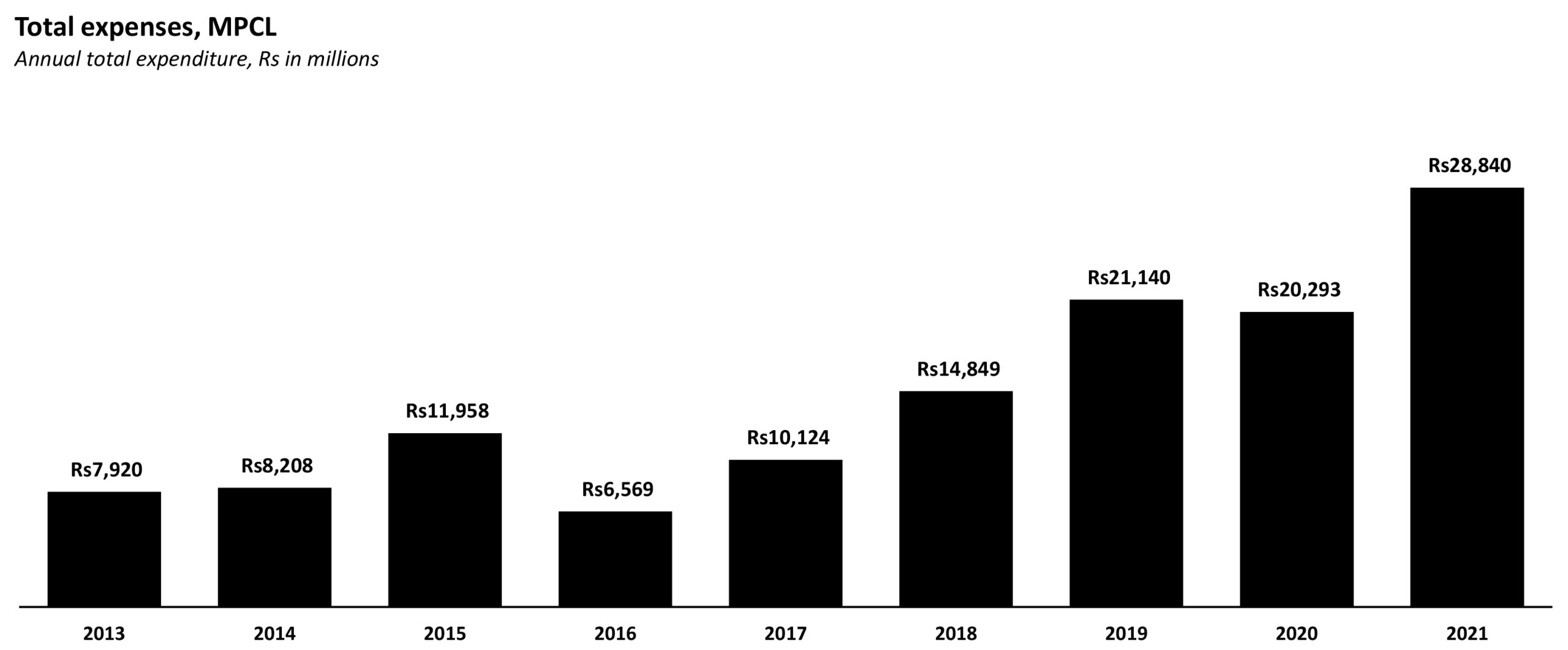

Mari has been on an upward trend for the past nine years, recording higher sales, gross profits, and net profits from the previous year, indicating a strong market position. Its net profit has risen from Rs5,650 million in 2015, to Rs30,313 million in 2020 (in fact, 2020’s profit is nearly double that of 2018’s). And it bumped up production in fiscal year 2021, though net sales were impacted by decreased pricing. If prices had remained the same, net sales would have stood at Rs77 billion; as it stands now however, net sales stand at Rs73 billion. Still, it was, by its own calculations, able to add an additional Rs2 billion to net profit. Furthermore, due to enhanced cost controls and treasury management, net profit as a percentage of net sales has steadily increased from 28 % in 2015-16 to 43 % in 2020-21.

However, there are some trouble spots: for one, Mari Petroleum relies heavily on the Mari field for its primary source of income. The company’s future strategic vision and actions aim to address this weakness, by accumulating more development and production leases – essentially avoiding putting all its eggs in one basket. For this purpose, Mari is investing heavily in further exploration as well as securing more development and production leases. As of now critical finds of Iqbal 1 in Mari field and Togh Bala-1 in Kohat Block highlight the company’s exploration progress; exploratory drilling in three key blocks, Bannu West, Karak, and Kalchas, has also begun. To meet its medium- to long-term objectives, the Mari has expanded its exploration portfolio by adding four new exploration blocks this year, including two operated and two non-operated blocks granted in a recently completed bid round. In addition, a farm-in with MOL Pakistan for their operated Margalla Block was finalised after the financial year ended and is awaiting permission from the Pakistani government. Mari also acquired a 20% equity interest in National Resources Limited, a company whose primary line of business is to undertake mineral mining projects in Balochistan.

However, the uncertainties of the post-pandemic reality still loom overhead. Low prices and the possible impact on operations owing to both international and local constraints due to the pandemic have been the company’s main risks and uncertainties in recent times. These extraordinary risks, when combined with the normal risks and uncertainties that exist in the E&P sector, such as security concerns that limit access to exploration and development areas, and fluctuating prices, could pose significant risks and uncertainties to the company. There is also a lack of significant gas finds in Pakistan over the last decade, which has resulted in a steep fall in the country’s discovered hydrocarbon resources, and could pose a risk to Mari.