ISLAMABAD: Pakistan Telecommunication Company Limited (PTCL) posted 7% growth in its revenues, owing to growth in Broadband and Corporate & Wholesale business segments..

The company has announced its annual financial results for the year 2021 at its Board of Directors’ meeting on February 10, 2022.

Once a completely state owned enterprise. PTCL was privatized by selling 26 per cent stakes to Etisalat with the management control back in 2005 at the price of $2.6 billion.

PTCL Group

PTCL Group posted a revenue of Rs138 billion in the year 2021 which is 6.3% higher as compared to 2020. PTML (Ufone) also posted a revenue growth of 4.3% despite stiff competition in the market. While UBank continued its growth momentum and achieved 8.4% growth in revenue. Overall, PTCL Group posted a net profit of Rs 2.6 billion.

PTCL (Parent Company)

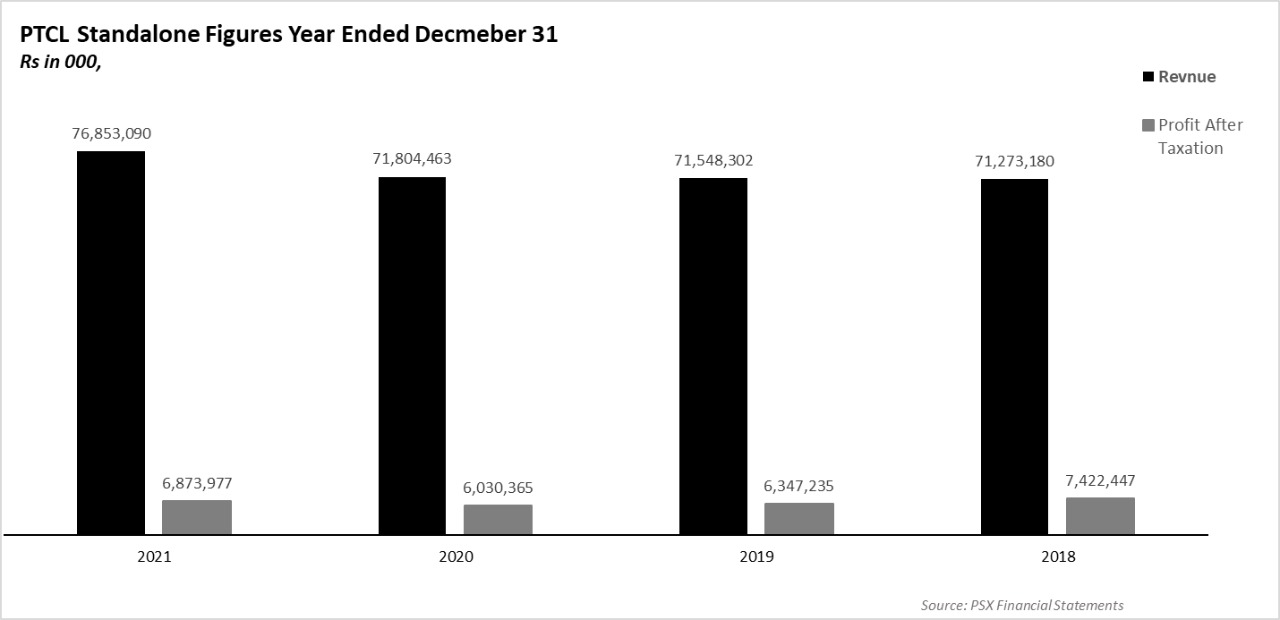

PTCL continued on its growth trajectory in 2021. PTCL’s revenue of Rs 77 billion for the year 2021 were 7% higher compared to 2020, mainly driven by Broadband and Corporate & Wholesale business segments.

PTCL registered the highest Fixed broadband Sales and Net Adds in 2021 since 2015, which allowed PTCL to grow in the broadband business segment.

PTCL, the largest player in the Fiber-To-The-Home (FTTH) market, had the highest Net adds within the FTTH market in 2021 making it fastest growing as well.

The company has posted operating profit of Rs 4.2 billion, a growth of 21% compared to 2020. While the net profits were up by 14% to Rs 6.9 billion as compared to last year.

The company is upgrading its existing infrastructure and network, besides expanding FTTH across the country in a bid to monetize on the opportunity created by the digital shift of the economy.

Furthermore, the company posted a strong performance in Corporate and Wholesale segments that reflects a policy move to focus on the growing of businesses for connectivity.

PTCL Consumer Business

During 2021, the company’s Fixed Broadband business grew by 11.7% YoY, whereas PTCL IPTV segment also grew by 13% YoY. Within the broadband business, PTCL Flash Fiber, the company’s FTTH service, showed a tremendous growth of 61.5%, whereas PTCL CharJi /Wireless Broadband Segment grew by 16.5%.

Voice revenue stream continued to decline on account of lower voice traffic and the ongoin conversion of customers to Over-The-Top (OTT) services.

Business Services

Business services segment continued its momentum sustaining market leadership in IP Bandwidth, Cloud, Data Center, and other ICT services segments. PTCL’s Enterprise business grew by 10% as compared to last year, while Carrier and Wholesale business continued its growth momentum and achieved 9% overall revenue growth. Similarly, international business growth was recorded at 4%.

PTML – Ufone

Ufone’s financial year 2021 ended on a high note as revenues grew by 4.3% compared to 2020 mainly driven by growth in data services

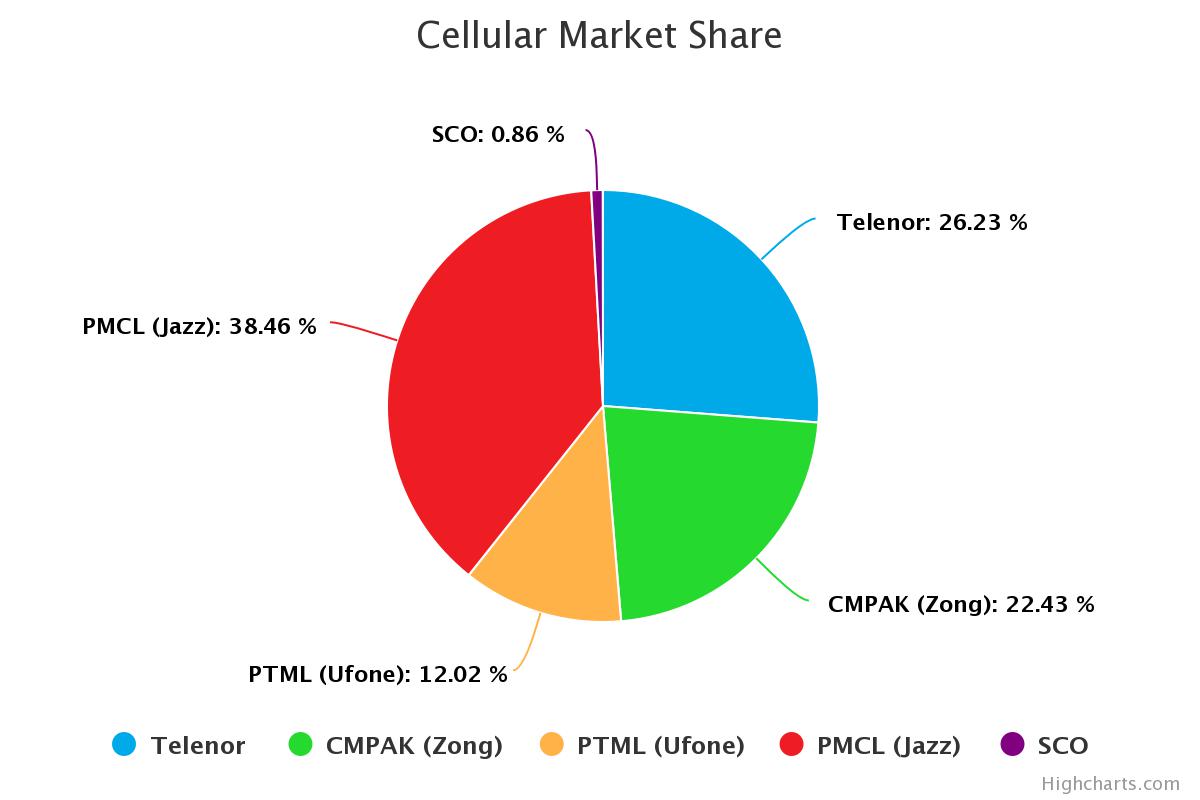

Ufone acquired additional 9 MHz 4G spectrum in the 1800 MHz Band in NGMS spectrum auction in September 2021 (An auction where all other participants refused to participate).

Post spectrum auction, significant network modernization activity was carried out in Q4 2021 that has allowed Ufone to significantly improve its share of the 4G net adds within the industry.

UBank

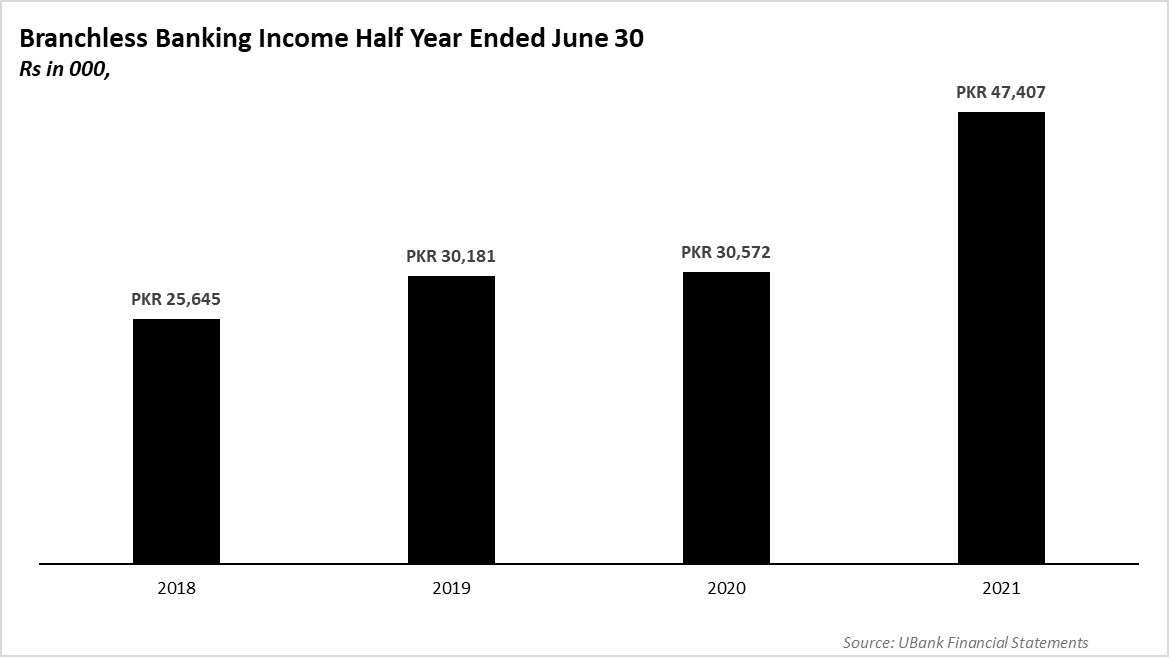

UBank, the microfinance and branchless banking subsidiary of PTCL, continued its growth trajectory and has achieved 8.4% growth in its revenue over last year by increasing its advances portfolio. The balance sheet footing of the bank crossed the Rs 100 billion mark as the bank diversified its funding streams and asset classes while ensuring positive bottom-line impact.

Major strategic initiatives undertaken by the bank include venturing into the low-cost housing loans, international remittance, and the launch of Islamic Banking.

Despite Ufone’s struggles in recent times, PTCL has quite a few other businesses. Its core business remains its landline-based business, which it has successfully transitioned towards becoming the backbone of its broadband internet and cable television business. PTCL also remains an important carrier of Pakistan’s telecommunications to the outside world, with an international business. And its mobile banking unit (UBank) has also grown quite rapidly over the past few years.

PTCL effectively has six business lines. They are, in order of size: Ufone, the broadband internet and cable television business, the corporate and ‘carrier’ business, home landlines, international services, and mobile banking. Of these six, three – Ufone, home landlines, and international services – have seen revenues consistently declining since 2017, only for Ufone to recover in 2021 as it shifted focus on mobile broadband.

Source: PTA

Of the three business lines that have had positive revenue growth, broadband internet and cable television has been a mostly steady business, growing at a steady rate in the last 4 years. That leaves two rapidly growing business segments: mobile banking and the corporate and carrier business. The mobile banking business and the carrier business are growing at a similar pace, but crucially, the carrier business has been able to nearly match the growth of the mobile banking business from a much higher base.

PTCL can grow its revenue by far by expanding FTTH at rapid speed which is too slow, I live in Rawalpindi near Satellite Town and FTTH is available just 5 streets away from my house and work underway for FTTH since 8 months. I can afford up to 30MB but had to stuck with 8mb copper wire so there must be hundreds of other consumers like me who are speed hungry but had to make peace with copper wire slow broadband. Although they are expanding but the speed in which they are expanding FTTH will take decades and till than 5g will takeover.

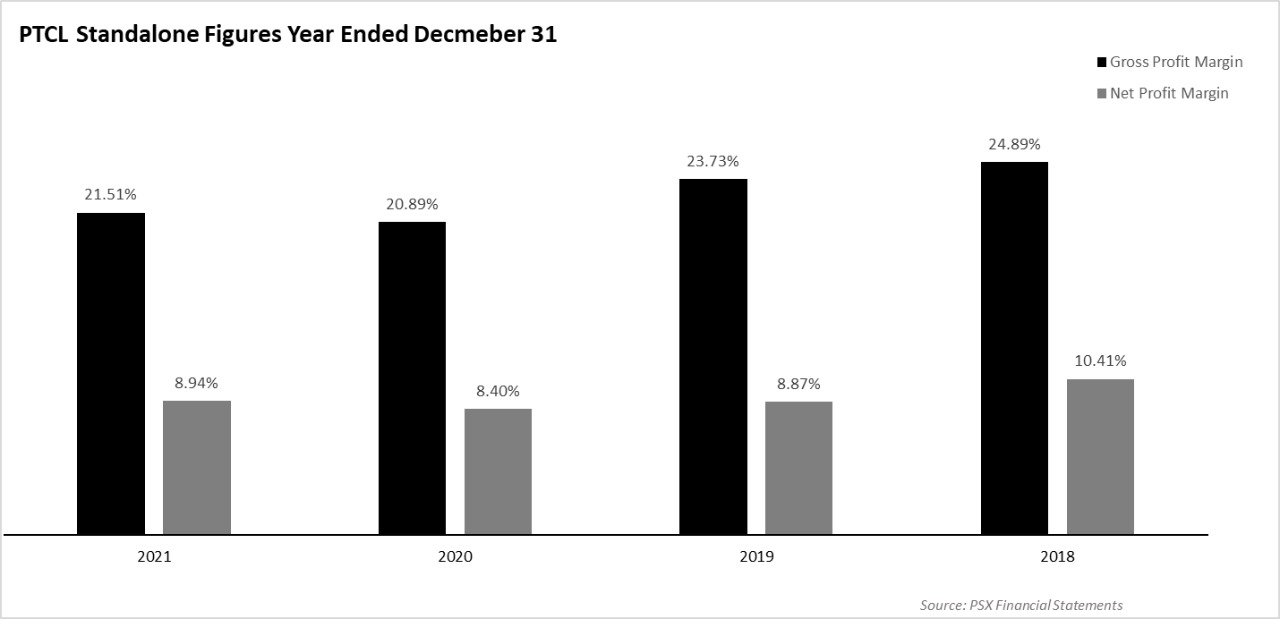

Given a 12% depreciation of PKR against USD, issue with UAE still unresolved by the majority share holder, I don’t think a single digit growth is something to be proud of. The company has a monopoly in FTTH and land line segments in the country and still the profit margins are extremely low for a company having such a high presence in the country.