During the last week of May, news broke out about Ernst & Young’s (EY) plan to carve out its consultancy business into a separate Public listed Company. The ambitious plan of the Big Four accounting firm comes after sustained global criticism regarding independence of auditors being marred due to the conflict of interest arising between audit and consultancy services.

If the plan is implemented, besides obvious repercussions on global services, Pakistan in particular would be impacted, say experts.

“Reputed Audit practices, especially the Big four, give credibility to almost all companies in different sectors. What I have witnessed over the last decade is that foreign investors and multinationals are inclined towards these global practices because of their reputation. Deloitte leaving Pakistan was a big blow, simply because of the fact that there is one less company in the country that foreign investors can trust on,” said Muhammad Havaris Arshad, a Senior Chartered Accountant and Audit Manager at PwC Pakistan.

Multinational firms tend to prefer having a single audit firm that can audit their operations around the world, which is why accounting firms tend to be the most global organisations of professional services providers. Moreover, the credibility they add to a country’s corporate sector and the transfer of global technical expertise they bring to the local markets is invaluable.

This impact would further be augmented by the fact that EY has two operations in Pakistan, the legacy partnership firm EY Ford Rhodes Sidat Hyder & Co and the Middle East operated EY Rapid Innovation Private Limited.

Moreover, the industry is staff intensive with more than 3,000 white collar professionals being employed by the country’s Big Four (Now Big Three) firms alone. Majority of this staff is in audit practices given its laborious nature. The payscale amongst the permanent staff in these firms varies according to designation. In EY, for instance, the supervisory staff is paid between Rs60K to Rs100K while the managerial staff is paid between Rs150K to Rs350K based on their experience. The salaries in the consulting functions are 10-20% higher compared to the audit practices.

Pakistan, after the exit of Deloitte in 2020, is the second-largest economy after heavily-sanctioned Iran to not have all Big Four accounting firms. The next largest economy to not have all Big Four is Ethiopia, which is about one-third the size of the Pakistani economy. There are economies in other parts of the world that are one-hundredth the size of Pakistan that still have all of the Big Four firms supporting their corporate sector.

Therefore, decisions impacting EY Pakistan hold immense importance for not only the existing clients of the firm but also the overall corporate environment and the investment climate of the country.

The Split

The proposal for restructuring is a strategic move by the accounting firm to liberate its consultancy business from regulatory requirements governing independence of firms that also provide audit services. The consultancy business is where the big bucks are for the global accounting firms including the Big Four; Deloitte, PwC, KPMG & EY. While audit is primarily a laborious task, as mentioned earlier, that involves loads of documentation and is not as rewarding as the consultancy assignments.

The company plans to set up a listed entity for its consultancy business and the existing partners would be the majority shareholders in the proposed entity. Further, the partners would be earning windfall returns in the form of a one time compensation based on a multiple of their existing salaries.

However, the standalone audit business would continue to operate under the current structure of global partnerships. The spinoff plan, to create a separate consulting entity, would be bad news for the audit partners and staff of the Big Four firm. As per the Wall Street Journal, the audit partners would receive windfall gains of around twice their existing salaries compared to consulting partners that can earn around seven to nine times of their existing salaries. Furthermore, the shares of the conceptualised public entity would be split into three parts; 70% with consulting partners, 15% with audit partners and 15% would be sold on the open market.

There is no confirmation yet on which service would form part of the audit practice, which earned around 35% of EY’s global revenues last year, and which one would be merged into the consultancy company. This is likely to be a complicated decision given that synergies, primarily, of knowledge and resource sharing between the departments add to the cost efficiencies of global accounting practices.

Source: Financial Times

EY Pakistan

A major upheaval at the global level would have a direct and a significant impact on the Pakistani operations. The unique structure of EY entities in Pakistan makes it even more interesting. The older firm, EY Ford Rhodes Sidat Hyder & Co operates under a partnership agreement between EY Global and Sidat Hyder & Co. The company has a very well-reputed practice in Pakistan specially for its consultancy services.

The relatively younger firm, formed in 2019, EY Rapid Innovation Private Limited is an entity established by EY Middle East and North Africa (MENA) operations to provide support services for their multiple offices in the region. The rationale behind setting up the firm was to benefit from the labor arbitrage and to cut costs. This is a trend that is being adopted by other firms as well including PwC Pakistan which is contracting with multiple global offices for provision of the services of trained staff on remote outsourcing basis.

The company that would be more affected by this split would be Ford Rhodes Sidat Hyder & Co as it has a well-established consultancy practice compared to Rapid innovation which is primarily engaged in audit services and is yet to launch a full-fledged consultancy wing.

The consultancy departments of global Big Four practices are dominated by services including Mergers & Acquisitions as well project management and implementation services. However, the case is a bit different in Pakistan. The taxation and legal services take a lead when it comes to revenue generation. Amongst the highest billing partners across the Big Four offices in the country are those involved in provision of taxation services.

But, in a global context, the Pakistan based partnerships are not significant. “The Big Four accounting firms don’t really get much out of Pakistan,” said Asad Ali Shah, in an interview with Profit back in 2021. “The biggest firm in Pakistan is AF Ferguson (PricewaterhouseCoopers Pakistan) and they have approximately Rs3 billion in revenues, the bulk of which goes to the partners and the local staff. And what little goes to the global firm, they have issues remitting the profits because of permissions needed from the State Bank of Pakistan, etc.”

“The global firm makes money out of Pakistan in two ways: one, they help the local firm buy professional insurance against the risk associated with providing services. And secondly, they earn a management fee, which can be around 3% to 4% of revenue,” he said.

In short, the firms are set up to benefit the local partnership much more than the global parent company, and yet the global parent company bears all of the risk that the local partners bear as well. “The global company has 100% of the risk of Pakistan. If something goes wrong here with an audit, they will take a hit on their reputation,” said Shah.

Profit tried to reach out to EY’s local management as well the regional management in MENA. However, no response was received regarding the impact of the proposed restructuring arrangement.

Sources in EY’s top management confirmed that there has not been any official communication regarding the plans to split departments, so far. They also stated that it is a high level plan and its implementation would be subject to approval of local authorities as well as the 13,000 partners across the globe. However, as per the Wall Street Journal, the details of the proposed restructuring plans have already been communicated to all the global partners through webcast by Global Chairman and Chief Executive Carmine Di Sibio.

Further, a partner at the firm, on the condition of anonymity, told Profit, “The global firm’s relationship with the local partnership is strong. We are not just looking to maintain our footprint in the country, but are also evaluating opportunities to expand it. As far as the implications of the proposed split are concerned, they are not clear yet. Therefore, it won’t be appropriate to comment.”

But, this is not the first time that EY Pakistan finds itself in a fix regarding plans of the global network to prevent reputational risk. Back in 2019, EY global was re-evaluating its relationship with its Pakistani partner Ford Rhodes Sidat Hyder, with a possibility of severing its ties with its local partner altogether.

According to sources familiar with the matter, the cause of the re-evaluation was the results of an internal compliance audit of Ford Rhodes Sidat Hyder by Ernst & Young’s global offices, a routine practice designed to ensure that the firm offers consistent standards of work to its clients worldwide. Those compliance audits found significant deficiencies within the practices of Ford Rhodes Sidat Hyder, and caused the re-evaluation to begin. However, assurances and future compliance with the SOPs mitigated the situation, and prevented any action from the global firm.

Lessons from the Past

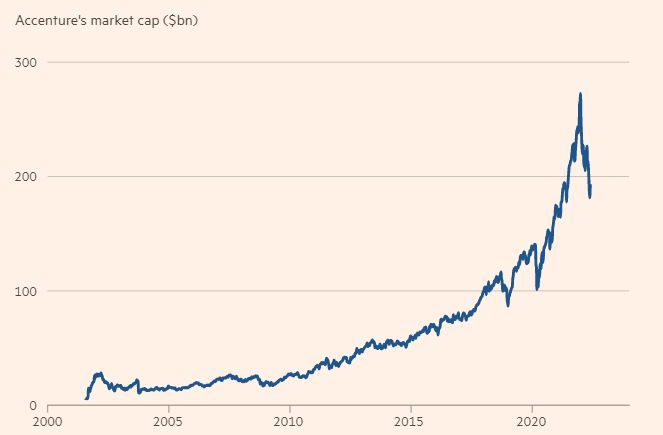

Conflict of interest regarding practice of the big accounting firms have been part of the debate for as long as one can remember. Particularly, around early 2000s the volatility amongst the members of the profession and specially the now Big Four practices was at its peak. Today we know the fab 4 of the accounting world as the Big Four, however, if we go down the memory lane the group of global accounting giants included a 5th member, Arthur Andersen. The firm had become a global giant by the time it entered its 88th year of operation in 2001. However, what came with such rapid growth was conflicting practices and internal tensions between the audit and consultancy function. It induced the firm into adopting dubious practices aimed at revenue maximisation through consultancy work earned at the expense of quality of the audit. These malpractices were caught by the US regulators in 2001 during the infamous scandal of American Energy Company, Ernon Corporation. The firm was subsequently banned, and slapped with heavy fines leading to cessation of operations in 2002. However, the firm’s consulting business broke off and started operating under the name of Accenture which has since grown to become one of the largest consultancy practices around the globe.

As per the Financial Times, EY’s strategy to split is partly inspired by Accenture’s success.

During the same period when Arthur Andersen was being surrounded by controversies, three of the now Big Four firms, EY, PwC & KPMG sold their consultancy businesses to Capgemini, IBM, and Bearing Point. The move was to avoid conflict of interest especially in the case of auditing IT systems for which these firms were also implementing partners.

Source: Financial Times

The implications of EY’s move for its global network of firms is unclear. Further, going public in the current bearish market would mean that the consultancy spinoff might not be able to generate the targeted $10 billion in stock sales. However, if EY is able to see the plan through, other firms like Deloitte, PwC & KPMG might follow suit.

Although the articles are super long on this website, its keeping me hooked! How u guys do that i dont know but such information is rare to find so Great work guys

A very good Read Ahtasam, keep writing ✨⚡️⚡️👍🏻

Well i think Yousif Adil, Ford Rhodes & Taseer Hadi in itself not as such of a brand as A.F Ferguson & Co and solely depending on BIG 4 affiliation was not a good strategy, nevertheless it is alarming for all the stakeholders.

Very insightful read! Don’t usually follow financial articles but this piece was quite informative and very well-written

APEPDCL Recruitment 2023 Application Form

I dеfinitely loved every little bit of it and I have you book marked too check .

온라인 카지노

j9korea.com