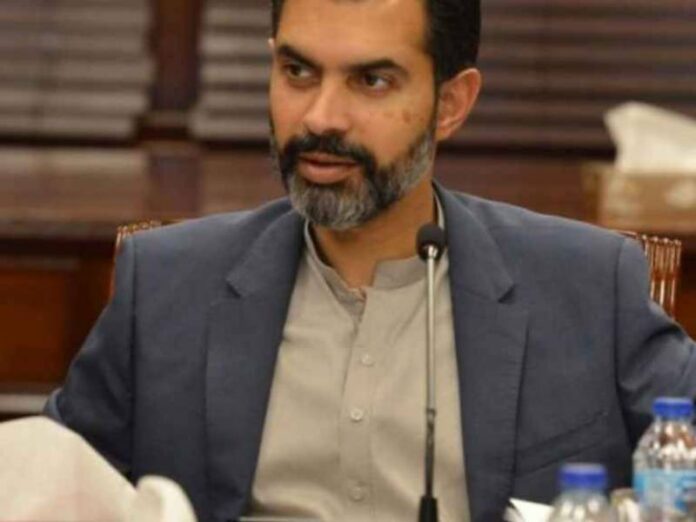

According to an article in Dawn, former governor of the State Bank of Pakistan (SBP), Dr Reza Baqir, has warned that debt restructuring for Pakistan will be a difficult process due to the nature of the country’s debt.

In a podcast, he stated that most of Pakistan’s debt constitutes “official debt,” which is owed to multilateral official partners like the International Monetary Fund (IMF) and the World Bank, or bilateral creditors like governments and their institutions.

He added that neither multilateral nor bilateral creditors are likely to offer debt reductions, with the Paris Club being “loath” to do so even in the face of a country’s insolvency.

Dr Baqir praised China for its help during his tenure as SBP governor but said that meaningful debt reduction was unlikely if any domestic debt was included in the restructuring. Pakistan’s external borrowings doubled from $65bn in 2014-15 (24% of GDP) to $130bn (40% of GDP) in 2021-22. It faces dollar-denominated loan repayments of $73bn in the next three years as its foreign exchange reserves dwindle.

To read the full article visit www.dawn.com