It seems that the long battle with inflation is finally coming to an end as the Monetary Policy Committee (MPC) of the State Bank of Pakistan (SBP) kicked off its monetary easing cycle and reduced the policy rate by 150 basis points on June 10, 2024, from 22% to 20.5%.

The analysts anticipated a rate cut of 100 basis points while the secondary market had already incorporated the expectation of rate cuts since October 2023. As per Topline Securities, the benchmark lending rate 6M KIBOR was trading at 20.68% as of June 10, which was 132 basis points lower than the policy rate of 22%. At the same time, as per JS Global, the spread between the policy rate and the 3-month tenor yield had widened to nearly -193 basis points, trading at 20.7%. “Historically, the 3-month yield typically trades at a premium of around 50 basis points to the policy rate,” reads JS Global report.

The MPC noted that while the significant decline in inflation since February was broadly in line with expectations, the May outturn was better than anticipated earlier. The Committee assessed that underlying inflationary pressures are also subsiding amidst a tight monetary policy stance, supported by fiscal consolidation. This is reflected by continued moderation in core inflation and ease in inflation expectations of both consumers and businesses in the latest surveys. Headline inflation in May clocked in at 11.8% from 17.3% in April. The core inflation clocked in at 14.2% in May as compared to 15.6% in April. Disinflationary trends, however, were driven by the high base effect and the recent decline in food and fuel prices.

This positive shift in real interest rates, now around 10%, gave the SBP the room to reduce the policy rate.

Despite the optimistic outlook, the MPC acknowledged potential upside risks to the near-term inflation outlook due to upcoming budgetary measures and uncertainty regarding future energy price adjustments. Nevertheless, the committee believes that the cumulative impact of earlier monetary tightening will keep inflationary pressures in check. It is also noteworthy that this is the first rate cut in four years, since June 26, 2020.

The policy rate was hiked to an all-time high of 22% at the end of June 2023 as the International Monetary Fund (IMF) mandated the central bank to maintain an appropriately tight monetary policy to bring down inflation. It is also worth noting that this is the first rate cut in four years since June 26, 2020.

Impact on the private sector

While tight monetary policy has helped anchor inflation expectations, it has also severely impacted the overall business environment. As per a report by Dawn, the interest rate needs to come down to 15% to enable Pakistani exporters to compete in the export market. Similar sentiments have been echoed by bankers and industry experts to Profit stating that projects above 15% are not viable. “These kinds of interest rates for long-term funding are a major impediment. Project financing at 25-26% interest rate is not viable.”

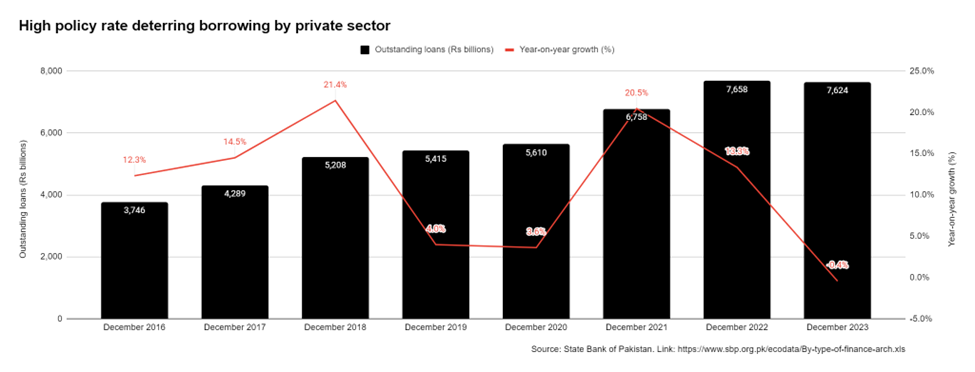

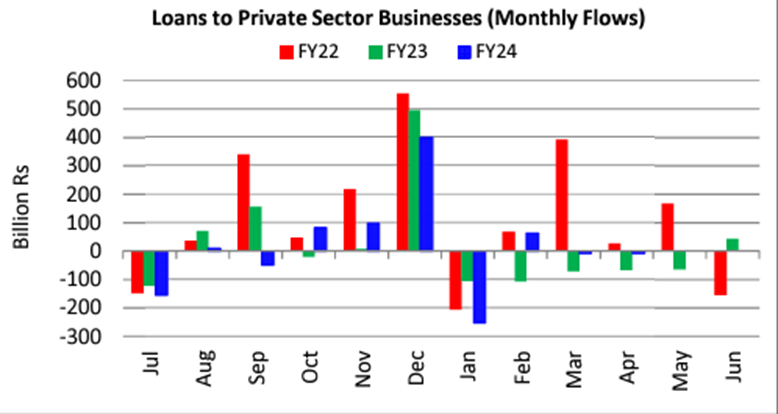

As a consequence of the high policy rate, credit to the private sector dwindled down. Banks channelled available liquidity towards government securities instead of lending to the risky private sector to avoid asset quality deterioration. Consequently, lending to the private sector fell by 0.4% year-on-year for the first In almost over a decade in 2023. Historically, there has usually been a double-digit growth in advances to the private sector. Moreover, lending to the private sector has remained muted in the fiscal year 2024.

Source: SBP

Source: SBP

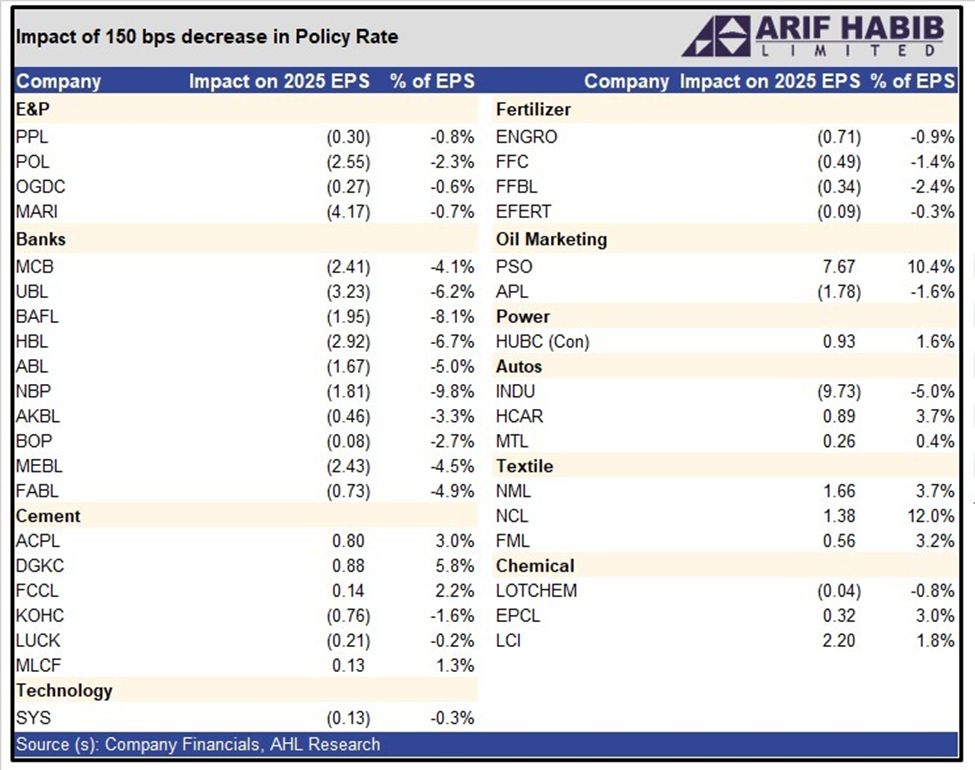

The current rate cut gives some leeway to the private sector. Some of the highly leveraged sectors include textile, steel, cement and pharmaceutical. Rate cut will have a positive impact on their financial performance as finance costs will decline.

The textile sector has a debt-to-equity ratio of 0.89 times, making it one of the top beneficiaries. Besides, as per Topline Securities, the textile sector’s fixed rate/subsidised loans were also repriced to market rates in December 2022. Companies like Gul Ahmed Textile Mills, Nishat Chunian, Nishat Mills, and Interloop will benefit from the rate cut and their earning per share might improve by 3-6% in fiscal year 2025.

Similarly, the steel sector is trading at a debt-to-equity ratio of 0.70 times, while cement sector has a debt to equity ratio of 0.53 times due to capital intensive nature of business and owing to frequent expansions. “Amongst the companies, we believe, companies like Mughal Steels (MUGHAL), Agha Steels (AGHA), and Amreli Steels (ASTL) will get benefit in the range of 5-22%”, read Topline Securities report. “Theoretically, amongst the companies, we believe, DG Khan (DGKC), Pioneer Cement (PIOC), Bestway Cement (BWCL), and Fauji Cement (FCCL) to have a positive impact of 3-5% per annum”, read the report.

Budget – the double-edged sword

However, just two days after the central bank kicked off monetary easing, the federal government presented the budget for the fiscal year 2024-2025. The government has set a challenging tax revenue target of Rs13 trillion, a jump of around 40% from the current year. In a bid to appease the IMF to strengthen the case for a new bailout deal, the government has found ways to increase revenues to reduce fiscal deficit. The government has raised taxes that will help raise additional revenues of Rs3.8 trillion in line with the IMF demands.

The government has increased taxes on salaried, non-salaried class, real estate, retailers, vehicles, removed general sales tax (GST) exemptions and slapped taxes on milk and milk products, mobile phones, and tier-1 retailers of branded stores at 18%. Moreover, the government has also made changes in tax regime for exporters from full and final tax of 1% to normal tax (29% along with applicable super tax). Textile sector accounts for major exports. “This shift is expected to significantly affect the profitability of the sector by 20-35%. Company wise, we believe (Interloop Limited) will get the highest hit of 30-35% on profits, followed by Nishat Mills and Gul Ahmed 15%-18%”, states a Topline securities budget analysis report.

All of these measures, while would help with fiscal consolidation, might also lead to increase in demand destruction. Essentially, the room that monetary easing created for the private sector businesses, is squeezed out as reduced demand would result in lesser consumer spending, and hence lower sales for the businesses.

Concluding up, fiscal year 2025 presents a mixed outlook for Pakistan’s private sector. While the monetary easing offers some relief, but the government’s new budget measures could counteract these benefits by increasing taxes and potentially reducing consumer demand. As the private sector navigates these changes, the balance between monetary easing and fiscal consolidation will be crucial in determining the overall economic impact.